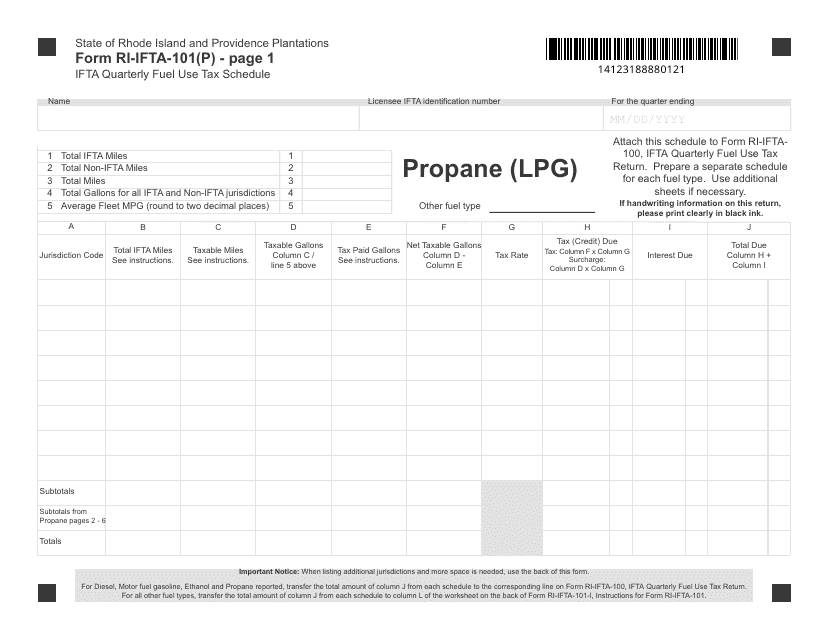

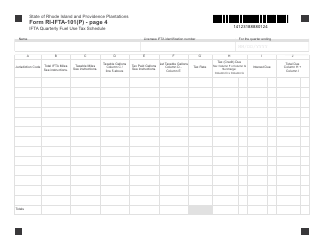

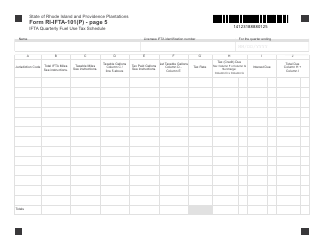

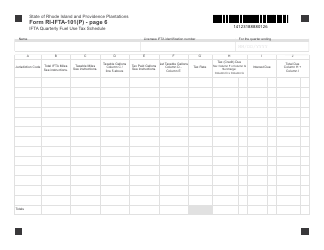

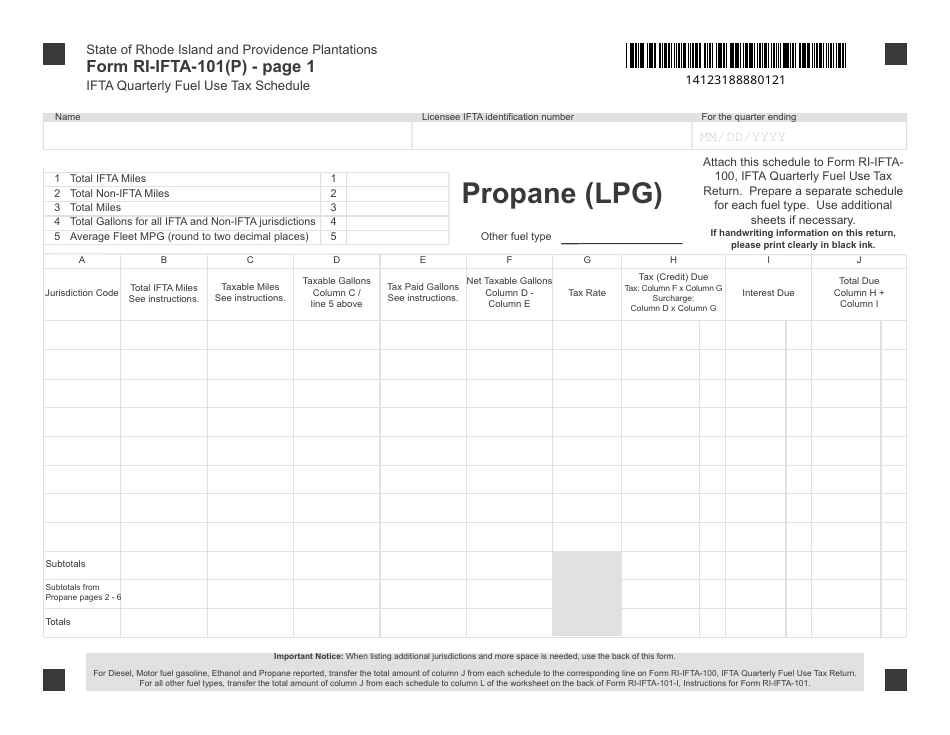

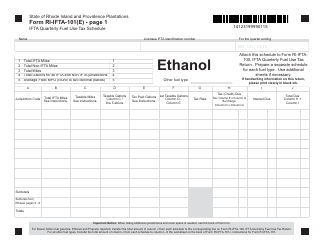

Form RI-IFTA-101(P) Ifta Quarterly Fuel Use Tax Schedule - Propane (Lpg) - Rhode Island

What Is Form RI-IFTA-101(P)?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RI-IFTA-101(P)?

A: RI-IFTA-101(P) is a form used for reporting quarterly fuel use tax schedule for propane (LPG) in Rhode Island.

Q: Who needs to file RI-IFTA-101(P)?

A: Individuals or businesses who use propane (LPG) for fuel in Rhode Island and meet certain requirements must file RI-IFTA-101(P).

Q: What is the purpose of RI-IFTA-101(P)?

A: The purpose of RI-IFTA-101(P) is to report and pay the quarterly fuel use tax on propane (LPG) used in Rhode Island.

Q: When is the deadline for filing RI-IFTA-101(P)?

A: The deadline for filing RI-IFTA-101(P) is the last day of the month following the end of the quarter.

