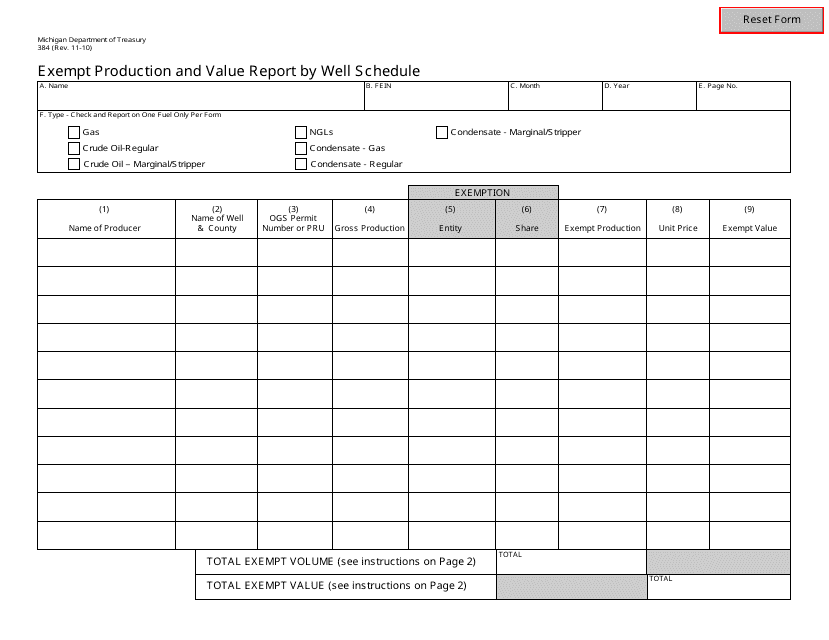

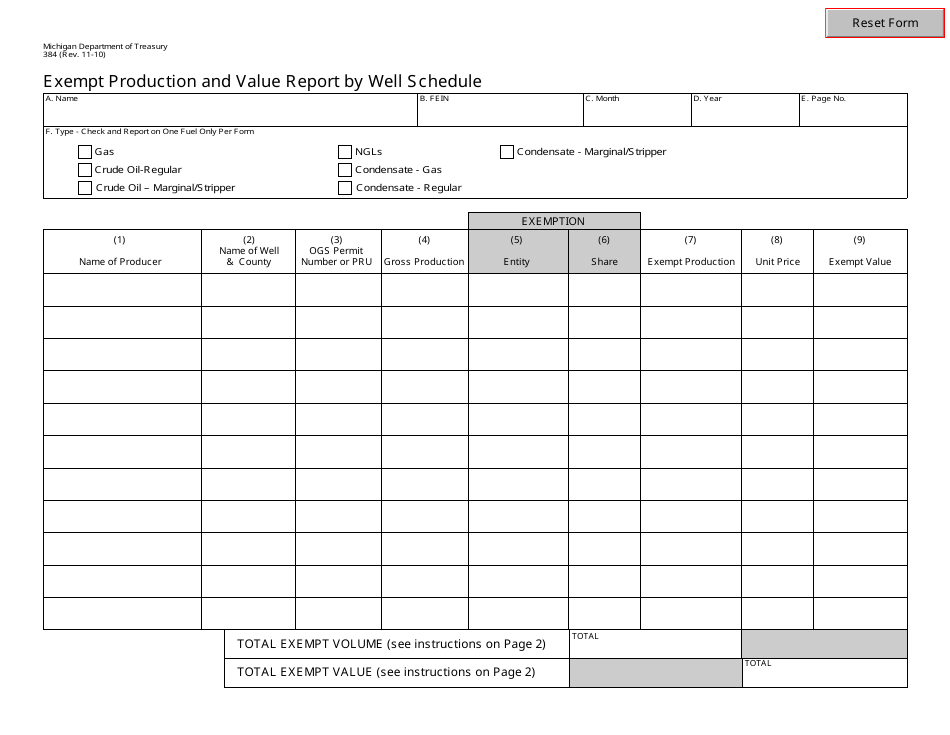

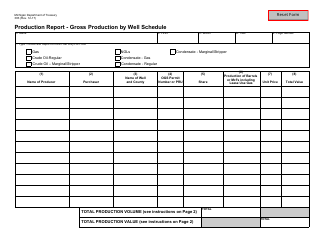

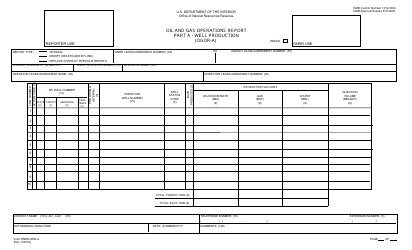

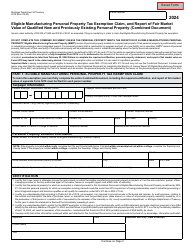

Form 384 Exempt Production and Value Report by Well Schedule - Michigan

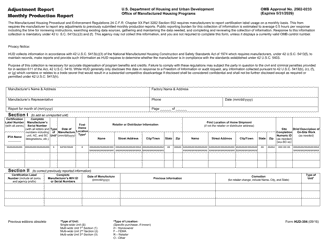

What Is Form 384?

