This version of the form is not currently in use and is provided for reference only. Download this version of

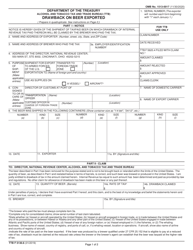

TTB Form 5100.25

for the current year.

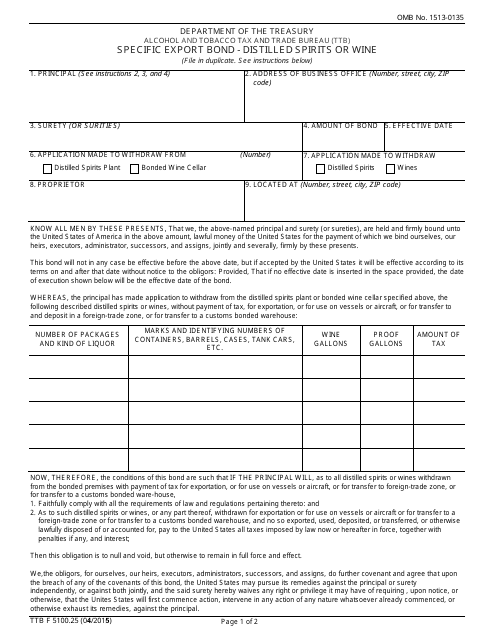

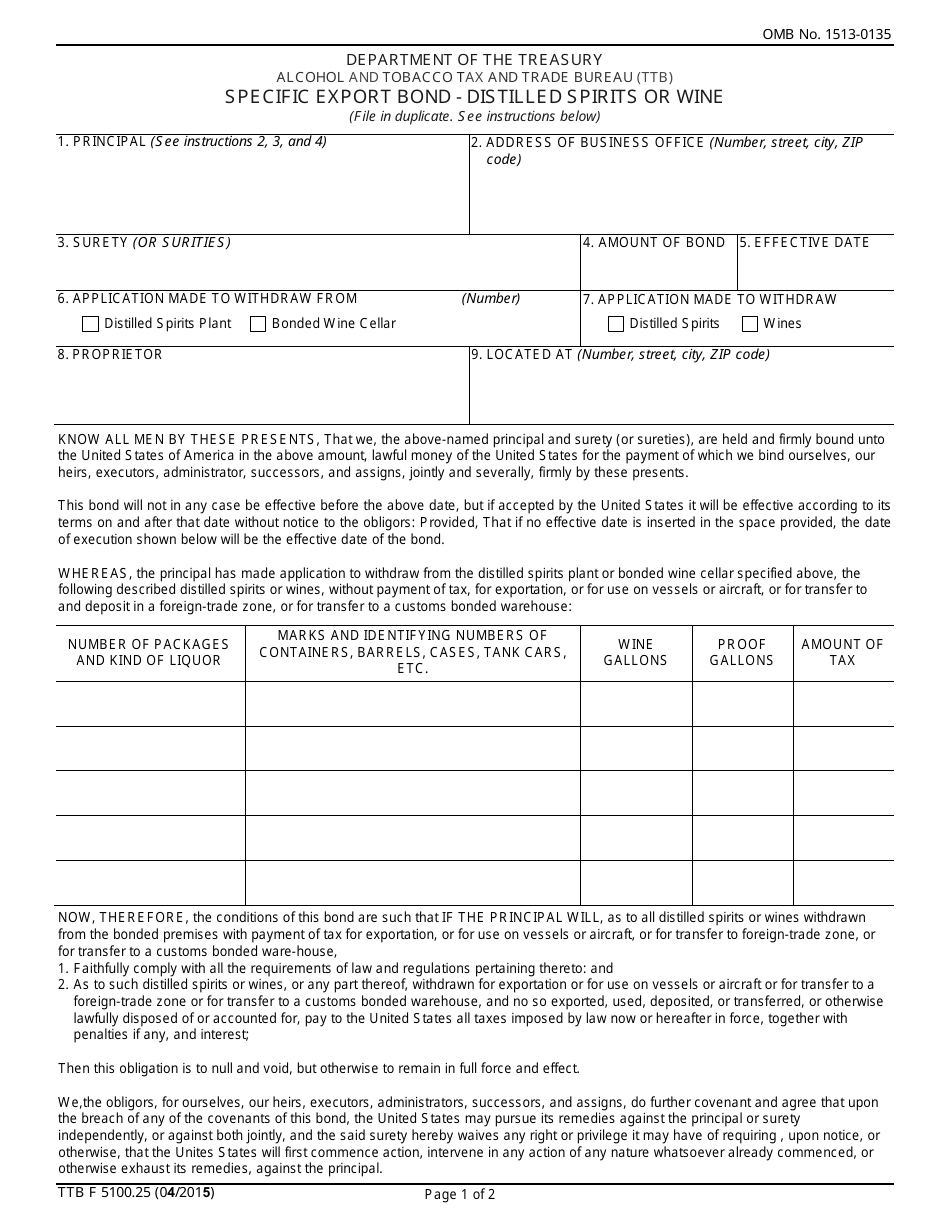

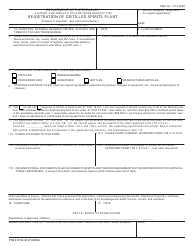

TTB Form 5100.25 Specific Export Bond - Distilled Spirits or Wine

What Is TTB Form 5100.25?

