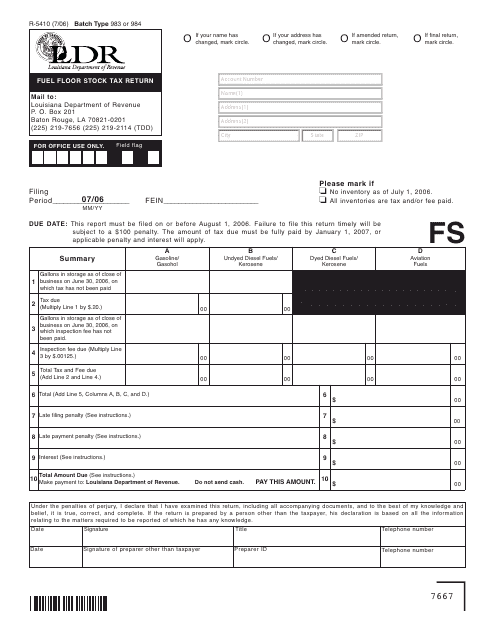

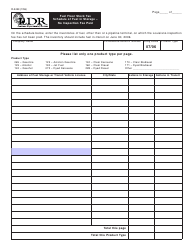

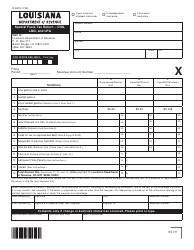

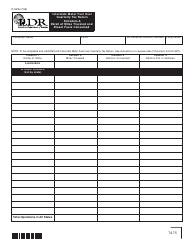

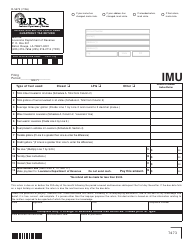

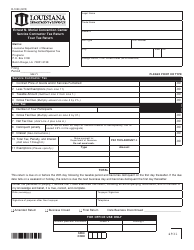

Form R-5410 Fuel Floor Stock Tax Return - Louisiana

What Is Form R-5410?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form R-5410?

A: Form R-5410 is the Fuel Floor Stock Tax Return.

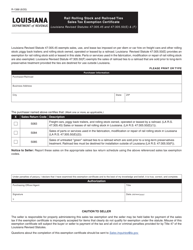

Q: What is the Fuel Floor Stock Tax?

A: The Fuel Floor Stock Tax is a tax imposed on fuel held in inventory.

Q: Who needs to file Form R-5410?

A: Any person or entity that holds fuel in inventory in Louisiana is required to file Form R-5410.

Q: What is the purpose of Form R-5410?

A: The purpose of Form R-5410 is to report and pay the Fuel Floor Stock Tax.

Q: When is Form R-5410 due?

A: Form R-5410 is due on a monthly basis, and the due date is the last day of the month following the month being reported.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing, non-filing, and underpayment of the Fuel Floor Stock Tax. It is important to file your returns on time to avoid these penalties.

Q: Are there any exemptions or deductions available for the Fuel Floor Stock Tax?

A: No, there are no exemptions or deductions available for the Fuel Floor Stock Tax in Louisiana.

Form Details:

- Released on July 1, 2006;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5410 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.