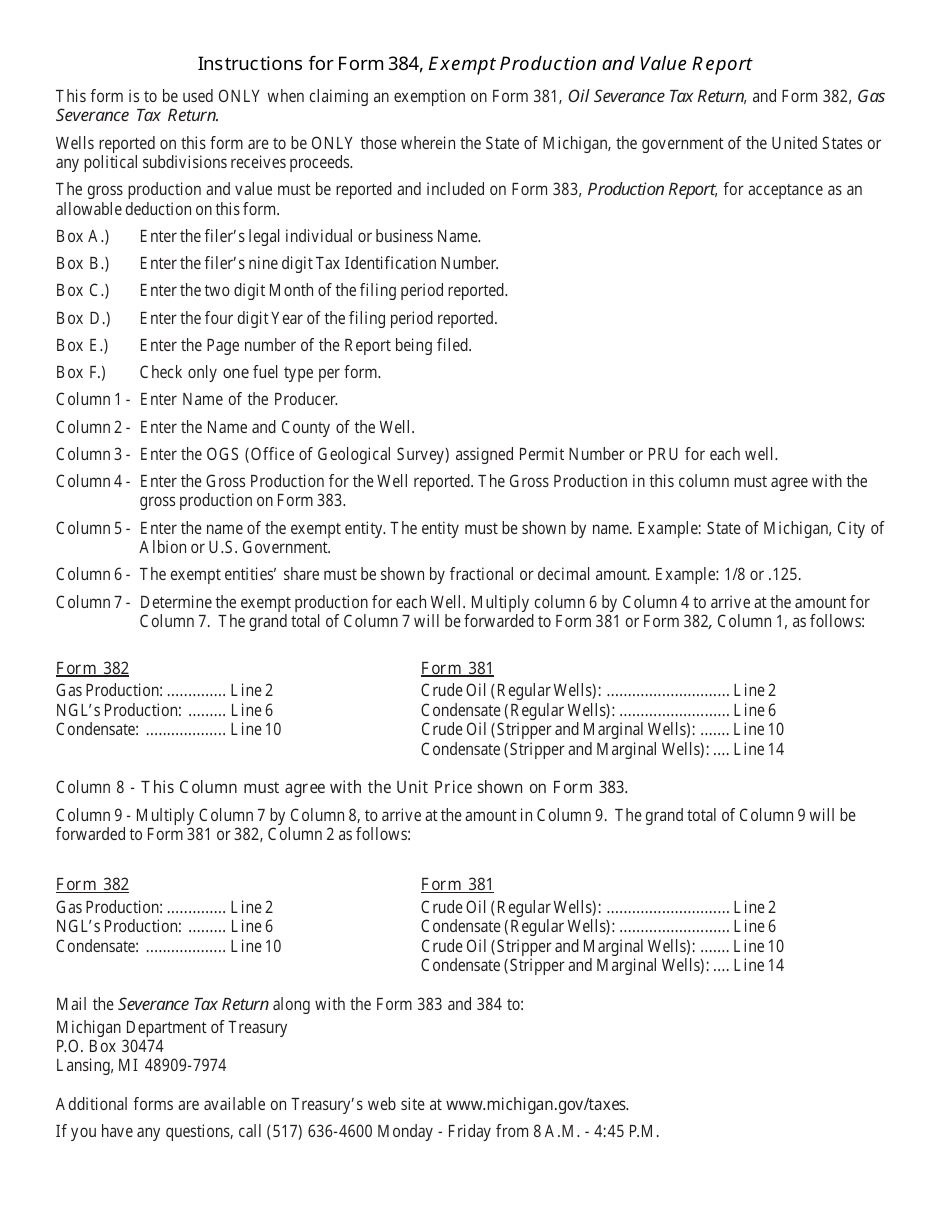

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form 384?

A: Form 384 is a document used in Michigan for reporting exempt production and value by well schedule.

Q: Who is required to file Form 384?

A: Operators of oil and gas wells in Michigan are required to file Form 384.

Q: What information is reported on Form 384?

A: Form 384 reports exempt production and value of oil and gas wells by well schedule in Michigan.

Q: What is exempt production?

A: Exempt production refers to the volume of oil and gas production that is not subject to certain taxes or royalties.

Q: Why is Form 384 important?

A: Form 384 is important for monitoring and assessing the production and value of oil and gas wells in Michigan.

Form Details:

- Released on November 1, 2010;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 384 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.