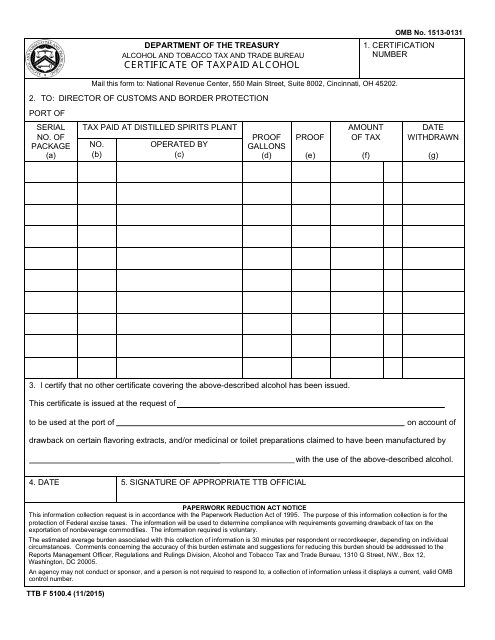

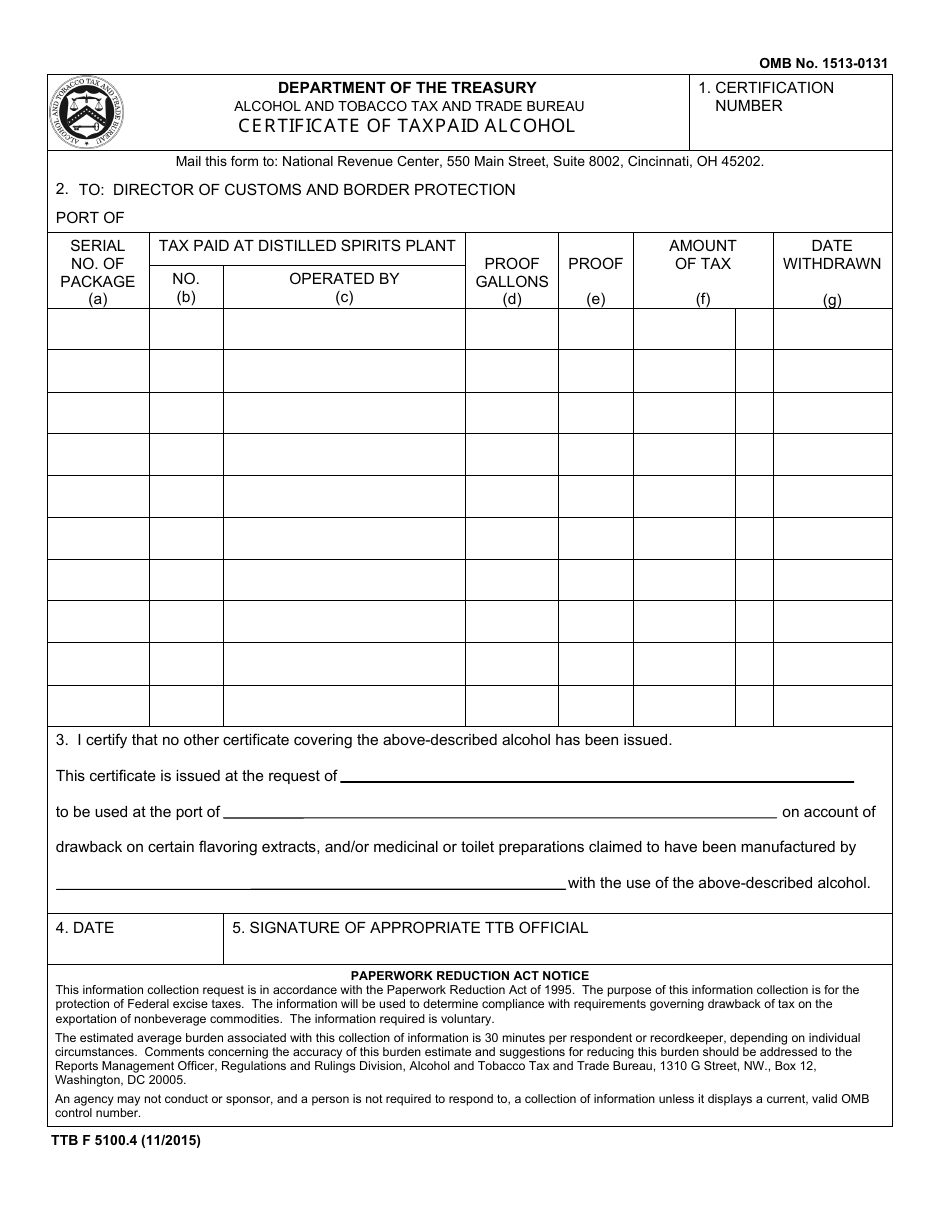

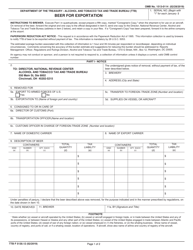

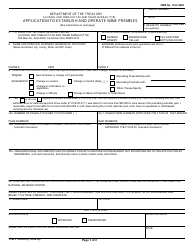

TTB Form 5100.4 Certificate of Taxpaid Alcohol

What Is TTB Form 5100.4?

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on November 1, 2015 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5100.4?

A: TTB Form 5100.4 is the Certificate of Taxpaid Alcohol form.

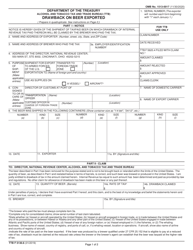

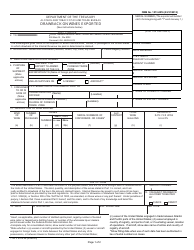

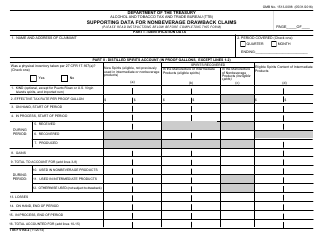

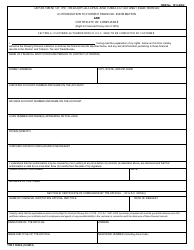

Q: What is the purpose of TTB Form 5100.4?

A: The purpose of TTB Form 5100.4 is to certify that alcohol has had the required taxes paid.

Q: Who needs to file TTB Form 5100.4?

A: Anyone who wants to certify that their alcohol has had the required taxes paid needs to file TTB Form 5100.4.

Q: What information is required on TTB Form 5100.4?

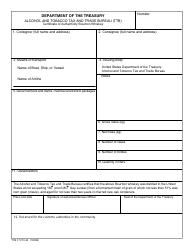

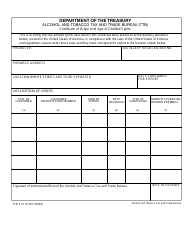

A: The form requires information such as the name and address of the producer, the type and quantity of alcohol, and details about the tax payment.

Q: Are there any fees associated with filing TTB Form 5100.4?

A: No, there are no fees associated with filing TTB Form 5100.4.

Q: What happens after I file TTB Form 5100.4?

A: After filing TTB Form 5100.4, you will receive a copy of the certified form for your records.

Q: Is TTB Form 5100.4 specific to the United States or Canada?

A: TTB Form 5100.4 is specific to the United States.

Form Details:

- Released on November 1, 2015;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5100.4 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.