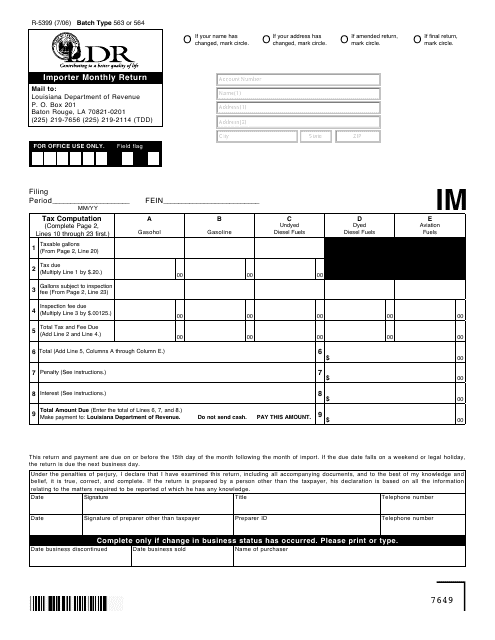

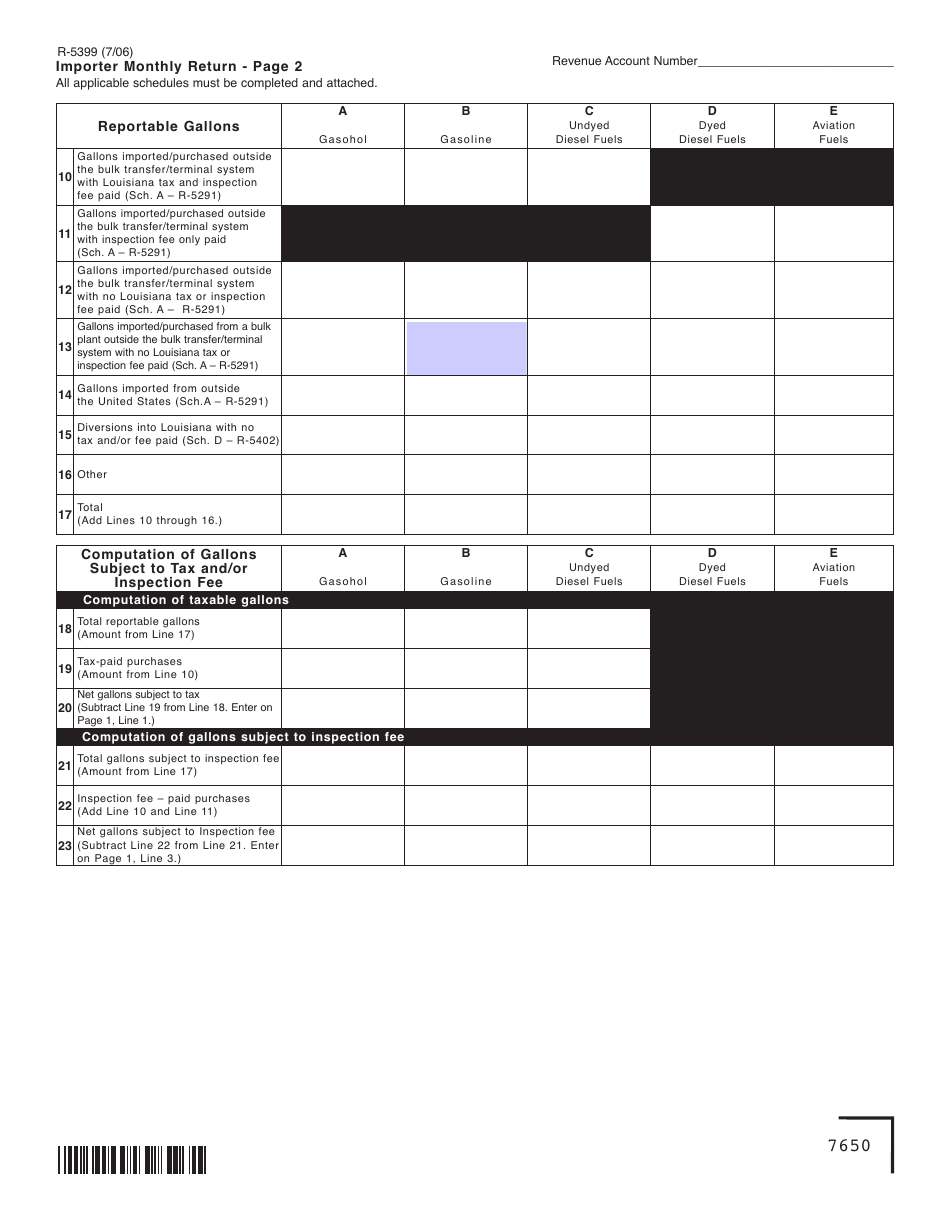

Form R-5399 Importer Monthly Return - Louisiana

What Is Form R-5399?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form R-5399?

A: Form R-5399 is the Importer Monthly Return form used in the state of Louisiana.

Q: Who needs to file Form R-5399?

