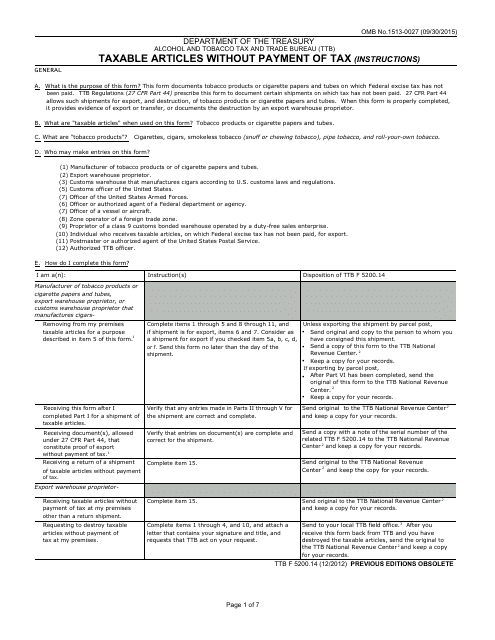

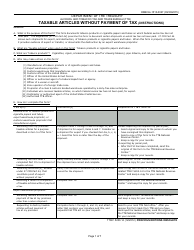

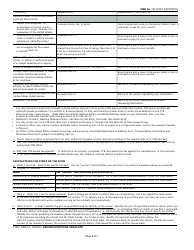

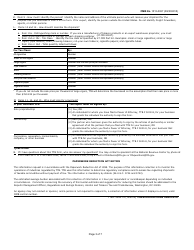

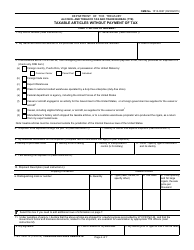

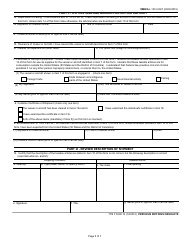

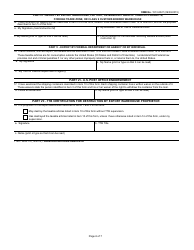

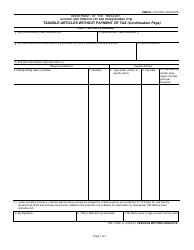

