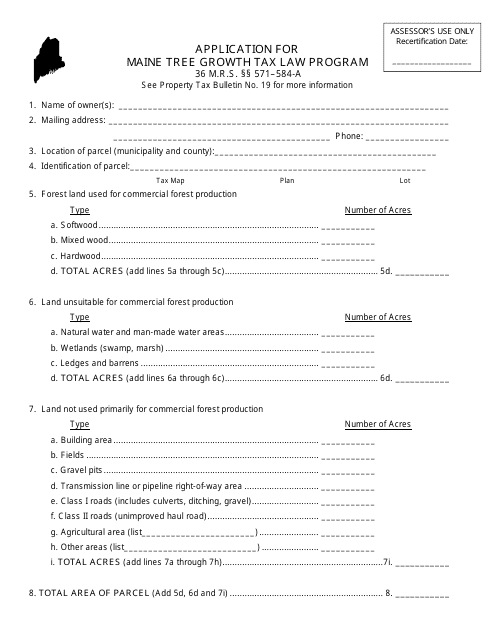

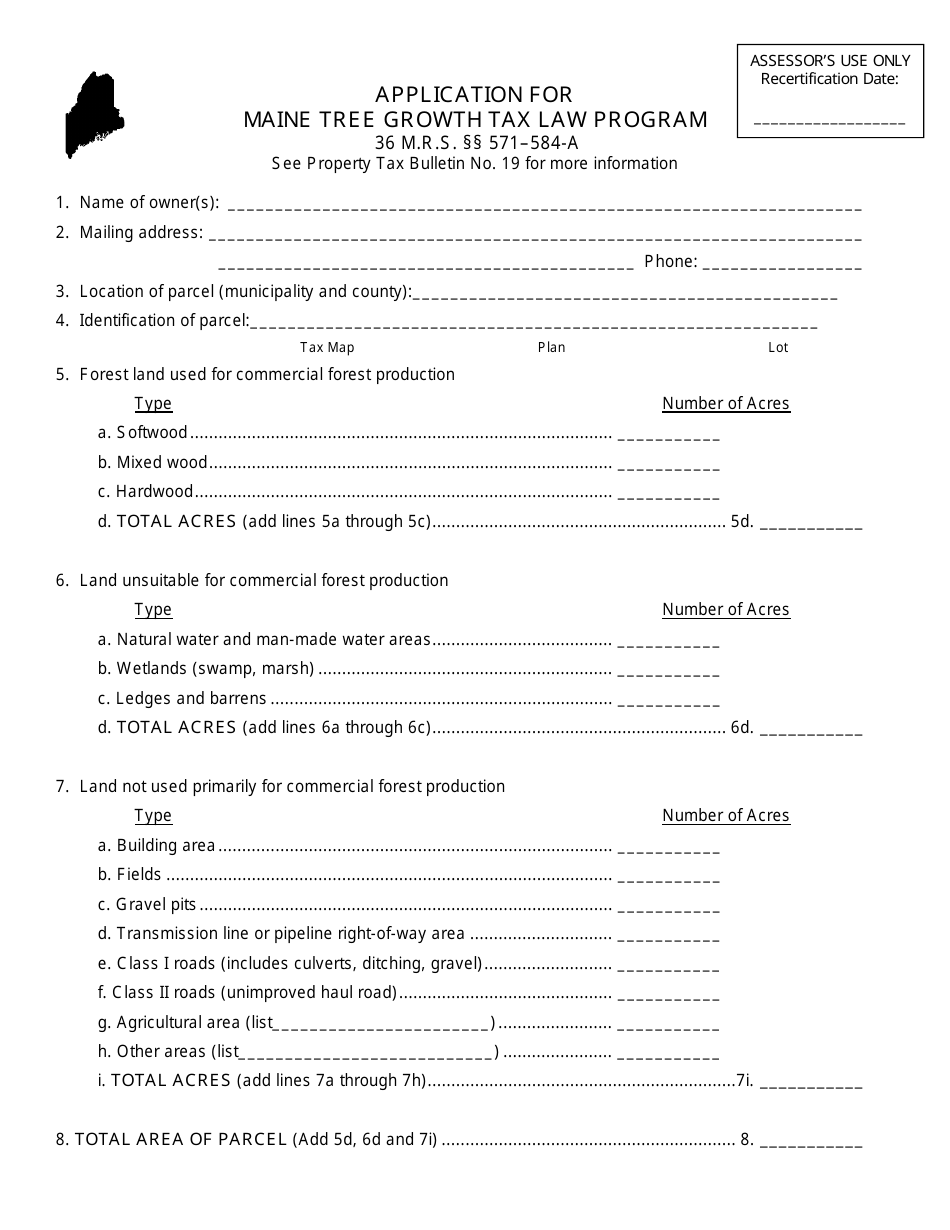

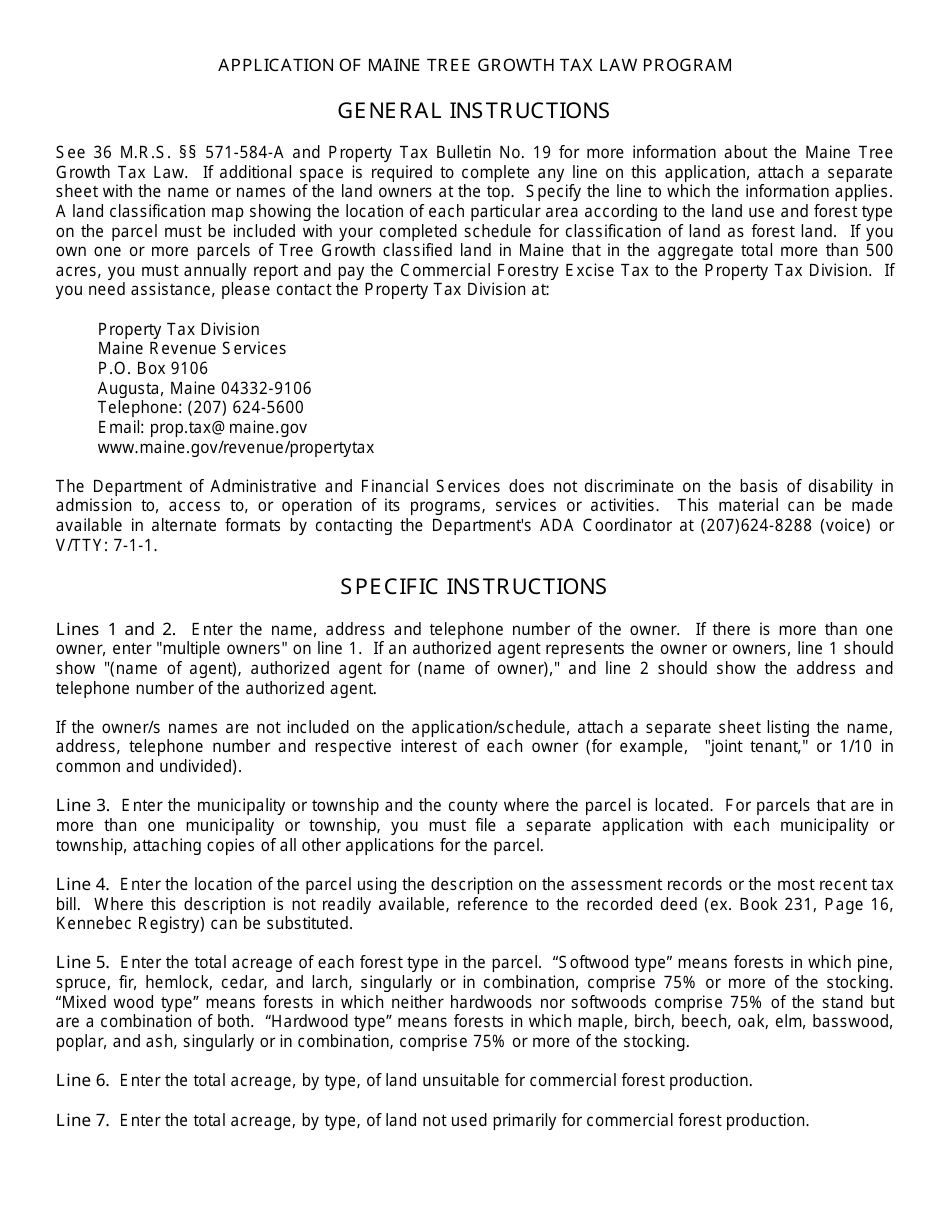

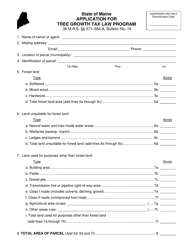

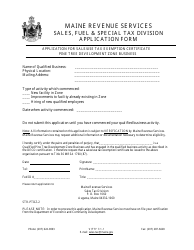

Application for Maine Tree Growth Tax Law Program - Maine

Application for Maine Tree Growth Tax Law Program is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

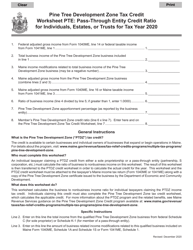

Q: What is the Maine Tree Growth Tax Law Program?

A: The Maine Tree Growth Tax Law Program is a tax incentive program that encourages landowners to keep their land in active timberland use.

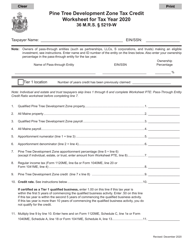

Q: Who is eligible for the Maine Tree Growth Tax Law Program?

A: Maine landowners who own at least 10 acres of forestland are eligible for the program.

Q: What are the benefits of participating in the Maine Tree Growth Tax Law Program?

A: Participating landowners receive property tax reductions for keeping their land in active timberland use and following a forest management plan.

