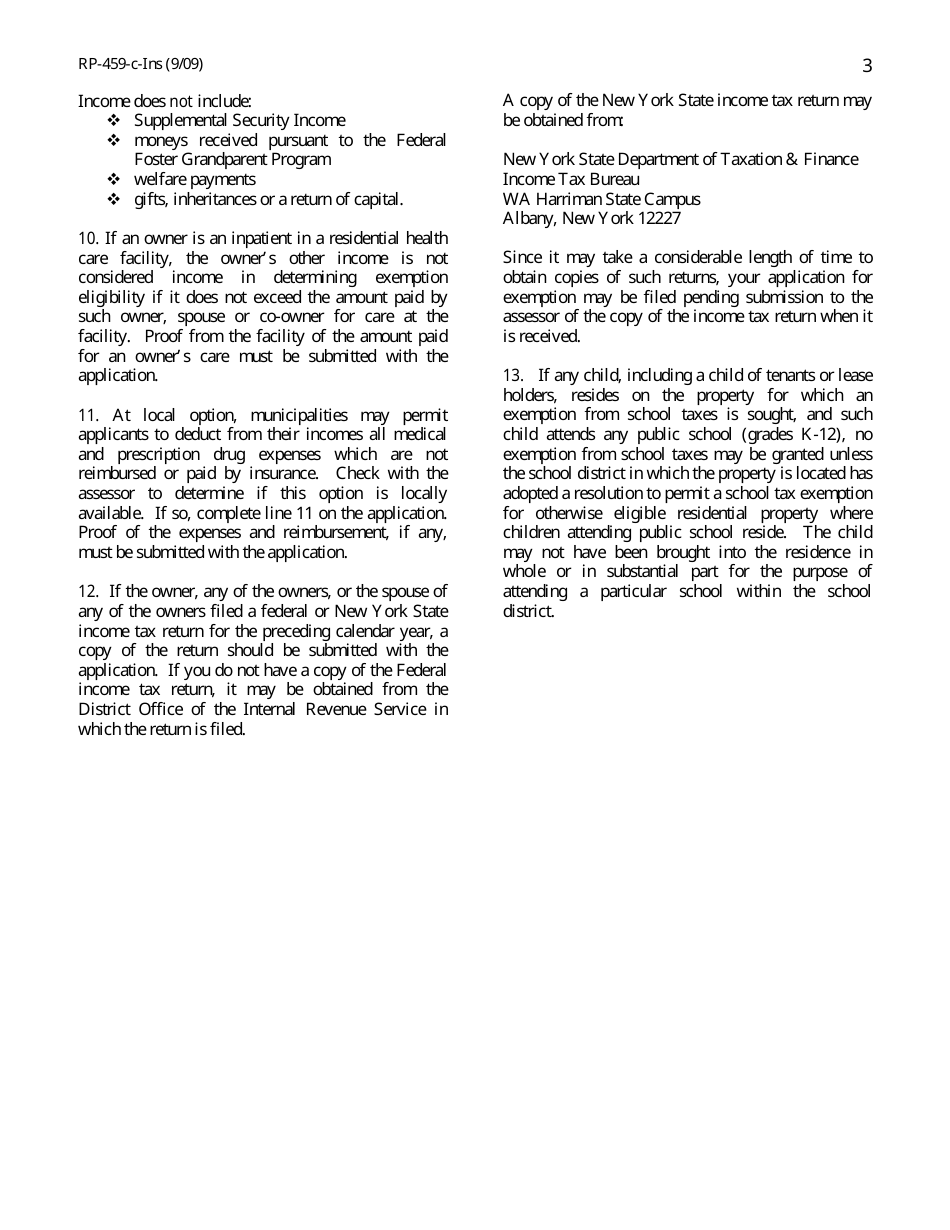

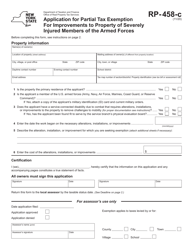

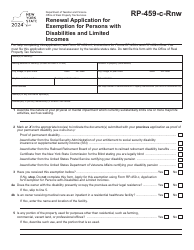

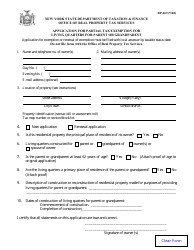

Instructions for Form RP-459-C Partial Property Tax Exemption for Persons With Disabilities and Limited Incomes With Disabilities and Limited Incomes - New York

This document contains official instructions for Form RP-459-C , Partial Property Tax Exemption for Persons With Disabilities and Limited Incomes With Disabilities and Limited Incomes - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form RP-459-C is available for download through this link.

FAQ

Q: What is Form RP-459-C?

A: Form RP-459-C is a form for applying for partial property tax exemption for persons with disabilities and limited incomes in New York.

Q: Who is eligible for this exemption?

A: Persons with disabilities and limited incomes are eligible for this exemption.

Q: What is the purpose of this exemption?

A: The purpose of this exemption is to provide relief to individuals with disabilities who have limited incomes and may struggle to pay their property taxes.

Q: How can I apply for this exemption?

A: You can apply for this exemption by filling out and submitting Form RP-459-C to the appropriate government agency.

Q: What documents do I need to submit with the application?

A: You may need to submit proof of disability, income documentation, and other relevant documents with your application.

Q: Is there an income limit for this exemption?

A: Yes, there is an income limit for this exemption. The specific income limit may vary depending on your location.

Q: Is there a deadline for submitting the application?

A: Yes, there is a deadline for submitting the application. The specific deadline may vary depending on your location. It is important to submit the application before the deadline to be considered for the exemption.

Q: What happens after I submit the application?

A: After you submit the application, it will be reviewed by the appropriate government agency. If you meet the eligibility criteria, you will be granted the partial property tax exemption.

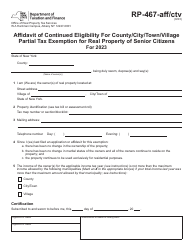

Q: Do I need to renew the exemption every year?

A: Yes, in most cases, you will need to renew the exemption every year. This ensures that your eligibility and circumstances are still valid.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.