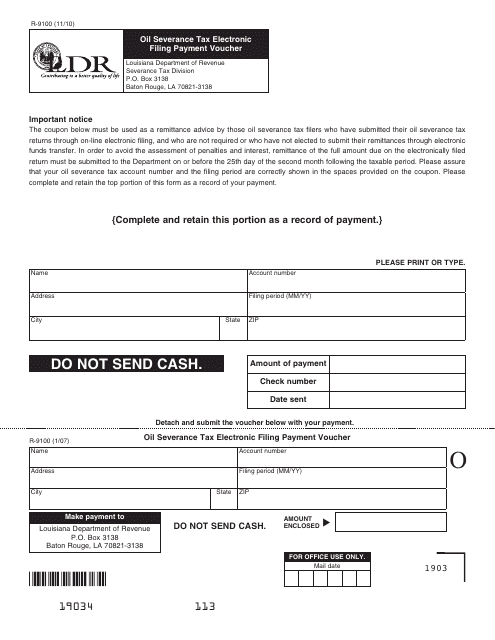

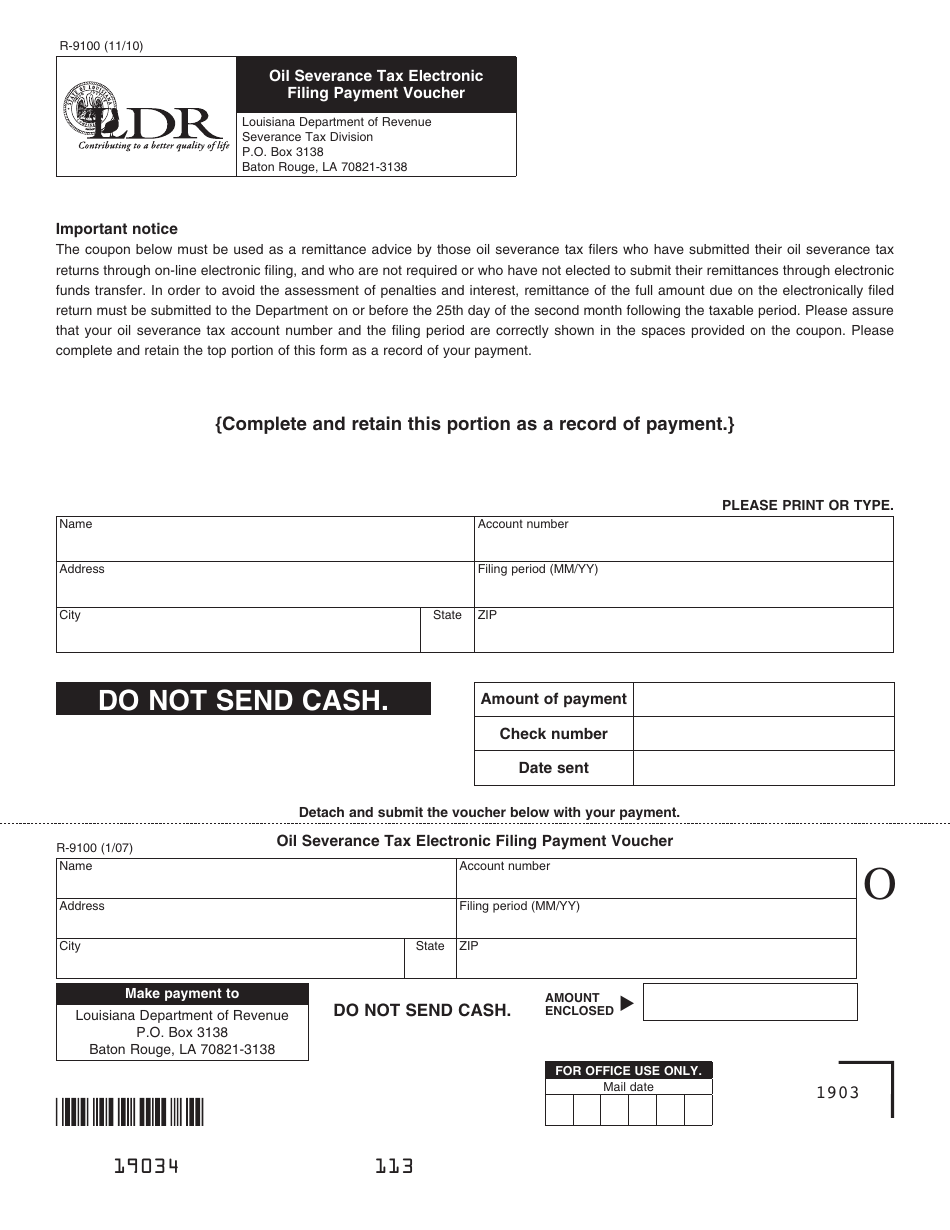

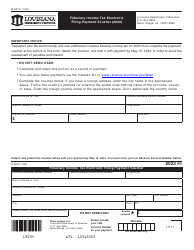

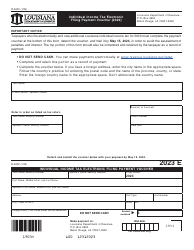

Form R-9100 Oil Severance Tax Electronic Filing Payment Voucher - Louisiana

What Is Form R-9100?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-9100?

A: Form R-9100 is an Oil Severance Tax Electronic Filing Payment Voucher used in Louisiana.

Q: What is the purpose of Form R-9100?

A: The purpose of Form R-9100 is to make electronic payment for oil severance tax in Louisiana.

Q: Who needs to file Form R-9100?

A: Anyone who owes oil severance taxes in Louisiana and is required to make electronic payments needs to file Form R-9100.

Q: Can I file Form R-9100 manually?

A: No, Form R-9100 must be filed electronically as it is an electronic filing payment voucher.

Q: What information is required on Form R-9100?

A: Form R-9100 requires the taxpayer's name, address, tax period, oil severance tax amount, and payment information.

Q: When is Form R-9100 due?

A: Form R-9100 is due on the 25th of the month following the month in which the oil severance tax liability was incurred.

Q: Are there any penalties for late filing of Form R-9100?

A: Yes, there are penalties for late filing, including interest charges and additional penalties for non-compliance.

Q: Can I make a payment with Form R-9100?

A: Yes, Form R-9100 is used to make electronic payments for oil severance tax liabilities in Louisiana.

Q: Is there any additional documentation required with Form R-9100?

A: No, additional documentation is not required with Form R-9100. However, taxpayers are advised to keep records of their oil severance tax activity for reference and audit purposes.

Form Details:

- Released on November 1, 2010;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-9100 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.