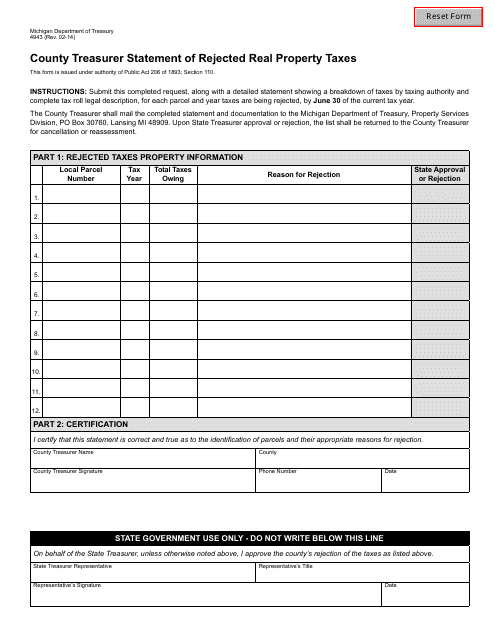

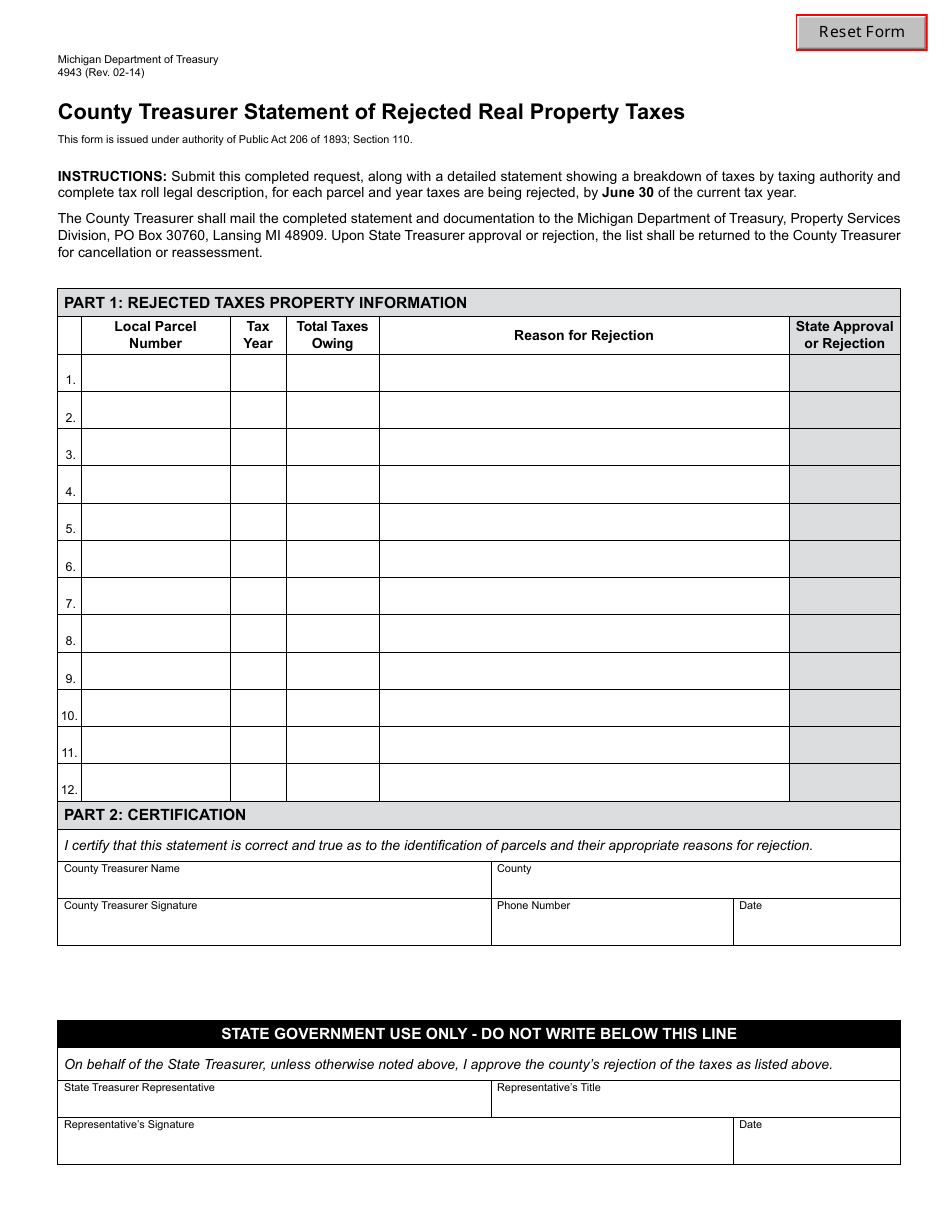

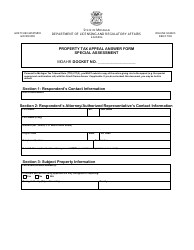

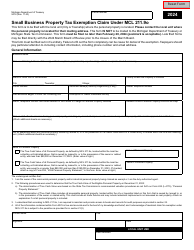

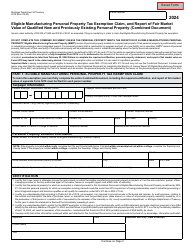

Form 4943 County Treasurer Statement of Rejected Real Property Taxes - Michigan

What Is Form 4943?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4943?

A: Form 4943 is the County Treasurer Statement of Rejected Real Property Taxes in Michigan.

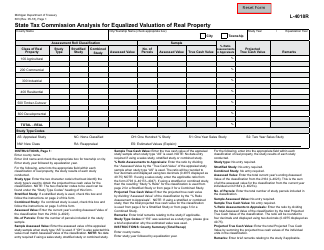

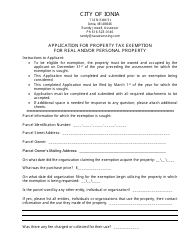

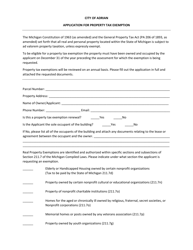

Q: What does Form 4943 entail?

A: Form 4943 is used by the county treasurer to report and document the details of rejected real property taxes in Michigan.

Q: Why are real property taxes rejected?

A: Real property taxes can be rejected for various reasons, such as errors in assessment, delinquency, or appeals.

Q: Who needs to file Form 4943?

A: County treasurers in Michigan are responsible for filing Form 4943 to report rejected real property taxes.

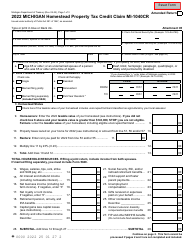

Form Details:

- Released on February 1, 2014;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4943 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.