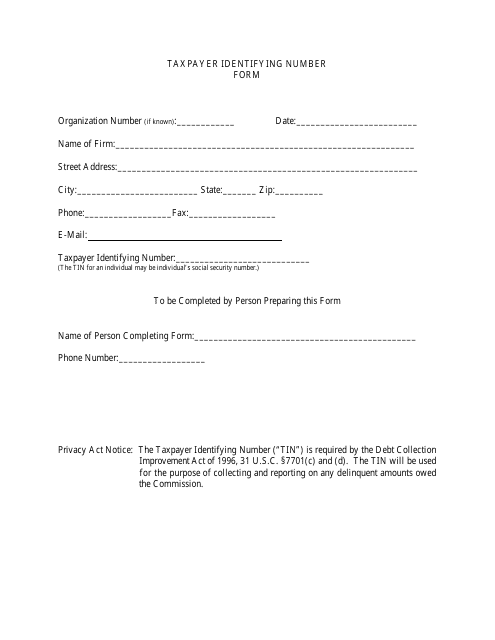

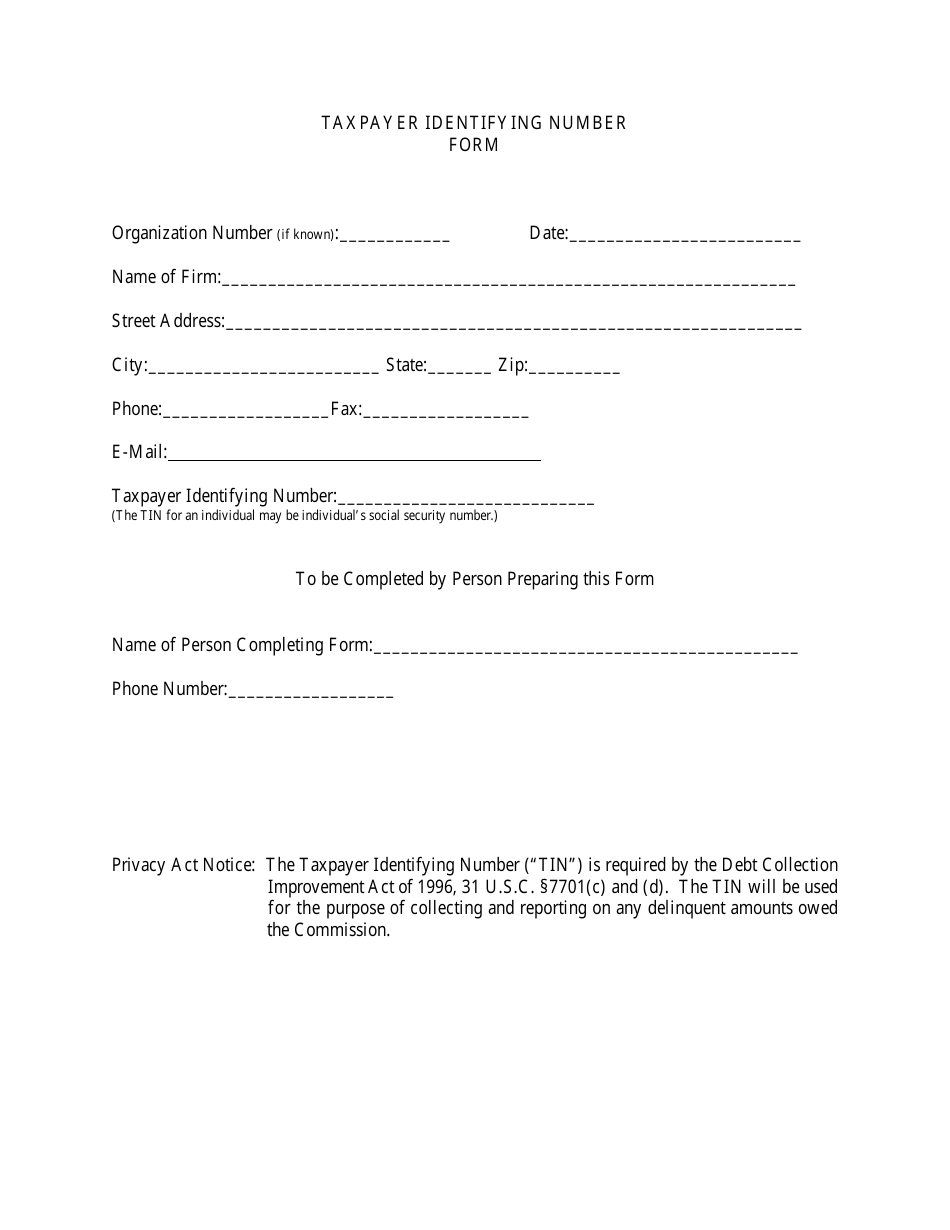

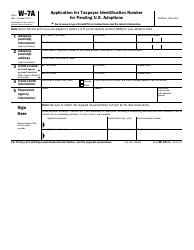

Taxpayer Identifying Number Form

Taxpayer Identifying Number Form is a 1-page legal document that was released by the U.S. Department of the Treasury - Bureau of the Fiscal Service and used nation-wide.

FAQ

Q: What is a Taxpayer Identifying Number?

A: A Taxpayer Identifying Number is a unique identification number assigned to individuals or businesses by the Internal Revenue Service (IRS).

Q: What are the different types of Taxpayer Identifying Numbers?

A: The different types of Taxpayer Identifying Numbers include Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), and Employer Identification Number (EIN).

Q: Who needs a Taxpayer Identifying Number?

A: Anyone who earns income in the United States, including U.S. citizens, resident aliens, and non-resident aliens, may need a Taxpayer Identifying Number.

Q: How do I apply for a Taxpayer Identifying Number?

A: To apply for a Taxpayer Identifying Number, you must complete the appropriate form provided by the IRS. The specific form you need depends on the type of Taxpayer Identifying Number you are applying for.

Q: Is there a fee to apply for a Taxpayer Identifying Number?

A: There is no fee to apply for a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). However, there may be a fee to apply for an Employer Identification Number (EIN).

Q: How long does it take to receive a Taxpayer Identifying Number?

A: The processing time to receive a Taxpayer Identifying Number varies depending on the type of number and the method of application. In general, it can take several weeks to receive a number.

Q: Can I use my Taxpayer Identifying Number for other purposes?

A: Yes, your Taxpayer Identifying Number can be used for various purposes, such as filing tax returns, opening bank accounts, and applying for loans or credit cards.

Q: What should I do if I lose my Taxpayer Identifying Number?

A: If you lose your Taxpayer Identifying Number, you should contact the IRS to request a replacement or to obtain your number.

Q: Are there any restrictions on using a Taxpayer Identifying Number?

A: There are no specific restrictions on using a Taxpayer Identifying Number, but it is important to use the number only for legitimate purposes and to safeguard it from identity theft or fraud.

Form Details:

- The latest edition currently provided by the U.S. Department of the Treasury - Bureau of the Fiscal Service;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.