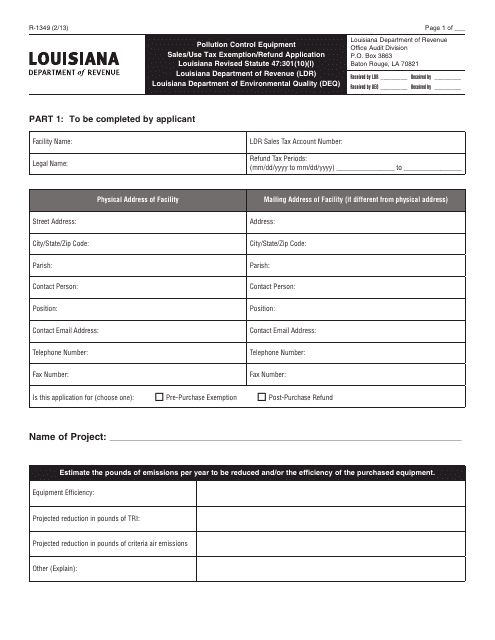

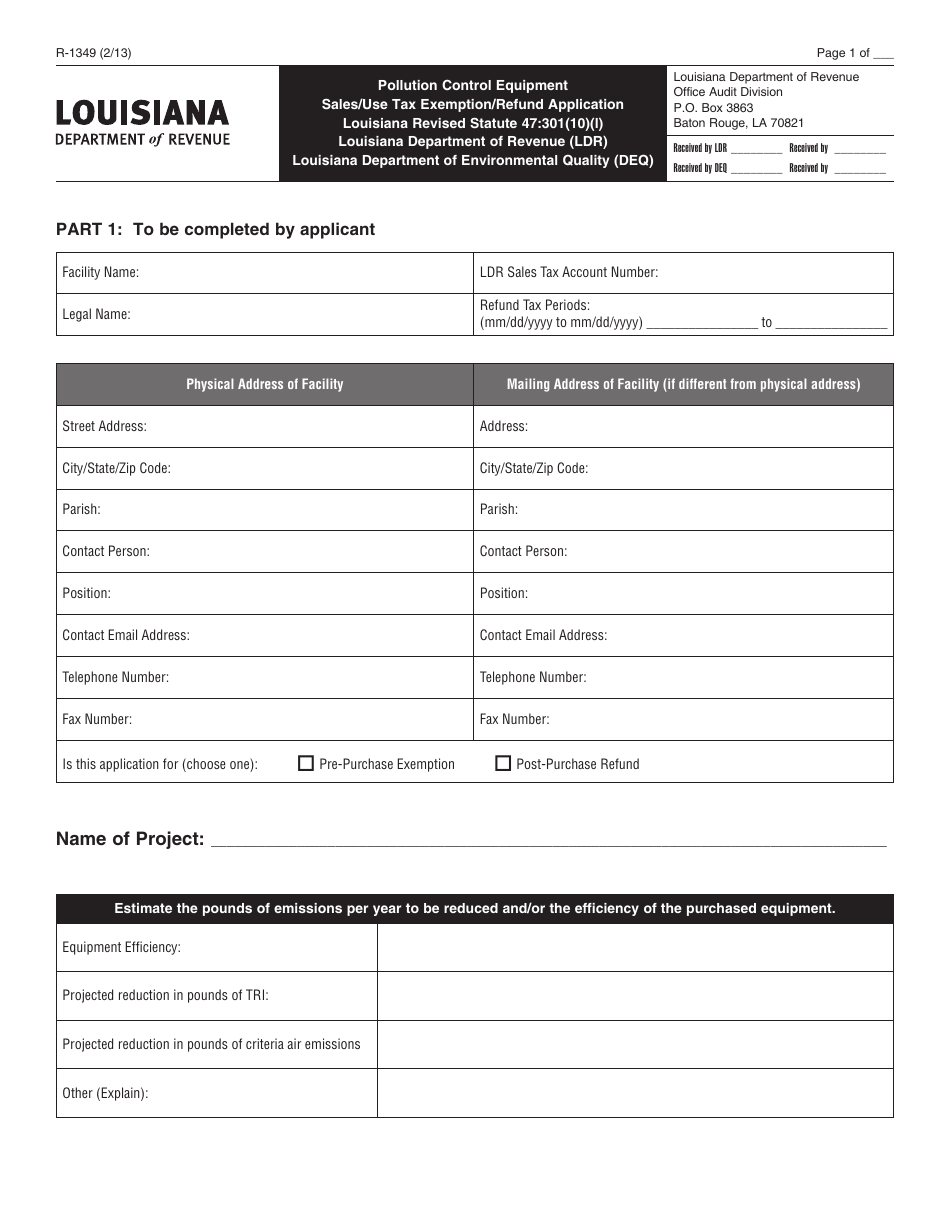

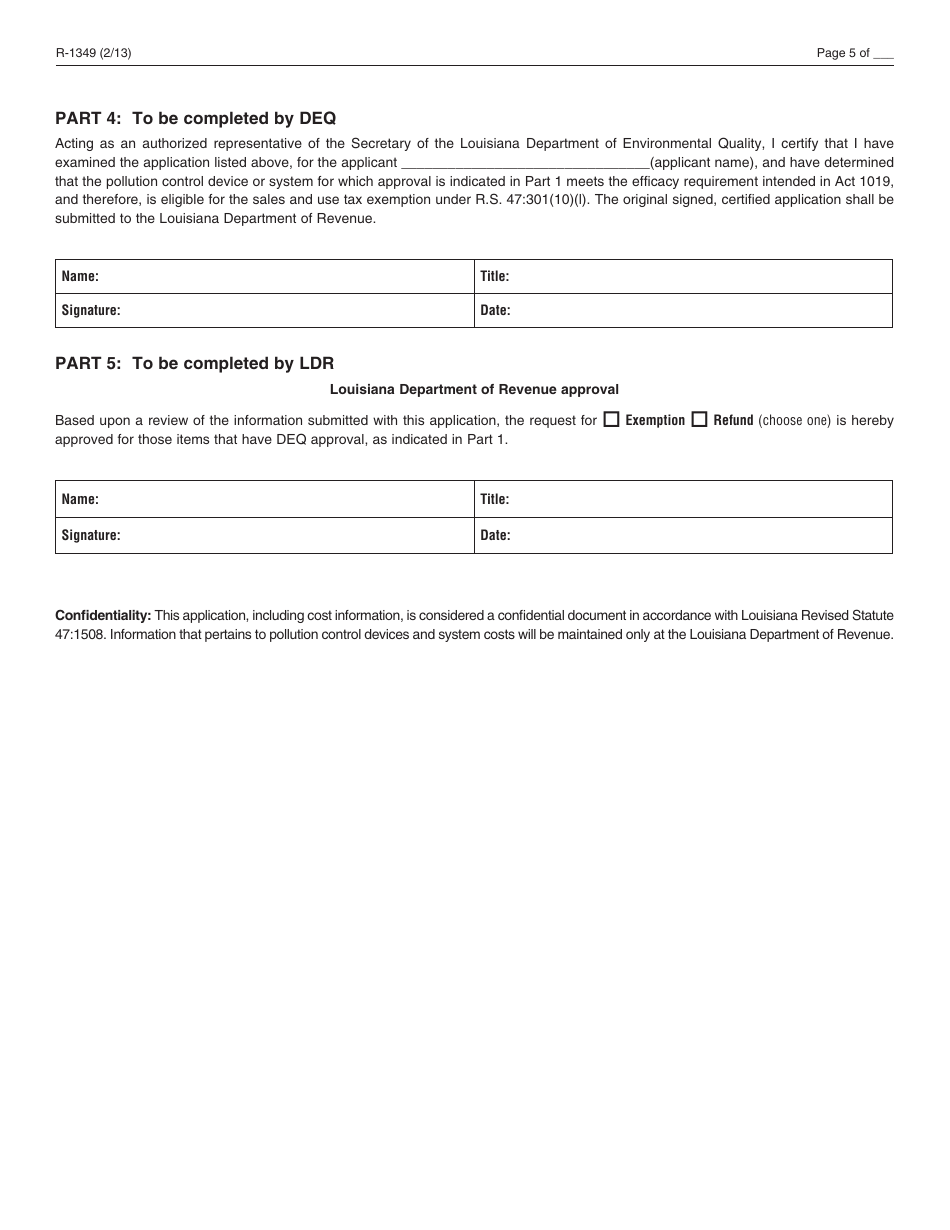

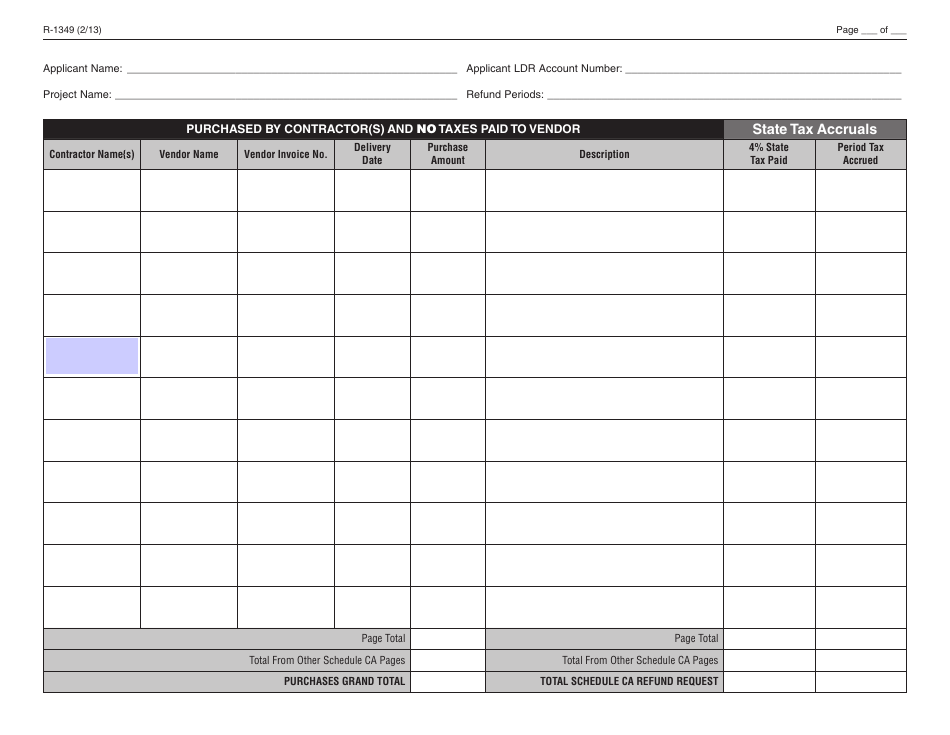

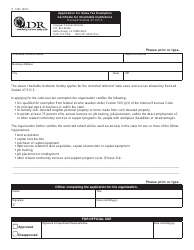

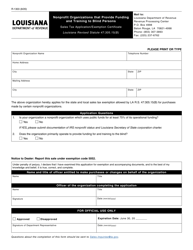

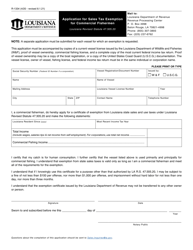

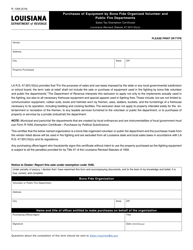

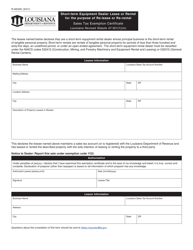

Form R-1349 Pollution Control Equipment Sales / Use Tax Exemption / Refund Application - Louisiana

What Is Form R-1349?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1349?

A: Form R-1349 is the Pollution Control Equipment Sales/Use Tax Exemption/Refund Application in Louisiana.

Q: What is the purpose of Form R-1349?

A: The purpose of Form R-1349 is to apply for exemption or refund of sales/use tax on pollution control equipment in Louisiana.

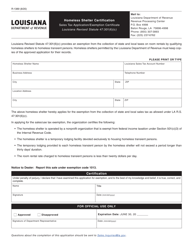

Q: Who can use Form R-1349?

A: Anyone in Louisiana who owns or is purchasing pollution control equipment can use Form R-1349.

Q: What is the benefit of using Form R-1349?

A: Using Form R-1349 allows eligible individuals to claim an exemption or refund for sales/use tax paid on pollution control equipment.

