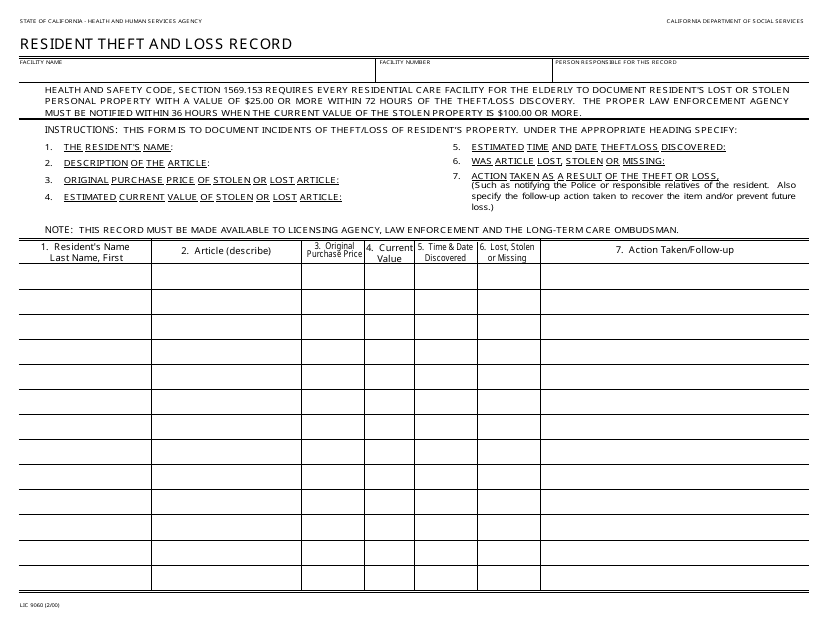

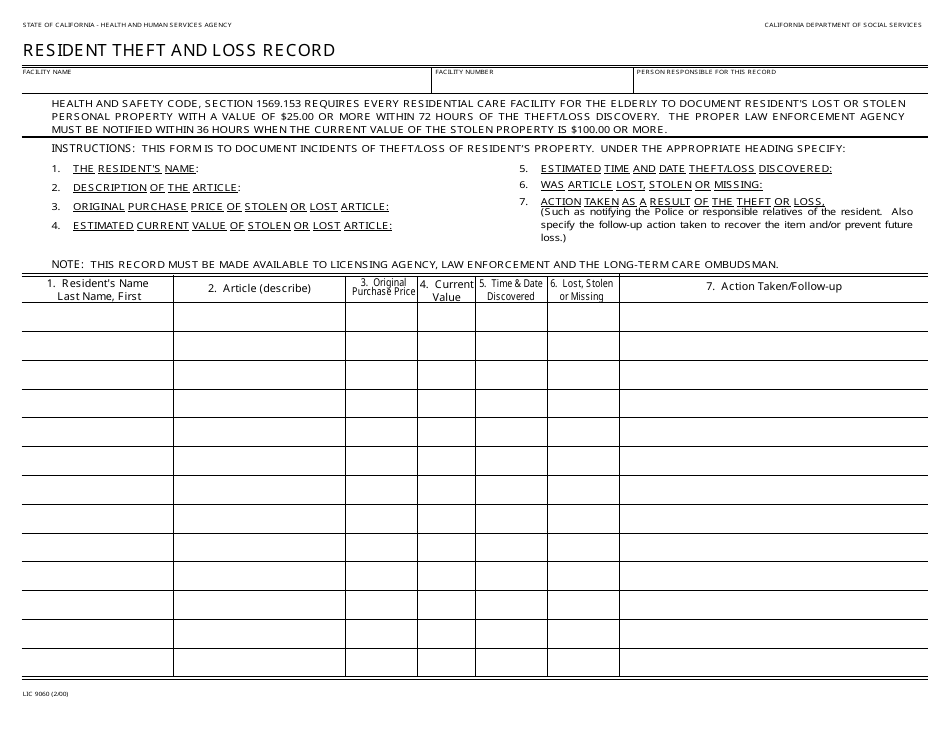

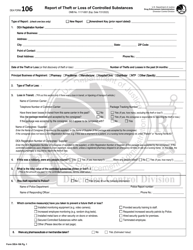

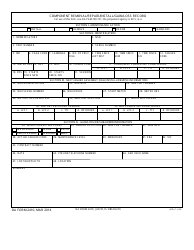

Form LIC9060 Resident Theft and Loss Record - California

What Is Form LIC9060?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LIC9060?

A: Form LIC9060 is the Resident Theft and Loss Record form in the state of California.

Q: What is the purpose of Form LIC9060?

A: The purpose of Form LIC9060 is to report any theft or loss of property in a residential setting in California.

Q: Who is required to fill out Form LIC9060?

A: Residential facilities such as care homes and assisted living facilities in California are required to fill out Form LIC9060.

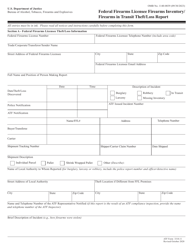

Q: What information is required on Form LIC9060?

A: Form LIC9060 requires details such as the date and time of the incident, a description of the lost or stolen property, and any known suspects.

Q: Is there a deadline for submitting Form LIC9060?

A: There is no specific deadline for submitting Form LIC9060, but it is recommended to file the form as soon as possible after the incident.

Q: What should I do if I have lost valuable property?

A: If you have lost valuable property, you should report the incident to the appropriate authorities and also complete Form LIC9060 to document the loss.

Q: What happens after I submit Form LIC9060?

A: After submitting Form LIC9060, the information will be documented and may be used for investigation purposes if applicable.

Q: Are there any penalties for not filing Form LIC9060?

A: While there are no specific penalties for not filing Form LIC9060, it is important to comply with reporting requirements to ensure accurate record keeping.

Form Details:

- Released on February 1, 2000;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LIC9060 by clicking the link below or browse more documents and templates provided by the California Department of Social Services.