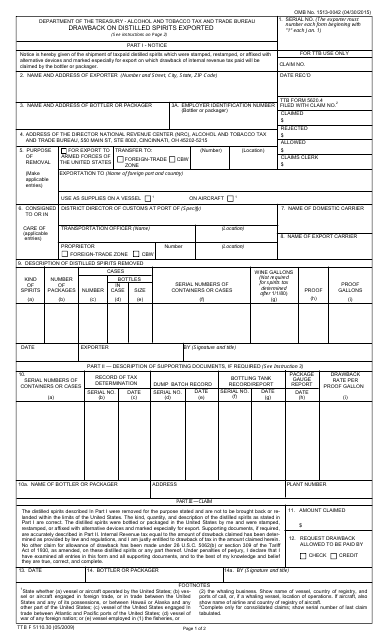

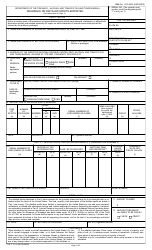

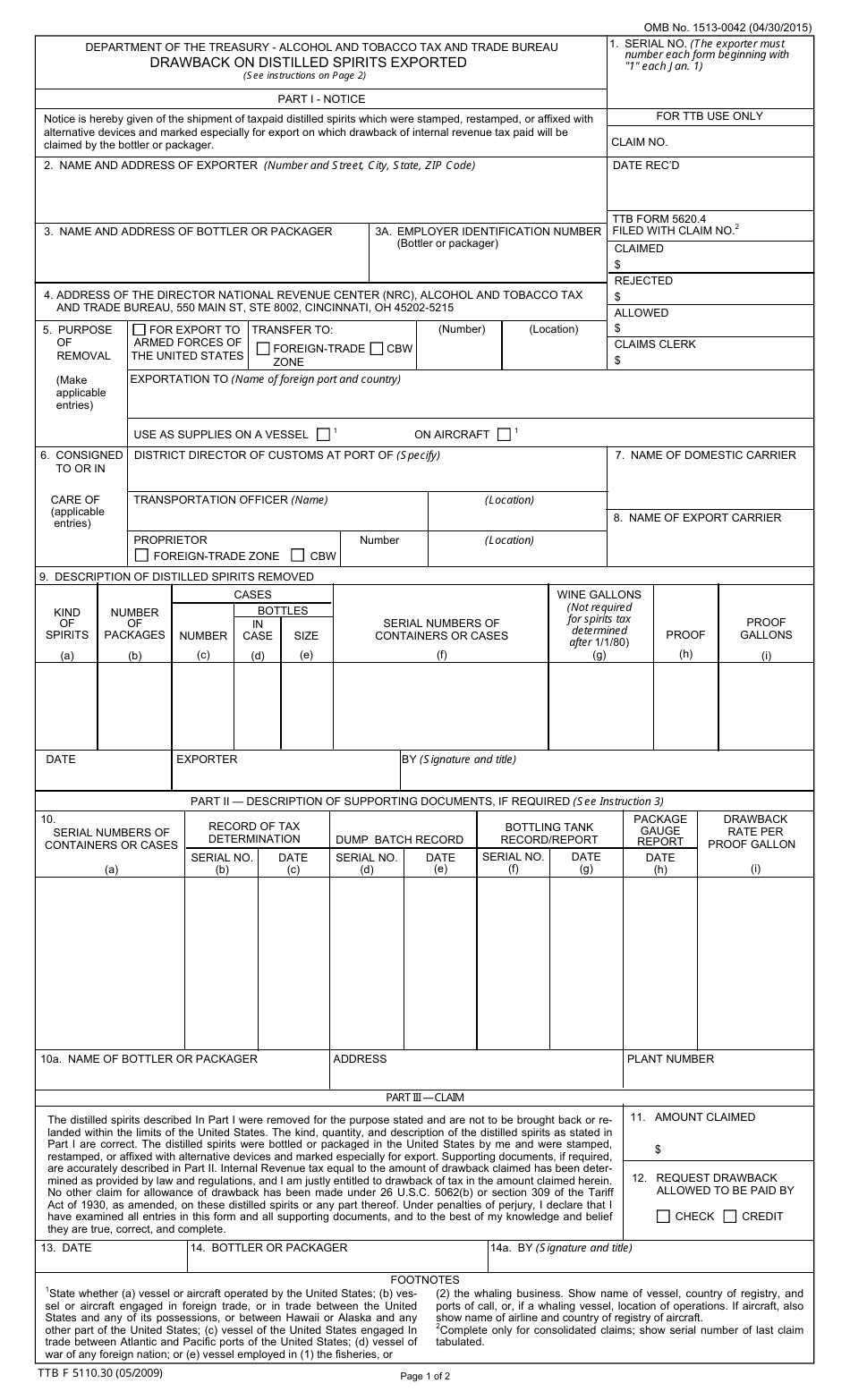

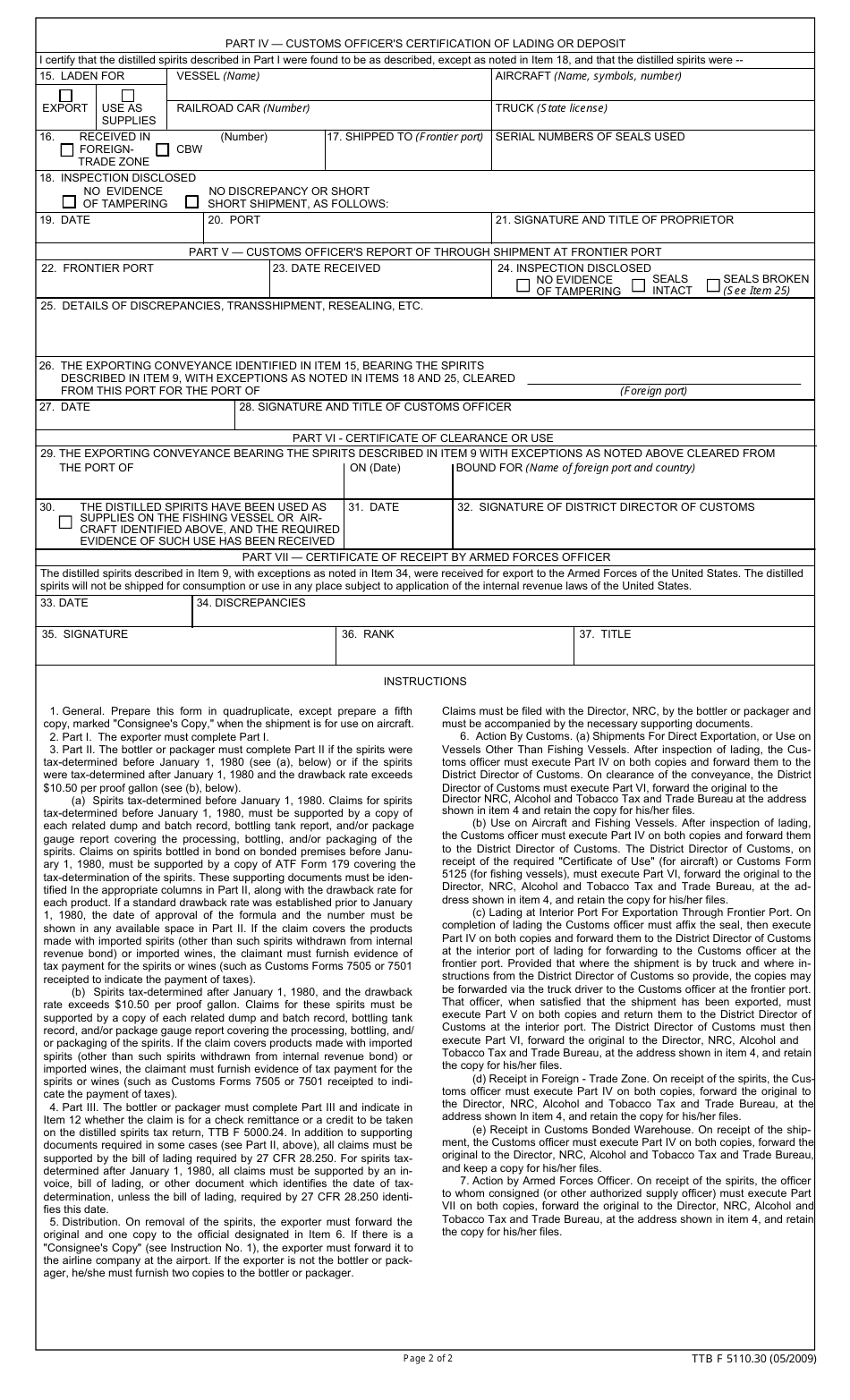

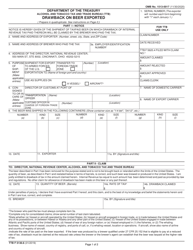

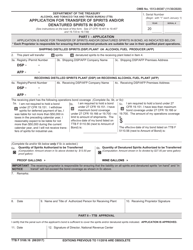

TTB Form 5110.30 Drawback on Distilled Spirits Exported

What Is TTB Form 5110.30?

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on May 1, 2009 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5110.30?

A: TTB Form 5110.30 is a form used for claiming drawback on distilled spirits exported.

Q: What is drawback?

A: Drawback is a refund of certain federal excise taxes paid on exported distilled spirits.

Q: Who can use TTB Form 5110.30?

A: Distilleries and other qualified persons can use this form to claim drawback on exported distilled spirits.

Q: How do I claim drawback using TTB Form 5110.30?

A: You need to provide the required information on the form, including details of the distilled spirits exported and proof of export.

Form Details:

- Released on May 1, 2009;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5110.30 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.