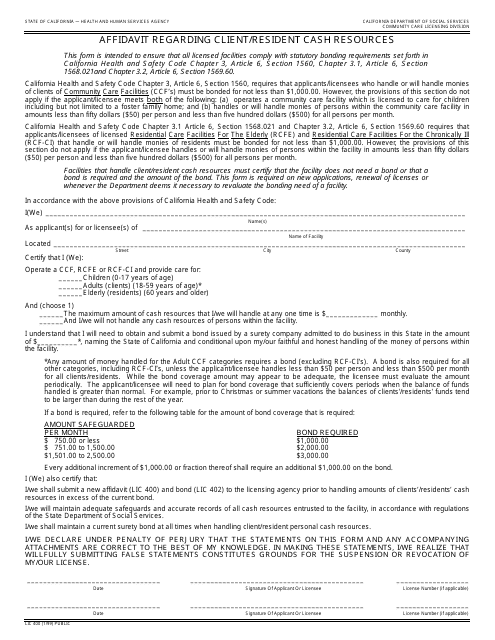

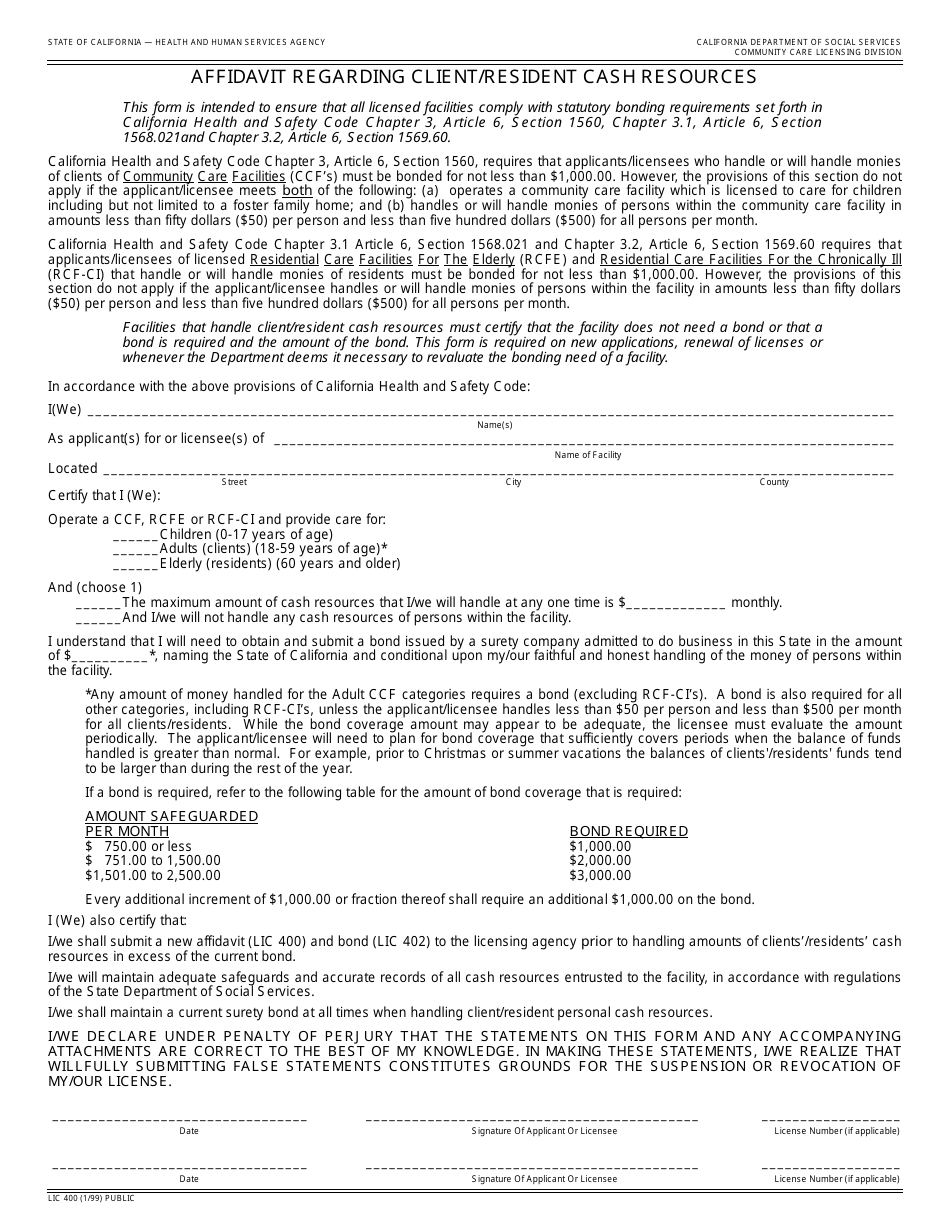

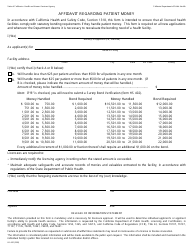

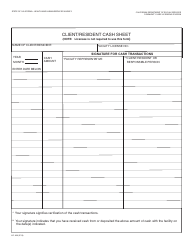

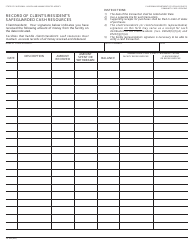

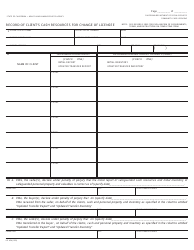

Form LIC400 Affidavit Regarding Client / Resident Cash Resources - California

What Is Form LIC400?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of the LIC400 form?

A: The LIC400 form is used to declare the cash resources of a client or resident in California.

Q: Who needs to fill out the LIC400 form?

A: The LIC400 form needs to be filled out by individuals or their authorized representatives who are applying for or receiving certain benefits or services in California.

Q: What information is required on the LIC400 form?

A: The LIC400 form requires information about the client or resident's cash resources, including bank accounts, cash on hand, and other financial assets.

Q: Are there any income limits or requirements associated with the LIC400 form?

A: Yes, there may be income limits or requirements that determine eligibility for certain benefits or services. The LIC400 form helps assess the client or resident's financial situation.

Form Details:

- Released on January 1, 1999;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LIC400 by clicking the link below or browse more documents and templates provided by the California Department of Social Services.