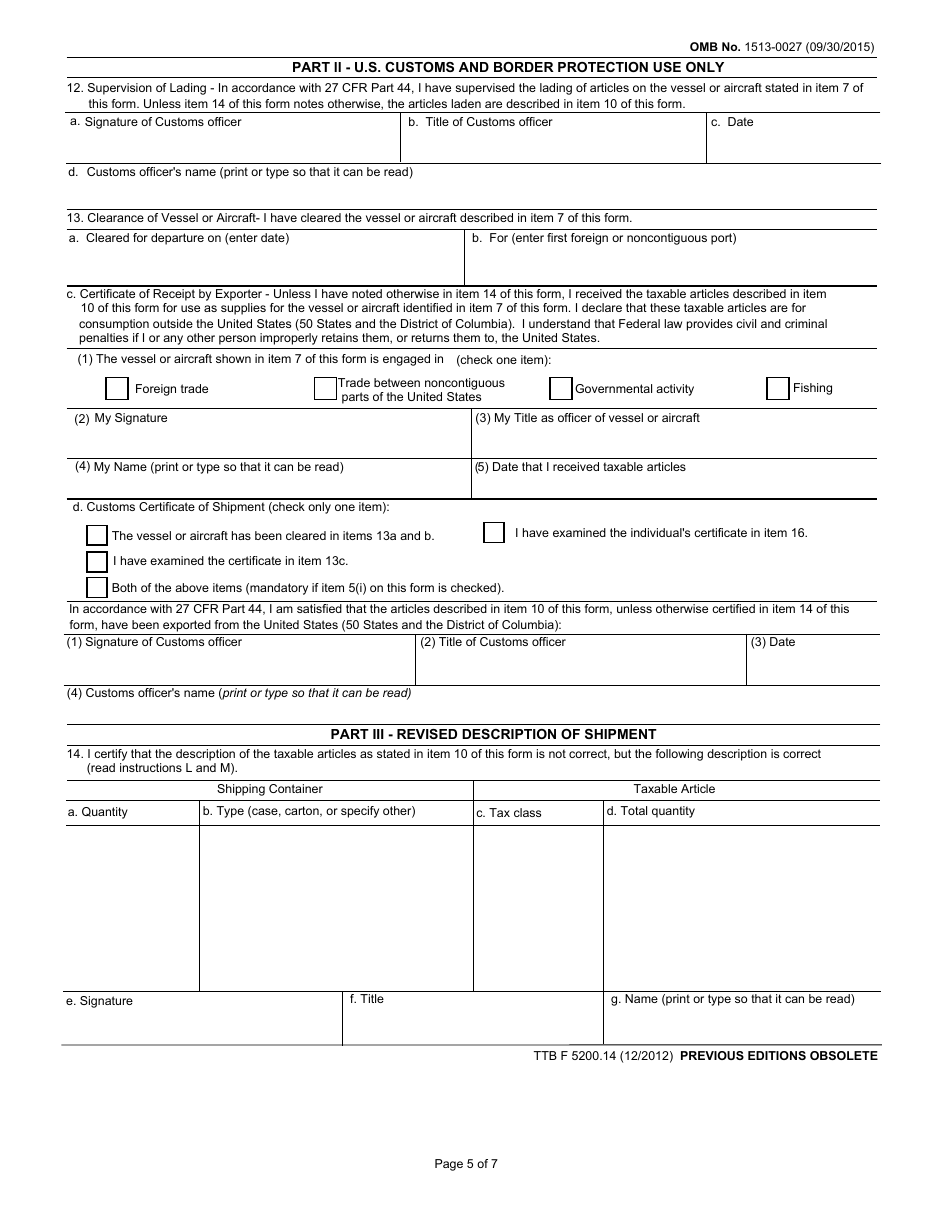

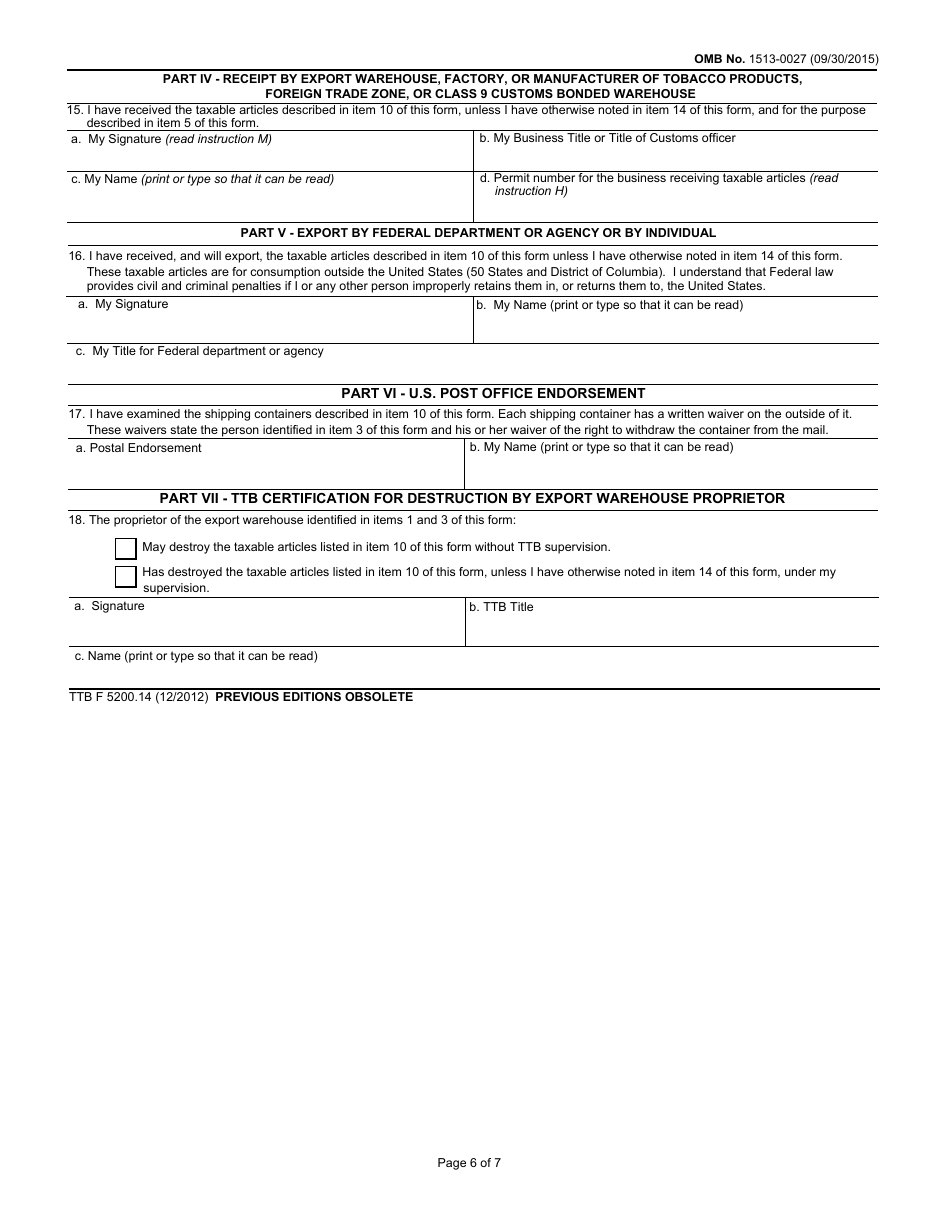

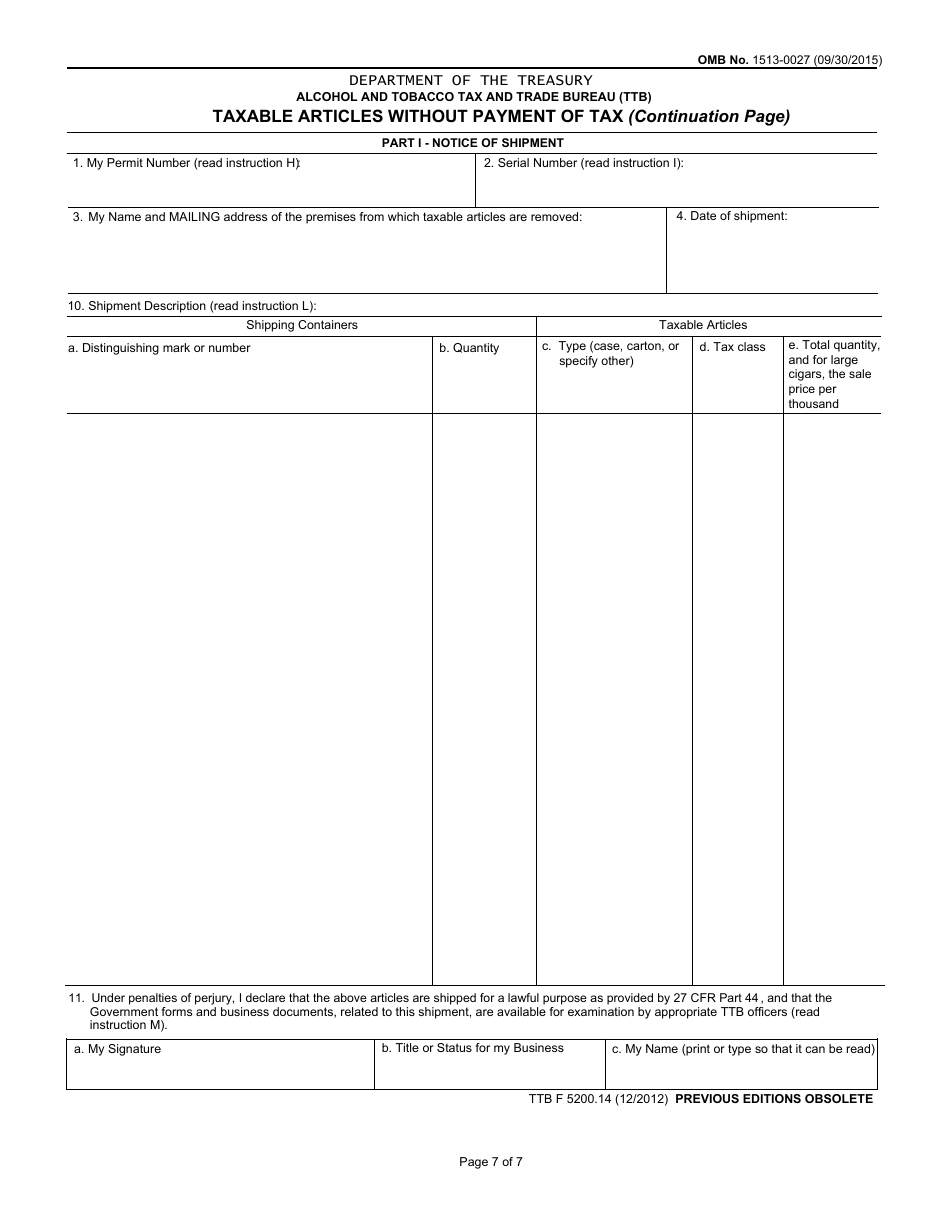

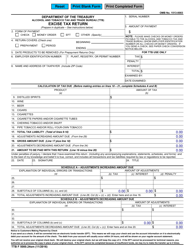

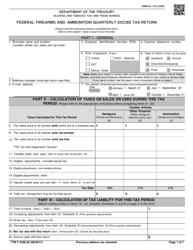

TTB Form 5200.14 Taxable Articles Without Payment of Tax

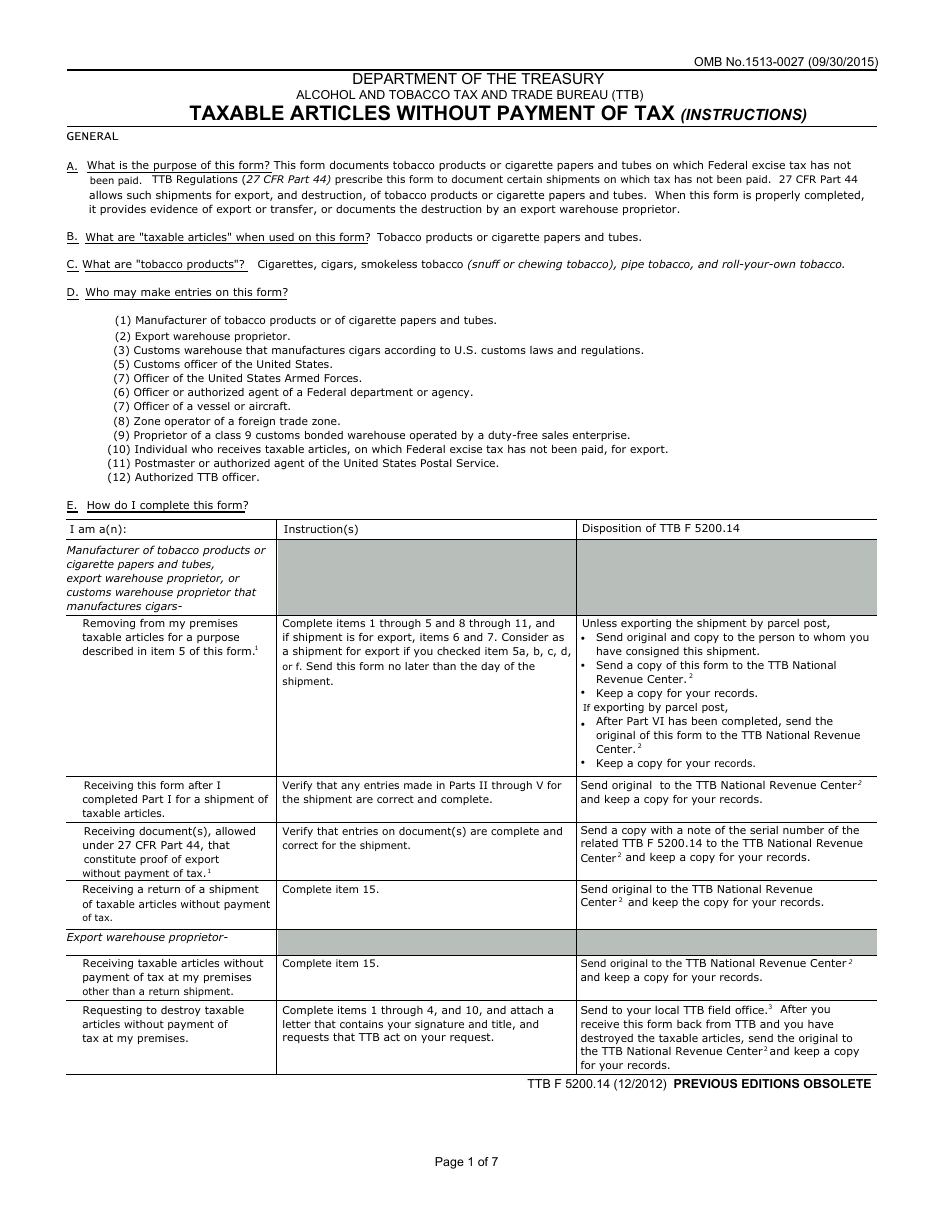

