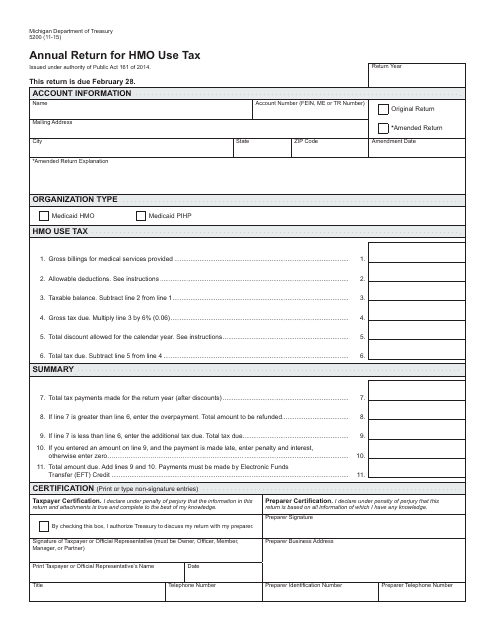

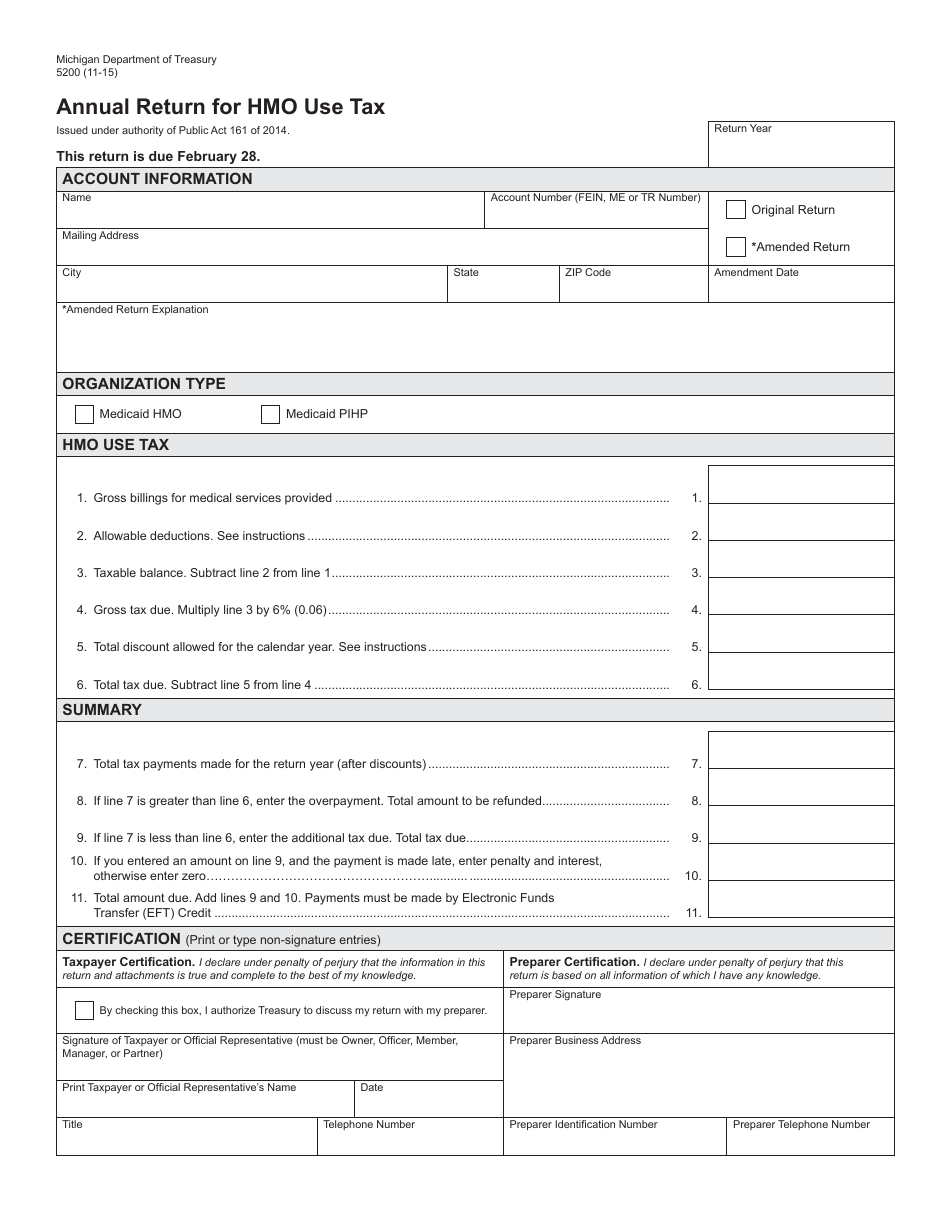

Form 5200 Annual Return for HMO Use Tax - Michigan

What Is Form 5200?

