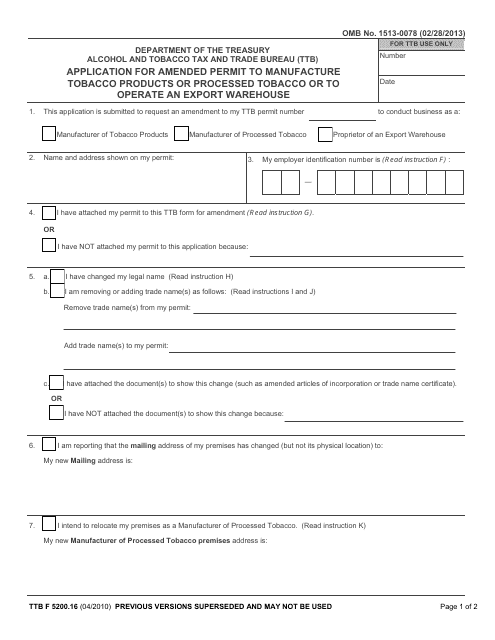

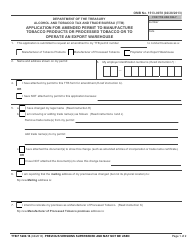

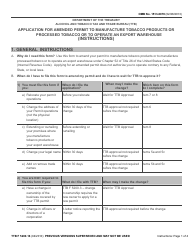

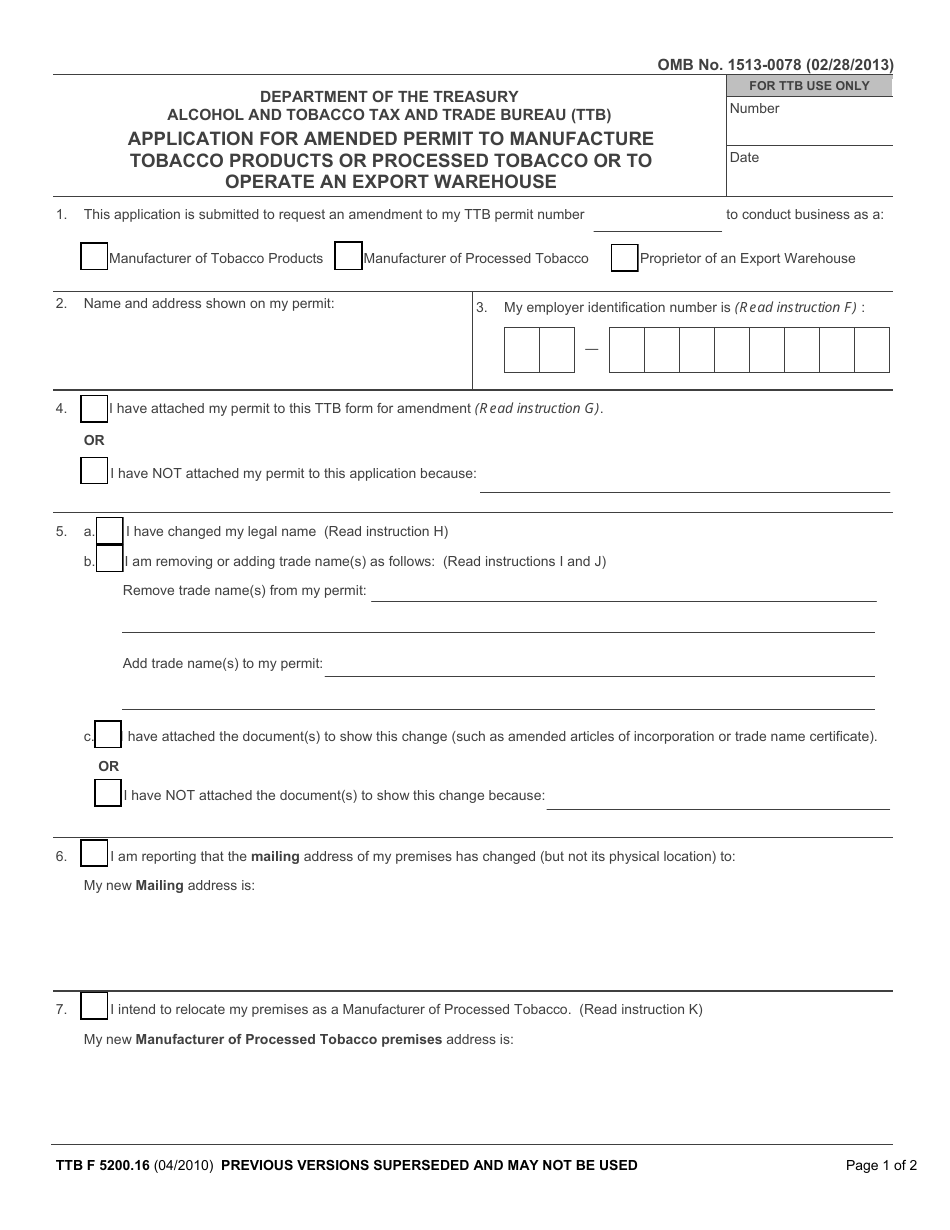

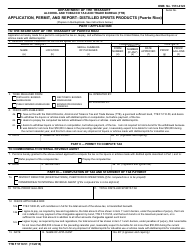

TTB Form 5200.16 Application for Amended Permit to Manufacture Tobacco Products or Processed Tobacco or to Operate an Export Warehouse

What Is TTB Form 5200.16?

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on April 1, 2010 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5200.16?

