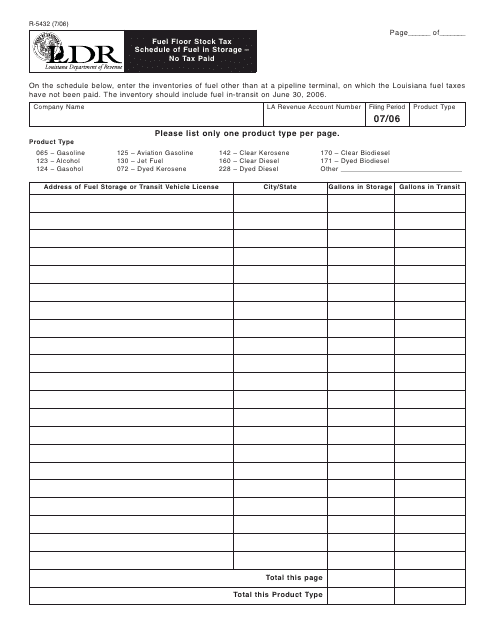

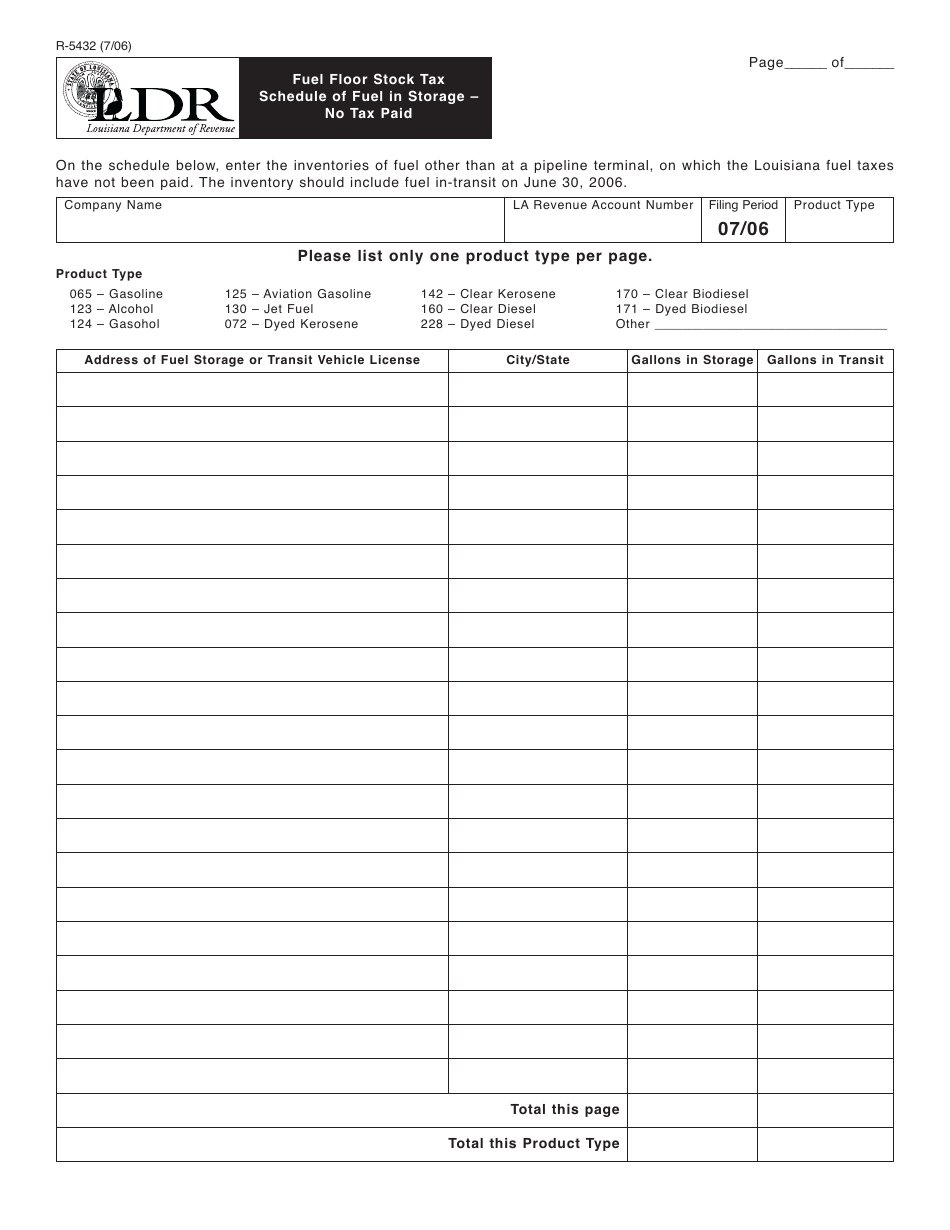

Form R-5432 Fuel Floor Stock Tax Schedule of Fuel in Storage - No Tax Paid - Louisiana

What Is Form R-5432?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-5432?

A: Form R-5432 is a Fuel Floor StockTax Schedule of Fuel in Storage for Louisiana.

Q: What is the purpose of Form R-5432?

A: The purpose of Form R-5432 is to report the fuel in storage for which no tax has been paid.

Q: Who needs to file Form R-5432?

A: Any individual or business that has fuel in storage for which no tax has been paid in the state of Louisiana may need to file Form R-5432.

Q: What is meant by 'fuel floor stock tax'?

A: Fuel floor stock tax refers to the tax owed on fuel that is in storage and has not yet been sold or used.

Q: Is Form R-5432 specific to Louisiana?

A: Yes, Form R-5432 is specific to the state of Louisiana and its fuel floor stock tax requirements.

Form Details:

- Released on July 1, 2006;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5432 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.