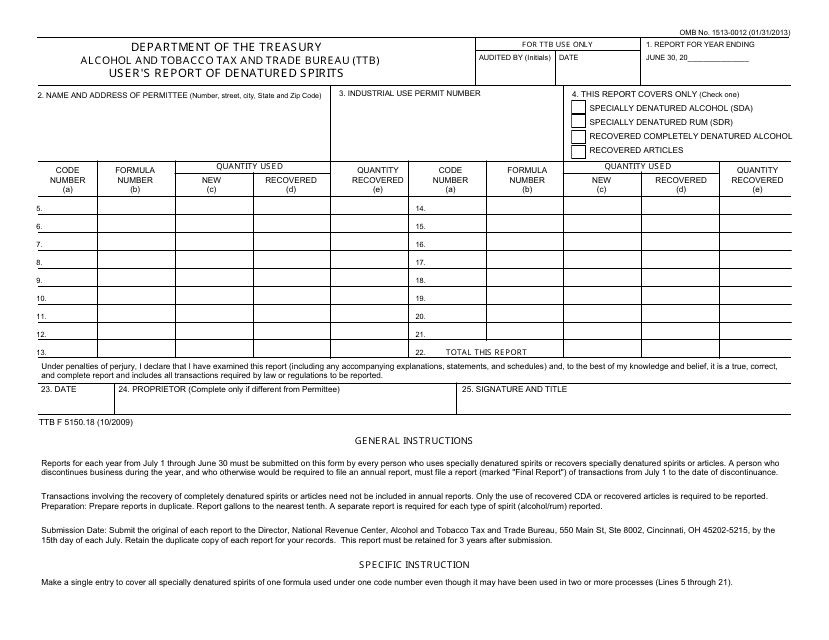

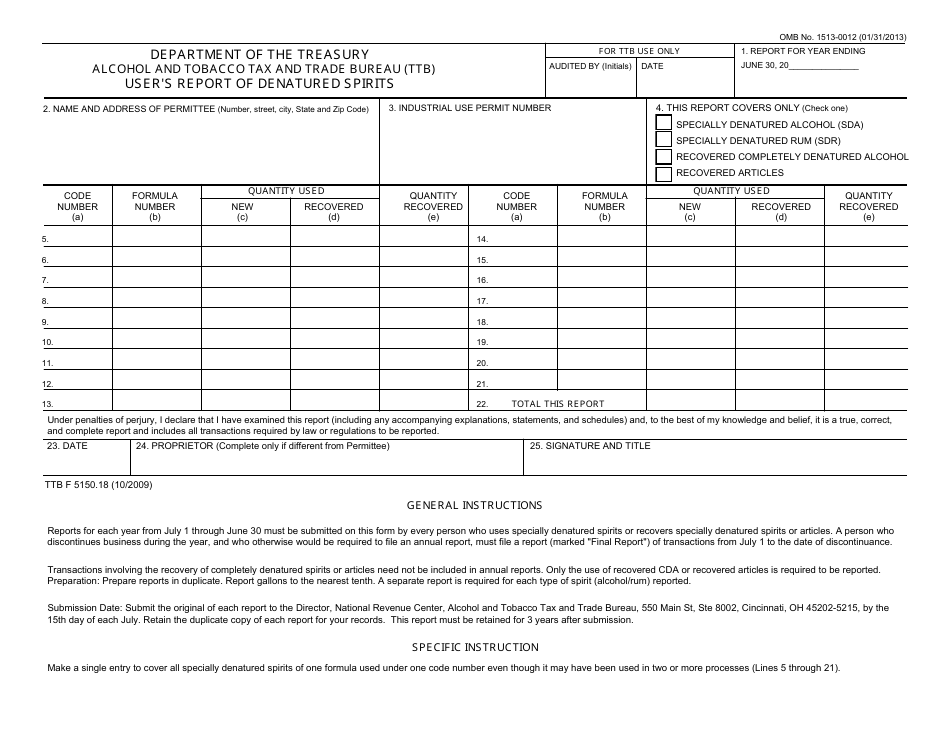

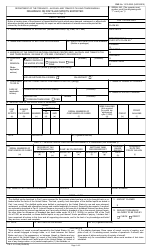

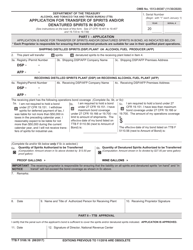

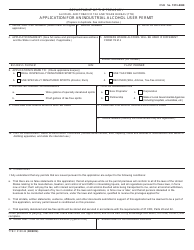

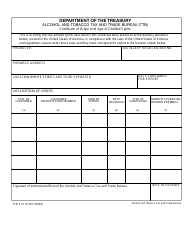

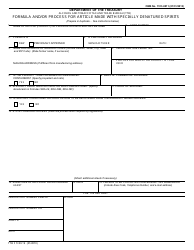

TTB Form 5150.18 User's Report of Denatured Spirits

What Is TTB Form 5150.18?

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on October 1, 2009 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5150.18?

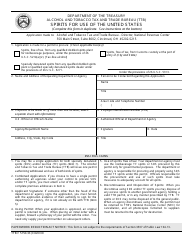

A: TTB Form 5150.18 is a User's Report of Denatured Spirits.

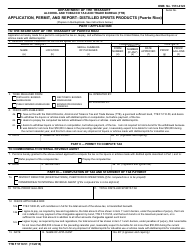

Q: What is the purpose of TTB Form 5150.18?

A: The purpose of TTB Form 5150.18 is to report the use of denatured spirits.

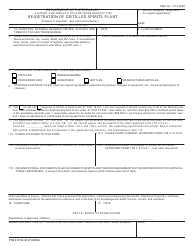

Q: Who needs to file TTB Form 5150.18?

A: Businesses and individuals who use denatured spirits need to file TTB Form 5150.18.

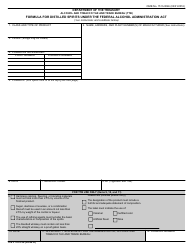

Q: What is a denatured spirit?

A: A denatured spirit is an alcohol that has been treated with substances to make it unfit for human consumption.

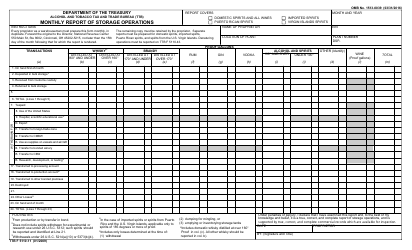

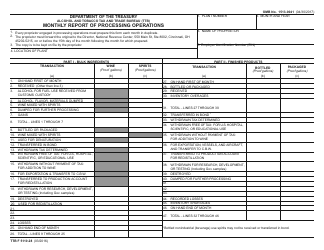

Q: What information is required on TTB Form 5150.18?

A: The form requires information such as the type and quantity of denatured spirits used, the purpose of use, and the name and address of the user.

Q: How often do I need to file TTB Form 5150.18?

A: The form needs to be filed quarterly, within 15 days after the end of each calendar quarter.

Q: Are there any penalties for not filing TTB Form 5150.18?

A: Yes, failure to file the form or filing false information can result in penalties and legal consequences.

Form Details:

- Released on October 1, 2009;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5150.18 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.