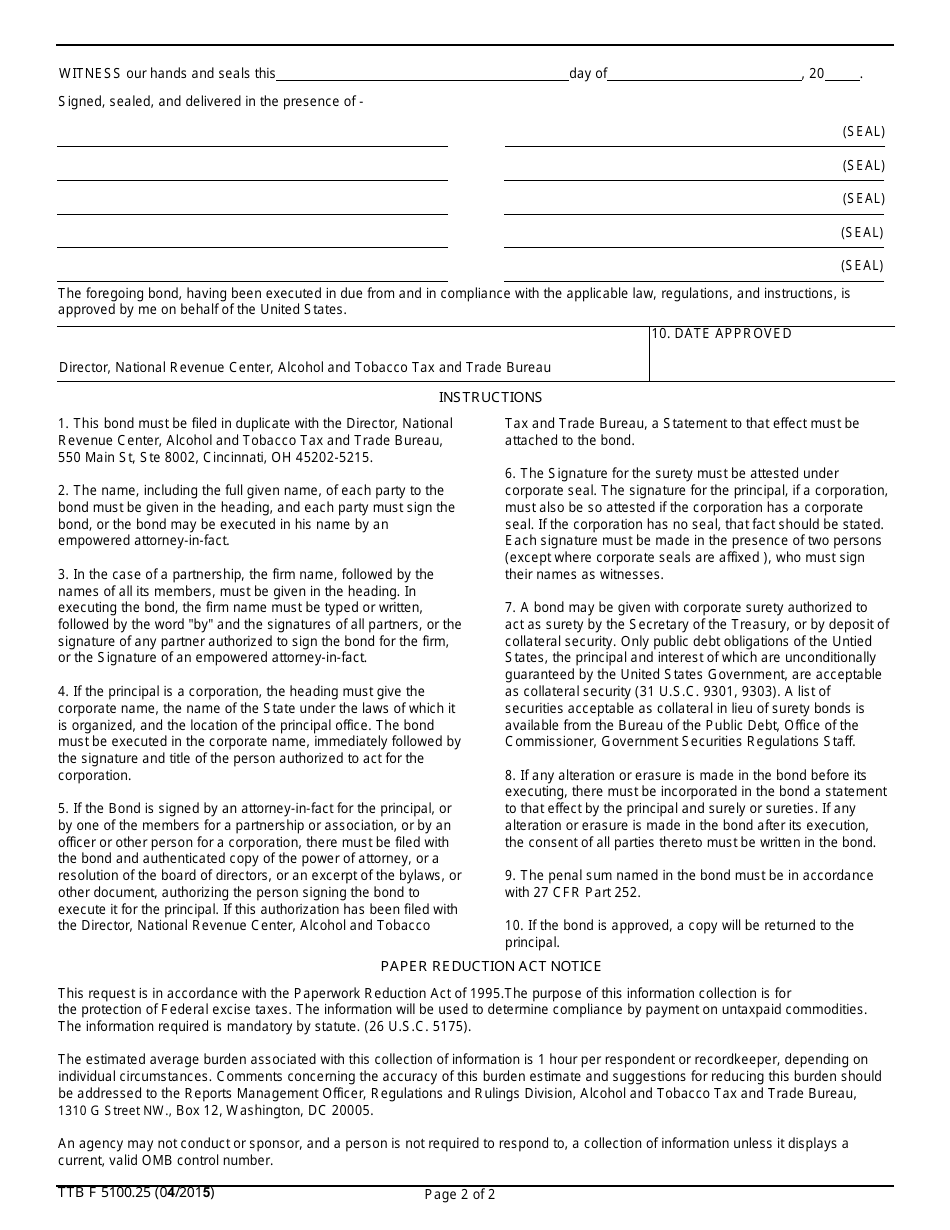

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on April 1, 2015 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5100.25?

A: TTB Form 5100.25 is the form used for Specific Export Bond for distilled spirits or wine.

Q: What is a Specific Export Bond?

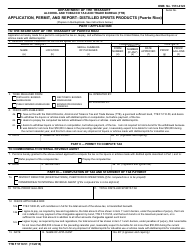

A: A Specific Export Bond is a type of bond required by the Alcohol and Tobacco Tax and Trade Bureau (TTB) for the exportation of distilled spirits or wine.

Q: When is TTB Form 5100.25 required?

A: TTB Form 5100.25 is required when a business wants to export distilled spirits or wine and needs to provide a bond to guarantee payment of taxes.

Q: Who needs to file TTB Form 5100.25?

A: Any business intending to export distilled spirits or wine from the United States needs to file TTB Form 5100.25.

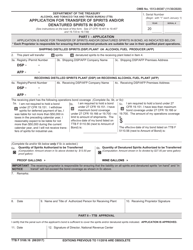

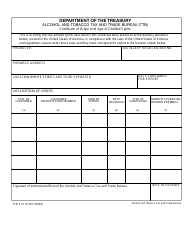

Q: What information is required on TTB Form 5100.25?

A: TTB Form 5100.25 requires information about the exporter, consignee, distilled spirits or wine being exported, and the bond amount.

Q: What happens after submitting TTB Form 5100.25?

A: After submitting TTB Form 5100.25, the TTB will review the form, process the bond, and provide approval for the exportation of the distilled spirits or wine.

Q: Is TTB Form 5100.25 specific to the exportation of distilled spirits or wine?

A: Yes, TTB Form 5100.25 is specifically used for the exportation of distilled spirits or wine.

Form Details:

- Released on April 1, 2015;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5100.25 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.