A: Importers in Louisiana are required to file Form R-5399 on a monthly basis.

Q: What is the purpose of Form R-5399?

A: Form R-5399 is used to report and pay use tax on imported goods in Louisiana.

Q: How often is Form R-5399 filed?

A: Form R-5399 is filed on a monthly basis.

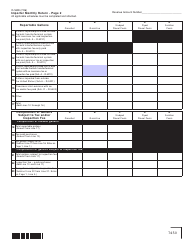

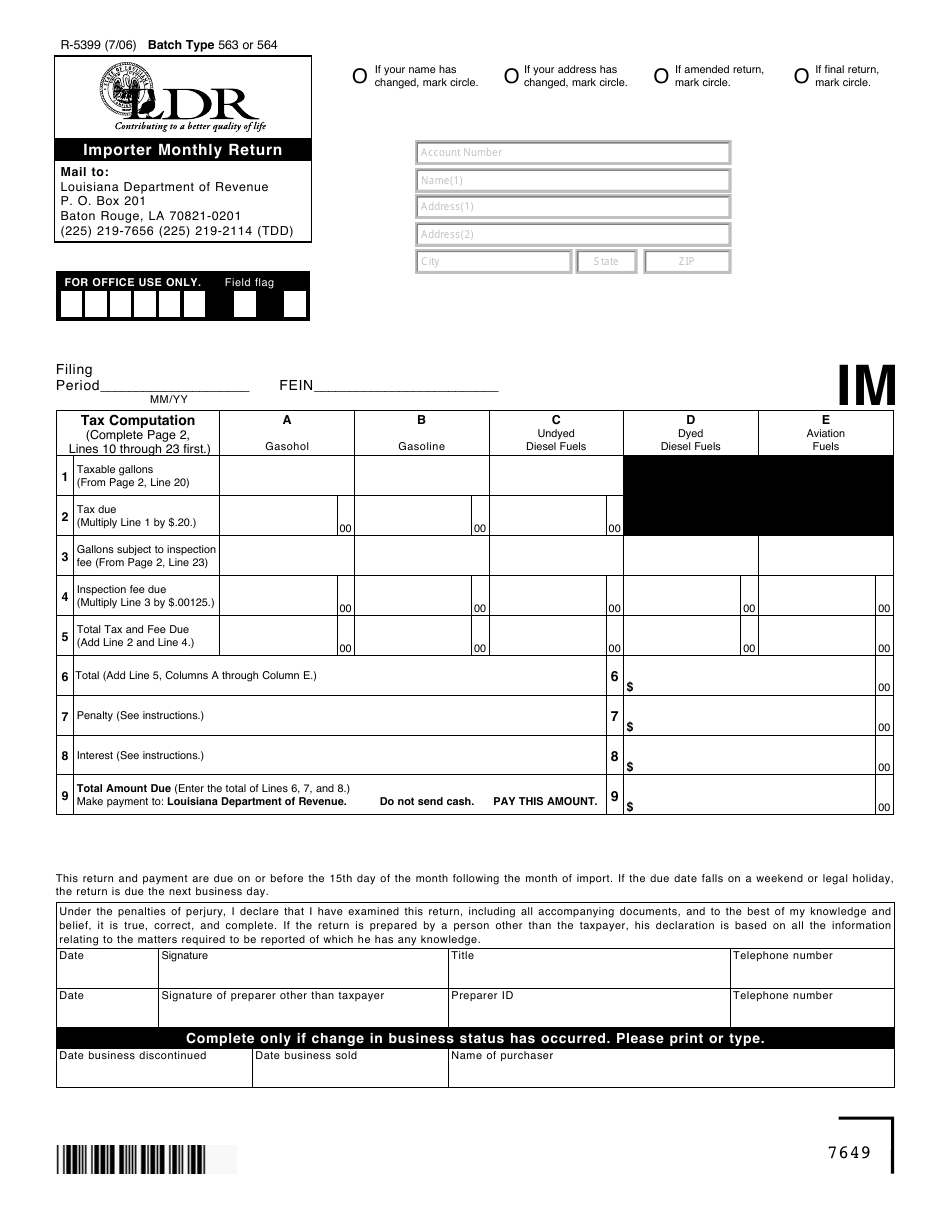

Q: What information is required on Form R-5399?

A: Form R-5399 requires the importers to provide details of their imported goods and calculate the use tax owed.

Q: When is Form R-5399 due?

A: Form R-5399 is due on the 20th day of the following month.

Q: Are there any penalties for late filing of Form R-5399?

A: Yes, there are penalties for late filing of Form R-5399. The penalty is based on the amount of unpaid use tax.

Q: Can Form R-5399 be filed electronically?

A: Yes, Form R-5399 can be filed electronically through the Louisiana Taxpayer Access Point (LaTAP).

Q: Is Form R-5399 only for businesses? Can individuals also file this form?

A: Form R-5399 is primarily for businesses, but individuals who meet certain criteria may also have to file this form.

Form Details:

- Released on July 1, 2006;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5399 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.