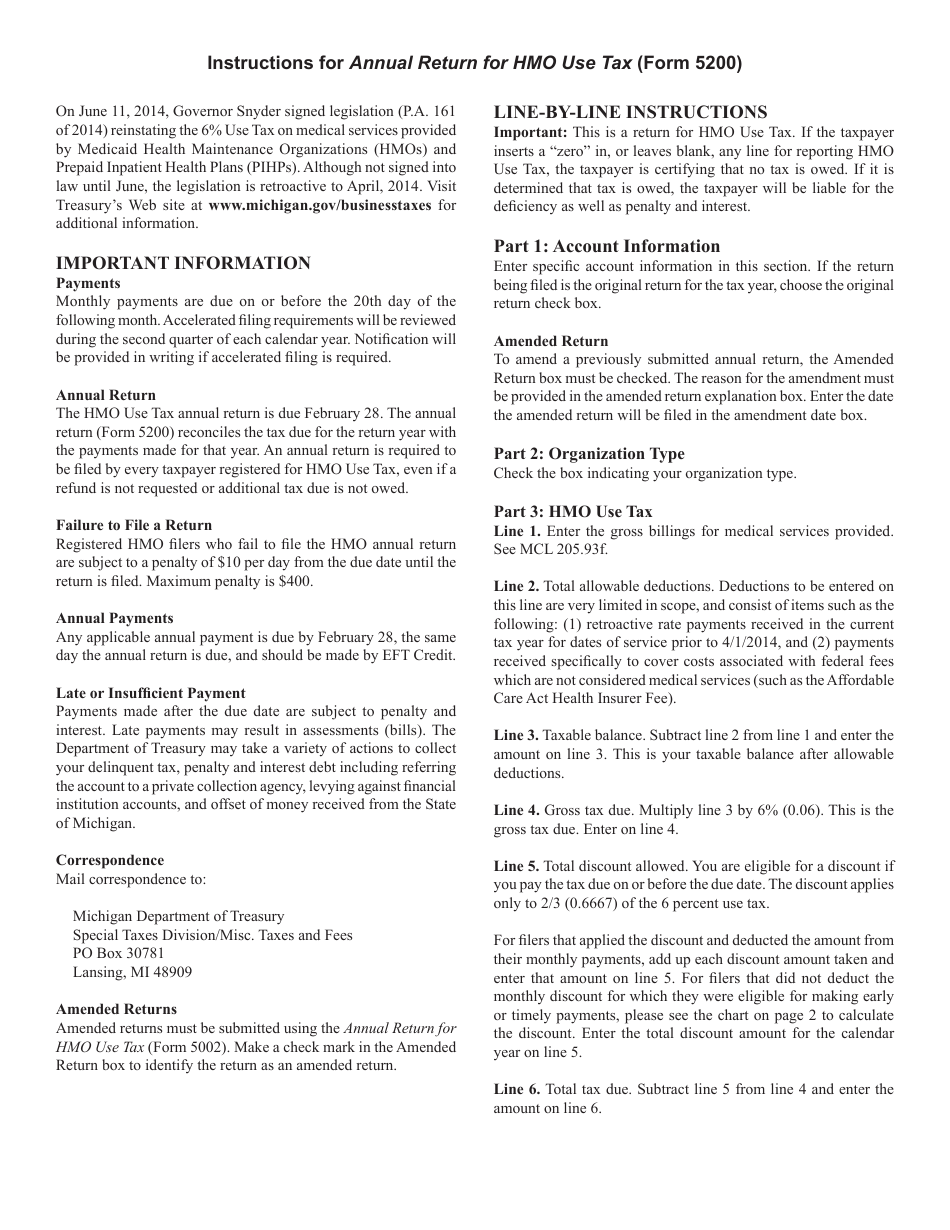

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5200?

