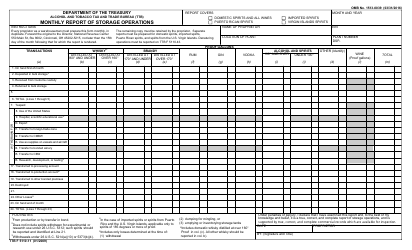

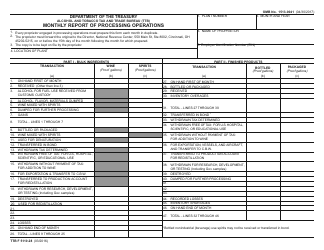

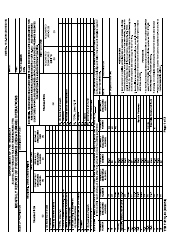

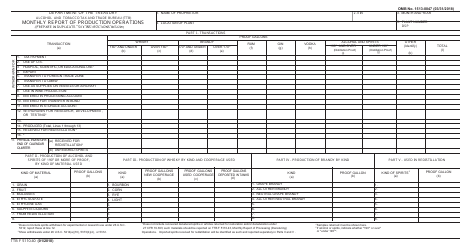

TTB Form 5250.1 Report - Manufacturer of Processed Tobacco

What Is TTB Form 5250.1?

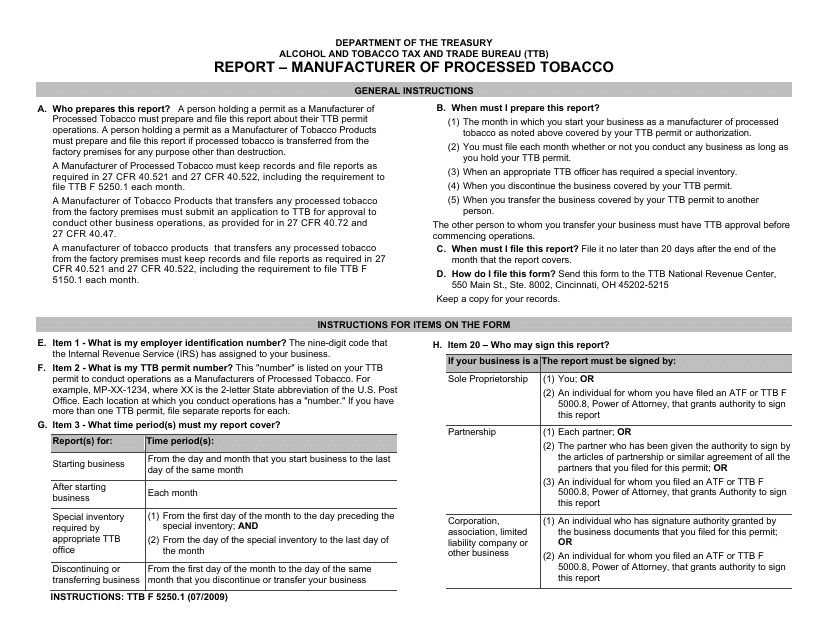

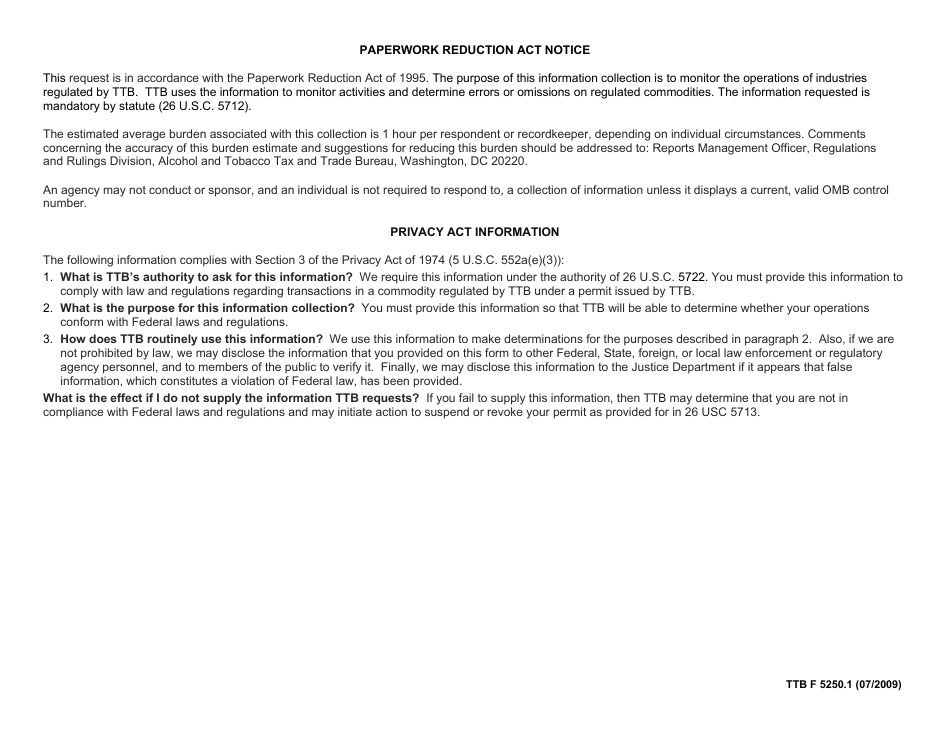

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on July 1, 2009 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5250.1?

