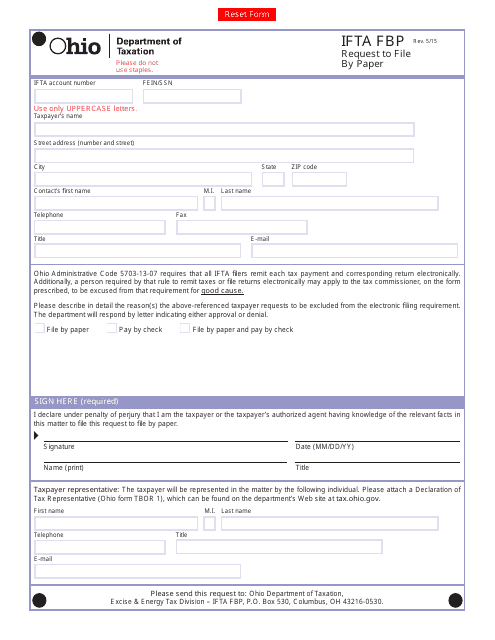

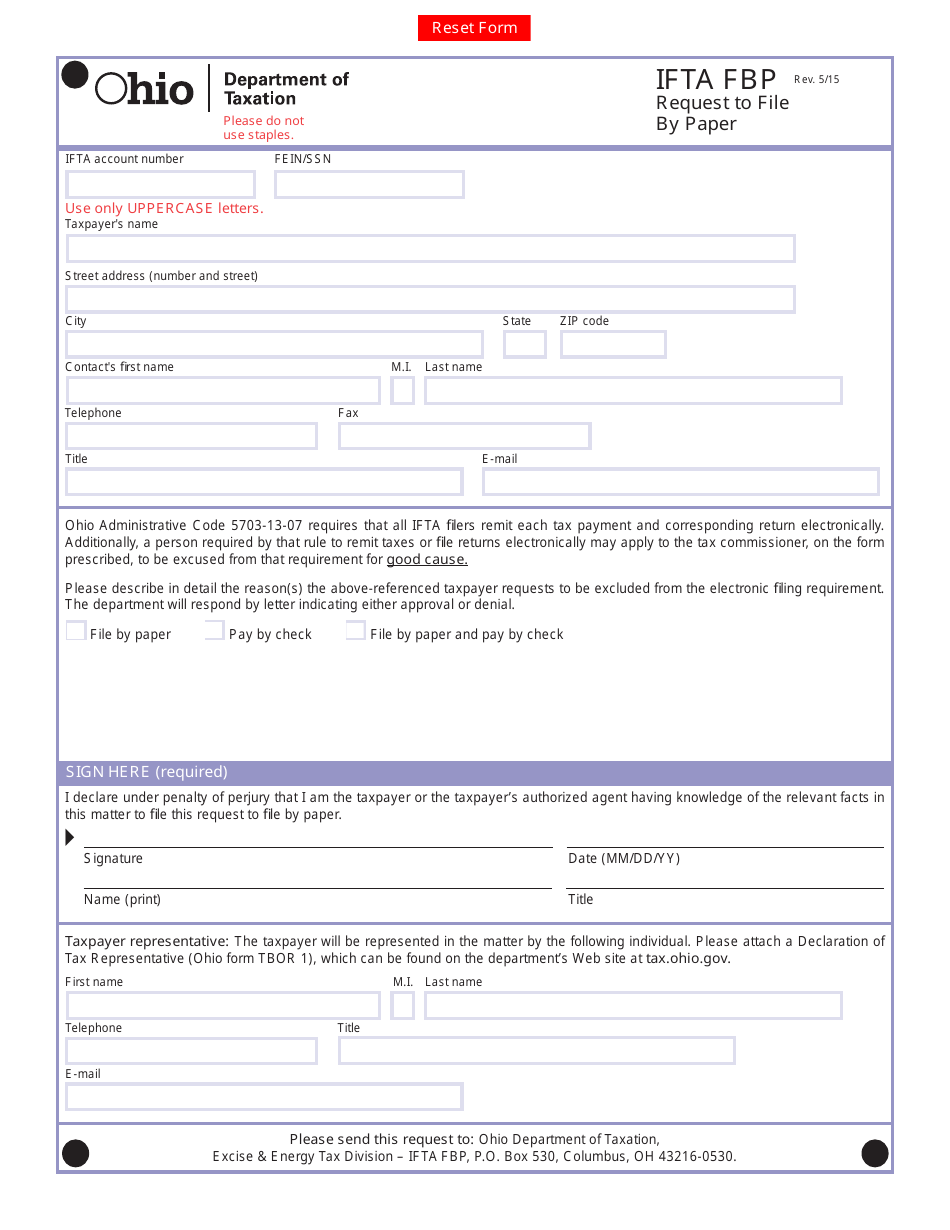

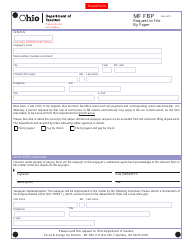

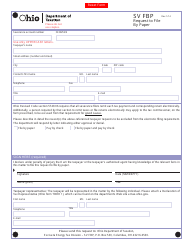

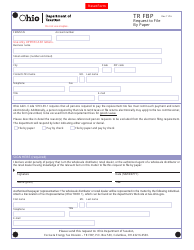

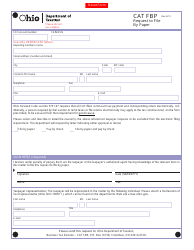

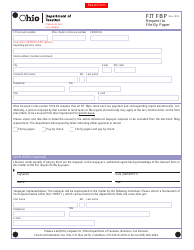

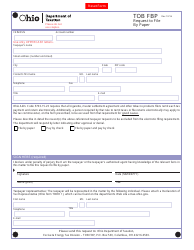

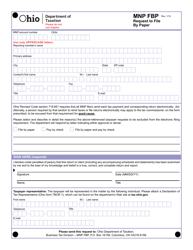

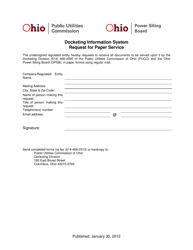

Form IFTA FBP Request to File by Paper - Ohio

What Is Form IFTA FBP?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

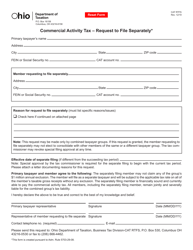

Q: What is a Form IFTA FBP?

A: Form IFTA FBP stands for International Fuel Tax Agreement Fuel Bypass Percentage. It is used to report fuel bypass activity for vehicles covered under the International Fuel Tax Agreement (IFTA).

Q: What is the purpose of filing a Form IFTA FBP?

A: The purpose of filing a Form IFTA FBP is to report fuel bypass activity and calculate the fuel tax owed or refunded for vehicles operating under the International Fuel Tax Agreement (IFTA).

Q: Who needs to file a Form IFTA FBP?

A: Motor carriers operating qualified motor vehicles under the International Fuel Tax Agreement (IFTA) need to file a Form IFTA FBP if they engage in fuel bypass activity.

Q: How do I file a Form IFTA FBP?

A: To file a Form IFTA FBP, you need to complete the form with accurate information regarding your fuel bypass activity and submit it to the appropriate authority, which in this case is Ohio.

Q: Can I file a Form IFTA FBP electronically?

A: No, the Form IFTA FBP can only be filed by paper and cannot be filed electronically.

Form Details:

- Released on May 1, 2015;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IFTA FBP by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.