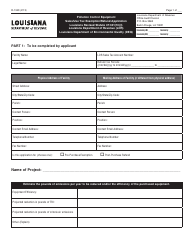

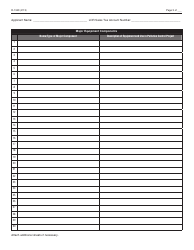

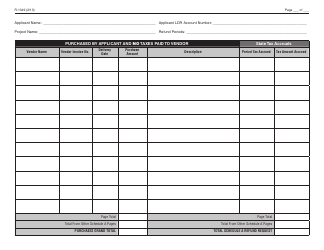

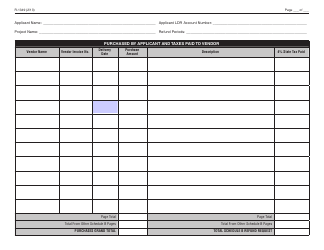

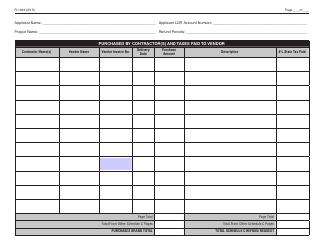

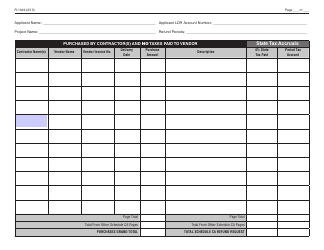

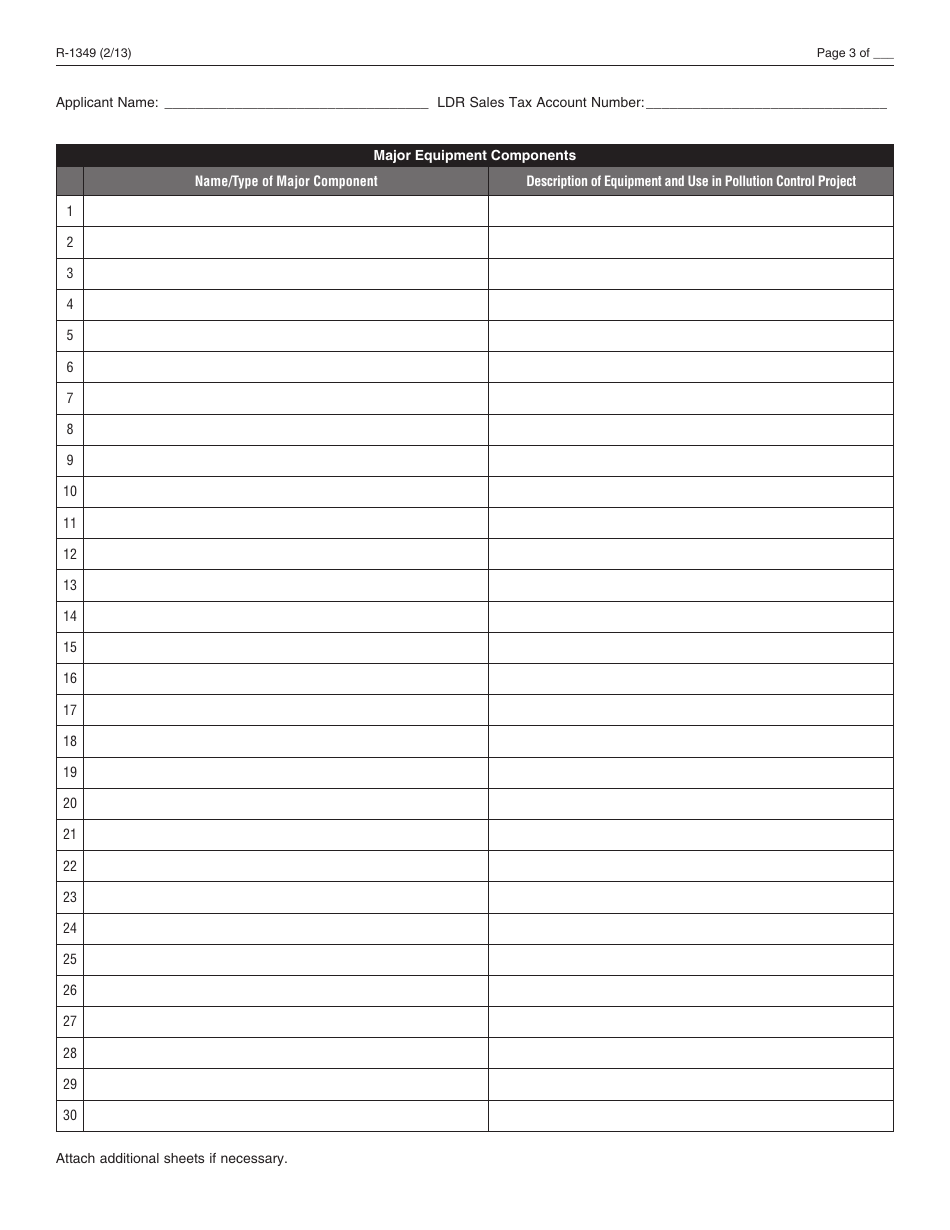

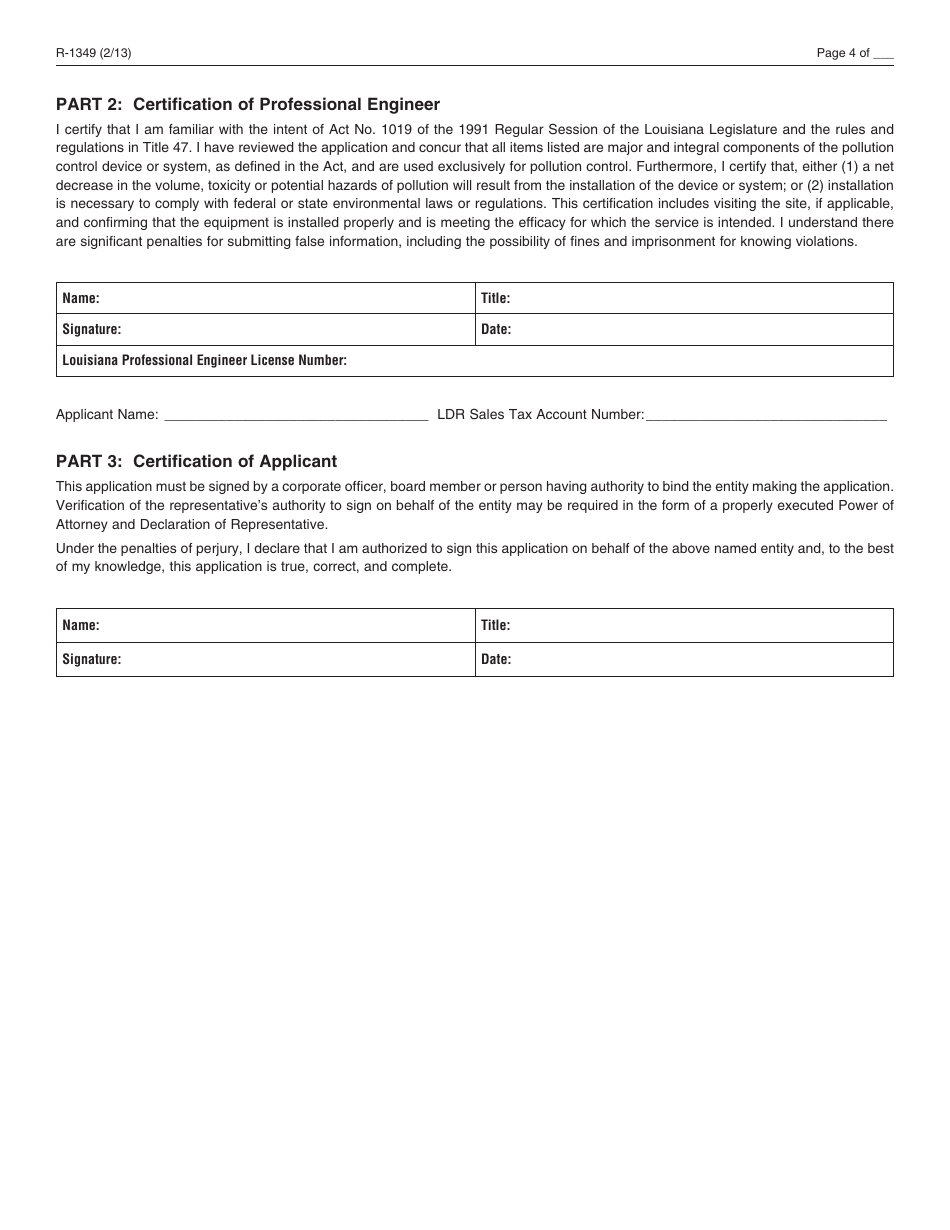

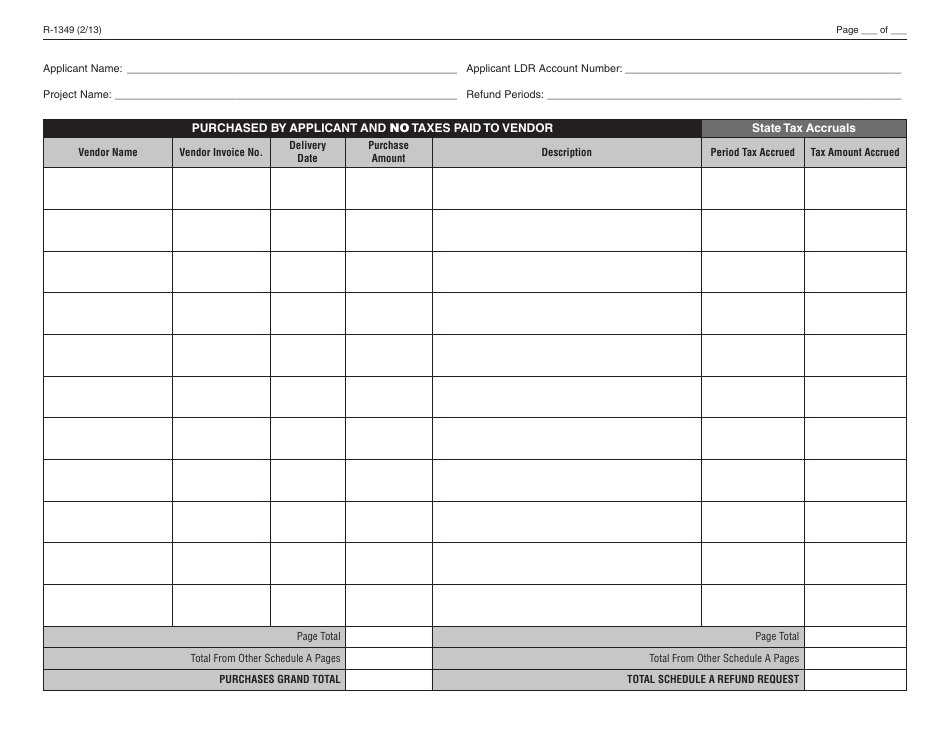