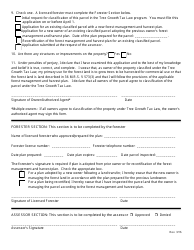

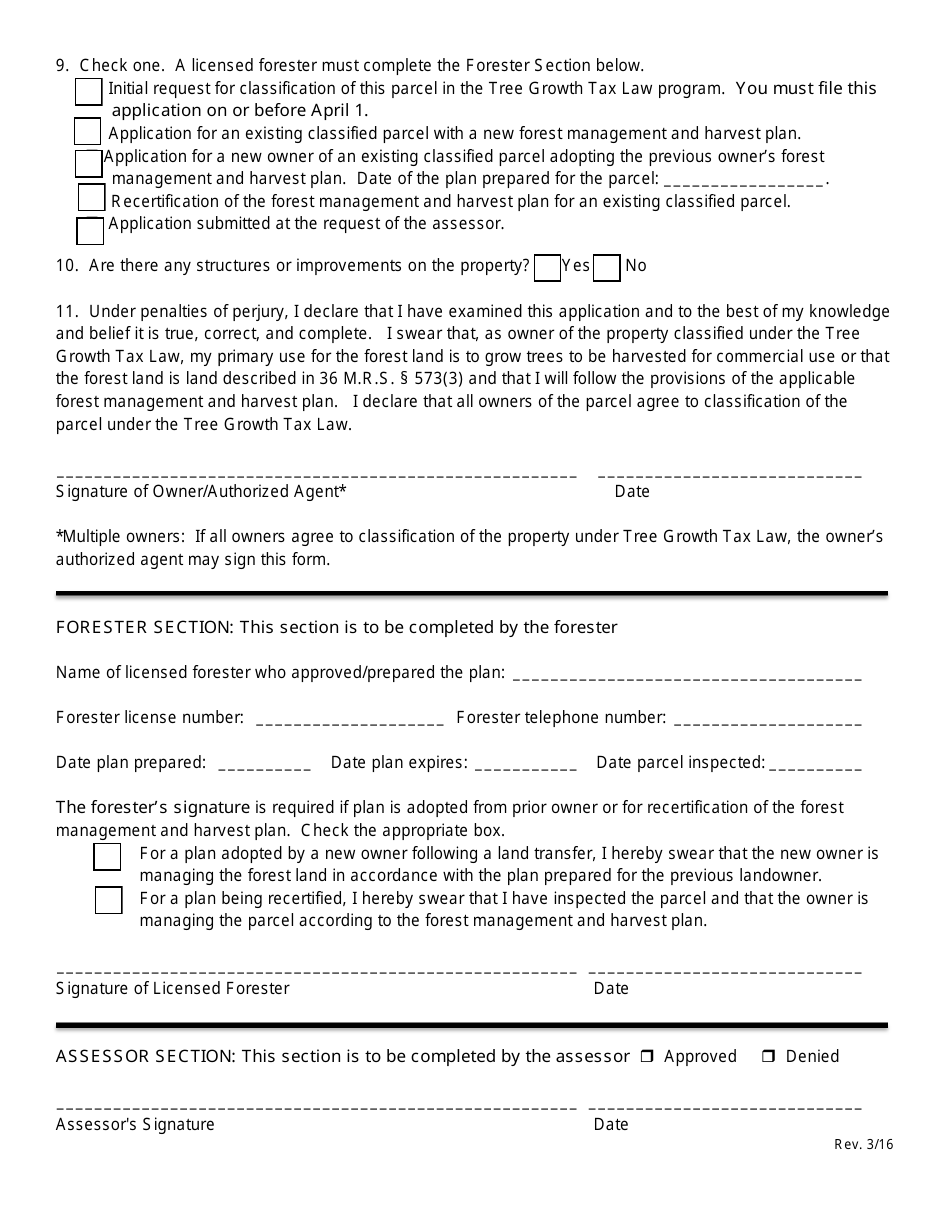

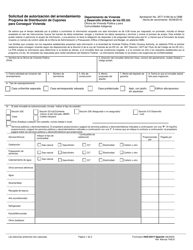

Q: How can I apply for the Maine Tree Growth Tax Law Program?

A: To apply, landowners must submit an application to their local municipal tax assessor's office.

Q: What is a forest management plan?

A: A forest management plan is a long-term plan that outlines the goals and strategies for managing a forestland property.

Q: Are there any requirements or restrictions for participating in the program?

A: Yes, there are requirements and restrictions regarding forest management practices and land use.

Q: How long does participation in the program last?

A: Participation in the program lasts for 10 years, with the option to renew for additional 10-year periods.

Q: Can I withdraw from the program before the 10-year period ends?

A: Yes, landowners can withdraw from the program, but they may be subject to penalties and back taxes.

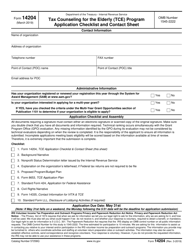

Form Details:

- Released on March 1, 2016;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.