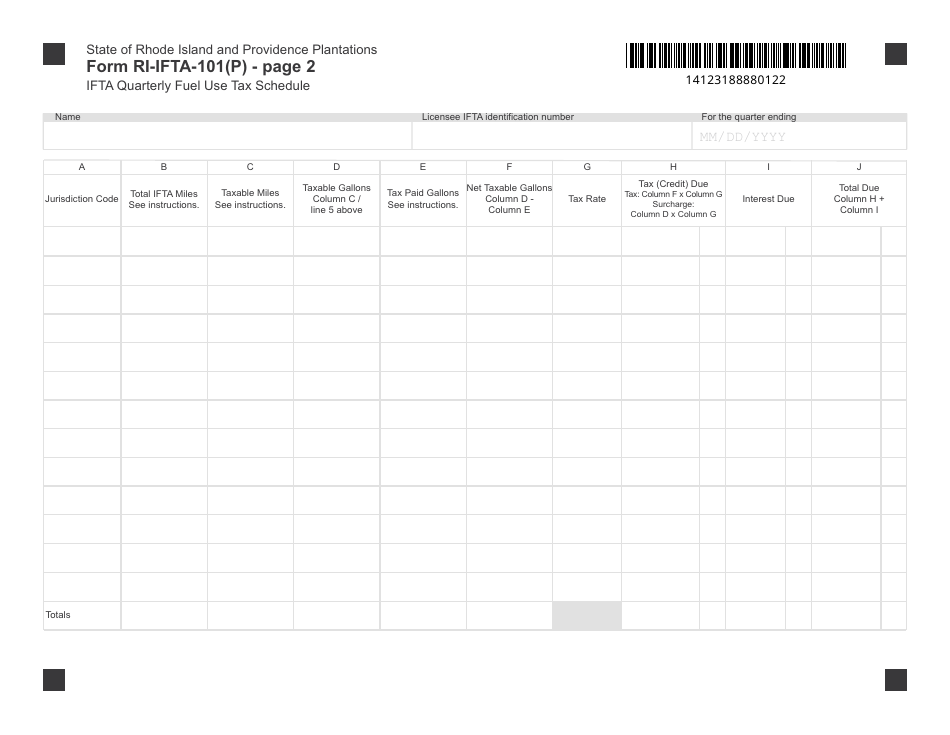

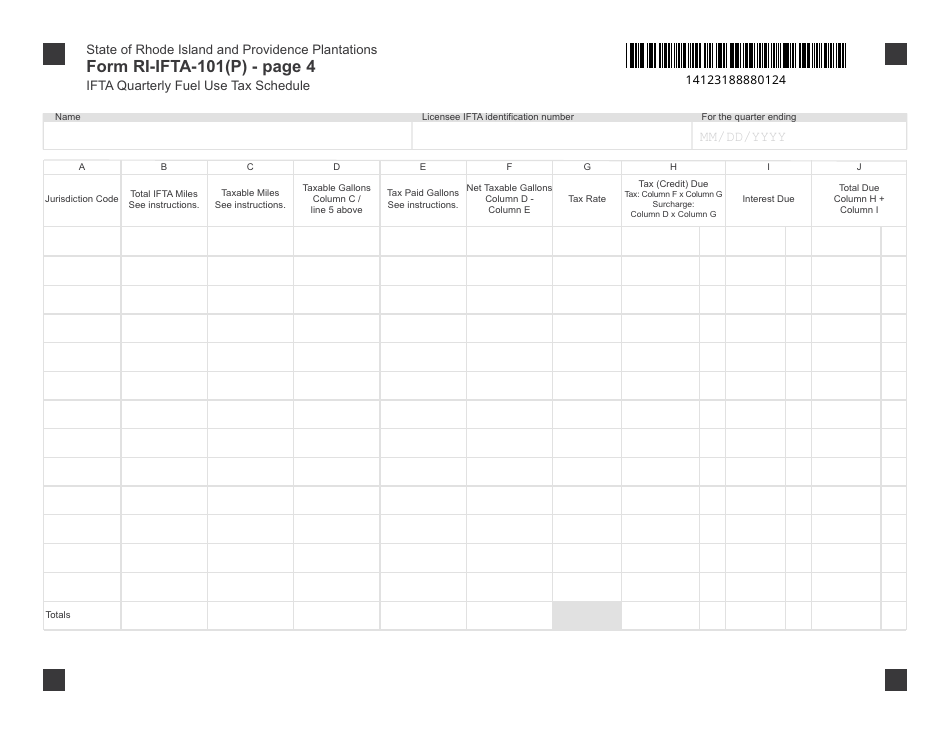

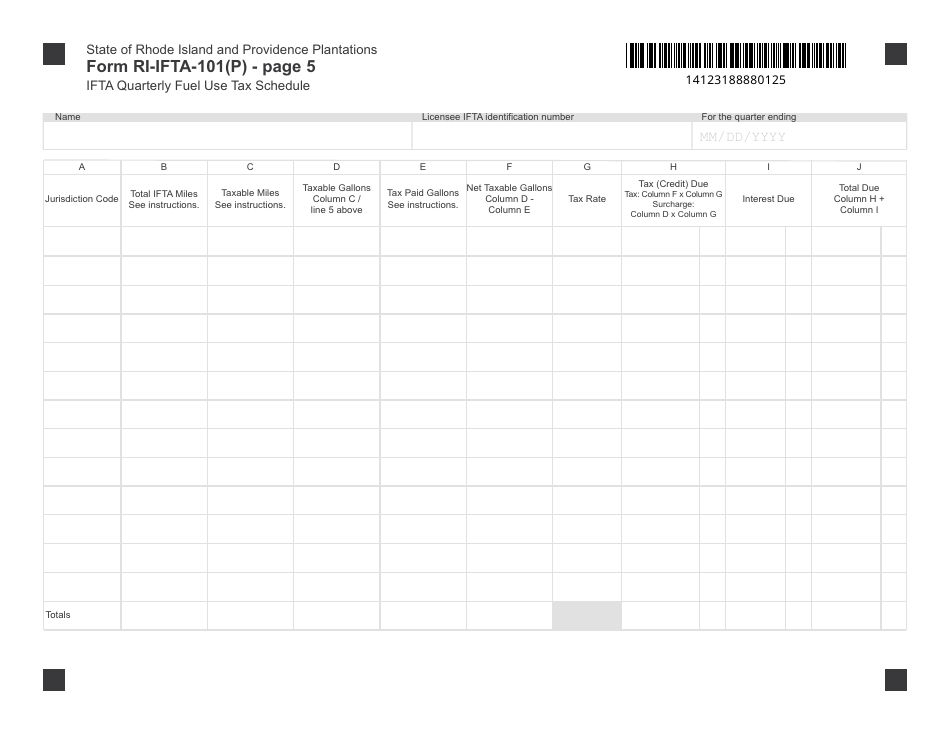

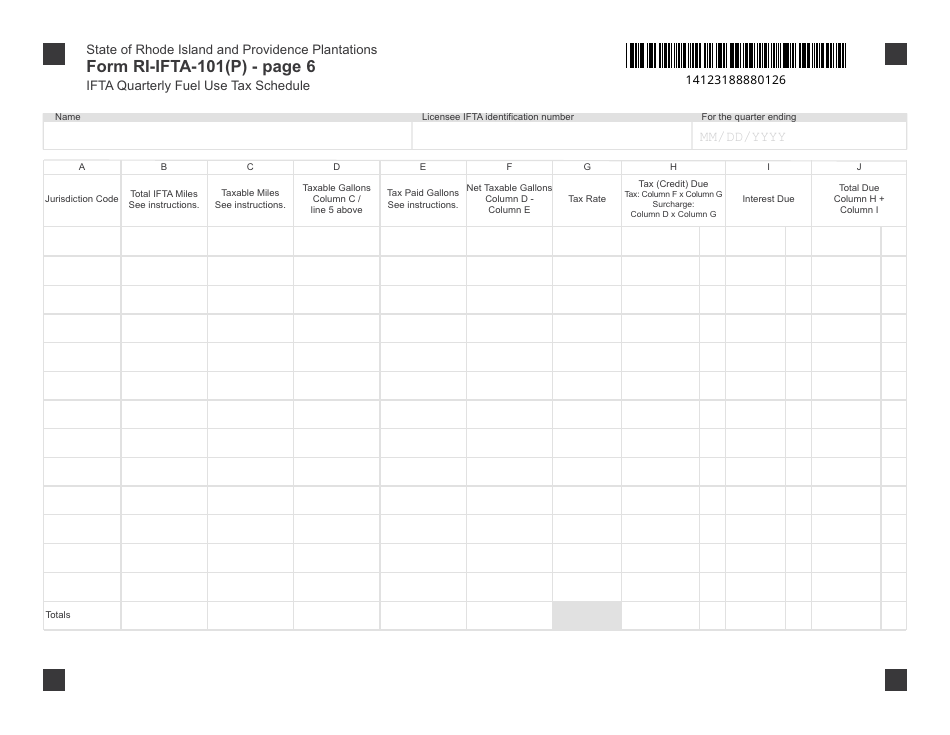

Q: What information is required on RI-IFTA-101(P)?

A: RI-IFTA-101(P) requires information about the total gallons of propane (LPG) used, miles traveled, and tax due for each jurisdiction.

Q: How do I calculate the tax due on RI-IFTA-101(P)?

A: The tax due on RI-IFTA-101(P) is calculated by multiplying the total gallons of propane (LPG) used by the tax rate for each jurisdiction.

Q: Is there a penalty for late filing of RI-IFTA-101(P)?

A: Yes, there may be penalties for late filing or non-filing of RI-IFTA-101(P). It is important to file by the deadline to avoid penalties.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-IFTA-101(P) by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.