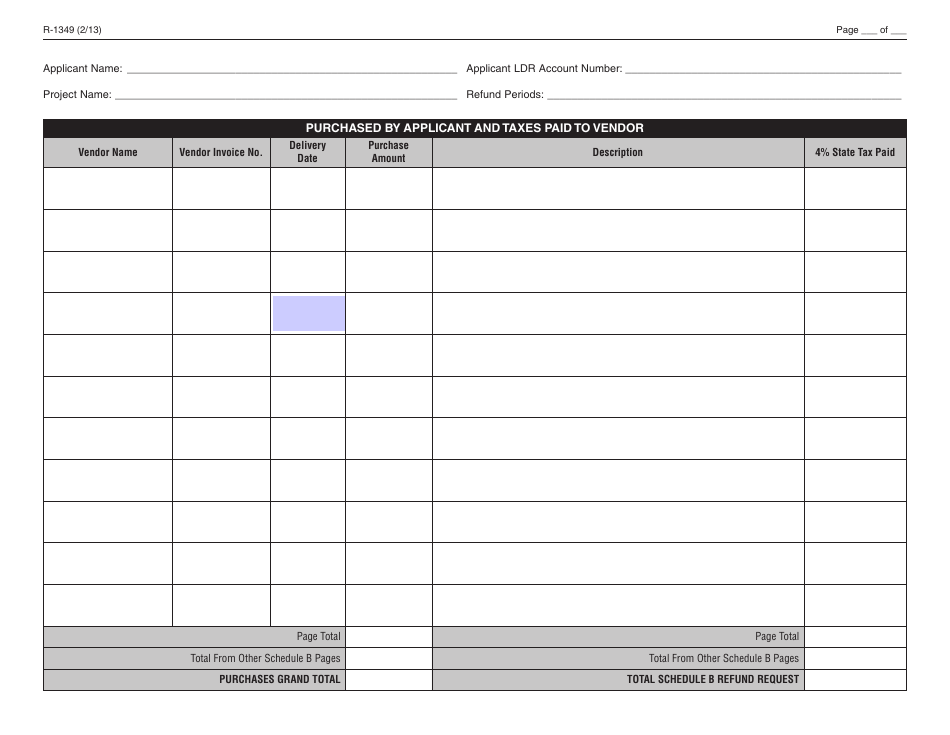

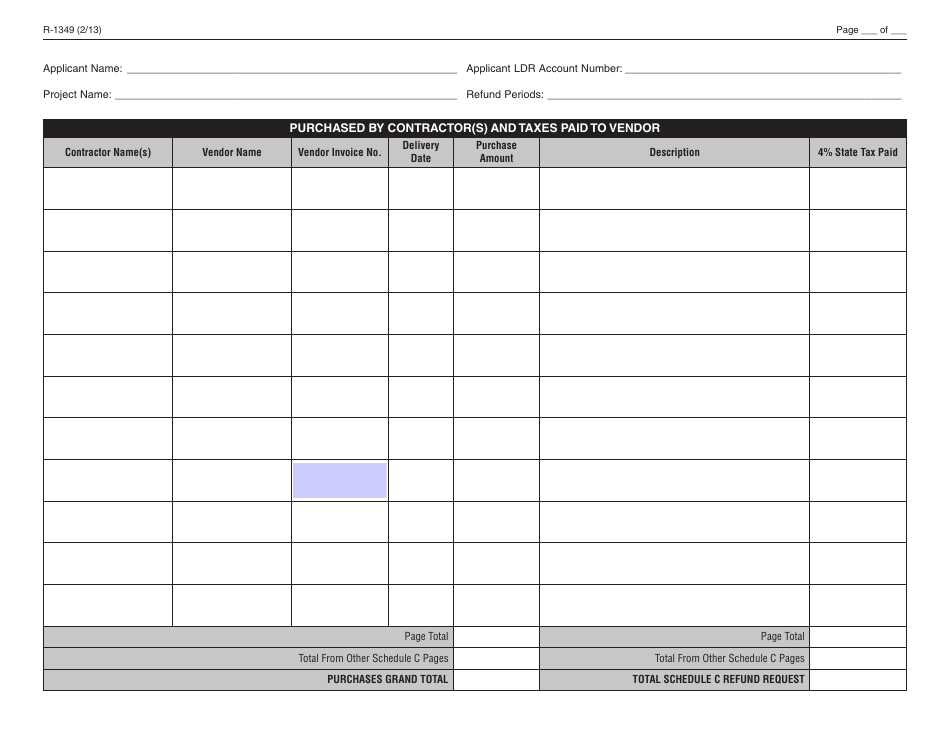

Q: What information is required on Form R-1349?

A: Form R-1349 requires information such as the applicant's name and address, description of the pollution control equipment, purchase details, and supporting documents.

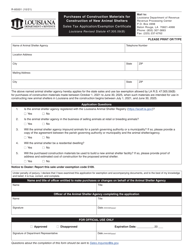

Q: Is there a deadline to submit Form R-1349?

A: Yes, Form R-1349 should be submitted within three years from the date of purchase or use of the pollution control equipment.

Q: Are there any fees associated with filing Form R-1349?

A: No, there are no fees associated with filing Form R-1349.

Q: How long does it take to process Form R-1349?

A: Processing times may vary, but the Louisiana Department of Revenue aims to process applications within 60 days.

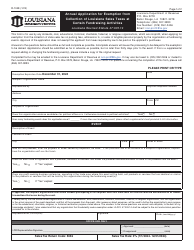

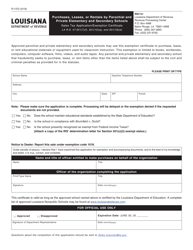

Form Details:

- Released on February 1, 2013;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1349 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.