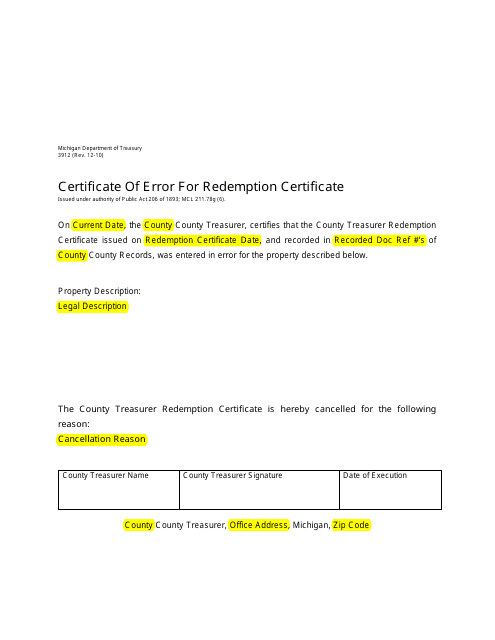

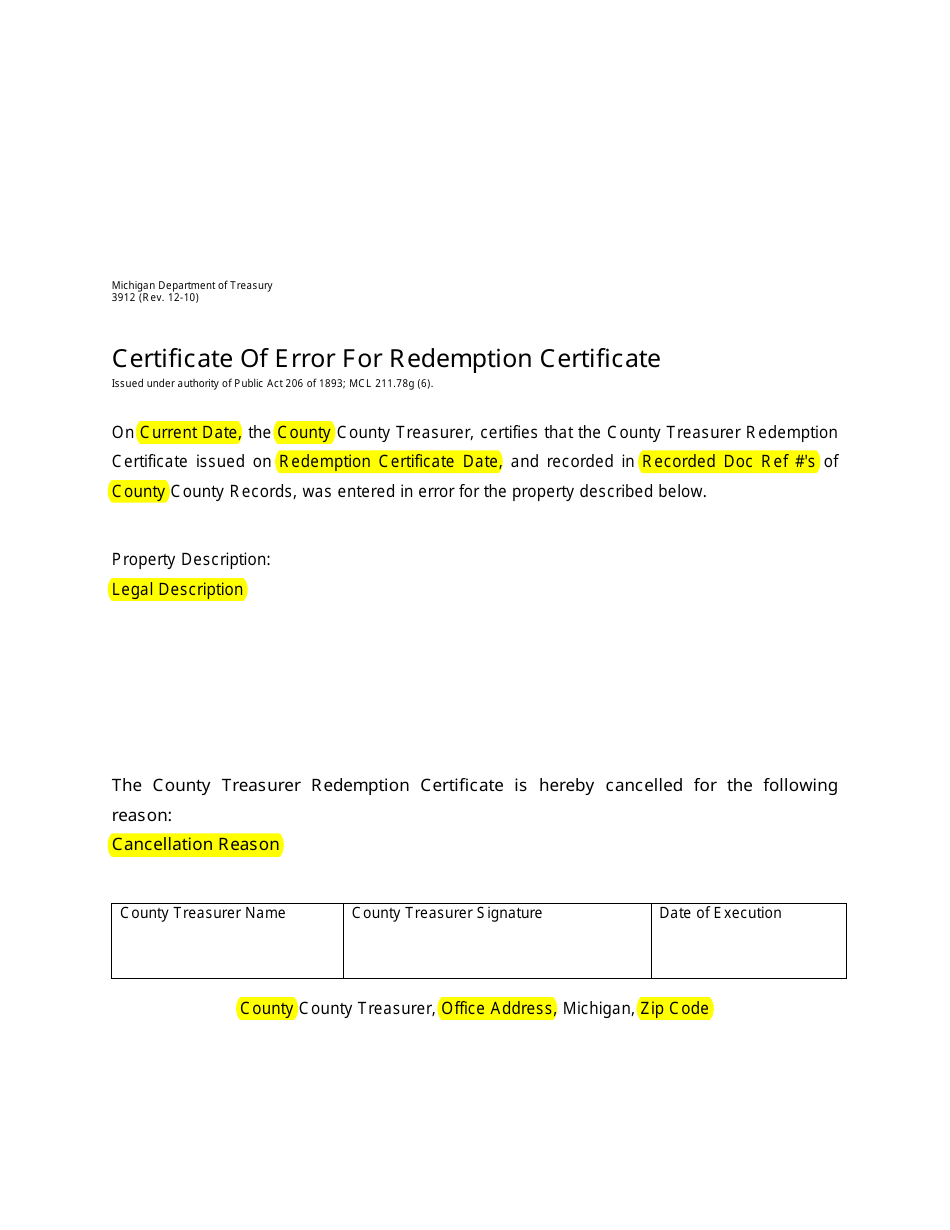

Sample Form 3912 Certificate of Error for Redemption Certificate - Michigan

What Is Form 3912?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3912?

A: Form 3912 is the Certificate of Error for Redemption Certificate used in Michigan.

Q: What is the purpose of Form 3912?

A: The purpose of Form 3912 is to correct errors made on a Redemption Certificate in Michigan.

Q: Who can use Form 3912?

A: Form 3912 can be used by individuals or entities who have made errors on a Redemption Certificate in Michigan.

Q: Is there a fee to file Form 3912?

A: There is no fee to file Form 3912 with the Michigan Department of Treasury.

Q: What information is required on Form 3912?

A: Form 3912 requires information such as the certificate number, property address, and details of the error.

Q: How should I submit Form 3912?

A: Form 3912 should be submitted by mail to the Michigan Department of Treasury.

Q: Is there a deadline to submit Form 3912?

A: There is no specific deadline to submit Form 3912, but it should be filed as soon as possible after the discovery of the error.

Q: What happens after submitting Form 3912?

A: After submitting Form 3912, the Michigan Department of Treasury will review the application and may contact you for further information or documentation.

Q: Can I appeal a decision on Form 3912?

A: If your application for a Certificate of Error is denied, you may file an appeal with the Michigan Tax Tribunal.

Form Details:

- Released on December 1, 2010;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 3912 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.