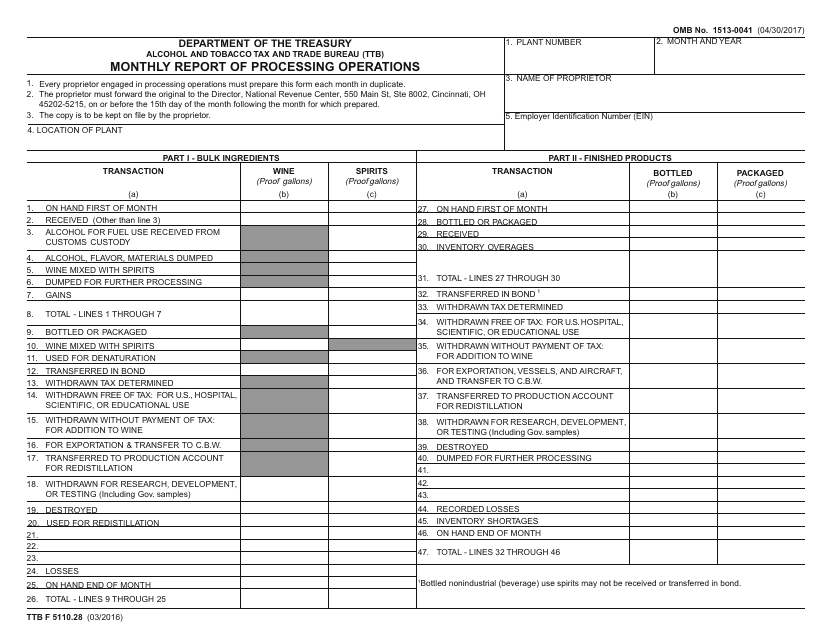

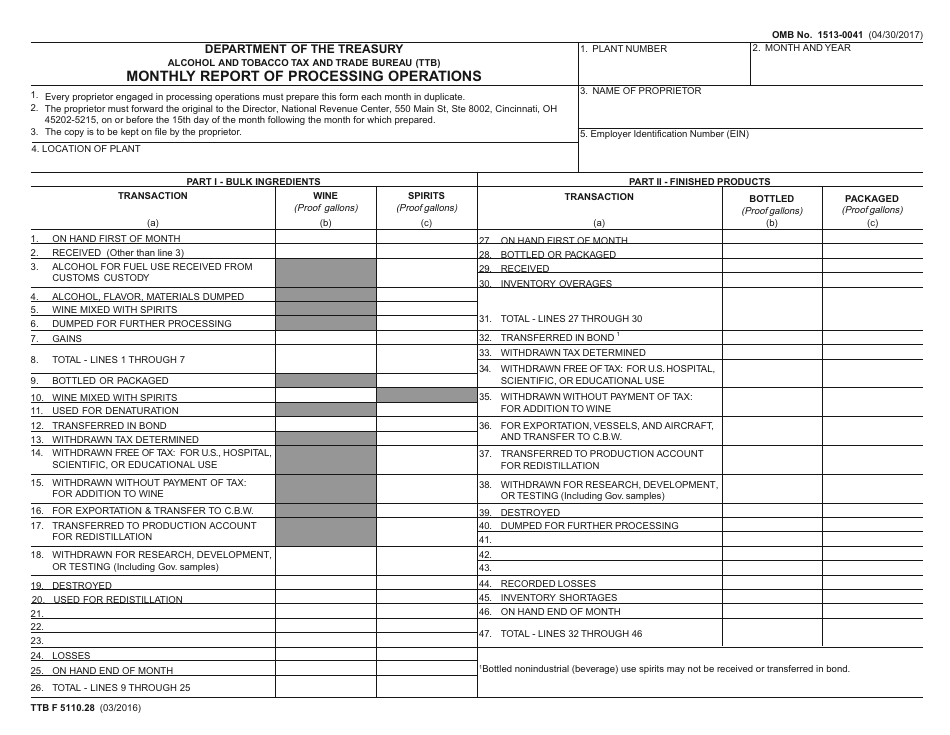

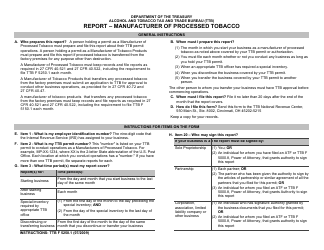

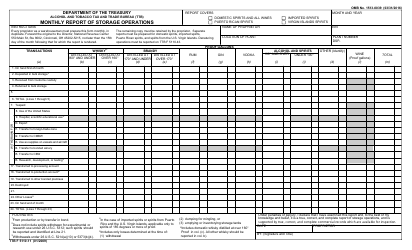

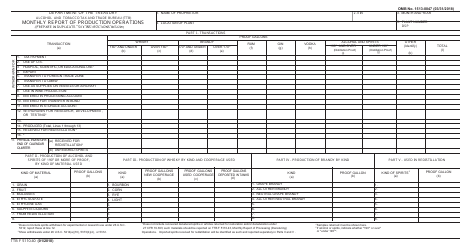

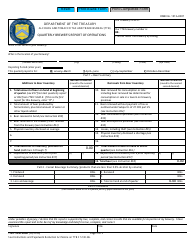

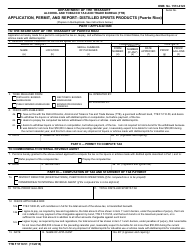

TTB Form 5110.28 Monthly Report of Processing Operations

What Is TTB Form 5110.28?

