This version of the form is not currently in use and is provided for reference only. Download this version of

Form 2848-ME

for the current year.

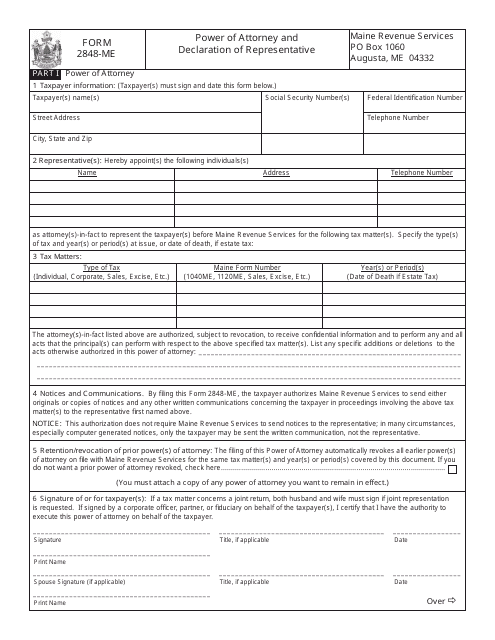

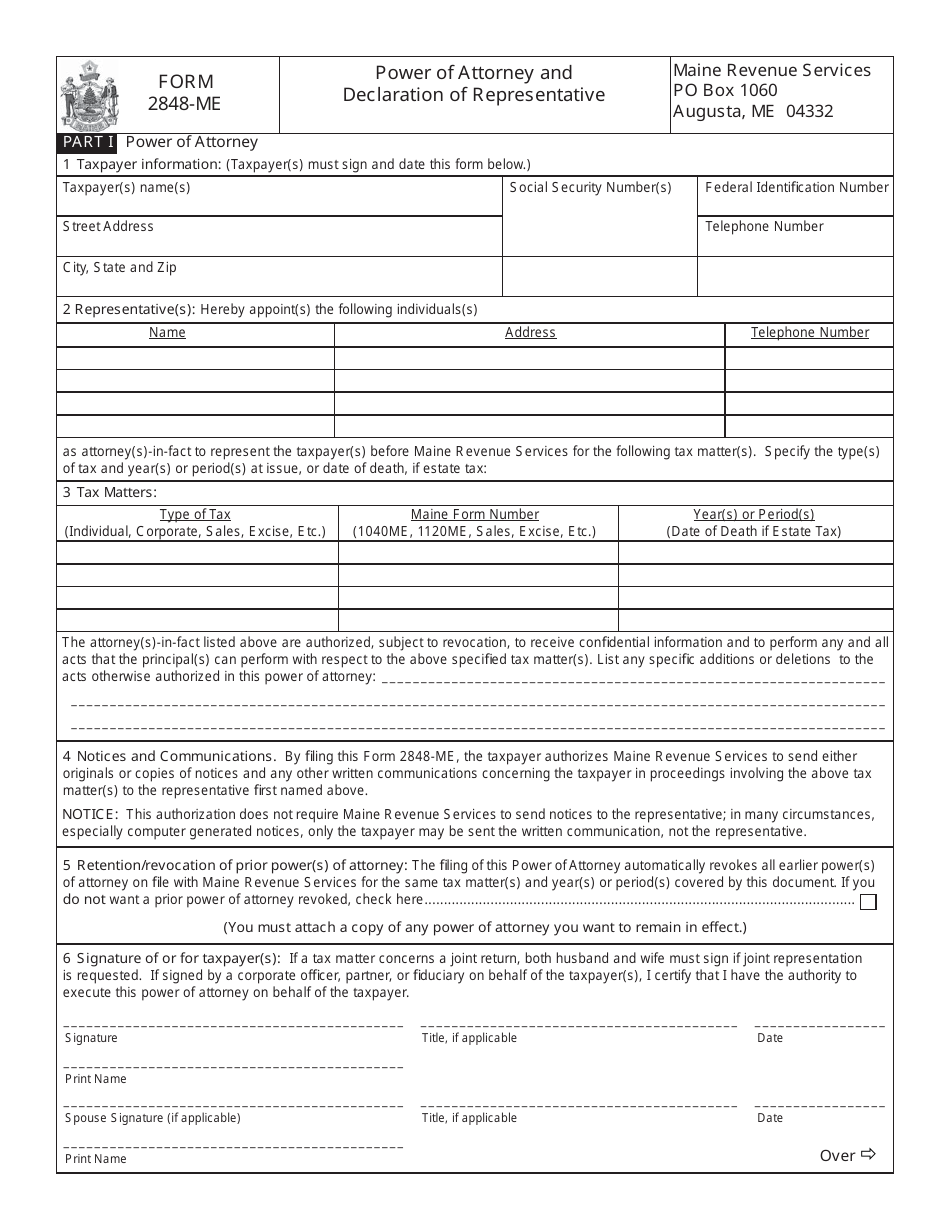

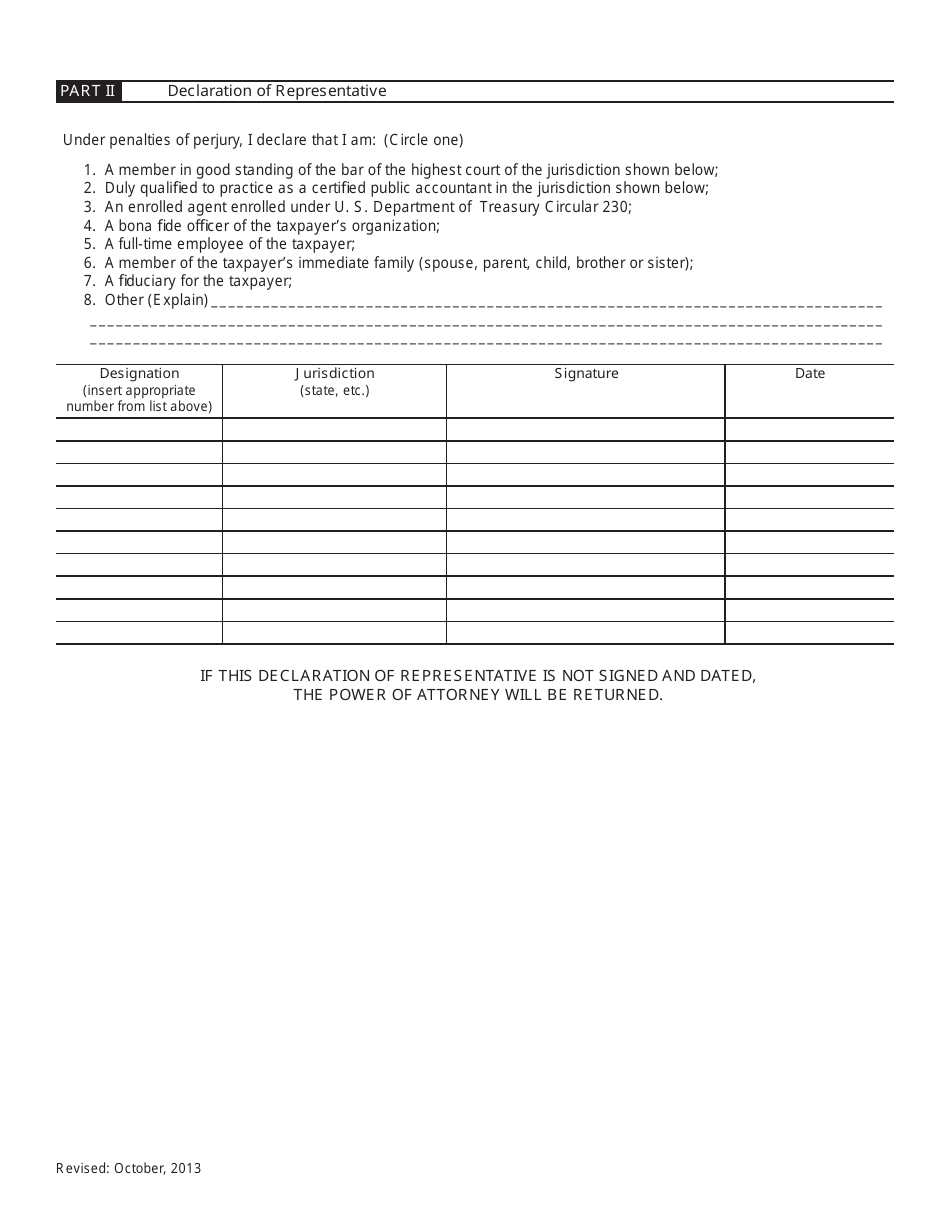

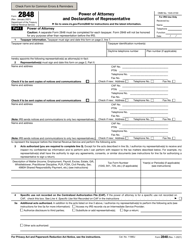

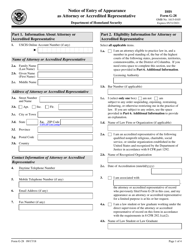

Form 2848-ME Power of Attorney and Declaration of Representative - Maine

What Is Form 2848-ME?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2848-ME?

A: Form 2848-ME is a Power of Attorney and Declaration of Representative specific to the state of Maine.

Q: What is the purpose of Form 2848-ME?

A: Form 2848-ME is used to authorize someone else to act on your behalf in tax matters with the Maine Revenue Service (MRS).

Q: Who can use Form 2848-ME?

A: Form 2848-ME can be used by individuals who want to authorize another person or organization to represent them before the MRS.

Q: What information is required on Form 2848-ME?

A: Some of the information required on Form 2848-ME includes the taxpayer's name, taxpayer identification number, representative's information, and details about the tax matters being addressed.

Q: Do I need to file Form 2848-ME?

A: Filing Form 2848-ME is optional, but it can be useful if you want someone else to represent you in tax-related matters with the MRS.

Q: Are there any fees associated with filing Form 2848-ME?

A: No, there are no fees associated with filing Form 2848-ME.

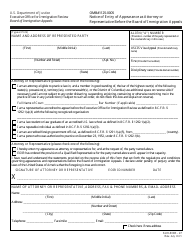

Q: Can I revoke or change my power of attorney?

A: Yes, you can revoke or change your power of attorney by submitting a new Form 2848-ME indicating the changes or by sending a written revocation to the MRS.

Form Details:

- Released on October 1, 2014;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 2848-ME by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.