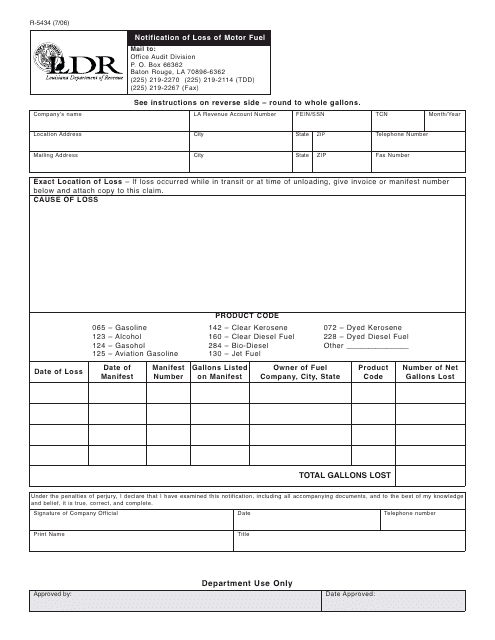

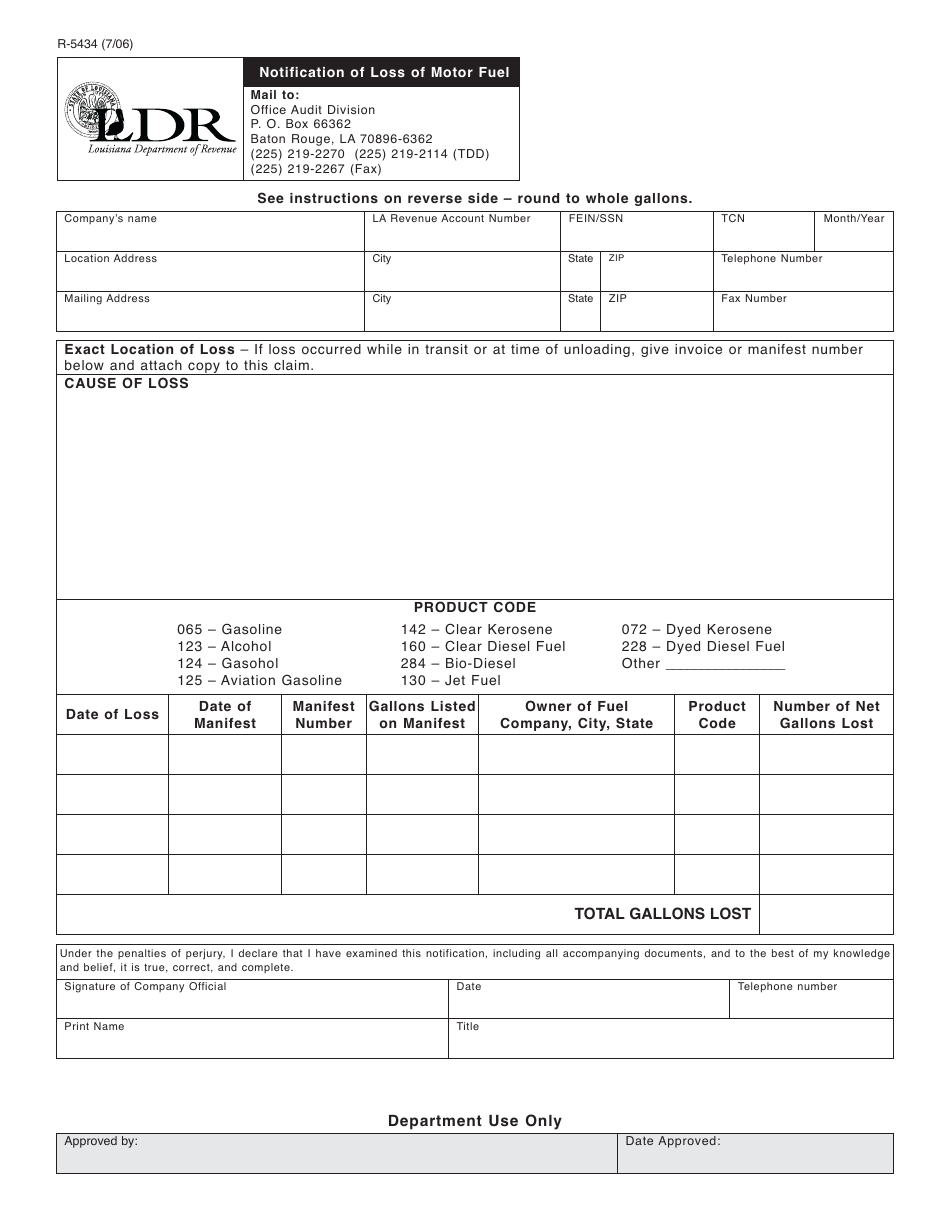

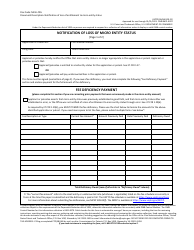

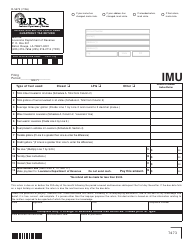

Form R-5434 Notification of Loss of Motor Fuel - Louisiana

What Is Form R-5434?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form R-5434?

A: Form R-5434 is a notification form used in Louisiana to report a loss of motor fuel.

Q: What is the purpose of Form R-5434?

A: The purpose of Form R-5434 is to notify the Louisiana Department of Revenue about any loss or theft of motor fuel.

Q: Who needs to file Form R-5434?

A: Any person or business in Louisiana that experiences a loss of motor fuel needs to file Form R-5434.

Q: When should Form R-5434 be filed?

A: Form R-5434 should be filed within 10 days of discovering the loss of motor fuel.

Q: Are there any penalties for not filing Form R-5434?

A: Yes, failure to file Form R-5434 or providing false information can result in penalties and fines.

Q: What information is required on Form R-5434?

A: Form R-5434 requires information such as the date and location of the loss, a description of the motor fuel, and the estimated quantity and value of the fuel lost.

Form Details:

- Released on July 1, 2006;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5434 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.