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on March 1, 2016 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5110.28?

A: TTB Form 5110.28 is a Monthly Report of Processing Operations.

Q: Who needs to file TTB Form 5110.28?

A: Businesses involved in processing operations for alcohol are required to file TTB Form 5110.28.

Q: What is the purpose of TTB Form 5110.28?

A: The purpose of TTB Form 5110.28 is for businesses to report their monthly processing operations related to alcohol.

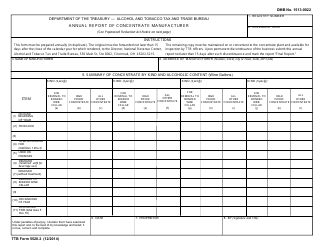

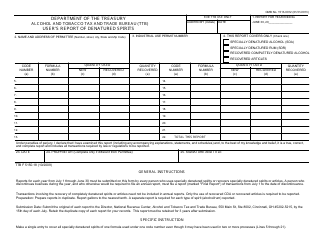

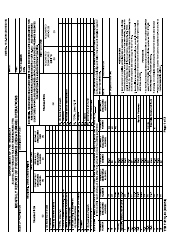

Q: What information is required on TTB Form 5110.28?

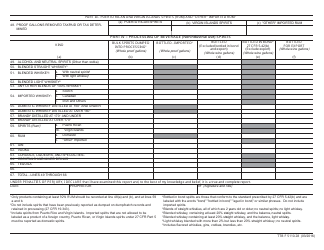

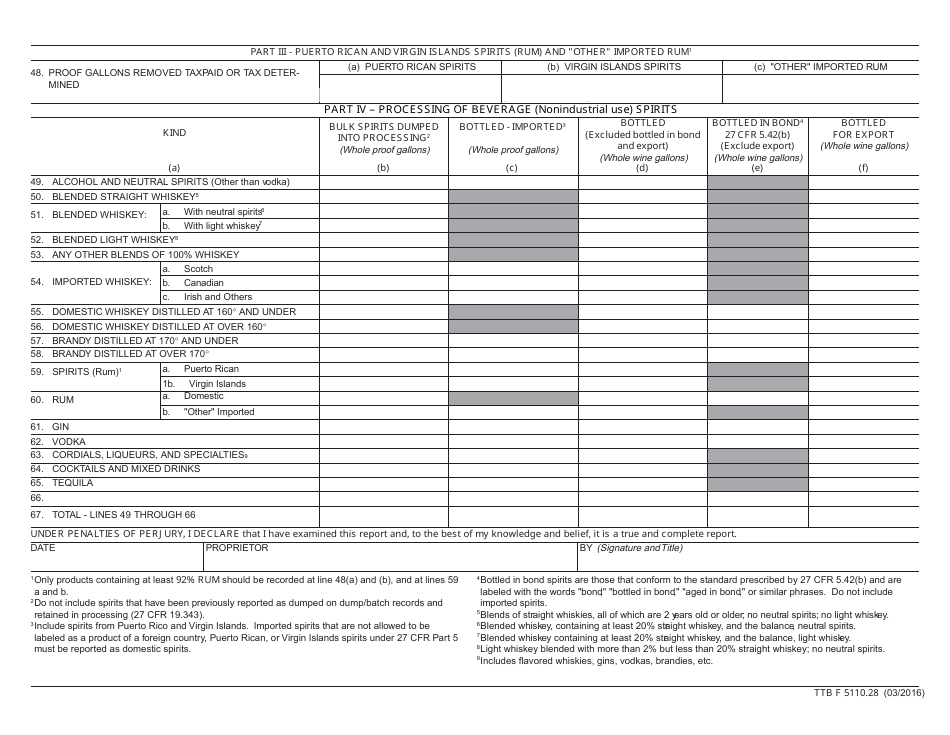

A: TTB Form 5110.28 requires businesses to provide information such as the type and quantity of alcohol processed, storage details, and any losses or gains.

Q: How often do businesses need to file TTB Form 5110.28?

A: Businesses need to file TTB Form 5110.28 monthly.

Form Details:

- Released on March 1, 2016;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5110.28 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.