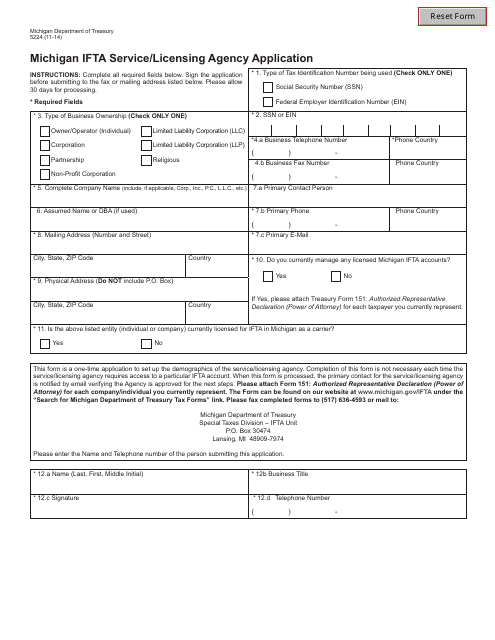

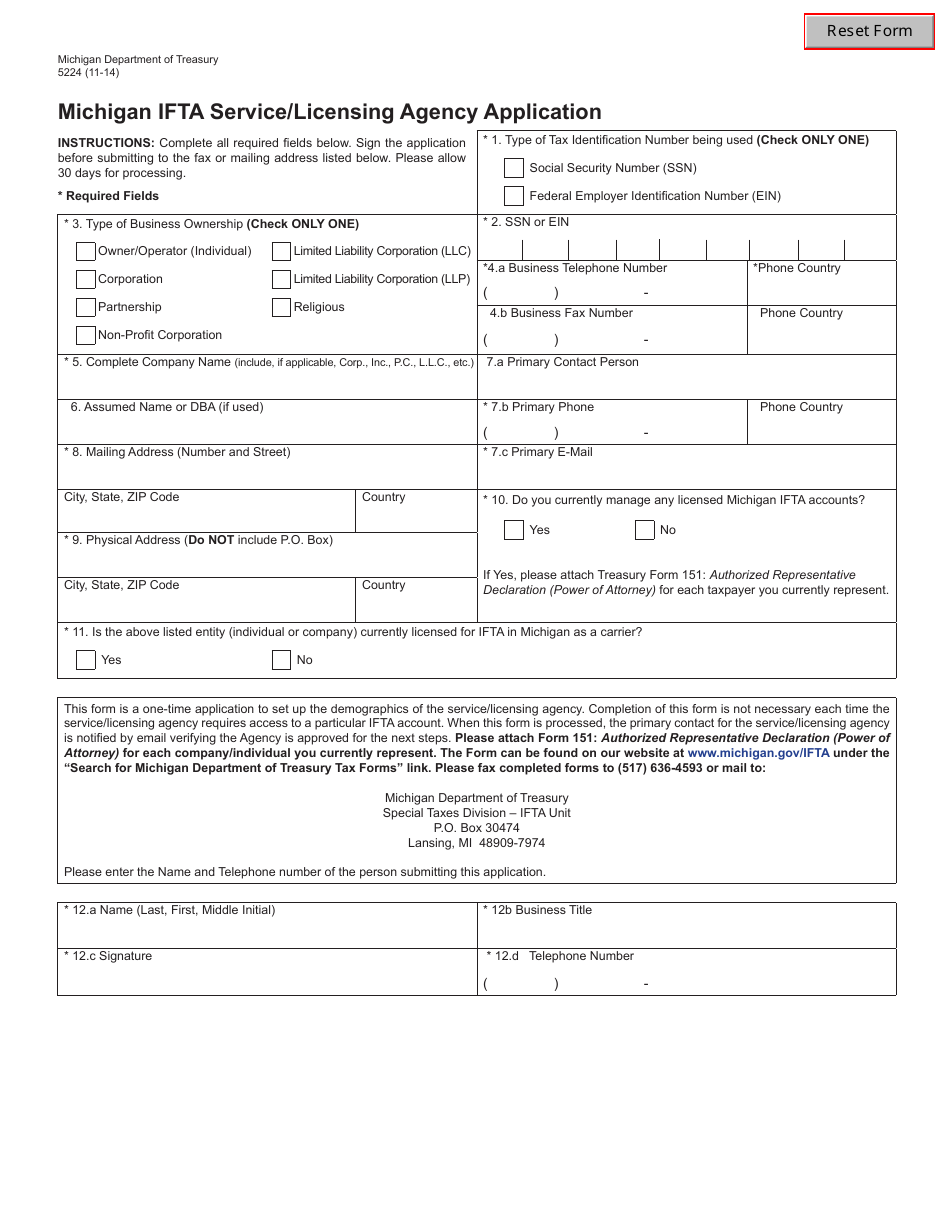

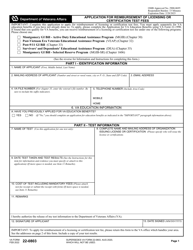

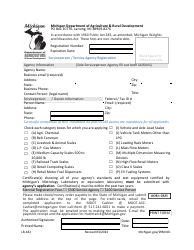

Form 5224 Michigan Ifta Service / Licensing Agency Application - Michigan

What Is Form 5224?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5224?

A: Form 5224 is the Michigan Ifta Service/Licensing Agency Application.

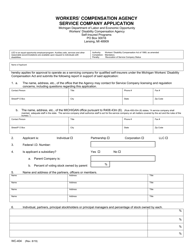

Q: What is IFTA?

A: IFTA stands for International Fuel Tax Agreement. It is an agreement between the 48 contiguous states of the United States and 10 Canadian provinces that simplifies the reporting of fuel use taxes.

Q: What is the purpose of Form 5224?

A: The purpose of Form 5224 is to apply for IFTA service and licensing in the state of Michigan.

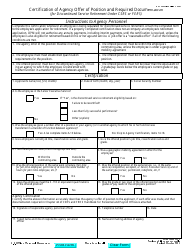

Q: Who needs to file Form 5224?

A: Motor carriers operating qualified motor vehicles across state lines and Canadian provinces need to file Form 5224.

Q: What information is required on Form 5224?

A: Form 5224 requires information such as the applicant's name, contact information, vehicle details, and other relevant information.

Q: What is the deadline for filing Form 5224?

A: Form 5224 must be filed before the first day of operations in order to obtain proper credentials.

Q: Are there any fees associated with filing Form 5224?

A: Yes, there are fees associated with filing Form 5224. The fees vary depending on the number of qualified motor vehicles.

Form Details:

- Released on November 1, 2014;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5224 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.