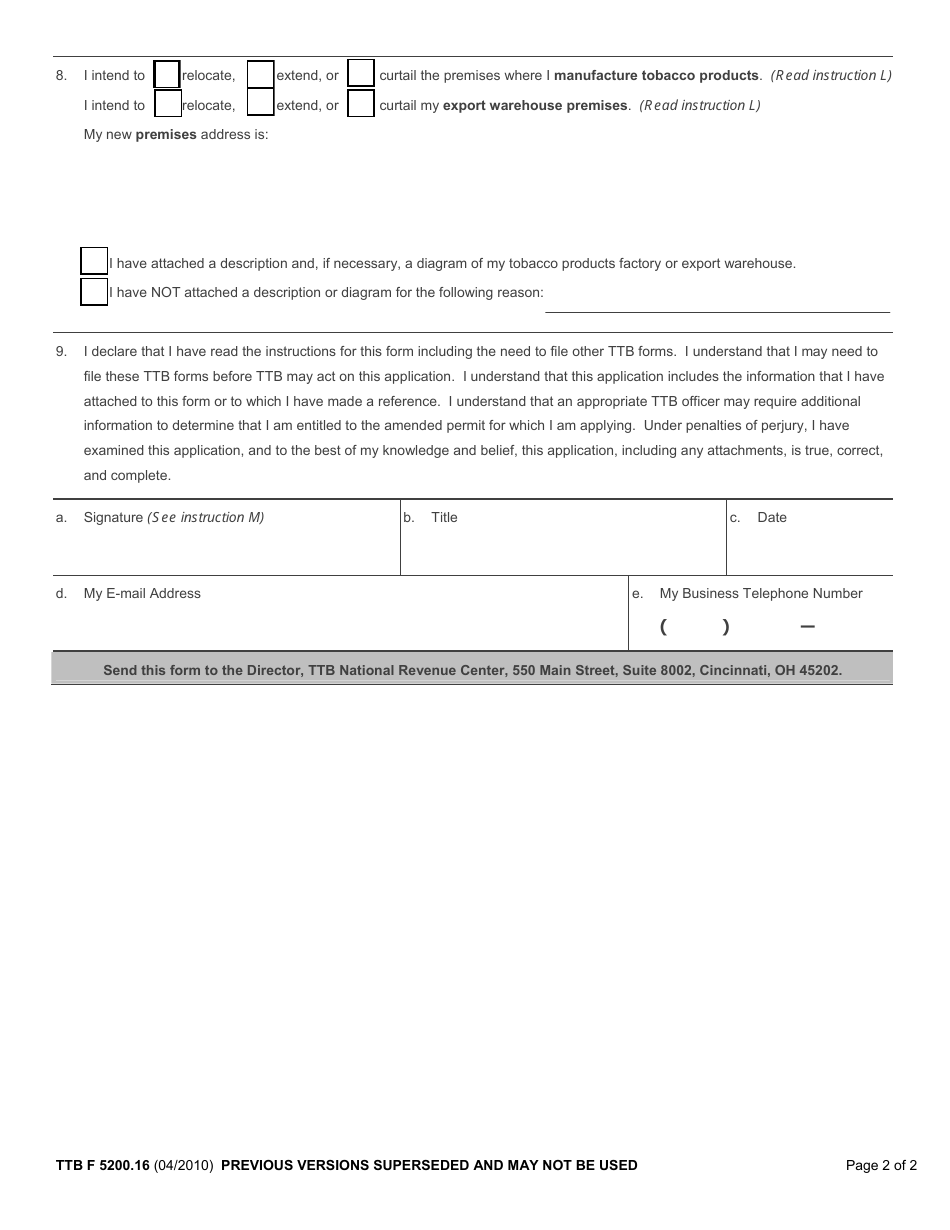

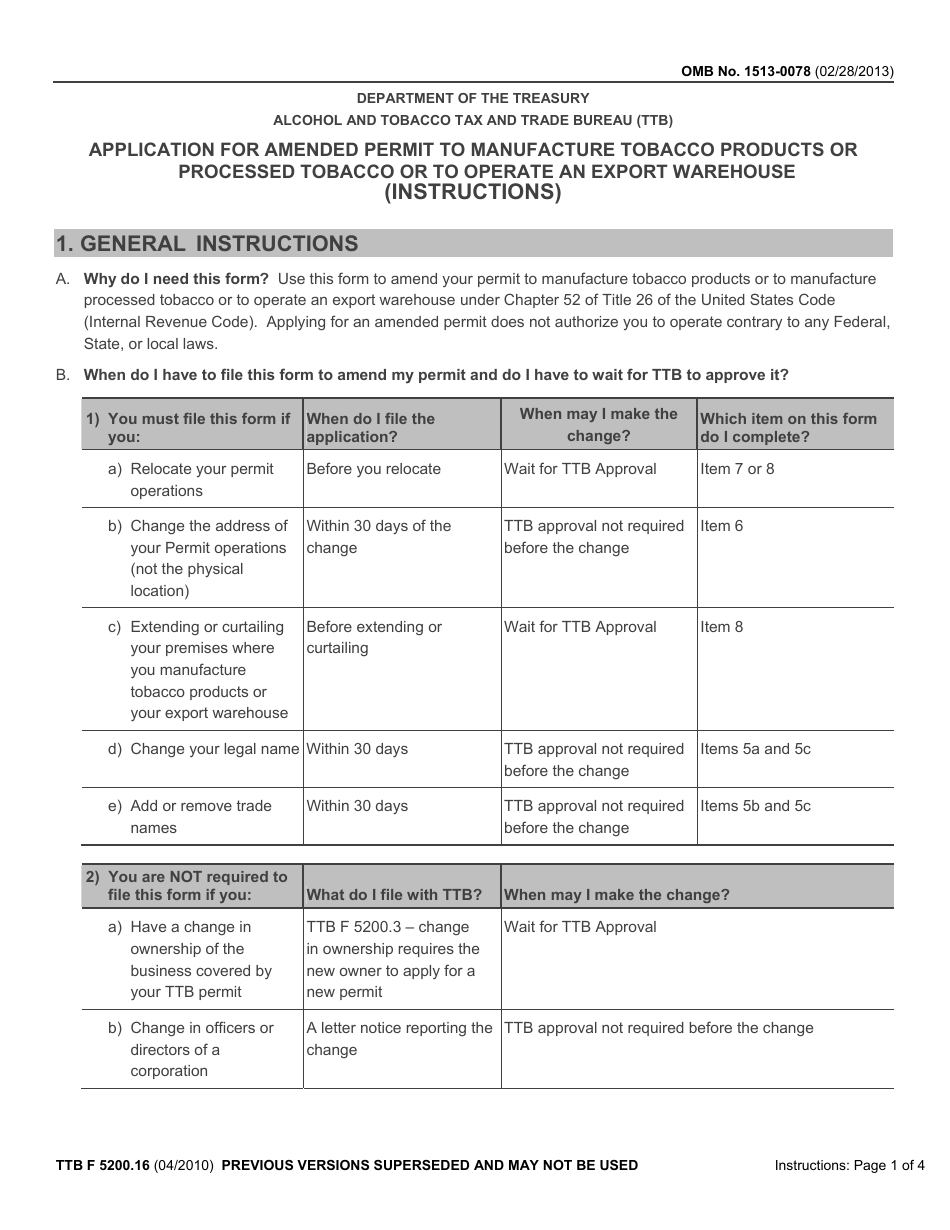

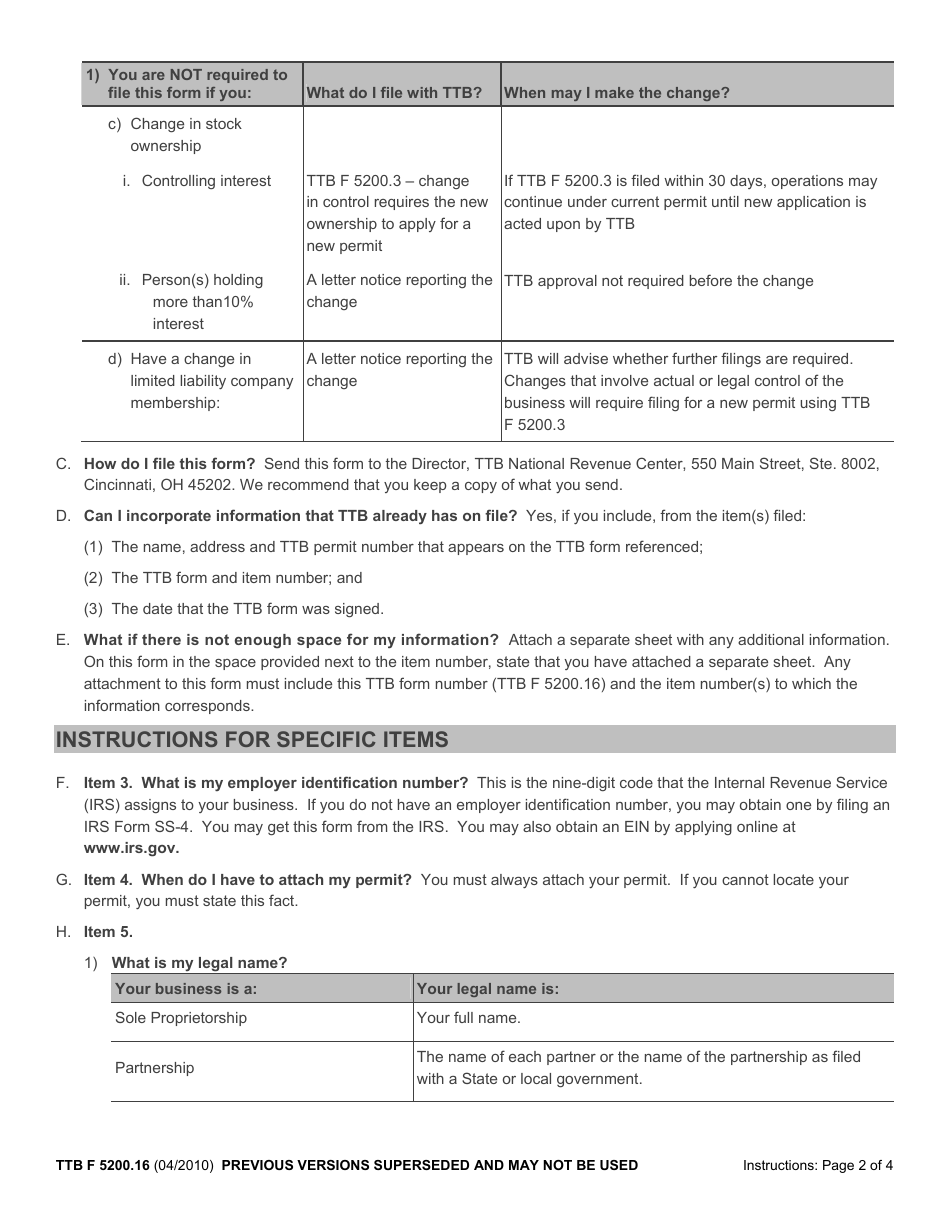

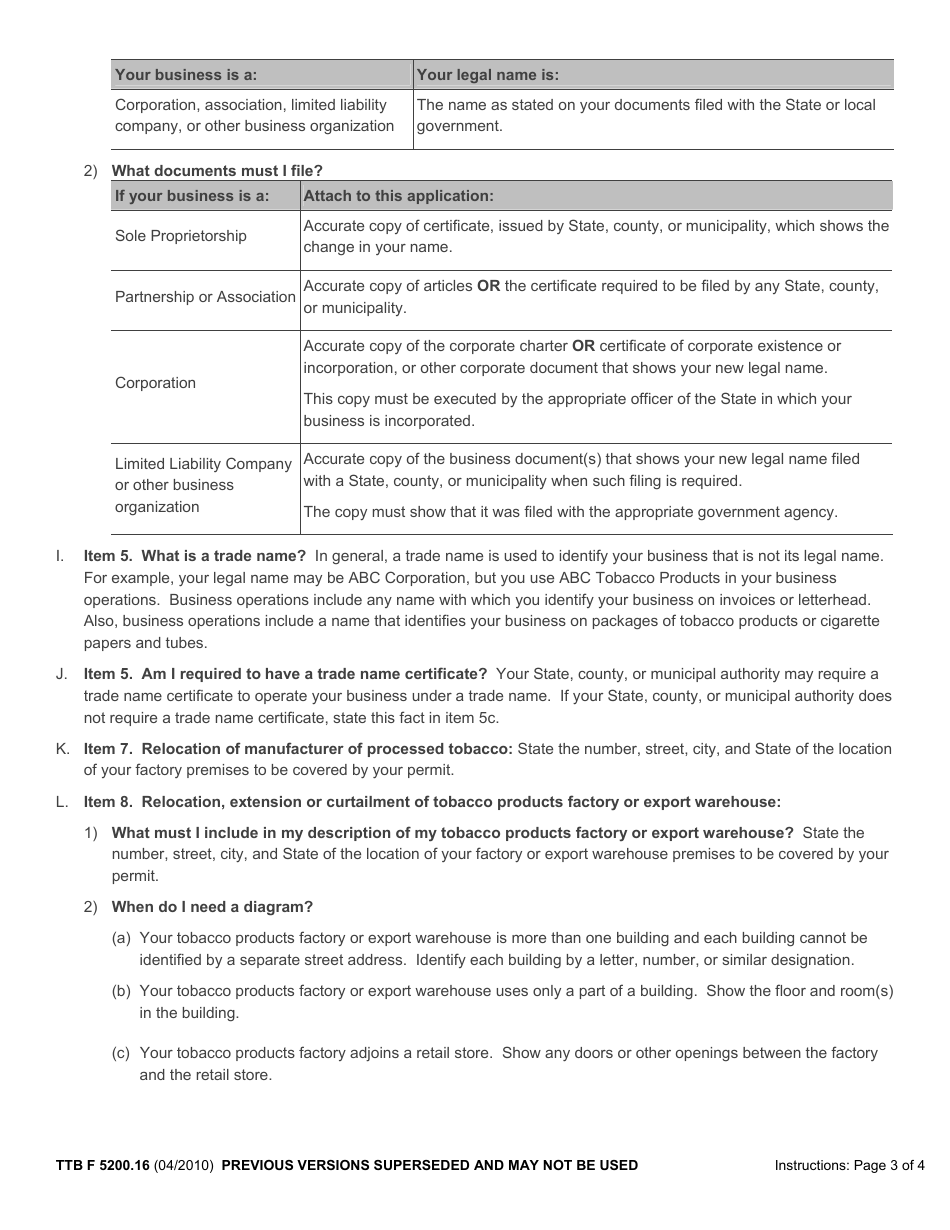

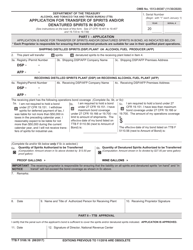

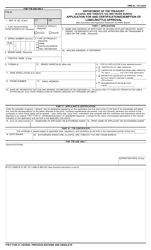

A: TTB Form 5200.16 is an application form used to request an amended permit to manufacture tobacco products or processed tobacco or to operate an export warehouse.

Q: Who can use TTB Form 5200.16?

A: Any individual or business entity involved in manufacturing tobacco products or processed tobacco or operating an export warehouse can use TTB Form 5200.16.

Q: What is the purpose of TTB Form 5200.16?

A: The purpose of TTB Form 5200.16 is to request changes or amendments to an existing permit for manufacturing tobacco products or processed tobacco or operating an export warehouse.

Q: Are there any fees associated with TTB Form 5200.16?

A: Yes, there are fees associated with TTB Form 5200.16. The specific fees depend on the type of amendment being requested.

Q: What information is required on TTB Form 5200.16?

A: TTB Form 5200.16 requires various information related to the applicant, the amendment being requested, and supporting documentation.

Q: Is TTB Form 5200.16 only for US residents?

A: No, TTB Form 5200.16 can be used by both US residents and non-residents who meet the eligibility criteria.

Q: How long does it take to process TTB Form 5200.16?

A: The processing time for TTB Form 5200.16 can vary, but the TTB aims to process applications within 90 days of receipt.

Q: Are there any penalties for providing false information on TTB Form 5200.16?

A: Yes, providing false information on TTB Form 5200.16 is subject to penalties, including fines and imprisonment.

Form Details:

- Released on April 1, 2010;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5200.16 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.