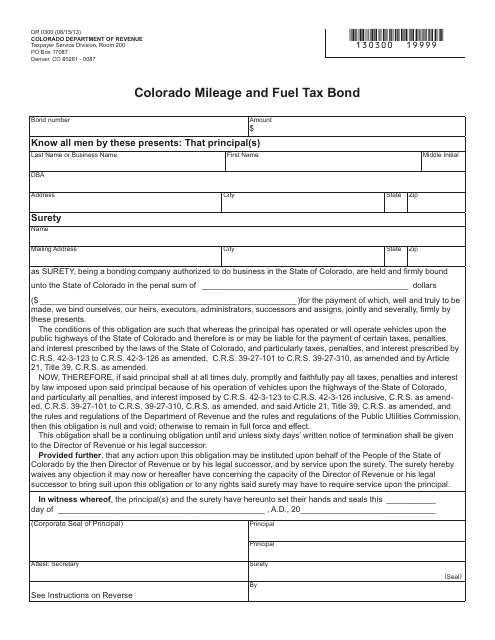

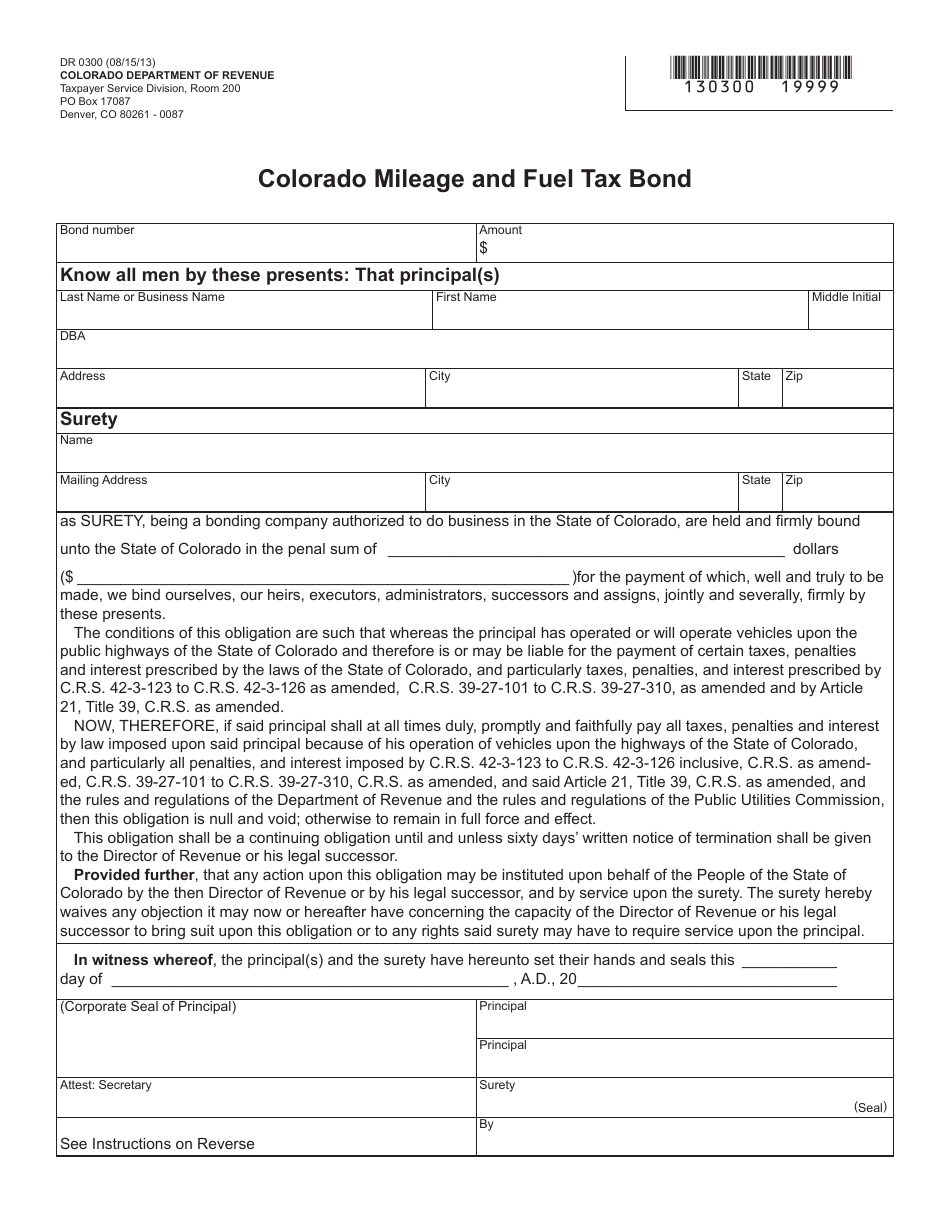

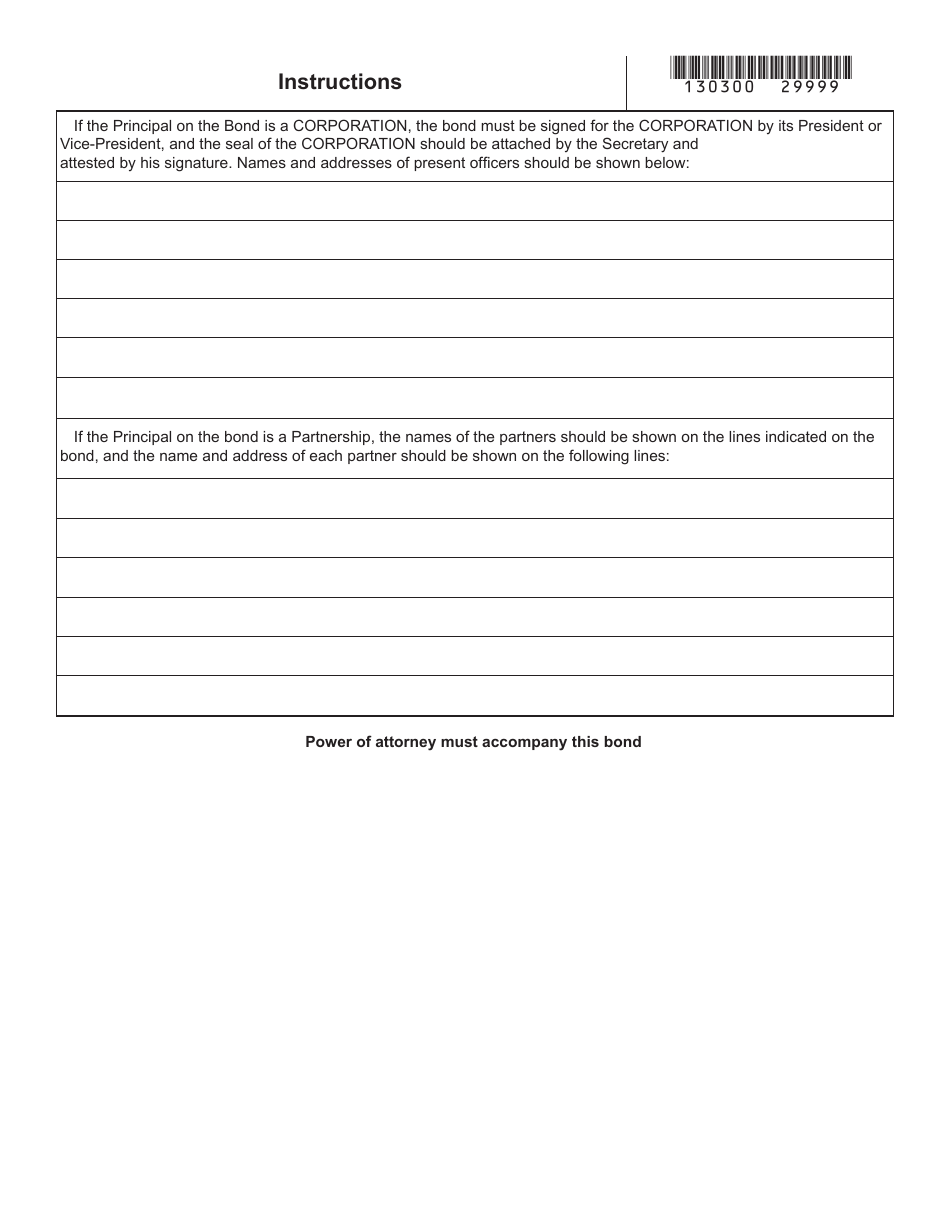

Form DR0300 Colorado Mileage and Fuel Tax Bond - Colorado

What Is Form DR0300?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form DR0300?

A: The Form DR0300 is the Colorado Mileage and Fuel Tax Bond form.

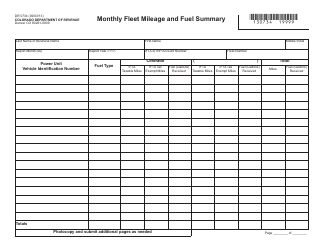

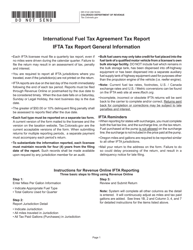

Q: What is the purpose of the Form DR0300?

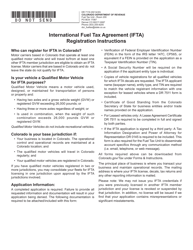

A: The Form DR0300 is used to obtain a surety bond for individuals and businesses engaged in the sale or distribution of fuel in Colorado.

Q: Do I need to file the Form DR0300?

A: Yes, if you are engaged in the sale or distribution of fuel in Colorado, you must file the Form DR0300 and obtain a mileage and fuel tax bond.

Q: What is the mileage and fuel tax bond?

A: The mileage and fuel tax bond is a financial guarantee that ensures the payment of any taxes owed on fuel sales or distribution in Colorado.

Q: How often do I need to file the Form DR0300?

A: The Form DR0300 must be filed annually. It is important to keep track of the filing deadlines to avoid any penalties or late fees.

Q: Can I cancel the mileage and fuel tax bond?

A: Yes, the mileage and fuel tax bond can be cancelled, but only after fulfilling all tax obligations and obtaining approval from the Colorado Department of Revenue.

Q: What happens if I fail to file the Form DR0300?

A: Failure to file the Form DR0300 and obtain a mileage and fuel tax bond can result in penalties, fines, and potential suspension of your fuel sales or distribution license.

Q: Is the Form DR0300 required for personal use of fuel?

A: No, the Form DR0300 and the mileage and fuel tax bond are not required for individuals who use fuel for personal use only.

Form Details:

- Released on August 15, 2013;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0300 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.