This version of the form is not currently in use and is provided for reference only. Download this version of

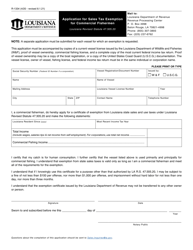

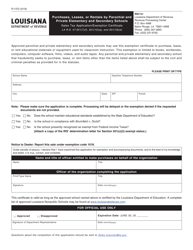

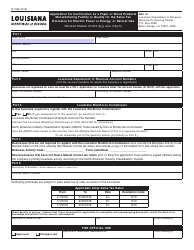

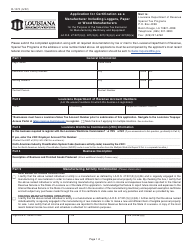

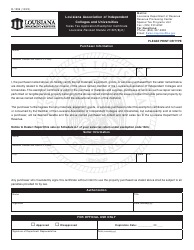

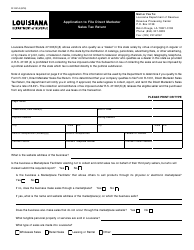

Form R-1313

for the current year.

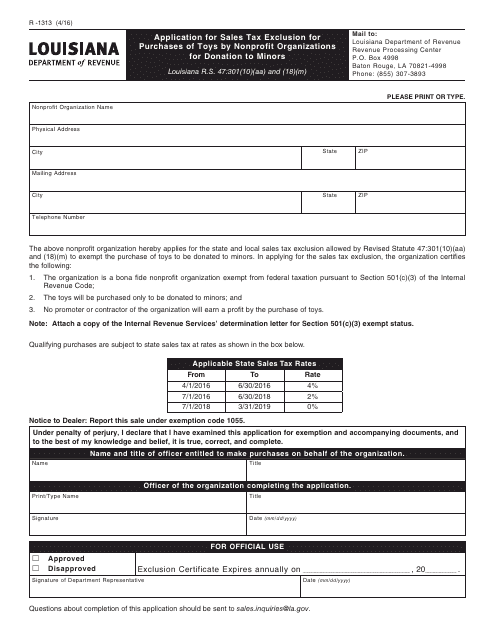

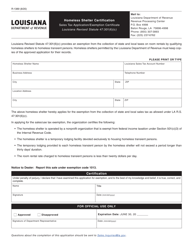

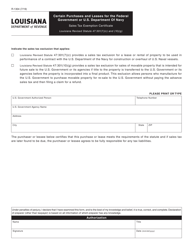

Form R-1313 Application for Sales Tax Exclusion for Purchases of Toys by Nonprofit Organizations for Donation to Minors - Louisiana

What Is Form R-1313?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

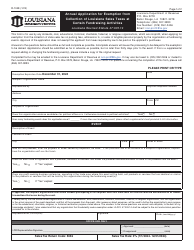

Q: What is Form R-1313?

A: Form R-1313 is an application for sales tax exclusion for purchases of toys by nonprofit organizations for donation to minors in Louisiana.

Q: Who is eligible to use Form R-1313?

A: Nonprofit organizations in Louisiana that want to purchase toys for donation to minors are eligible to use Form R-1313.

Q: What is the purpose of Form R-1313?

A: The purpose of Form R-1313 is to apply for a sales tax exclusion on purchases of toys made by nonprofit organizations for the purpose of donating them to minors.

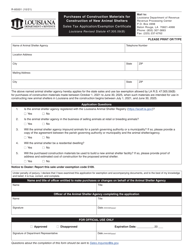

Q: What information do I need to provide on Form R-1313?

A: You will need to provide information about your nonprofit organization, details of the toy purchases, and the intended recipients of the donated toys.

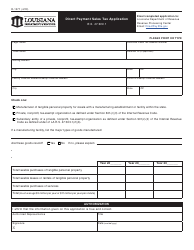

Q: Is there a deadline for submitting Form R-1313?

A: There is no specific deadline mentioned for submitting Form R-1313. However, it is recommended to submit the application well in advance of the planned toy purchases.

Q: Are there any fees involved in submitting Form R-1313?

A: No, there are no fees involved in submitting Form R-1313.

Q: Can I request a refund for sales tax paid on previous toy purchases?

A: No, Form R-1313 is only for applying for a sales tax exclusion on future toy purchases.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1313 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.