This version of the form is not currently in use and is provided for reference only. Download this version of

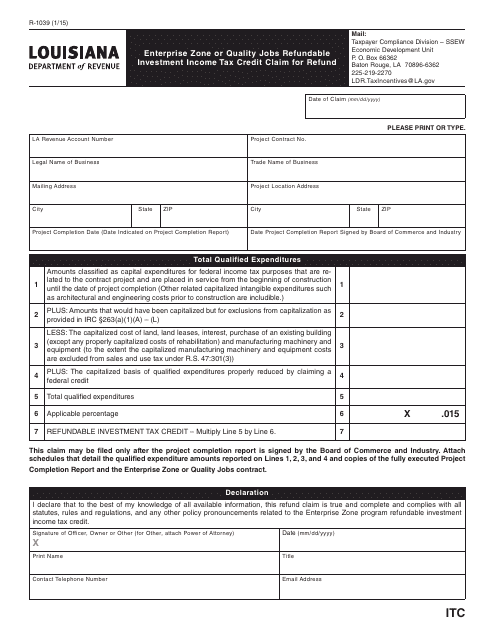

Form R-1039

for the current year.

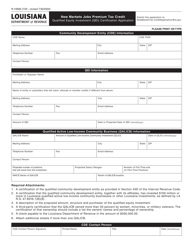

Form R-1039 Enterprise Zone or Quality Jobs Refundable Investment Income Tax Credit Claim for Refund - Louisiana

What Is Form R-1039?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1039?

A: Form R-1039 is a tax form used for claiming the Enterprise Zone or Quality Jobs Refundable Investment Income Tax Credit in Louisiana.

Q: What is the Enterprise Zone or Quality Jobs Refundable Investment Income Tax Credit?

A: The Enterprise Zone or Quality Jobs Refundable Investment Income Tax Credit is a tax credit in Louisiana that helps businesses offset their income tax liability.

Q: Who can claim the Enterprise Zone or Quality Jobs Refundable Investment Income Tax Credit?

A: Businesses operating in designated enterprise zones or businesses participating in the Quality Jobs program in Louisiana may be eligible to claim this tax credit.

Q: What is the purpose of the Enterprise Zone Program?

A: The Enterprise Zone Program aims to promote business growth and economic development in designated areas with high poverty and unemployment rates.

Q: What is the Quality Jobs program?

A: The Quality Jobs program provides tax incentives to businesses that create high-quality jobs with comprehensive benefits in Louisiana.

Q: How do I claim the Enterprise Zone or Quality Jobs Refundable Investment Income Tax Credit?

A: To claim the tax credit, you need to complete and file Form R-1039 with the Louisiana Department of Revenue.

Q: Is the Enterprise Zone or Quality Jobs Refundable Investment Income Tax Credit refundable?

A: Yes, this tax credit is refundable, meaning that if the credit exceeds your income tax liability, you can receive a refund of the excess amount.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1039 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.