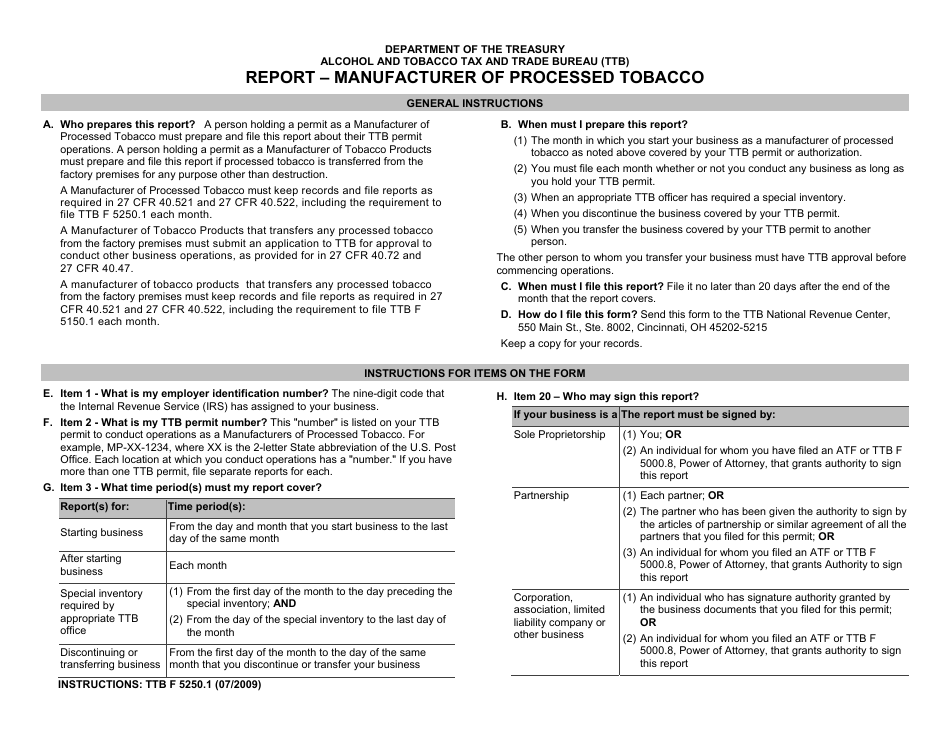

A: TTB Form 5250.1 is a report used by manufacturers of processed tobacco to provide information to the Alcohol and Tobacco Tax and Trade Bureau (TTB).

Q: Who needs to file TTB Form 5250.1?

A: Manufacturers of processed tobacco are required to file TTB Form 5250.1.

Q: What information is required on TTB Form 5250.1?