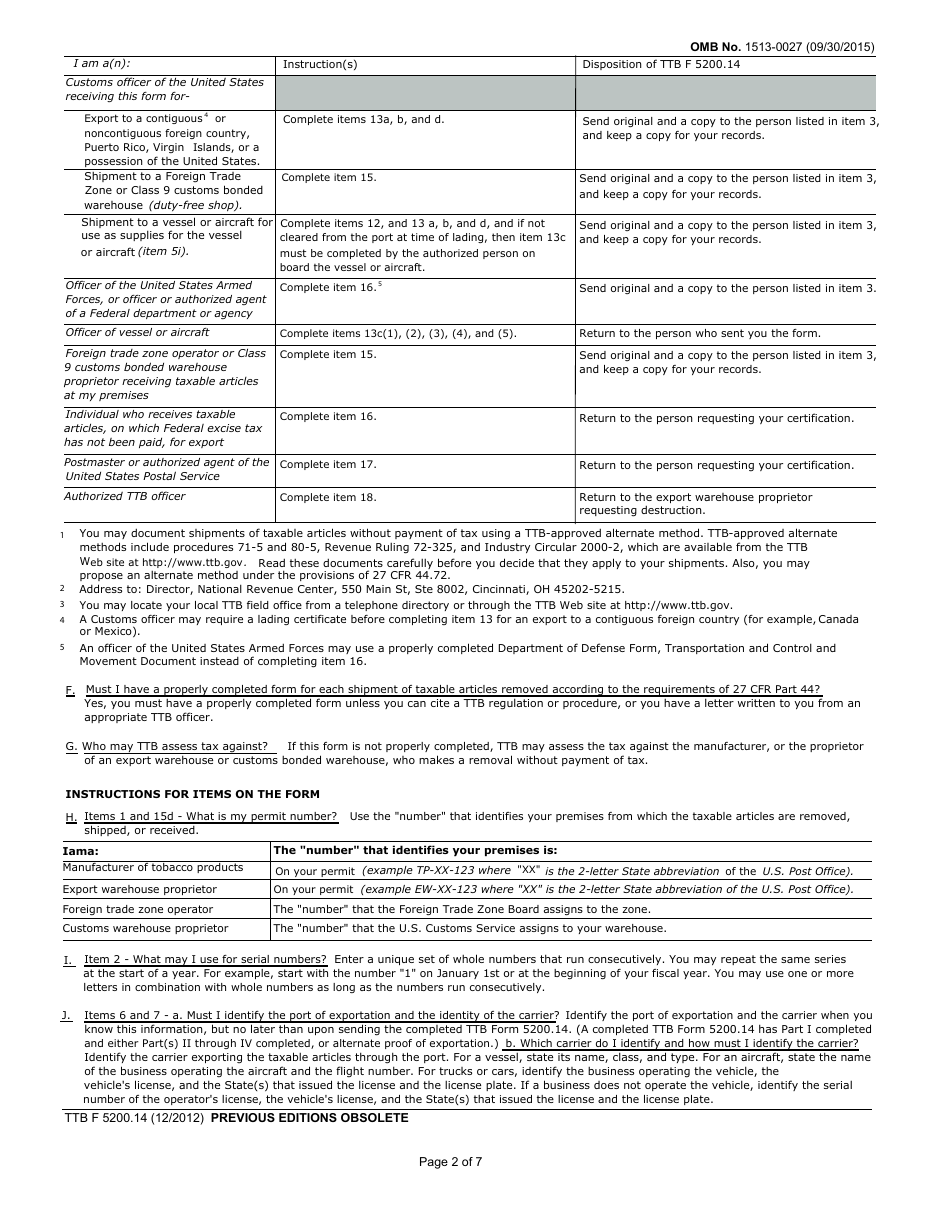

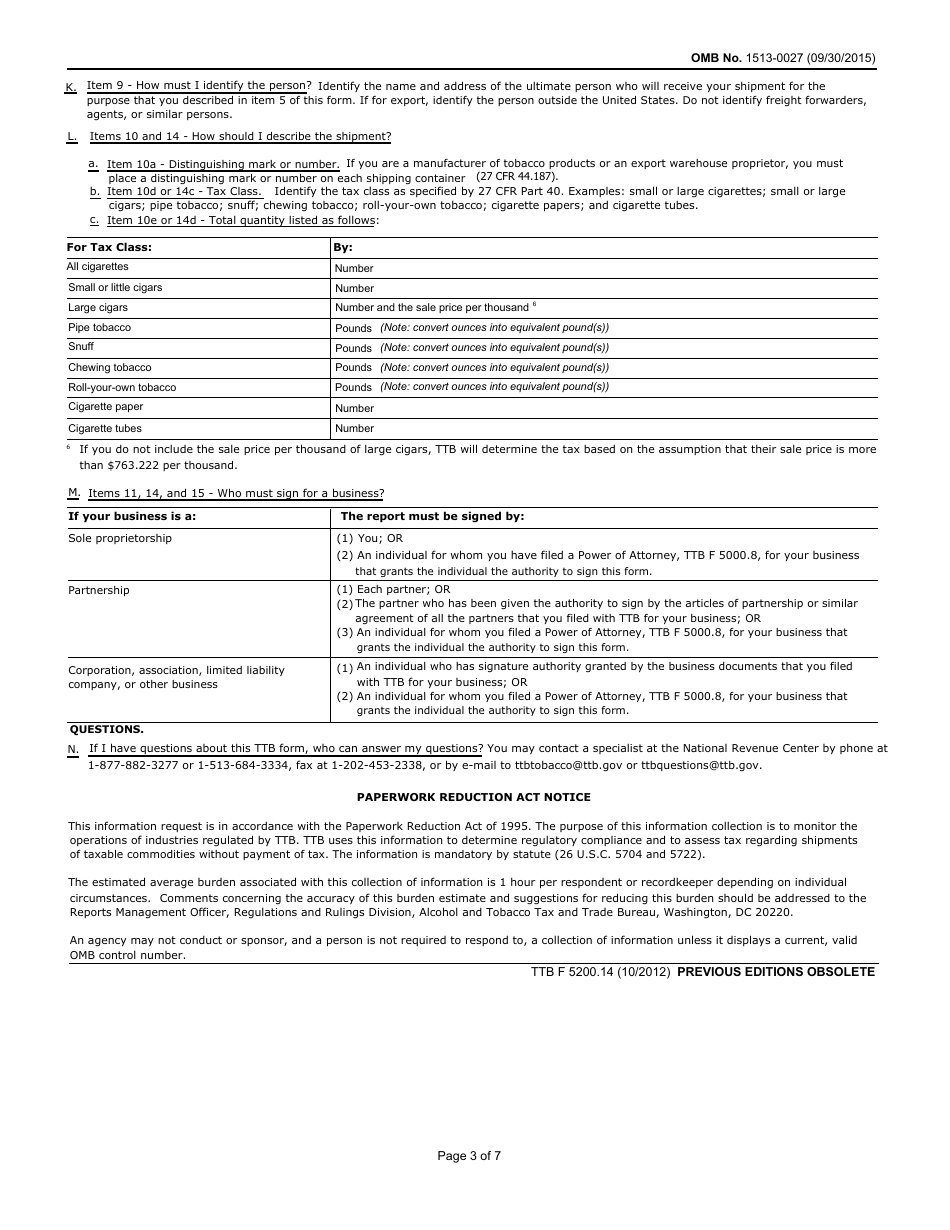

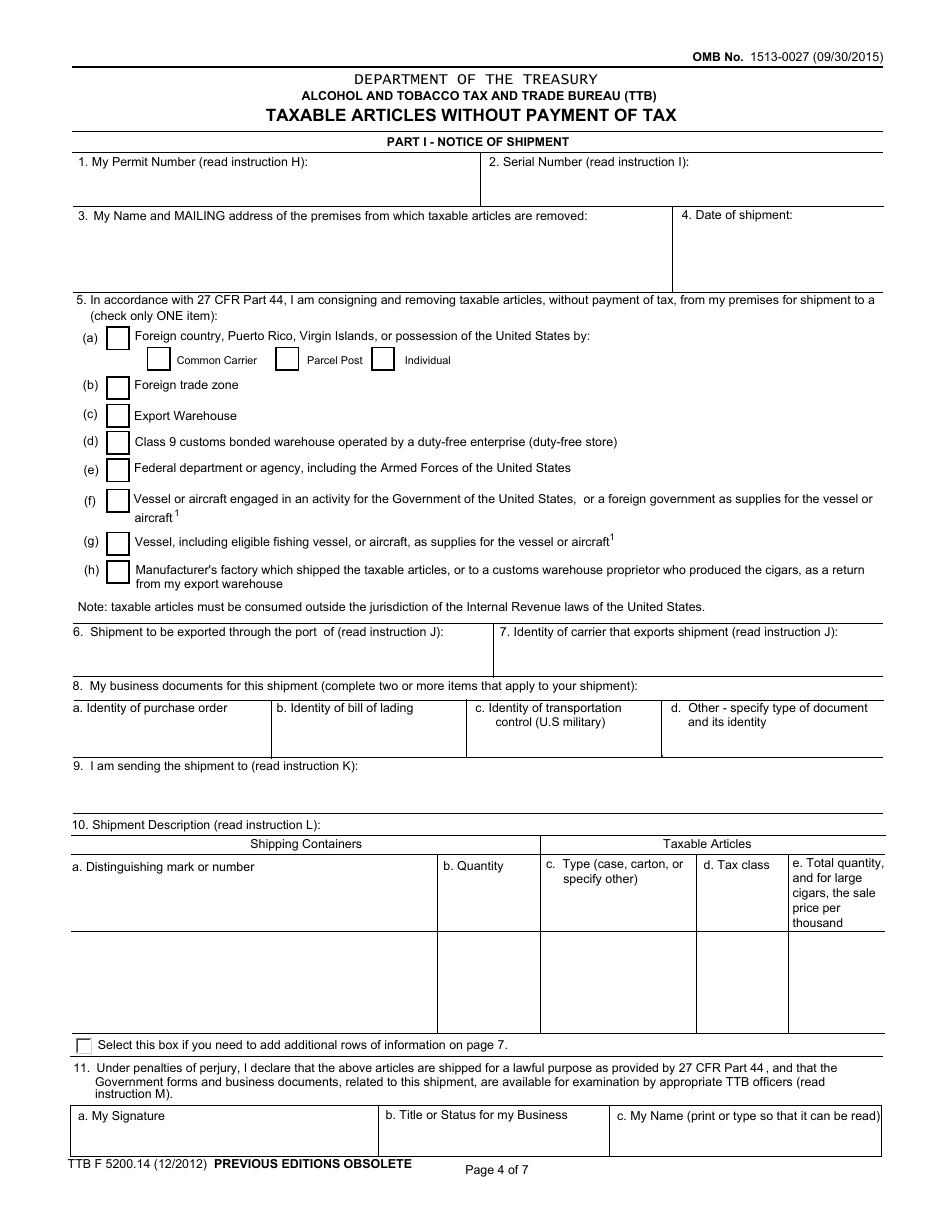

What Is TTB Form 5200.14?

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on December 1, 2012 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5200.14?

A: TTB Form 5200.14 is a tax form.

Q: What does TTB stand for?

A: TTB stands for Alcohol and Tobacco Tax and Trade Bureau.

Q: What is the purpose of TTB Form 5200.14?

A: The purpose of TTB Form 5200.14 is to report taxable articles that were not paid for.

Q: Who needs to fill out TTB Form 5200.14?

A: Businesses and individuals who have taxable articles that were not paid for must fill out this form.

Q: What are taxable articles?

A: Taxable articles refer to goods such as alcohol and tobacco that are subject to taxes.

Q: Why are taxable articles without payment of tax reported?

A: Reporting taxable articles without payment of tax is required by law to ensure compliance with tax regulations.

Q: How often is TTB Form 5200.14 submitted?

A: The frequency of submission varies depending on the reporting entity's schedule.

Q: Are there any penalties for not filing TTB Form 5200.14?

A: Yes, there may be penalties for not filing TTB Form 5200.14, including fines and other legal consequences.

Q: What should I do if I have questions about TTB Form 5200.14?

A: If you have questions about TTB Form 5200.14, you should contact the Alcohol and Tobacco Tax and Trade Bureau for assistance.

Form Details:

- Released on December 1, 2012;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5200.14 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.