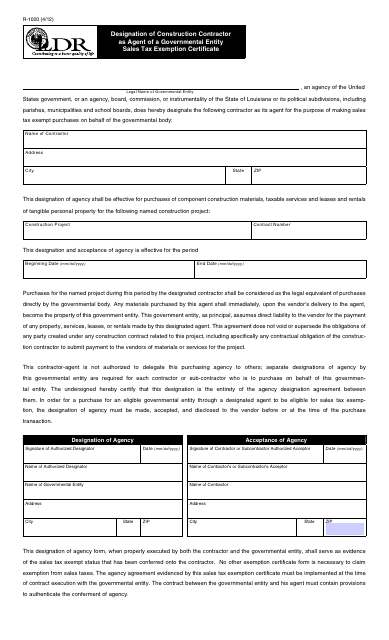

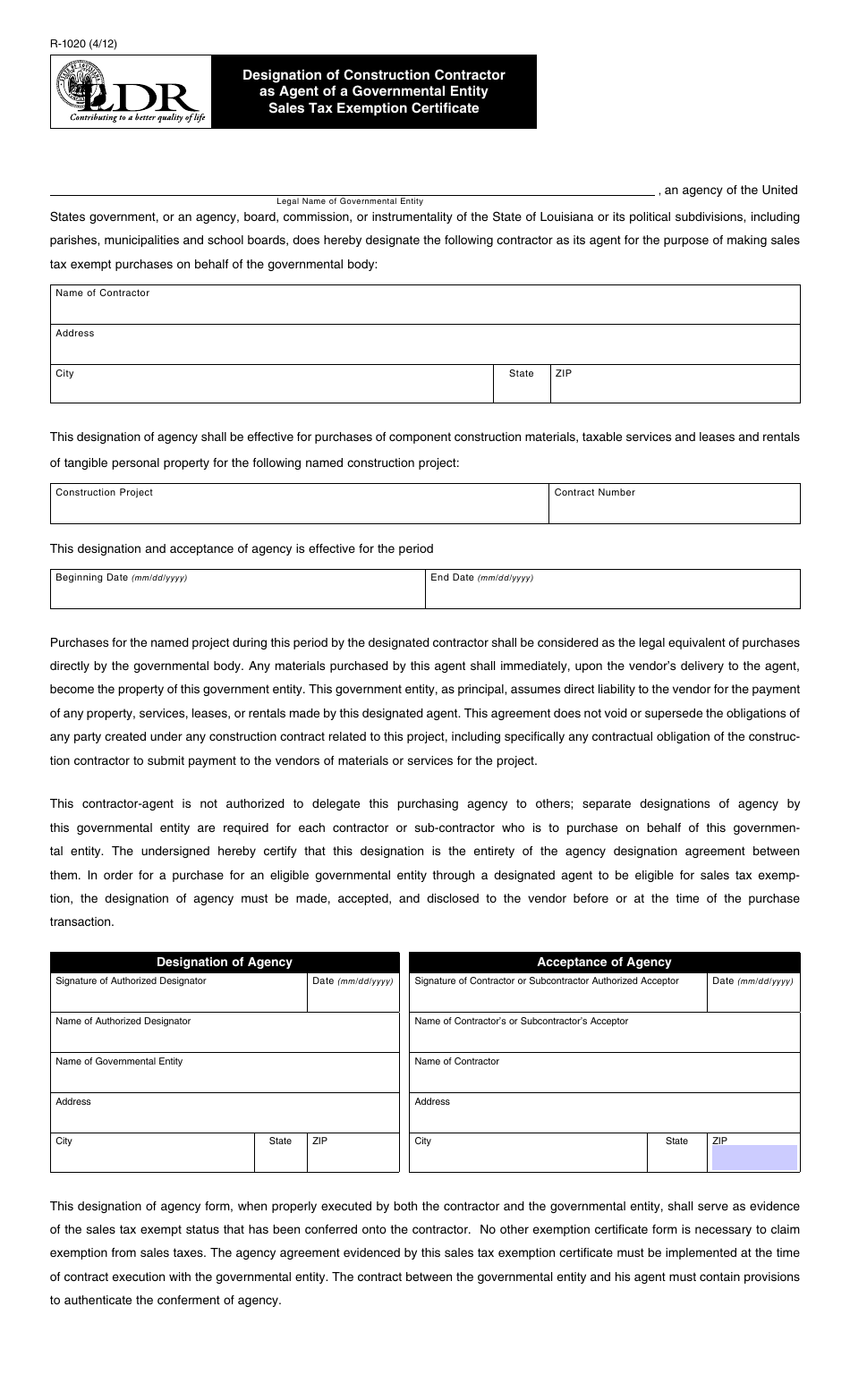

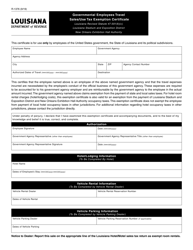

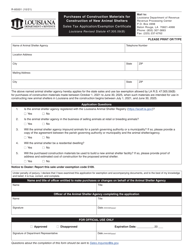

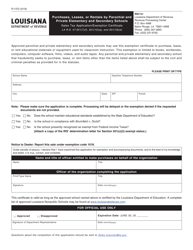

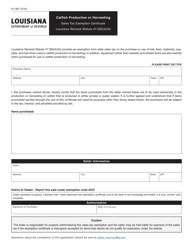

Form R-1020 Designation of Construction Contractor as Agent of a Governmental Entity Sales Tax Exemption Certificate - Louisiana

What Is Form R-1020?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1020?

A: Form R-1020 is the Designation of Construction Contractor as Agent of a Governmental Entity Sales Tax Exemption Certificate in Louisiana.

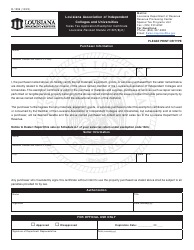

Q: What is the purpose of Form R-1020?

A: The purpose of Form R-1020 is to designate a construction contractor as an agent of a governmental entity for sales tax exemption purposes in Louisiana.

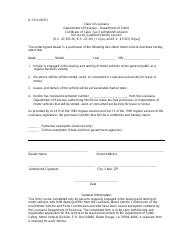

Q: When do I need to use Form R-1020?

A: You need to use Form R-1020 when you are a construction contractor and you are working on a project for a governmental entity in Louisiana.

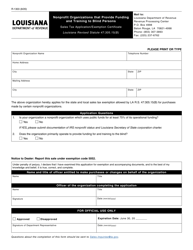

Q: What does it mean to designate a construction contractor as an agent of a governmental entity?

A: Designating a construction contractor as an agent of a governmental entity means that the contractor can purchase materials and supplies for the project without paying sales tax.

