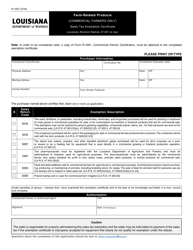

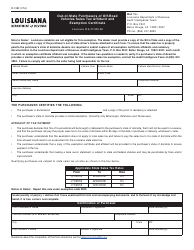

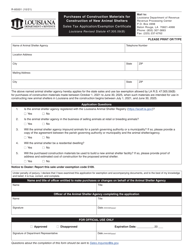

This version of the form is not currently in use and is provided for reference only. Download this version of

Form R-1065

for the current year.

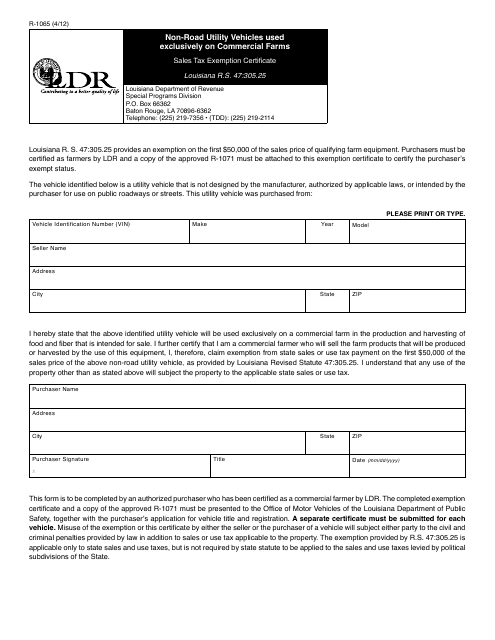

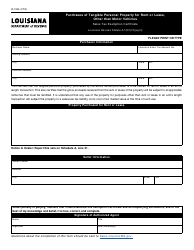

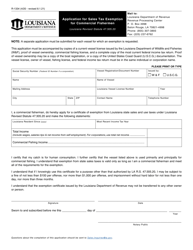

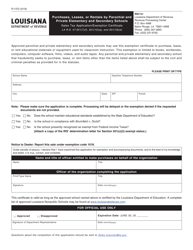

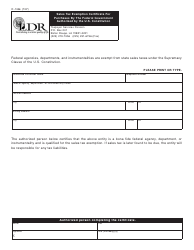

Form R-1065 Non-road Utility Vehicles Used Exclusively on Commercial Farms - Sales Tax Exemption Certificate - Louisiana

What Is Form R-1065?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

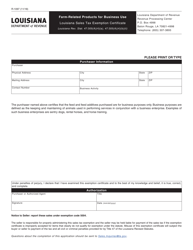

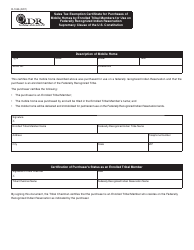

Q: What is Form R-1065?

A: Form R-1065 is a Sales Tax Exemption Certificate specifically for non-road utility vehicles used exclusively on commercial farms in Louisiana.

Q: Who is eligible to use Form R-1065?

A: Farmers or farm businesses in Louisiana who use non-road utility vehicles exclusively on their commercial farms are eligible to use Form R-1065.

Q: What is the purpose of Form R-1065?

A: The purpose of Form R-1065 is to claim a sales tax exemption on non-road utility vehicles used exclusively on commercial farms.

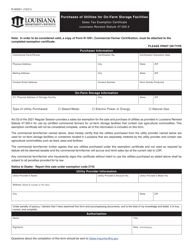

Q: What is a non-road utility vehicle?

A: A non-road utility vehicle is a motor vehicle that is designed and used primarily for the transportation of goods and materials on commercial farms.

Q: What does 'exclusively used on commercial farms' mean?

A: 'Exclusively used on commercial farms' means that the non-road utility vehicle is used solely for farming activities and not for personal or non-agricultural purposes.

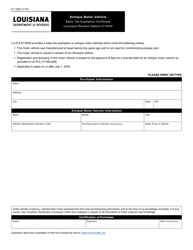

Form Details:

- Released on April 1, 2012;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1065 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.