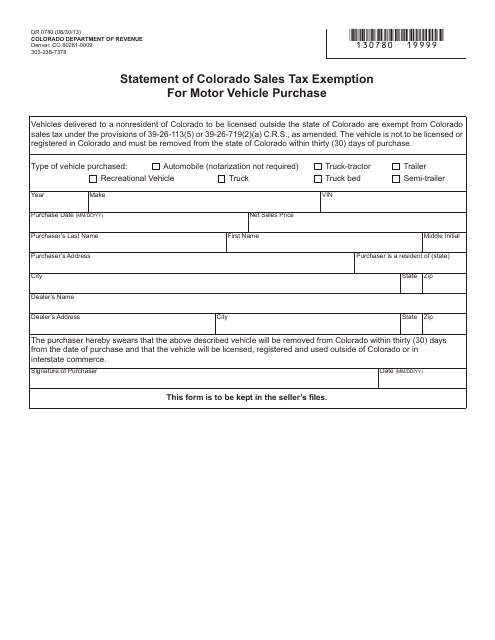

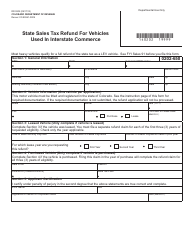

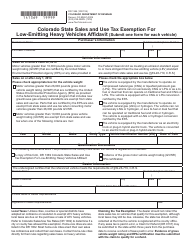

Form DR0780 Statement of Colorado Sales Tax Exemption for Motor Vehicle Purchase - Colorado

What Is Form DR0780?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0780?

A: Form DR0780 is the Statement of Colorado Sales Tax Exemption for Motor Vehicle Purchase.

Q: What is the purpose of Form DR0780?

A: The purpose of Form DR0780 is to claim an exemption from paying sales tax when purchasing a motor vehicle in Colorado.

Q: Who needs to fill out Form DR0780?

A: Anyone who wants to claim a sales tax exemption when buying a motor vehicle in Colorado needs to fill out Form DR0780.

Q: Are there any requirements to be eligible for a sales tax exemption?

A: Yes, there are specific eligibility requirements outlined on Form DR0780. It is important to review these requirements to determine if you qualify for the exemption.

Q: When should I submit Form DR0780?

A: Form DR0780 should be submitted at the time of purchase when buying a motor vehicle in Colorado.

Q: What should I do after filling out Form DR0780?

A: After filling out Form DR0780, you should provide the completed form to the seller or the Division of Motor Vehicles at the time of purchase.

Q: Is there a fee to submit Form DR0780?

A: No, there is no fee to submit Form DR0780.

Q: Can I use Form DR0780 for other types of purchases?

A: No, Form DR0780 is specifically for claiming a sales tax exemption for motor vehicle purchases in Colorado.

Q: How long does it take to process Form DR0780?

A: Processing times can vary, but it is recommended to submit Form DR0780 as early as possible to allow for sufficient processing time before the purchase of the motor vehicle.

Form Details:

- Released on August 30, 2013;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0780 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.