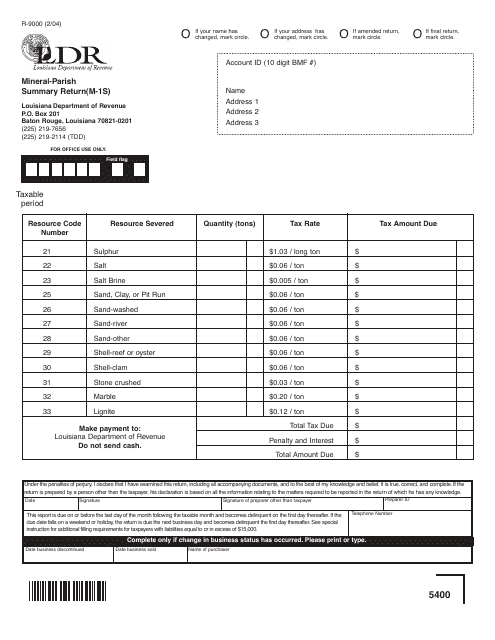

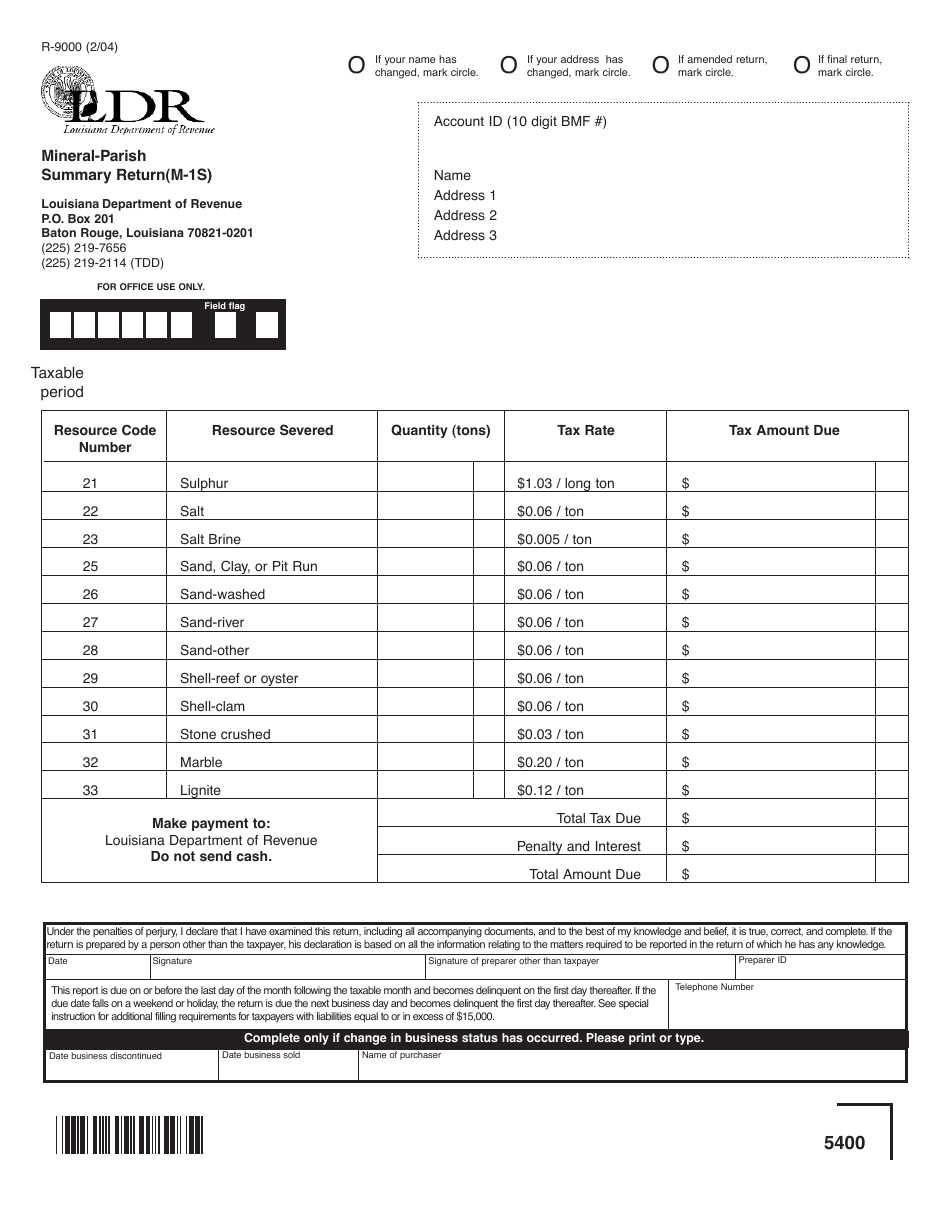

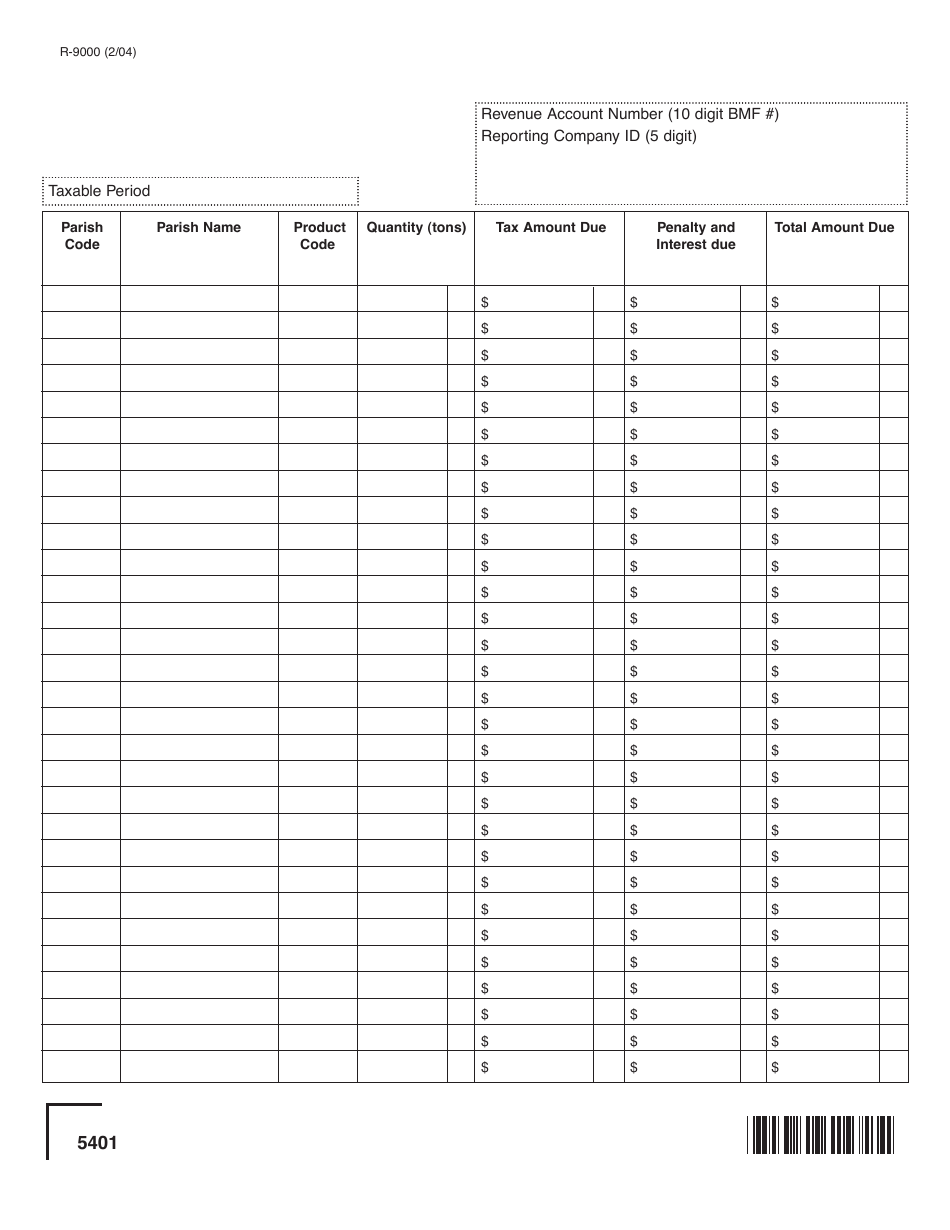

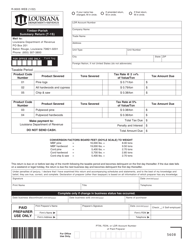

Form R-9000 Mineral-Parish Summary Return(M-1s) - Louisiana

What Is Form R-9000?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-9000 Mineral-Parish Summary Return(M-1s)?

A: Form R-9000 Mineral-Parish Summary Return(M-1s) is a tax form used in the state of Louisiana to report mineral parishes summary return.

Q: Who needs to file Form R-9000 Mineral-Parish Summary Return(M-1s)?

A: Anyone who has mineral interests in the state of Louisiana needs to file Form R-9000 Mineral-Parish Summary Return(M-1s).

Q: What information is required on Form R-9000 Mineral-Parish Summary Return(M-1s)?

A: Form R-9000 Mineral-Parish Summary Return(M-1s) requires information about the mineral interests, such as the type of mineral, location, and production data.

Q: When is the deadline to file Form R-9000 Mineral-Parish Summary Return(M-1s)?

A: The deadline to file Form R-9000 Mineral-Parish Summary Return(M-1s) is typically on or before the 15th day of the 5th month following the end of the taxable year.

Q: Are there any penalties for late filing of Form R-9000 Mineral-Parish Summary Return(M-1s)?

A: Yes, there are penalties for late filing of Form R-9000 Mineral-Parish Summary Return(M-1s). It is important to file the form on time to avoid penalties.

Form Details:

- Released on February 1, 2004;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-9000 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.