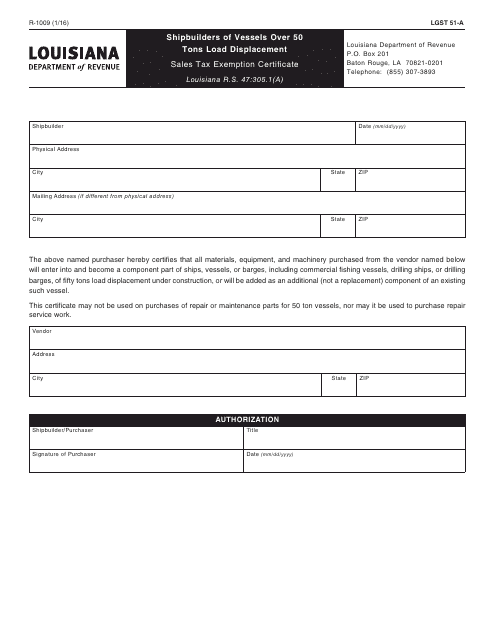

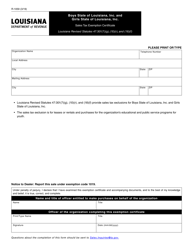

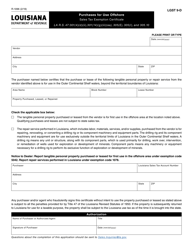

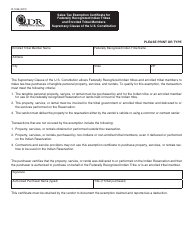

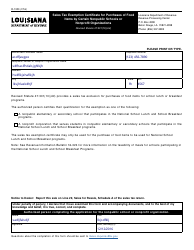

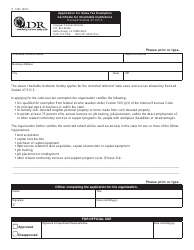

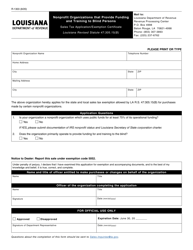

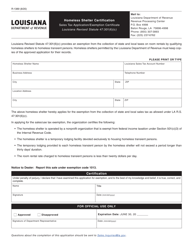

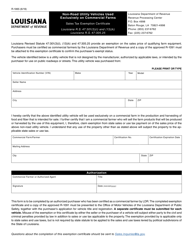

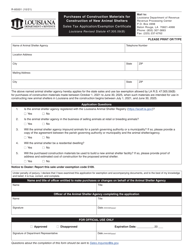

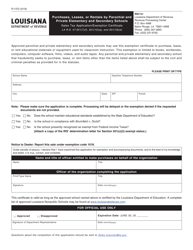

Form R-1009 Shipbuilders of Vessels Over 50 Tons Load Displacement - Sales Tax Exemption Certificate - Louisiana

What Is Form R-1009?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1009?

A: Form R-1009 Shipbuilders of Vessels Over 50 Tons Load Displacement - Sales Tax Exemption Certificate is a form used in Louisiana.

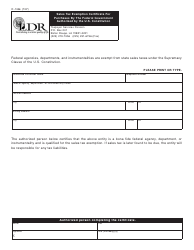

Q: Who can use Form R-1009?

A: Shipbuilders of vessels over 50 tons load displacement can use Form R-1009.

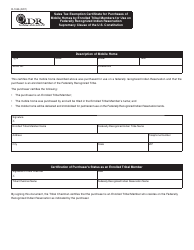

Q: What is the purpose of Form R-1009?

A: The purpose of Form R-1009 is to apply for a sales tax exemption for shipbuilders of vessels over 50 tons load displacement in Louisiana.

Q: What does the sales tax exemption apply to?

A: The sales tax exemption applies to the purchase of materials, supplies, and equipment used in the construction, repair, or conversion of vessels over 50 tons load displacement.

Q: Is Form R-1009 specific to Louisiana?

A: Yes, Form R-1009 is specific to Louisiana and is used to apply for the sales tax exemption for shipbuilders in the state.

Q: Are all shipbuilders eligible for the sales tax exemption?

A: No, only shipbuilders of vessels over 50 tons load displacement are eligible for the sales tax exemption in Louisiana.

Q: Can I use Form R-1009 for vessels under 50 tons load displacement?

A: No, Form R-1009 is specifically for shipbuilders of vessels over 50 tons load displacement.

Q: What information is required on Form R-1009?

A: Form R-1009 requires information about the shipbuilder, vessel details, and a statement of intent to use the materials, supplies, and equipment in the construction, repair, or conversion of vessels over 50 tons load displacement.

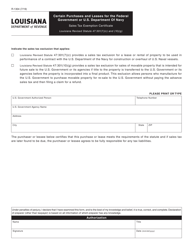

Q: How long does the sales tax exemption last?

A: The sales tax exemption provided by Form R-1009 is valid for one year from the date of issuance unless revoked by the Louisiana Department of Revenue.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1009 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.