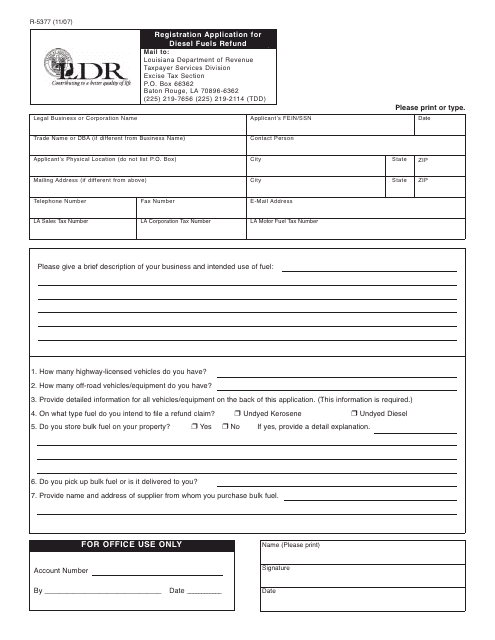

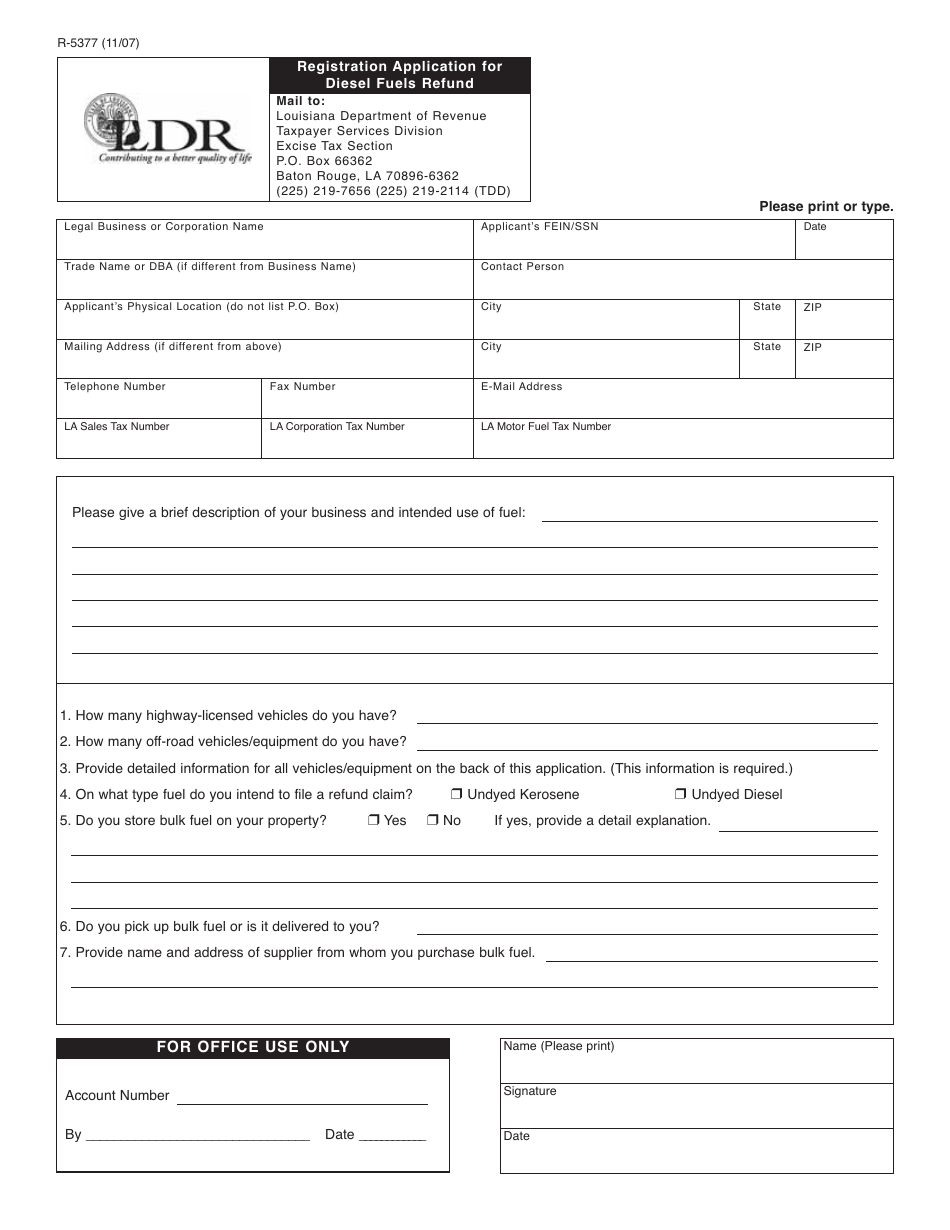

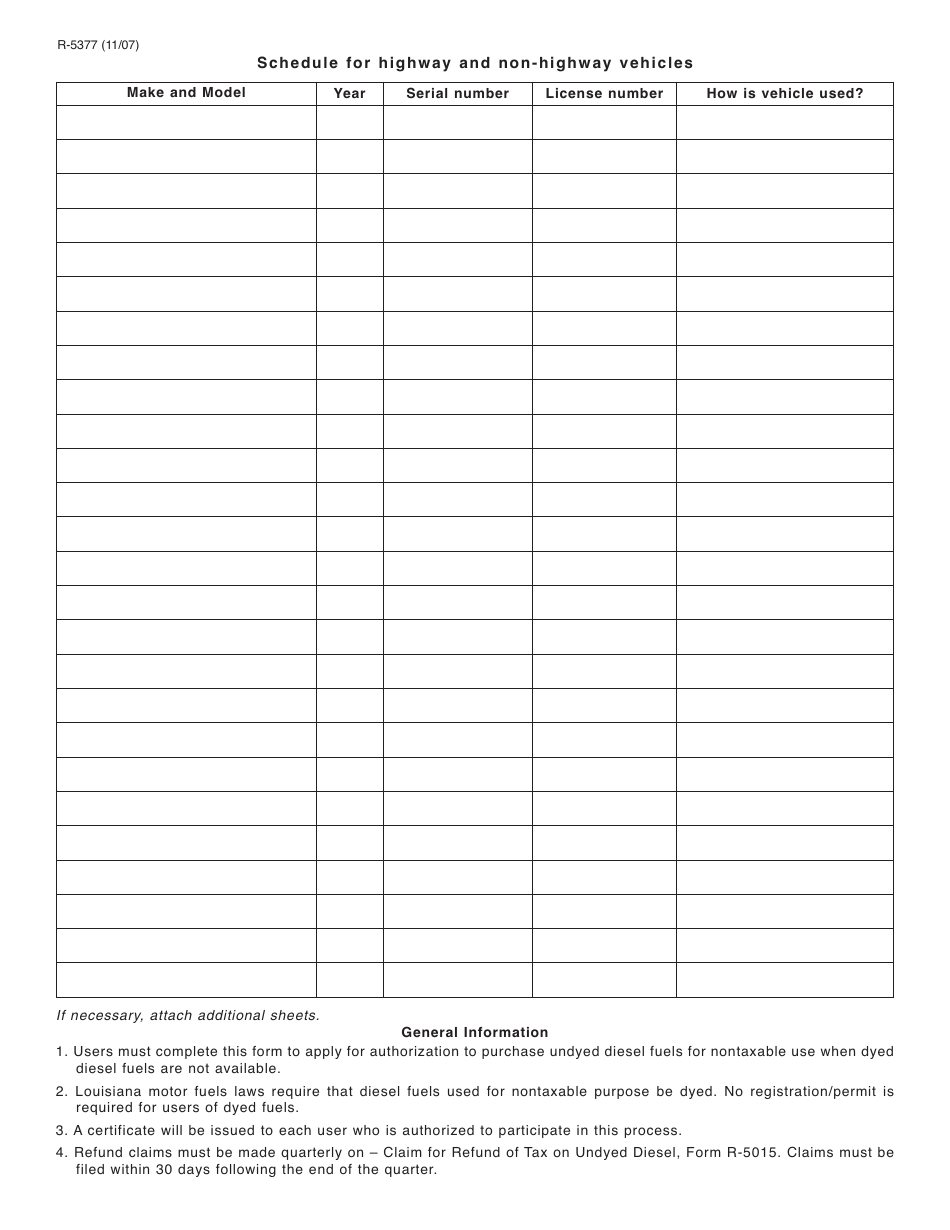

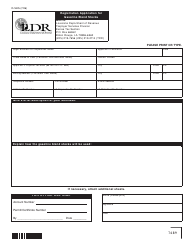

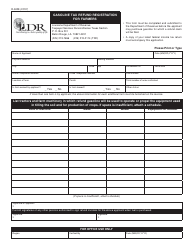

Form R-5337 Registration Application for Diesel Fuels Refund - Louisiana

What Is Form R-5337?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-5337?

A: Form R-5337 is a registration application for Diesel Fuels Refund in Louisiana.

Q: What is the purpose of Form R-5337?

A: The purpose of Form R-5337 is to apply for a refund of diesel fuelstax paid in Louisiana.

Q: Who can use Form R-5337?

A: Anyone who has paid diesel fuels tax in Louisiana may use Form R-5337 to apply for a refund.

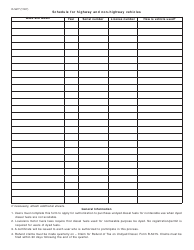

Q: What information is required on Form R-5337?

A: Form R-5337 requires information such as the taxpayer's name, address, social security number or tax ID, and details of the diesel fuel purchases.

Q: When is Form R-5337 due?

A: Form R-5337 is due on a quarterly basis, with the deadline being the last day of the month following the end of each quarter.

Q: How long does it take to receive a refund after filing Form R-5337?

A: It typically takes approximately 4-6 weeks to process and receive a refund after filing Form R-5337.

Q: What should I do if I made an error on Form R-5337?

A: If you made an error on Form R-5337, you should file an amended form as soon as possible to correct the mistake.

Form Details:

- Released on November 1, 2007;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5337 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.