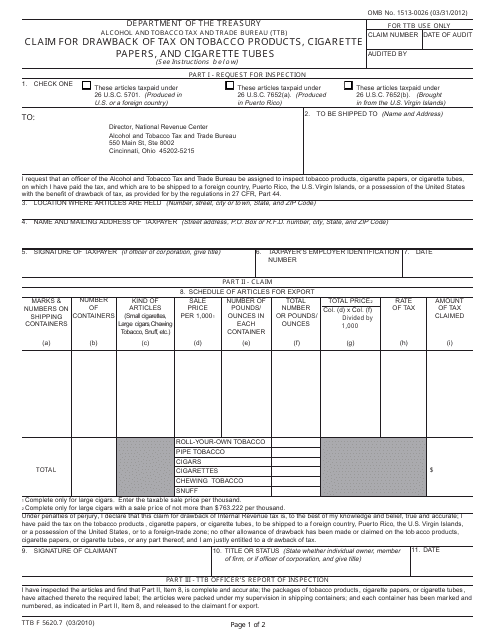

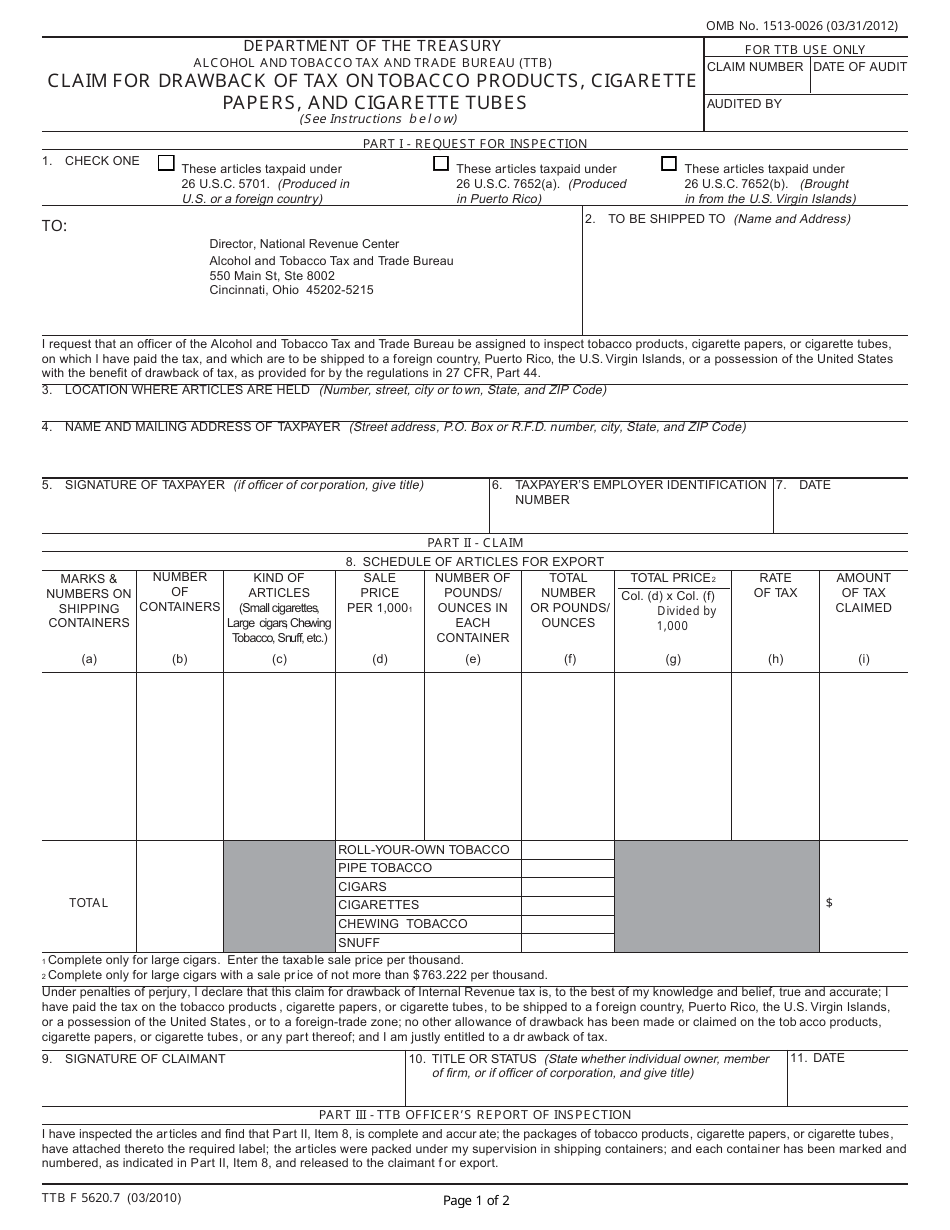

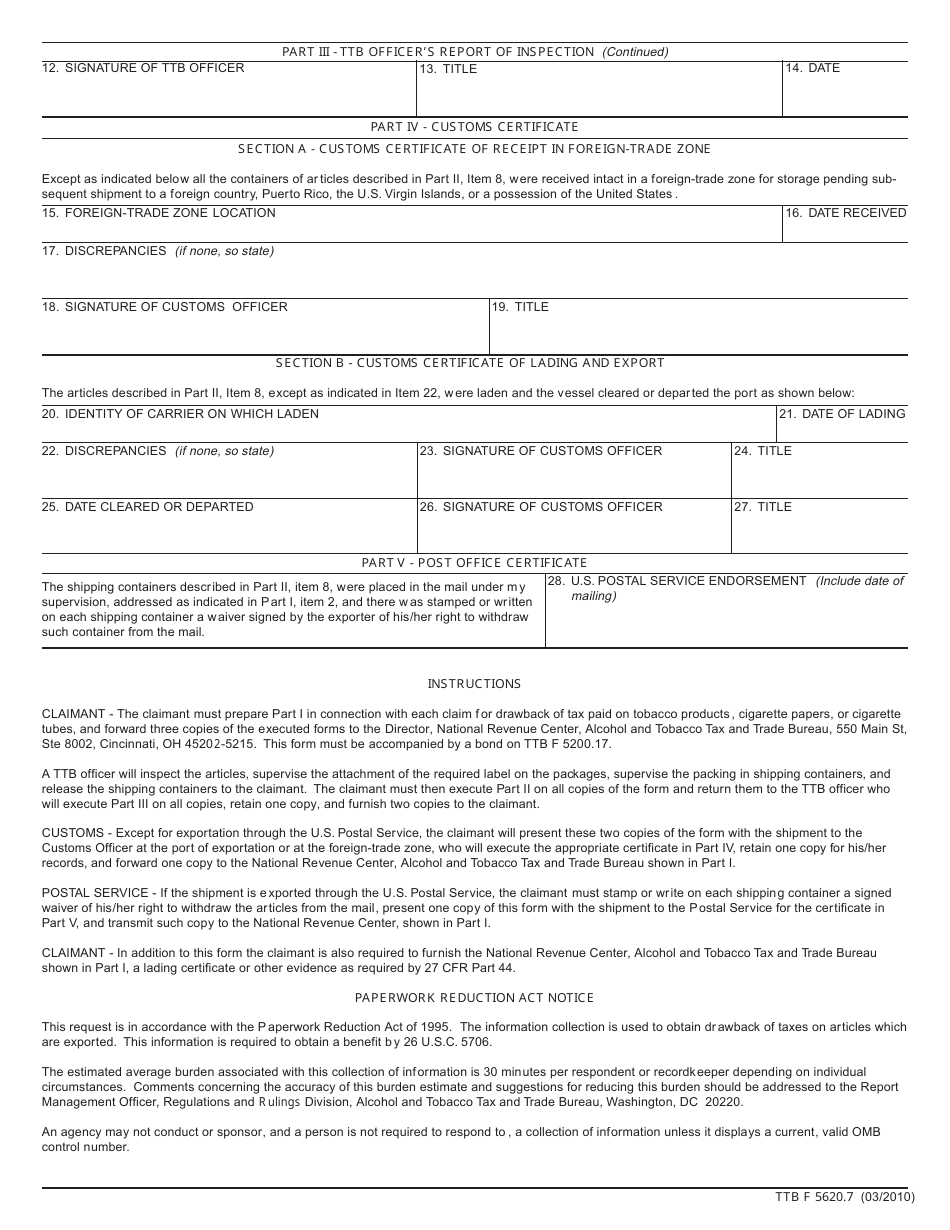

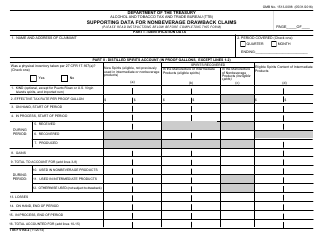

TTB Form 5620.7 Claim for Drawback of Tax on Tobacco Products, Cigarette Papers, and Cigarette Tubes

What Is TTB Form 5620.7?

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on March 1, 2010 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5620.7?

A: TTB Form 5620.7 is a form used to claim drawback of tax on tobacco products, cigarette papers, and cigarette tubes.

Q: What can be claimed as drawback using this form?

A: This form can be used to claim drawback of tax on tobacco products, cigarette papers, and cigarette tubes.

Q: Who can use TTB Form 5620.7?

A: Anyone who is eligible to claim drawback of tax on tobacco products, cigarette papers, and cigarette tubes can use this form.

Q: How do I fill out TTB Form 5620.7?

A: You need to provide details about the products, including the quantity, tax paid, and reason for the claim.

Q: Is there a deadline for filing TTB Form 5620.7?

A: Yes, you must file the form within 3 years from the date the tax was paid on the products.

Q: What happens after I submit TTB Form 5620.7?

A: The TTB will review your claim and determine if you are eligible for a refund of the tax paid.

Q: Can I claim drawback for products that were not exported?

A: No, this form is specifically for claiming drawback on products that were exported.

Q: Can I claim drawback for other types of products?

A: No, this form is only for claiming drawback on tobacco products, cigarette papers, and cigarette tubes.

Q: Is there a fee for submitting TTB Form 5620.7?

A: No, there is no fee for submitting this form.

Form Details:

- Released on March 1, 2010;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5620.7 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.