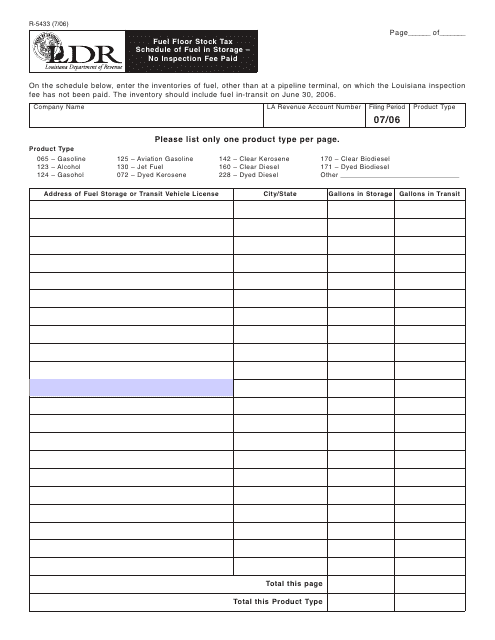

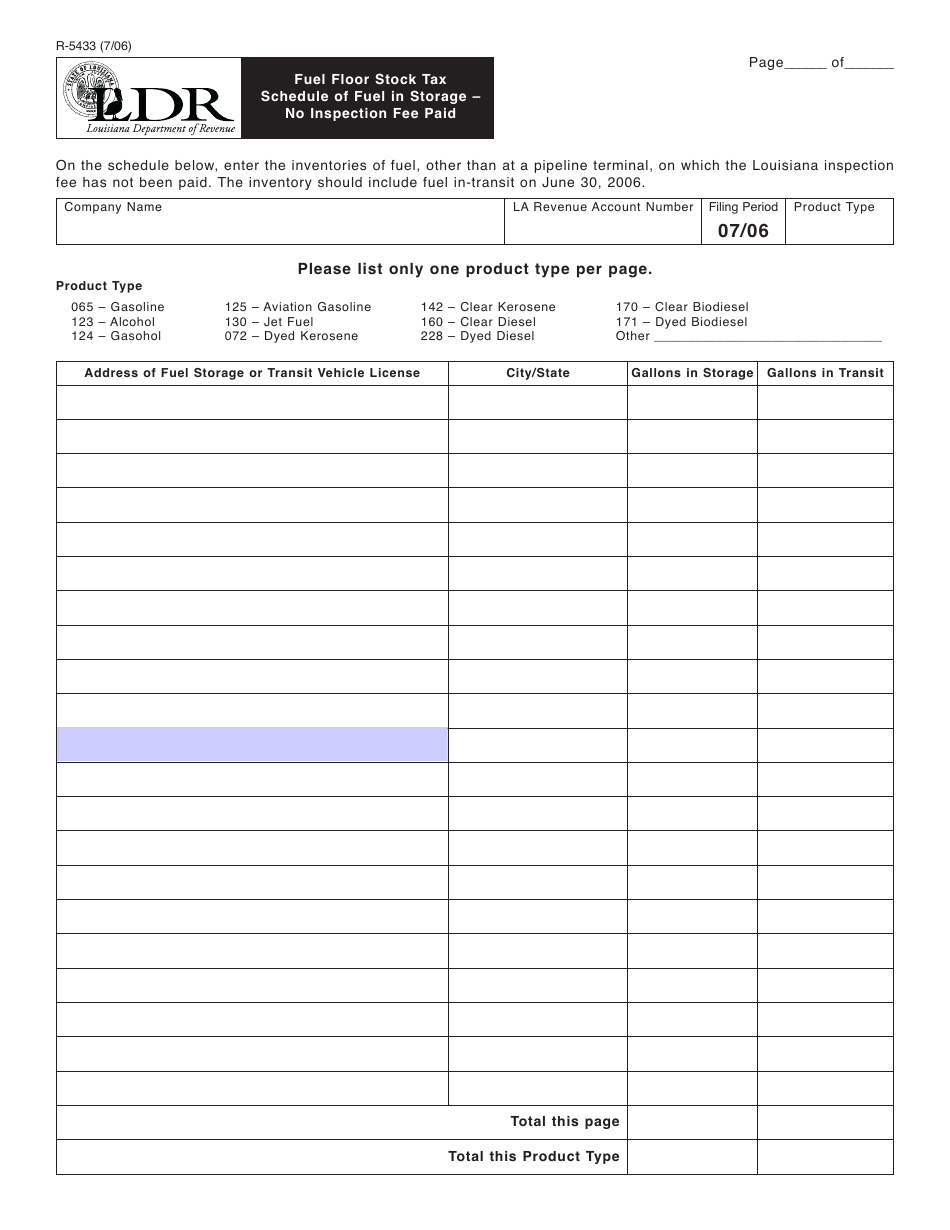

Form R-5433 Fuel Floor Stock Tax - Schedule of Fuel in Storage - No Inspection Fee Paid - Louisiana

What Is Form R-5433?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-5433?

A: Form R-5433 is the Fuel Floor Stock Tax - Schedule of Fuel in Storage - No Inspection Fee Paid form used in Louisiana.

Q: What is the purpose of Form R-5433?

A: Form R-5433 is used to report the quantity of fuel stored without paying the inspection fee in Louisiana.

Q: What is Fuel Floor Stock Tax?

A: Fuel Floor Stock Tax is a tax imposed on the storage of fuel without paying the inspection fee.

Q: Who needs to file Form R-5433?

A: Any person or business that stores fuel without paying the inspection fee in Louisiana needs to file Form R-5433.

Q: Is there an inspection fee for storing fuel in Louisiana?

A: Yes, there is an inspection fee for storing fuel in Louisiana. If the fee has not been paid, it should be reported on Form R-5433.

Q: What information is required on Form R-5433?

A: Form R-5433 requires the taxpayer to report the quantity of fuel in storage, the type of fuel, and the location where the fuel is stored.

Q: When is Form R-5433 due?

A: Form R-5433 is due on the 20th day of the month following the end of the reporting period.

Q: What happens if I don't file Form R-5433?

A: Failure to file Form R-5433 or underreporting the quantity of fuel stored may result in penalties and interest.

Q: Who can I contact for more information about Form R-5433?

A: For more information about Form R-5433, you can contact the Louisiana Department of Revenue.

Form Details:

- Released on July 1, 2006;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5433 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.