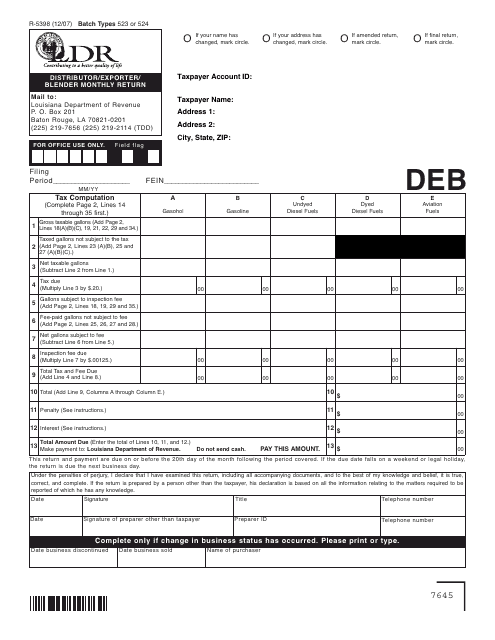

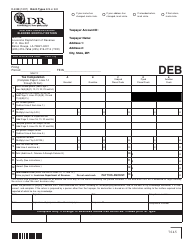

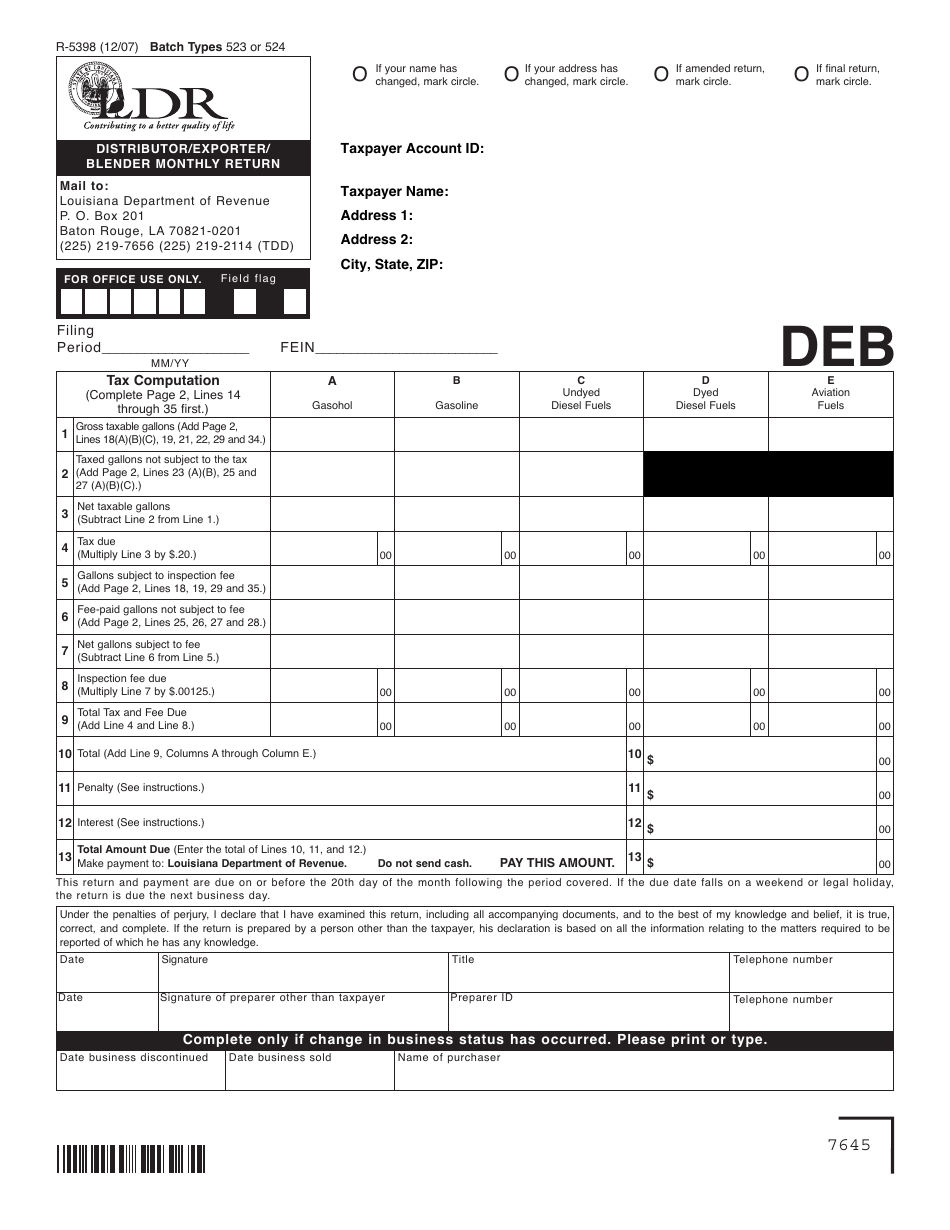

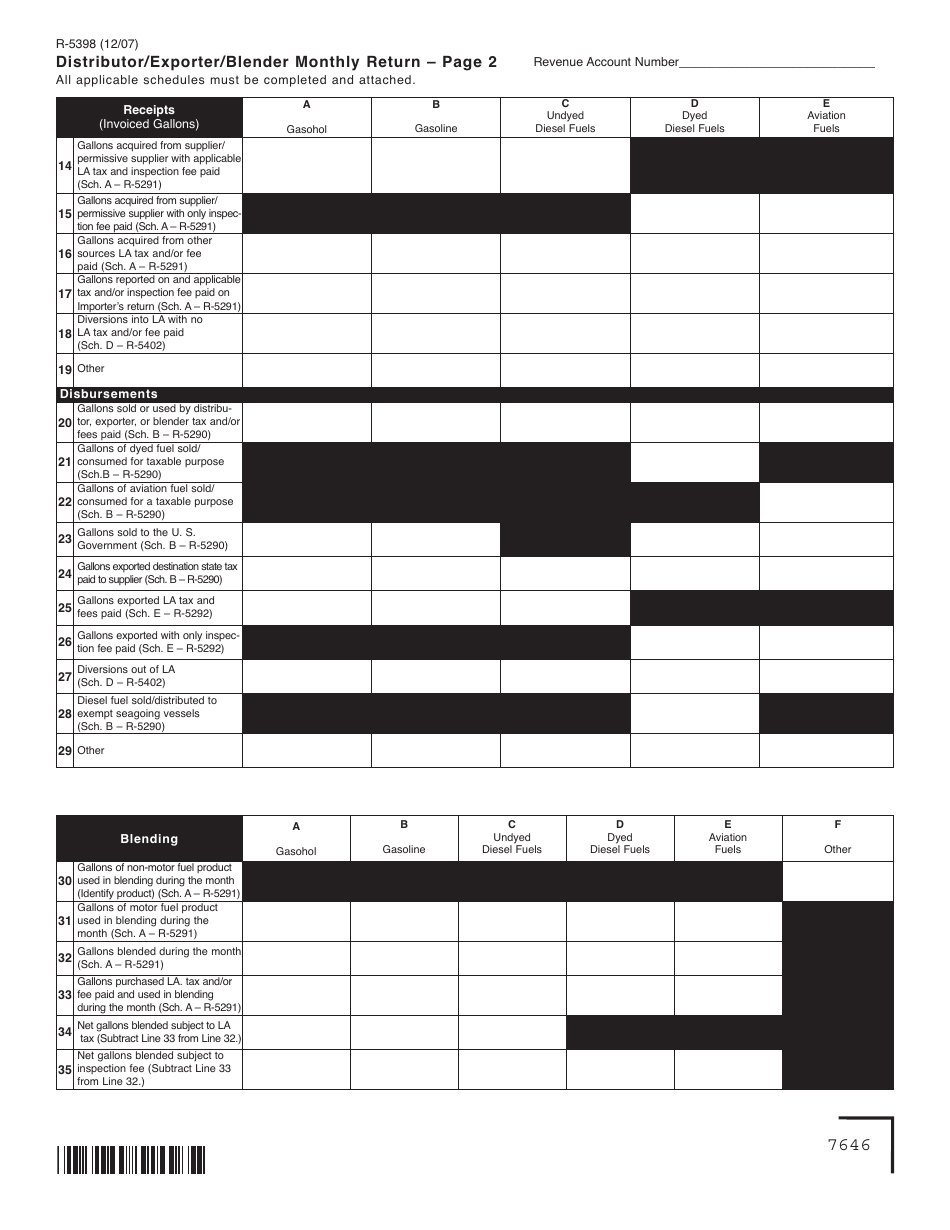

Form R-5398 Distributor / Exporter / Blender Monthly Return - Louisiana

What Is Form R-5398?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form R-5398?

A: Form R-5398 is the Distributor/Exporter/Blender Monthly Return for Louisiana.

Q: Who needs to file Form R-5398?

A: Distributors, exporters, and blenders in Louisiana need to file Form R-5398.

Q: What is the purpose of Form R-5398?

A: The purpose of Form R-5398 is to report and remit taxes on petroleum products distributed, exported, or blended in Louisiana.

Q: How often do I need to file Form R-5398?

A: Form R-5398 is a monthly return, so it must be filed every month.

Q: What taxes are reported on Form R-5398?

A: Form R-5398 is used to report and remit the Louisiana petroleum products tax.

Q: What information is required on Form R-5398?

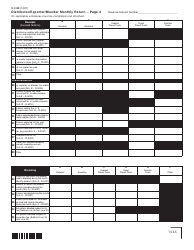

A: Form R-5398 requires information such as the distributor's name, address, and tax identification number, as well as details about the petroleum products distributed, exported, or blended.

Q: Is there a deadline for filing Form R-5398?

A: Yes, Form R-5398 must be filed on or before the 20th day of the month following the reporting period.

Q: Are there any penalties for late or incorrect filing of Form R-5398?

A: Yes, there are penalties for late filing, failure to file, and incorrect or incomplete filing of Form R-5398. Penalties can include monetary fines and interest charges.

Form Details:

- Released on December 1, 2007;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5398 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.