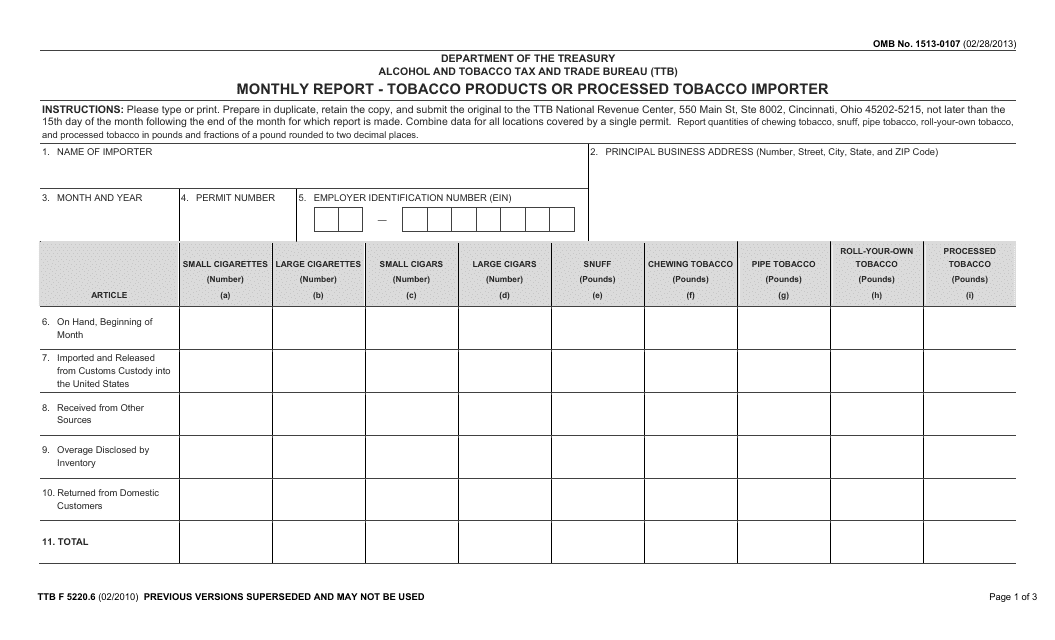

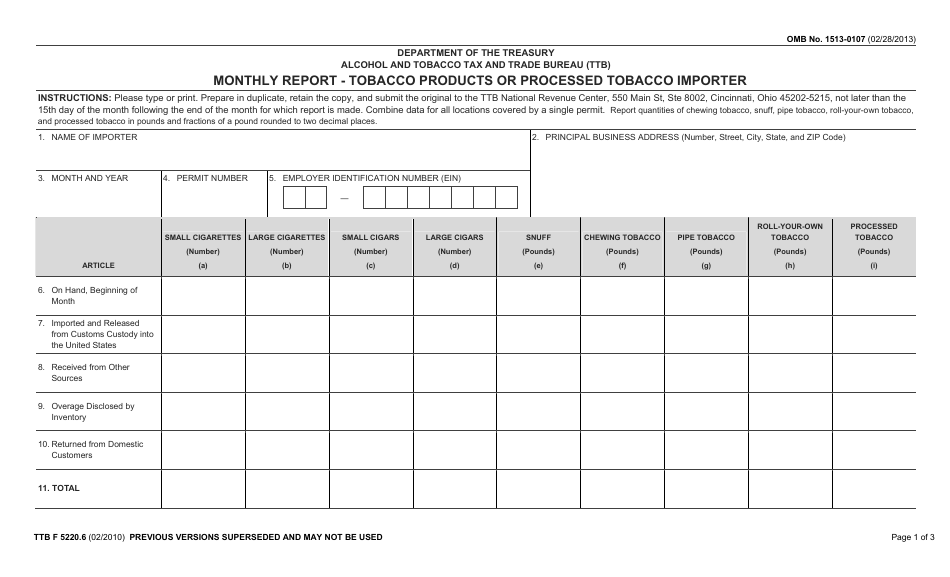

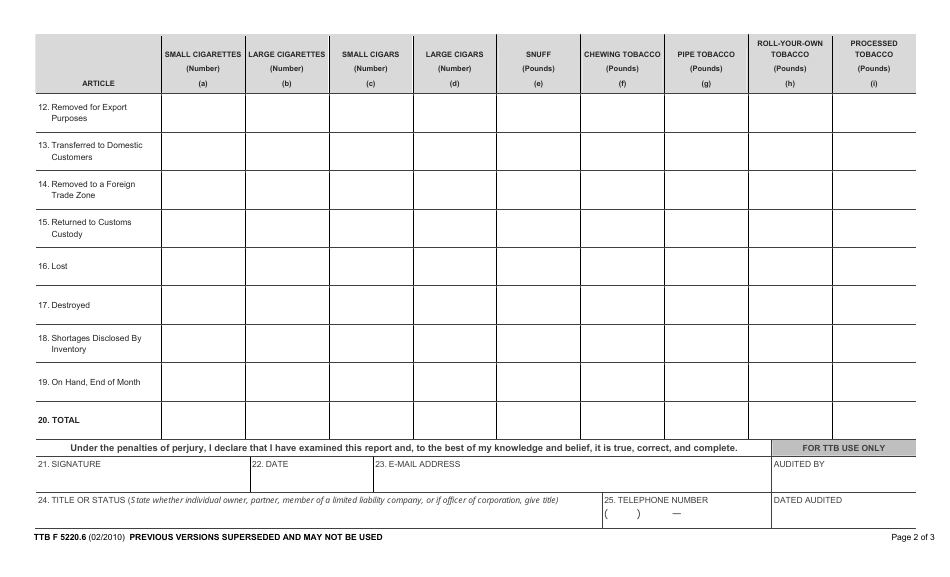

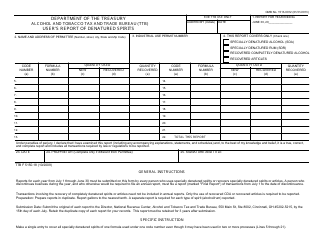

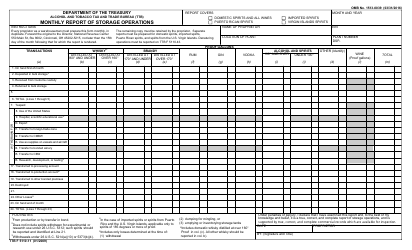

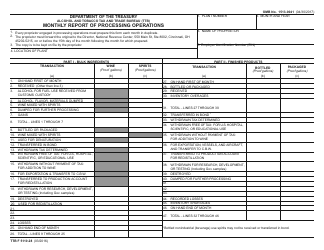

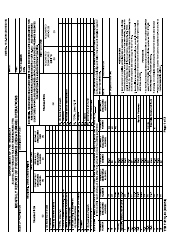

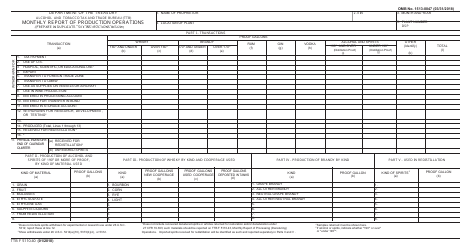

TTB Form 5220.6 Monthly Report - Tobacco Products or Processed Tobacco Importer

What Is TTB Form 5220.6?

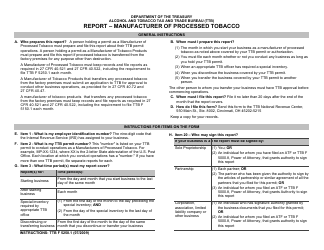

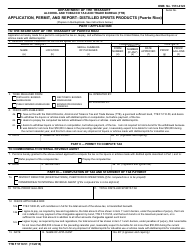

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on February 1, 2010 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5220.6?

A: TTB Form 5220.6 is a monthly report that needs to be filled out by tobacco product or processed tobacco importers.

Q: Who needs to fill out TTB Form 5220.6?