A: Form 5200 is the Annual Return for HMO Use Tax.

Q: Who needs to file Form 5200?

A: HMOs (Health Maintenance Organizations) in Michigan need to file Form 5200.

Q: What is the purpose of Form 5200?

A: Form 5200 is used to report and pay the use tax on the services purchased or obtained by the HMO.

Q: When is Form 5200 due?

A: Form 5200 is due on or before February 28th of the year following the calendar year being reported.

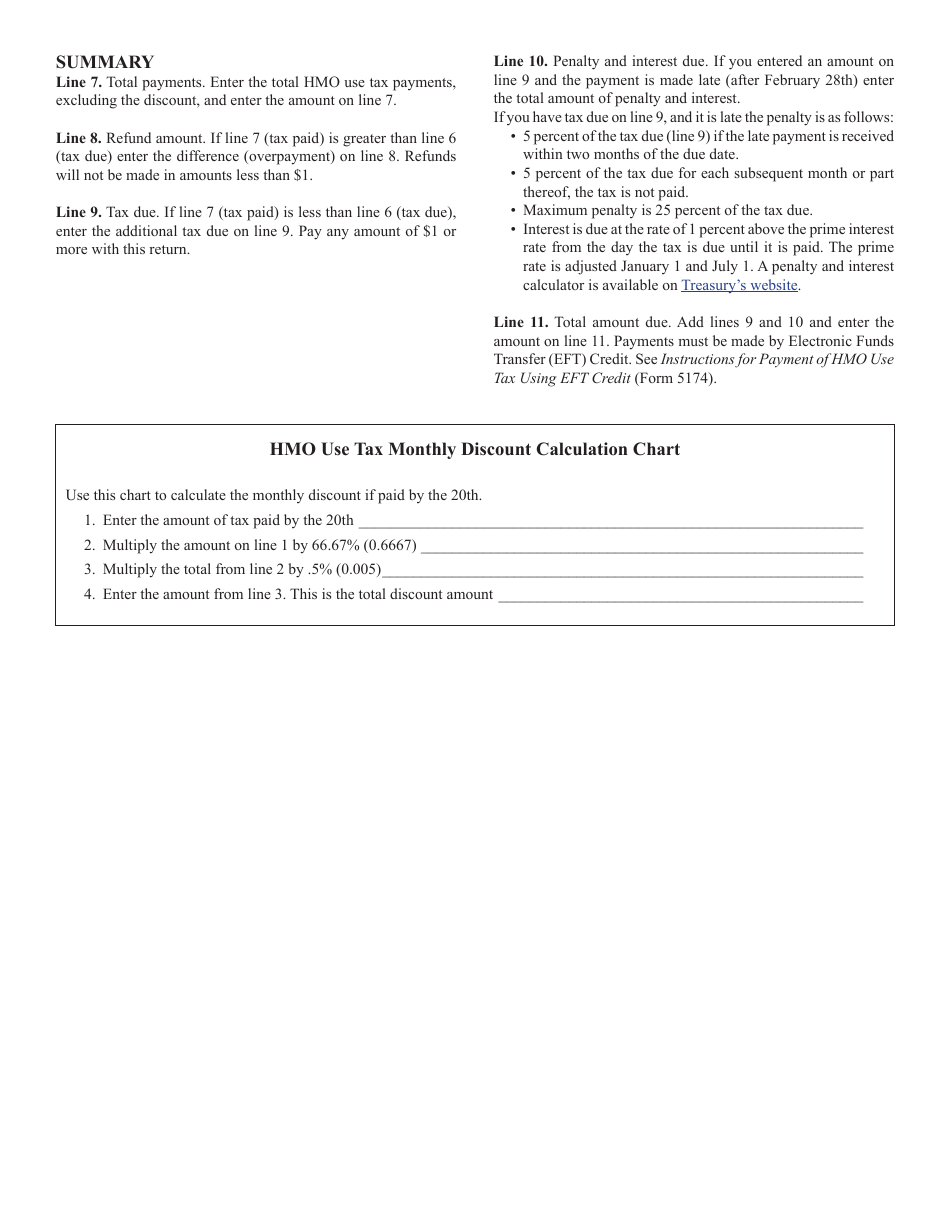

Q: Are there any penalties for late filing of Form 5200?

A: Yes, there are penalties for late filing of Form 5200. It is important to file the form on time to avoid penalties.

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5200 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.