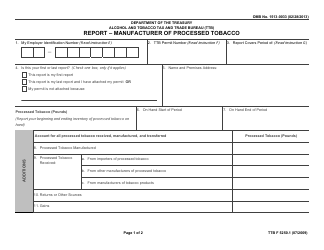

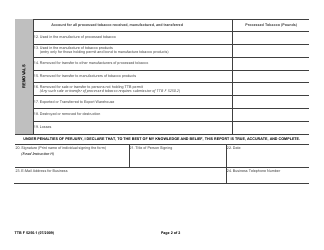

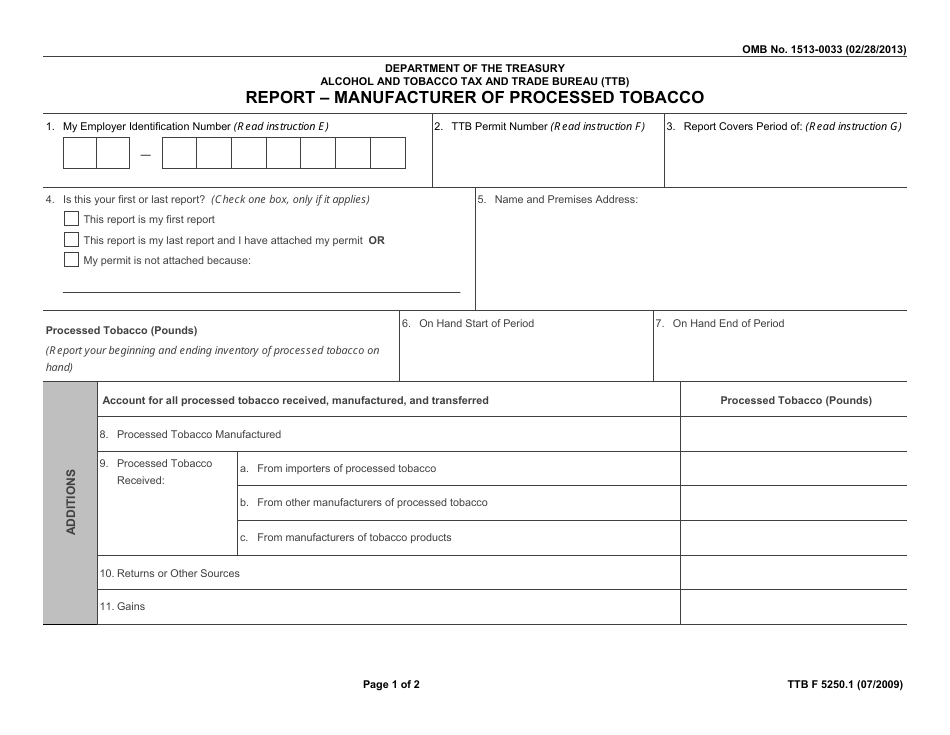

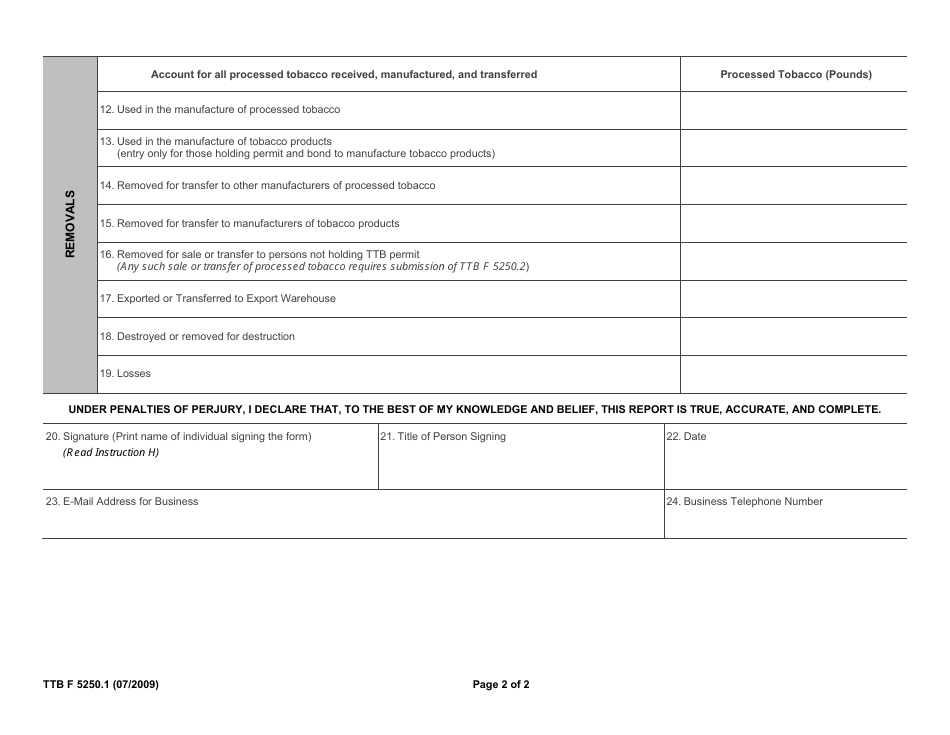

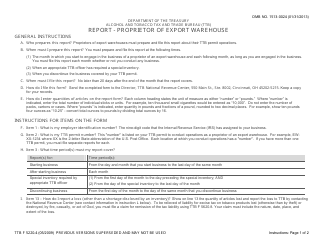

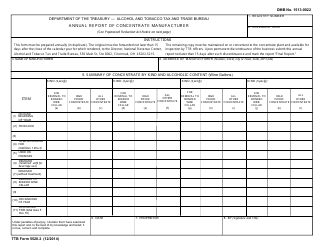

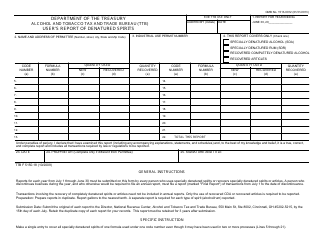

A: TTB Form 5250.1 requires manufacturers to provide information about their operations, including production quantities, exports, and inventory.

Q: How often do you need to file TTB Form 5250.1?

A: TTB Form 5250.1 must be filed monthly, within 15 days after the end of each reporting period.

Q: Are there any penalties for not filing TTB Form 5250.1?

A: Yes, failure to file TTB Form 5250.1 or filing false or incomplete information can result in penalties, including monetary fines and suspension or revocation of permits.

Q: Is TTB Form 5250.1 used for both the USA and Canada?

A: No, TTB Form 5250.1 is used only in the United States. It does not apply to Canada.

Form Details:

- Released on July 1, 2009;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5250.1 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.