Q: Who is eligible for sales tax exemption using Form R-1020?

A: Construction contractors who are working on projects for governmental entities in Louisiana are eligible for sales tax exemption using Form R-1020.

Q: Do I need to submit Form R-1020 to claim the sales tax exemption?

A: Yes, you need to submit Form R-1020 to the Louisiana Department of Revenue in order to claim the sales tax exemption.

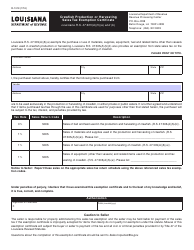

Q: Are there any deadlines for submitting Form R-1020?

A: Yes, Form R-1020 must be submitted to the Louisiana Department of Revenue within 30 days after the contract is awarded or within 30 days after a change in the contract.

Q: What supporting documents do I need to include with Form R-1020?

A: You need to include a copy of the contract between the construction contractor and the governmental entity, as well as any other relevant documentation.

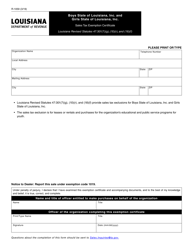

Q: Can I use Form R-1020 for multiple projects?

A: Yes, you can use Form R-1020 for multiple projects as long as they are for governmental entities in Louisiana.

Form Details:

- Released on April 1, 2012;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1020 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.