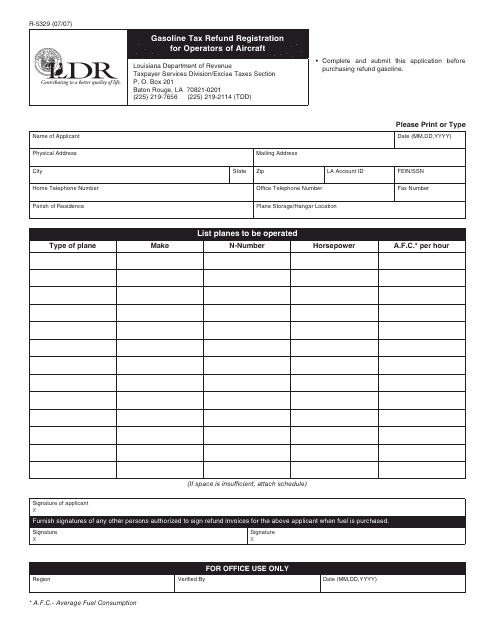

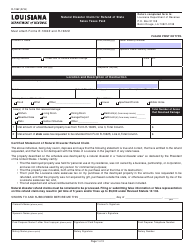

Form R-5329 Gasoline Tax Refund Registration for Operators of Aircraft - Louisiana

What Is Form R-5329?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-5329?

A: Form R-5329 is a Gasoline Tax Refund Registration form.

Q: Who needs to fill out Form R-5329?

A: Operators of aircraft in Louisiana need to fill out Form R-5329.

Q: What is the purpose of Form R-5329?

A: The purpose of Form R-5329 is to register for gasoline tax refunds for operators of aircraft.

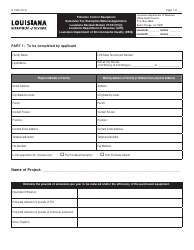

Q: How do I fill out Form R-5329?

A: You need to provide your personal and aircraft information, as well as details about your fuel purchases and usage.

Q: Are there any specific requirements for filling out Form R-5329?

A: Yes, you must be a registered aviation fuel dealer in Louisiana to qualify for gasoline tax refunds.

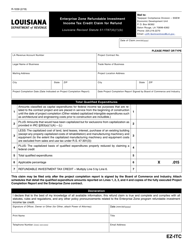

Q: Is there a deadline for submitting Form R-5329?

A: Yes, Form R-5329 must be submitted on or before the 20th day of the month following the quarter in which the purchases were made.

Q: What should I do after submitting Form R-5329?

A: After submitting Form R-5329, you should keep a copy for your records and await the approval of your registration.

Form Details:

- Released on July 1, 2007;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form R-5329 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.