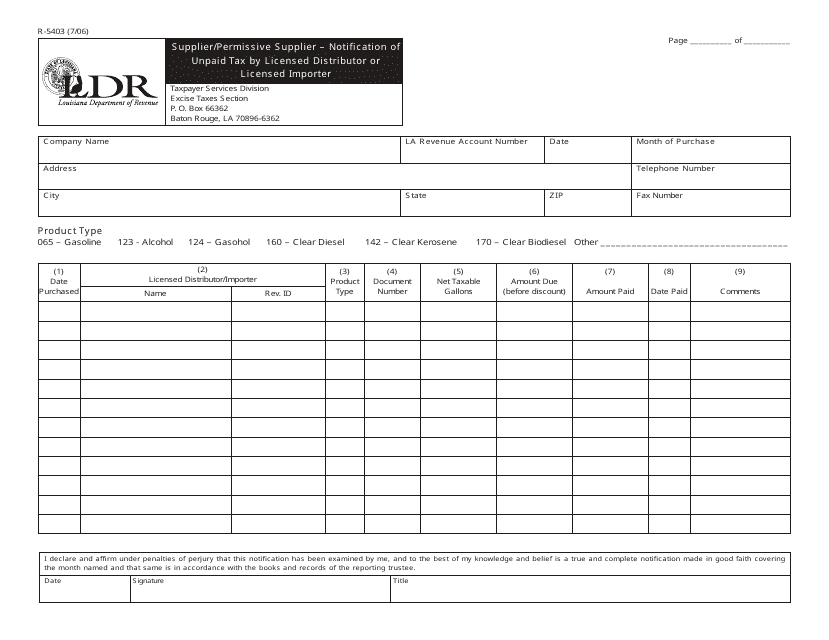

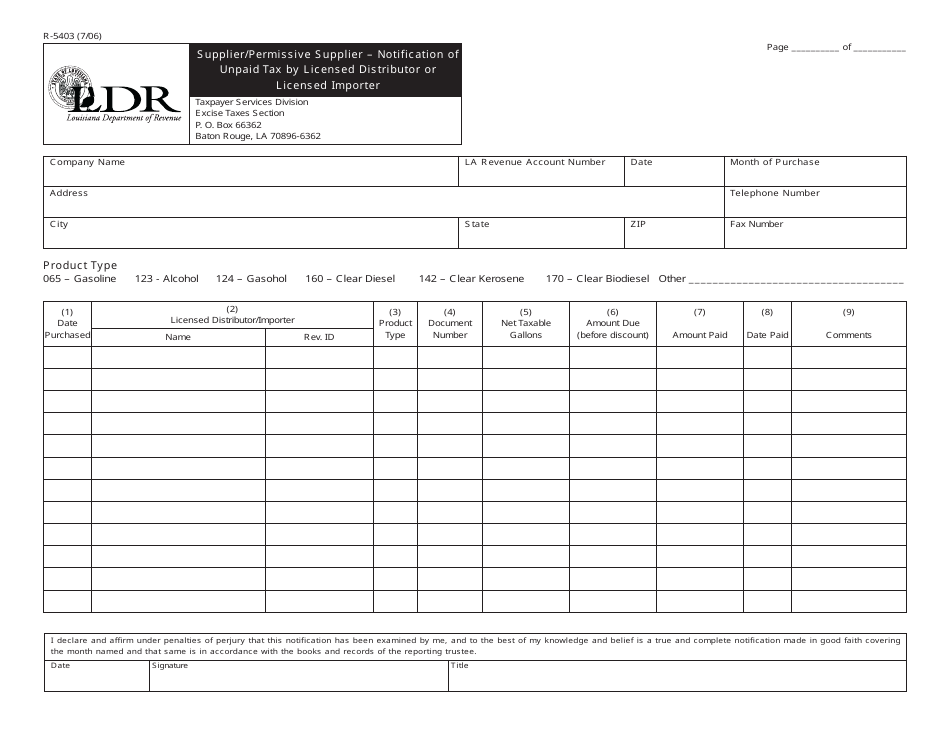

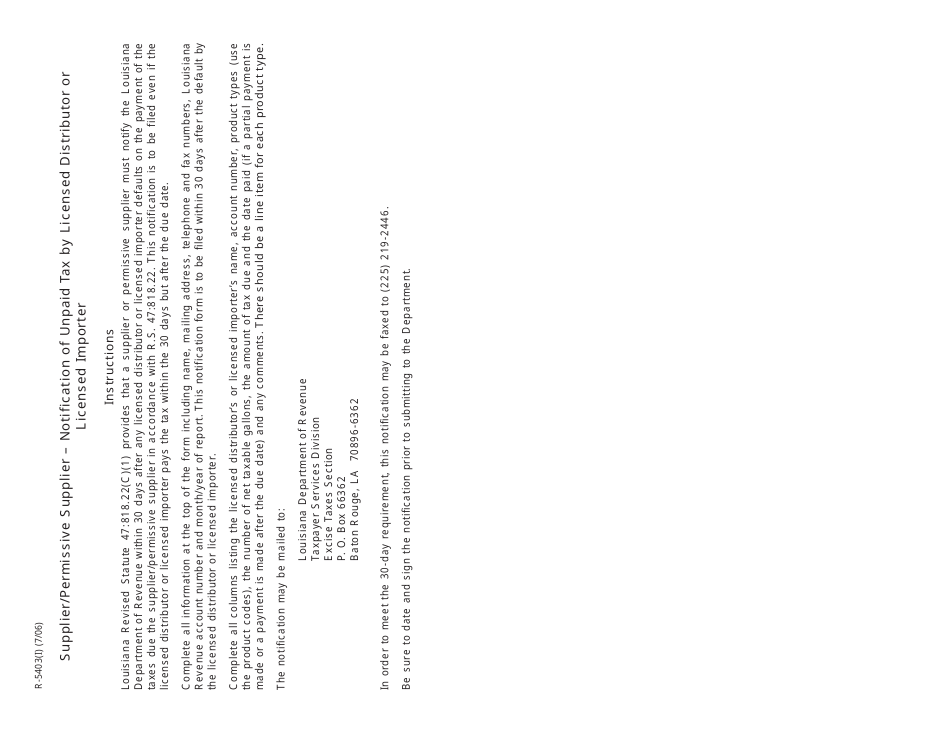

Form R-5403 Supplier / Permissive Supplier - Notification of Unpaid Tax by Licensed Distributor or Licensed Importer - Louisiana

What Is Form R-5403?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-5403?

A: Form R-5403 is a notification form used in Louisiana. It is used to report unpaid taxes by a licensed distributor or licensed importer.

Q: Who is required to fill out Form R-5403?

A: Licensed distributors or licensed importers in Louisiana are required to fill out Form R-5403 if they have unpaid taxes.

Q: What is the purpose of Form R-5403?

A: The purpose of Form R-5403 is to notify suppliers and permissive suppliers about unpaid taxes by a licensed distributor or licensed importer.

Q: What information is required on Form R-5403?

A: Form R-5403 requires information such as the distributor or importer's name, address, tax identification number, amount of unpaid taxes, and the period covered by the unpaid taxes.

Form Details:

- Released on July 1, 2006;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5403 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.