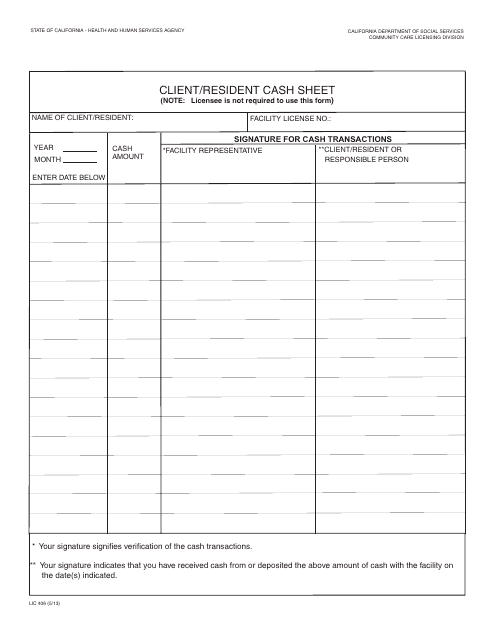

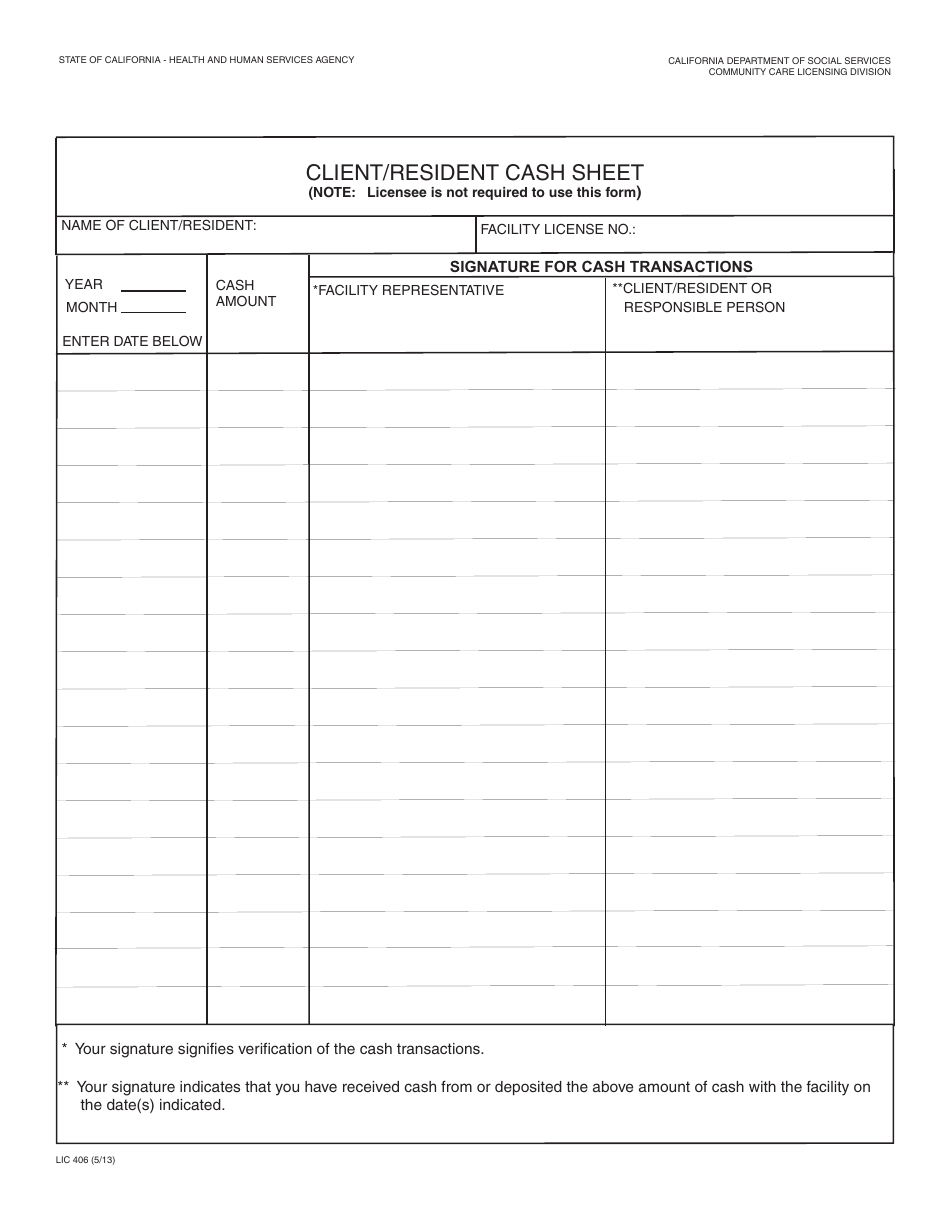

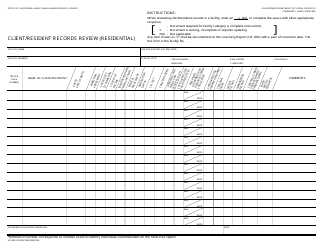

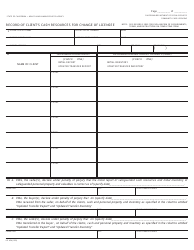

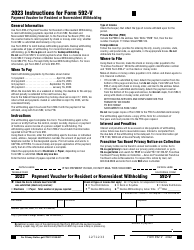

Form LIC406 Client / Resident Cash Sheet - California

What Is Form LIC406?

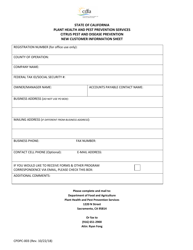

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

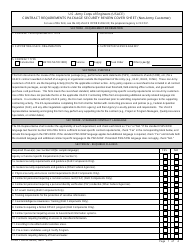

Q: What is LIC406 Client/Resident Cash Sheet?

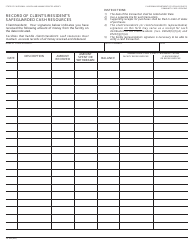

A: LIC406 Client/Resident Cash Sheet is a form used in California to record cash transactions for clients or residents in licensed facilities.

Q: Why is LIC406 Client/Resident Cash Sheet used?

A: LIC406 Client/Resident Cash Sheet is used to keep track of cash received, disbursed, and balances for clients or residents in licensed facilities.

Q: Who uses LIC406 Client/Resident Cash Sheet?

A: Licensed facilities in California use LIC406 Client/Resident Cash Sheet to maintain accurate financial records for their clients or residents.

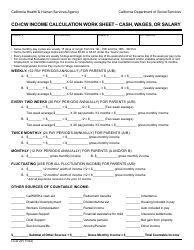

Q: What information is recorded on LIC406 Client/Resident Cash Sheet?

A: LIC406 Client/Resident Cash Sheet records details of cash received, cash disbursed, starting balance, ending balance, and any additional comments.

Q: Is LIC406 Client/Resident Cash Sheet mandatory in California?

A: Yes, licensed facilities in California are required to use LIC406 Client/Resident Cash Sheet to comply with state regulations and ensure proper financial management.

Form Details:

- Released on May 1, 2013;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LIC406 by clicking the link below or browse more documents and templates provided by the California Department of Social Services.