A: Tobacco product or processed tobacco importers are required to fill out TTB Form 5220.6.

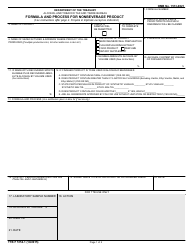

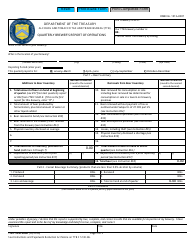

Q: What information needs to be provided on TTB Form 5220.6?

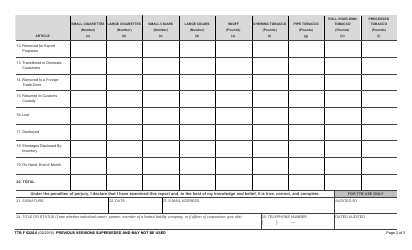

A: TTB Form 5220.6 requires importers to provide information about their import activities, including quantity and value of tobacco products or processed tobacco imported.

Q: How often should TTB Form 5220.6 be filed?

A: TTB Form 5220.6 should be filed on a monthly basis.

Q: Are there any penalties for not filing TTB Form 5220.6?

A: Failure to file TTB Form 5220.6 may result in penalties or other enforcement actions by the TTB.

Form Details:

- Released on February 1, 2010;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5220.6 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.