This version of the form is not currently in use and is provided for reference only. Download this version of

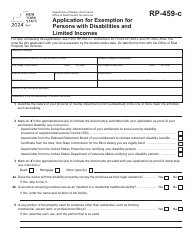

Form RP-459-C-RNW

for the current year.

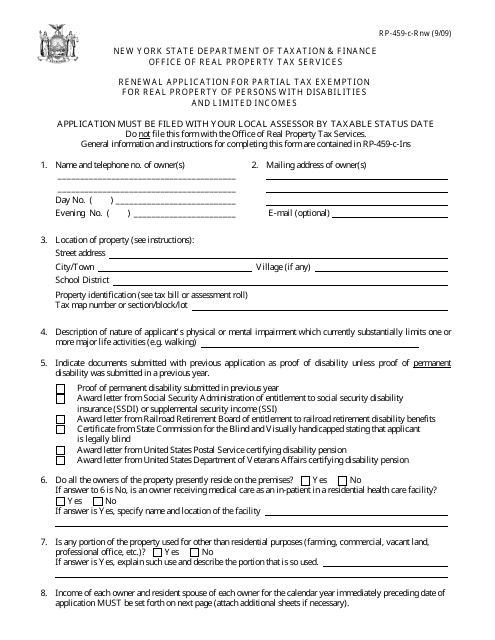

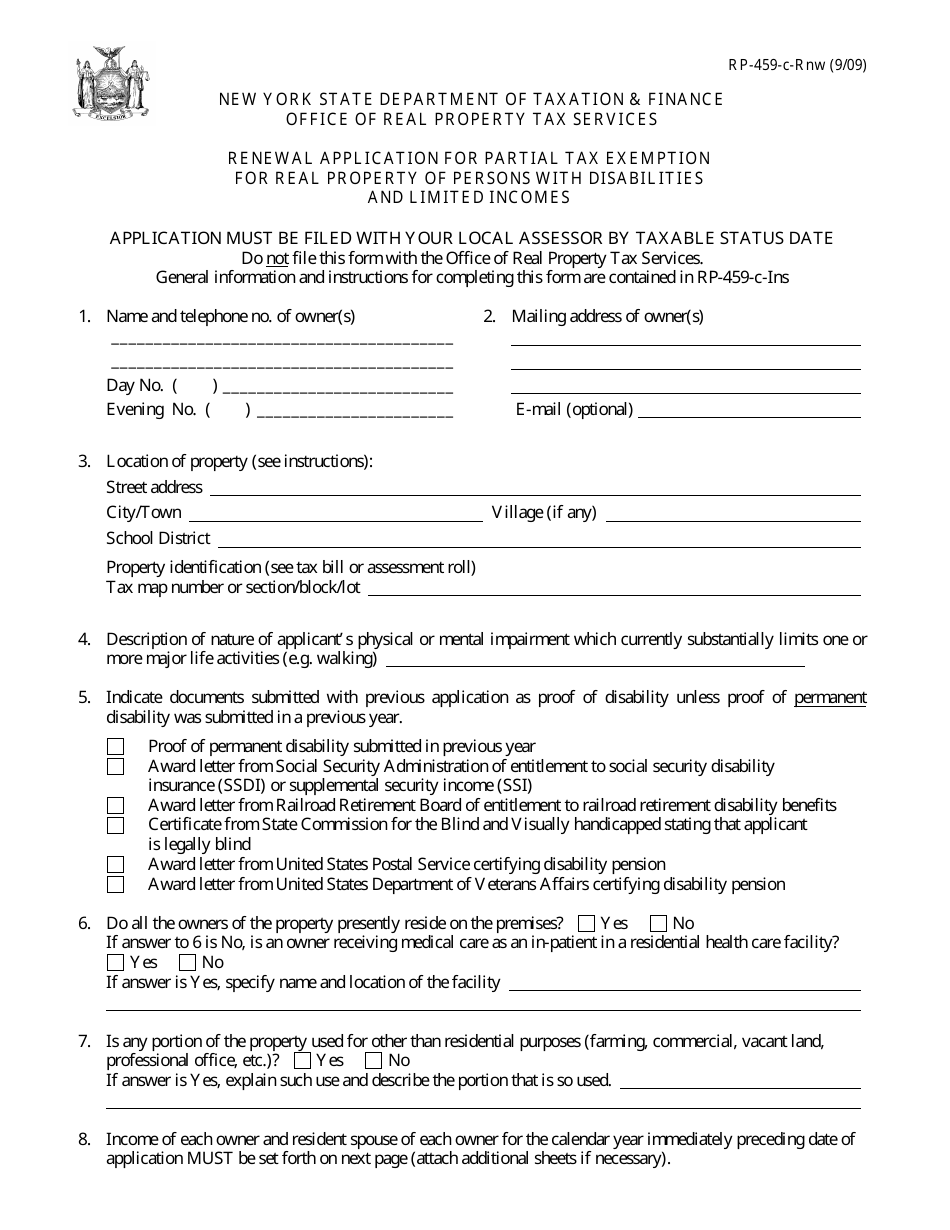

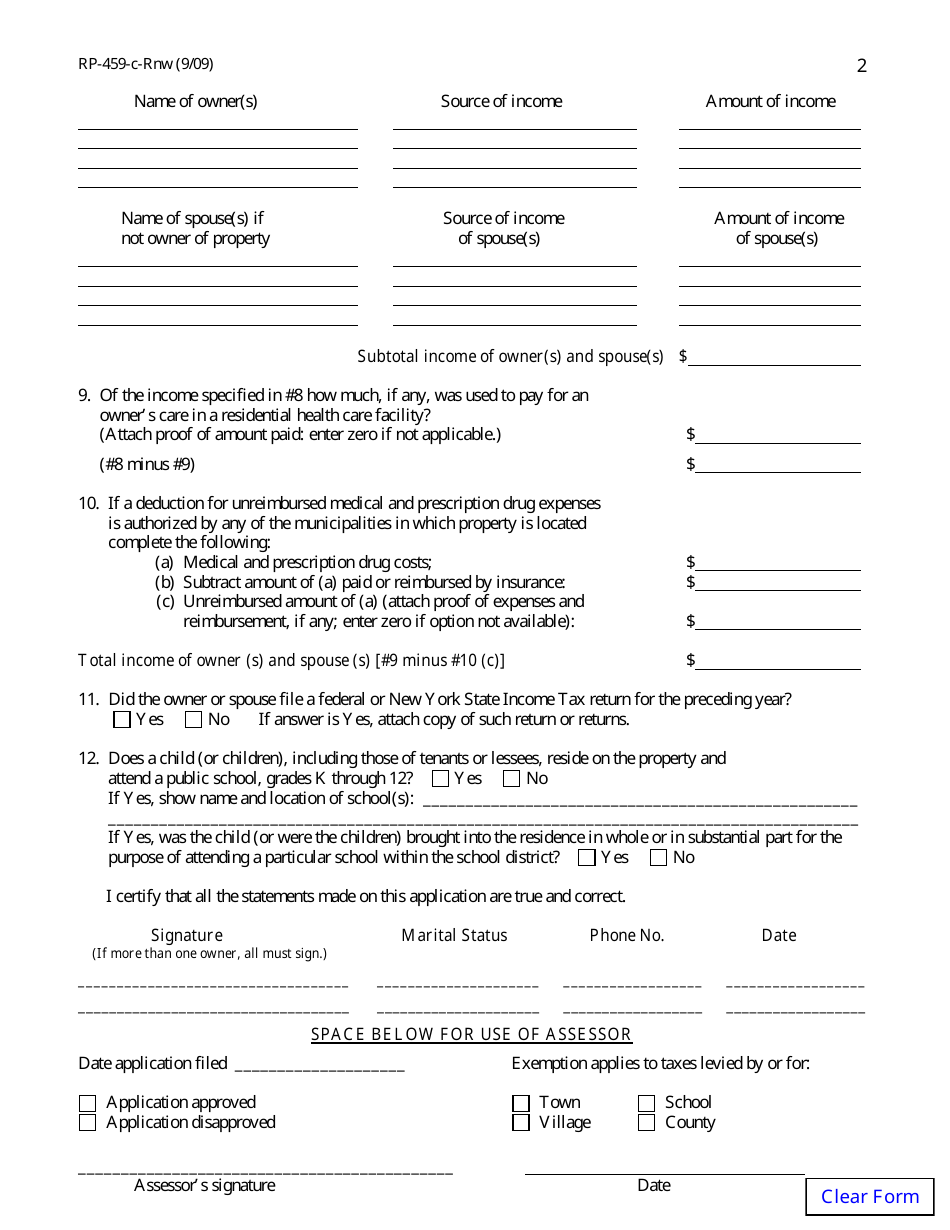

Form RP-459-C-RNW Renewal Application for Partial Tax Exemption for Real Property of Persons With Disabilities and Limited Incomes - New York

What Is Form RP-459-C-RNW?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-459-C-RNW?

A: Form RP-459-C-RNW is the Renewal Application for Partial Tax Exemption for Real Property of Persons With Disabilities and Limited Incomes in New York.

Q: Who is eligible for this tax exemption?

A: Persons with disabilities and limited incomes are eligible for this tax exemption.

Q: What is the purpose of this form?

A: The purpose of this form is to renew the application for partial tax exemption on real property for individuals with disabilities and limited incomes.

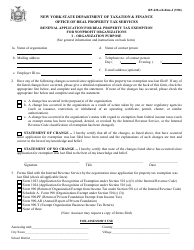

Q: Is there a deadline to submit this form?

A: Yes, the renewal application must be submitted by the specified deadline each year.

Q: What documents do I need to submit along with the form?

A: You may need to submit proof of income, disability status, and ownership of the property.

Q: How long does the tax exemption last?

A: The tax exemption is usually granted for a specified period of time, but it must be renewed periodically.

Q: What happens if I do not renew the tax exemption?

A: If you do not renew the tax exemption, you may lose the partial tax exemption on your real property.

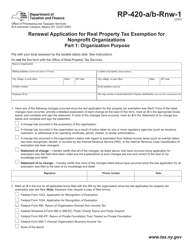

Q: Can I apply for this tax exemption if I have a high income?

A: No, this tax exemption is specifically for individuals with limited incomes.

Q: Are there any other tax benefits available for persons with disabilities in New York?

A: Yes, there may be other tax benefits available, such as the Enhanced STAR exemption or the Disabled or Non-disabled Homeowners Exemption.

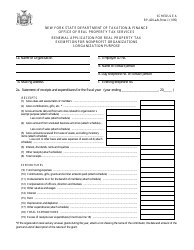

Form Details:

- Released on September 1, 2009;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-459-C-RNW by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.