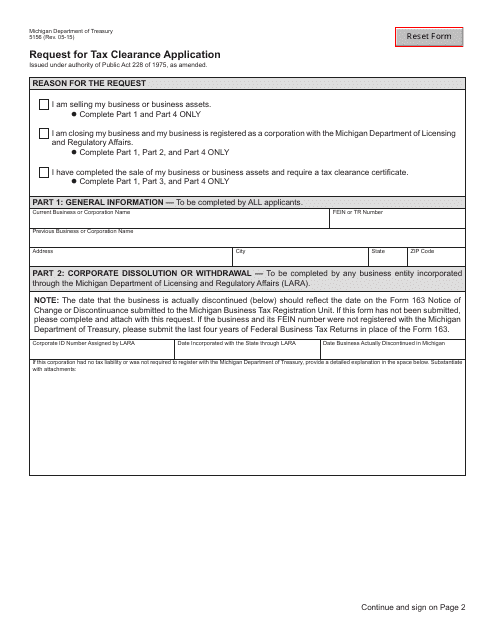

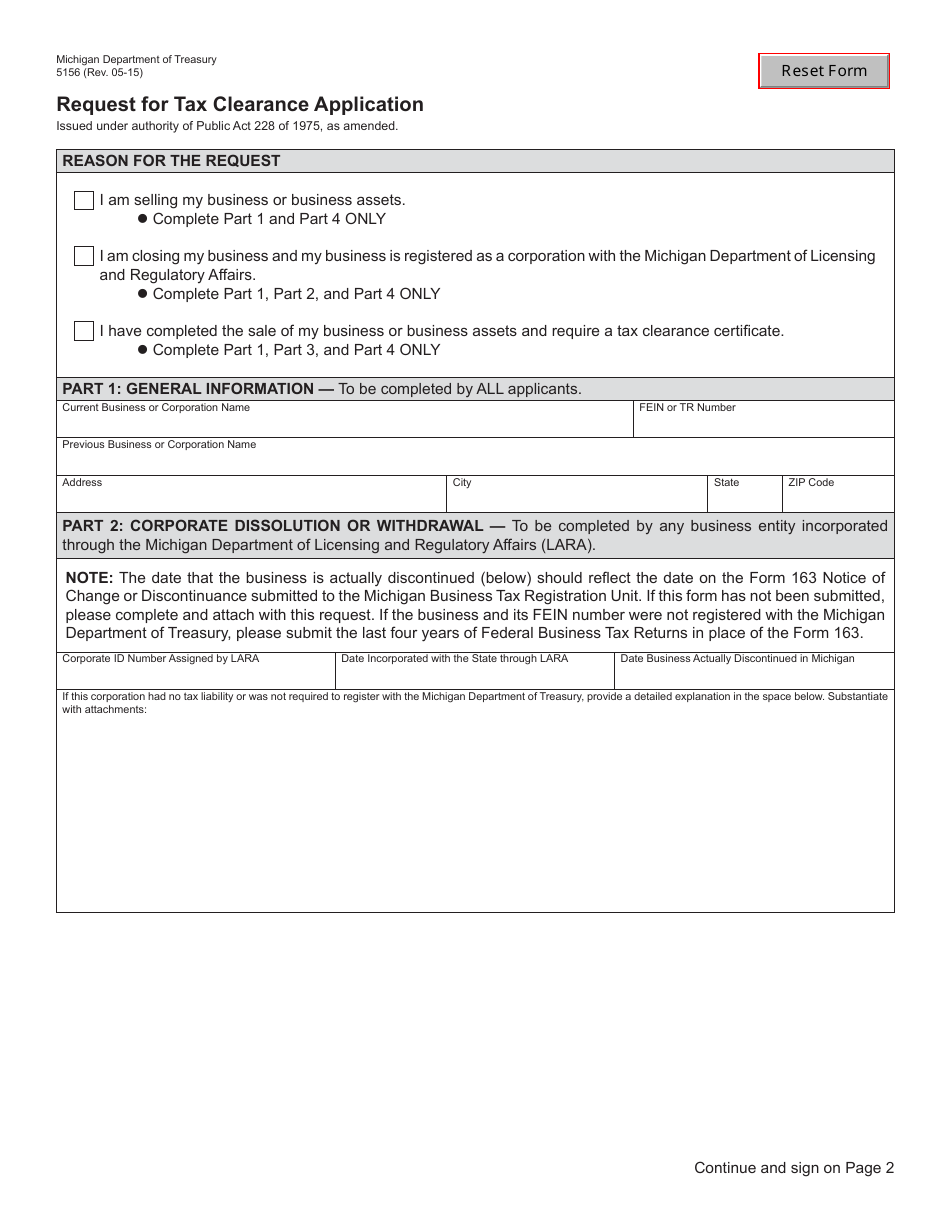

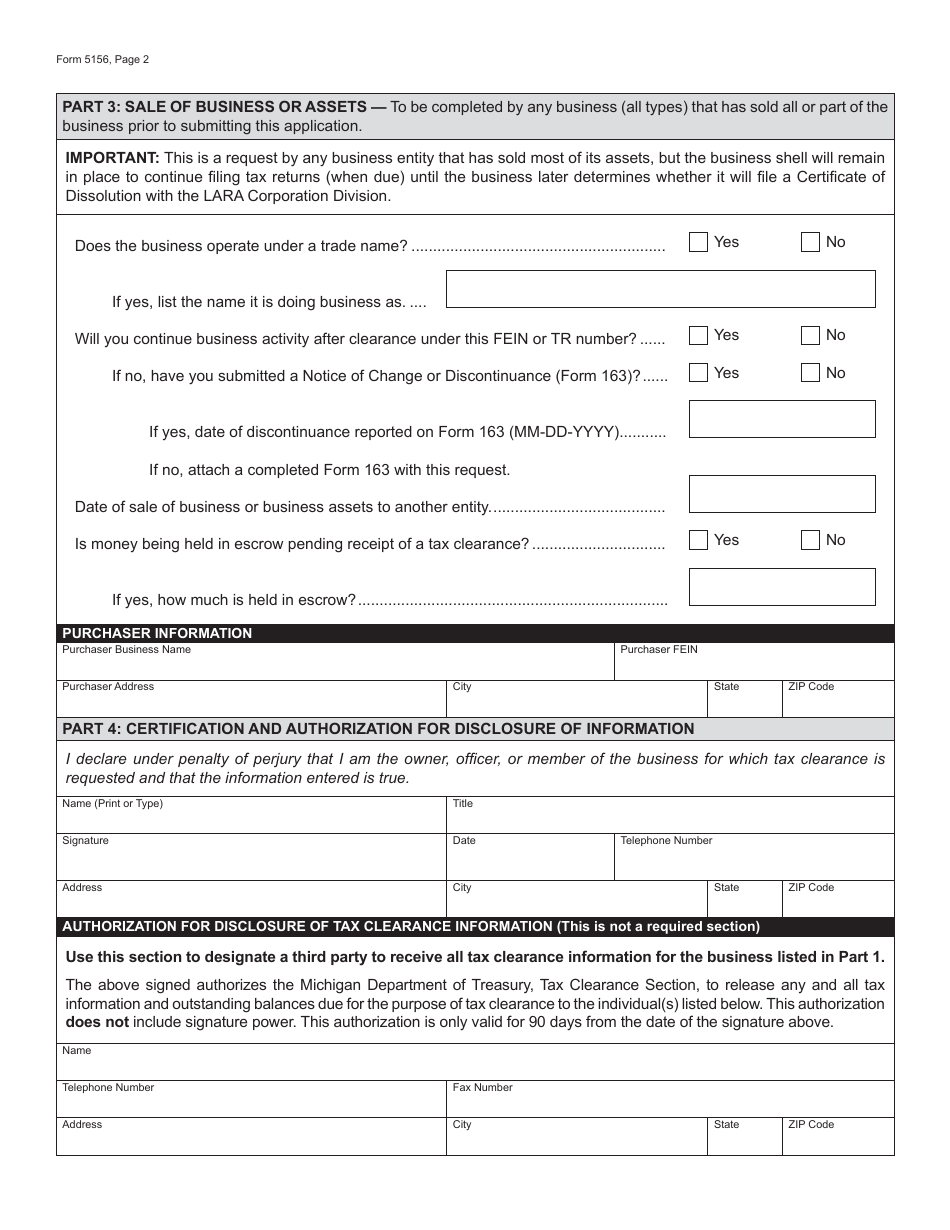

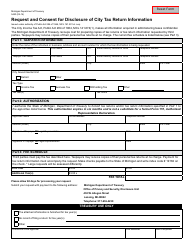

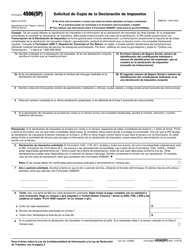

Form 5156 Request for Tax Clearance Application - Michigan

What Is Form 5156?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5156?

A: Form 5156 is the Request for Tax Clearance Application in Michigan. It is used to obtain a tax clearance certificate for various purposes.

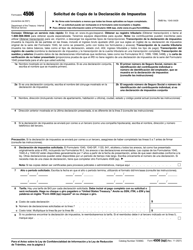

Q: What is a tax clearance certificate?

A: A tax clearance certificate is a document issued by the state of Michigan that confirms an individual or business has paid all their taxes and is clear of any outstanding debts.

Q: Why would I need a tax clearance certificate?

A: You may need a tax clearance certificate for various reasons, such as obtaining a professional license, bidding on contracts, or transferring business assets.

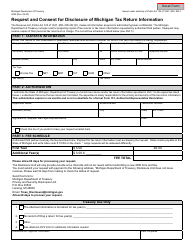

Q: What information is required on Form 5156?

A: Form 5156 requires information such as the taxpayer's name, address, tax identification number, and a description of the purpose for which the tax clearance is requested.

Q: Are there any fees associated with Form 5156?

A: There is no fee required to submit Form 5156 for tax clearance application in Michigan.

Q: How long does it take to process Form 5156?

A: The processing time for Form 5156 can vary, but it generally takes a few weeks to receive a tax clearance certificate.

Q: Can I mail Form 5156?

A: Yes, you can mail Form 5156 to the Michigan Department of Treasury at the address provided on the form.

Q: What should I do if I have additional questions about Form 5156?

A: If you have additional questions about Form 5156 or the tax clearance application process, you can contact the Michigan Department of Treasury for assistance.

Form Details:

- Released on May 1, 2015;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5156 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.