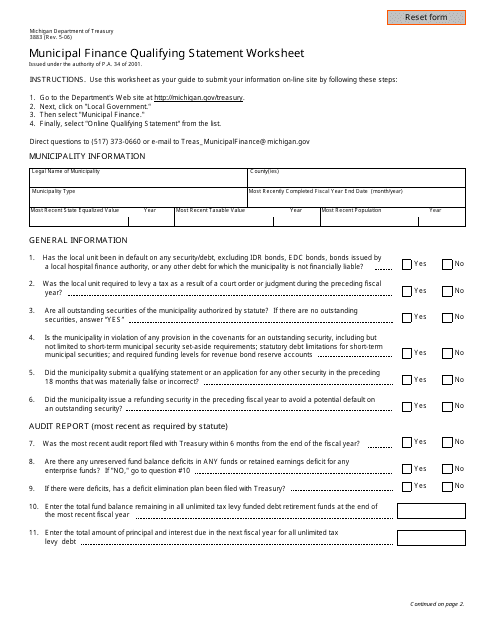

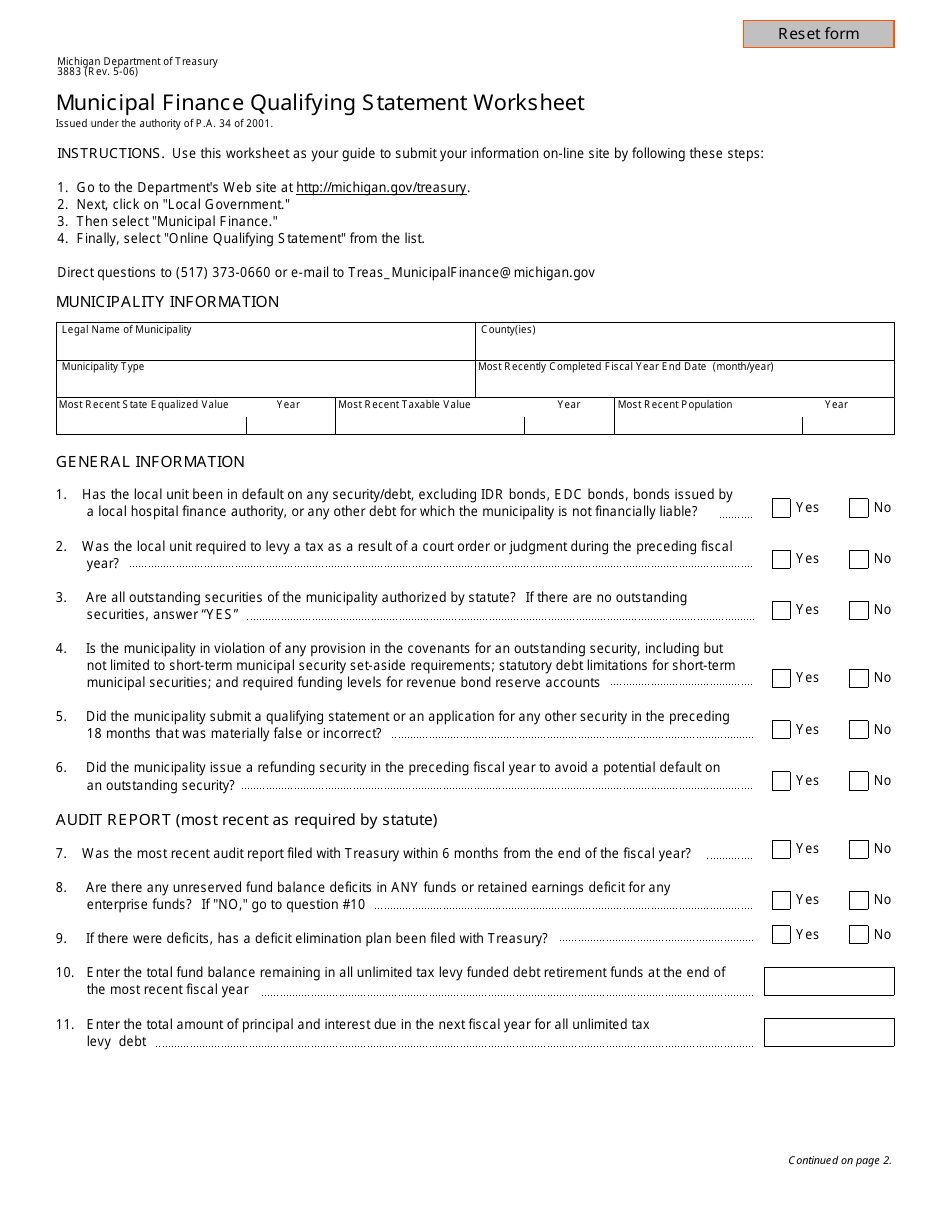

Form 3883 Municipal Finance Qualifying Statement Worksheet - Michigan

What Is Form 3883?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3883?

A: Form 3883 is the Municipal Finance Qualifying Statement Worksheet used in Michigan.

Q: What is the purpose of Form 3883?

A: The purpose of Form 3883 is to calculate the maximum amount of municipal debt a city or township in Michigan can incur.

Q: Who uses Form 3883?

A: Form 3883 is used by cities and townships in Michigan.

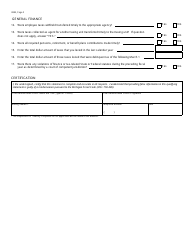

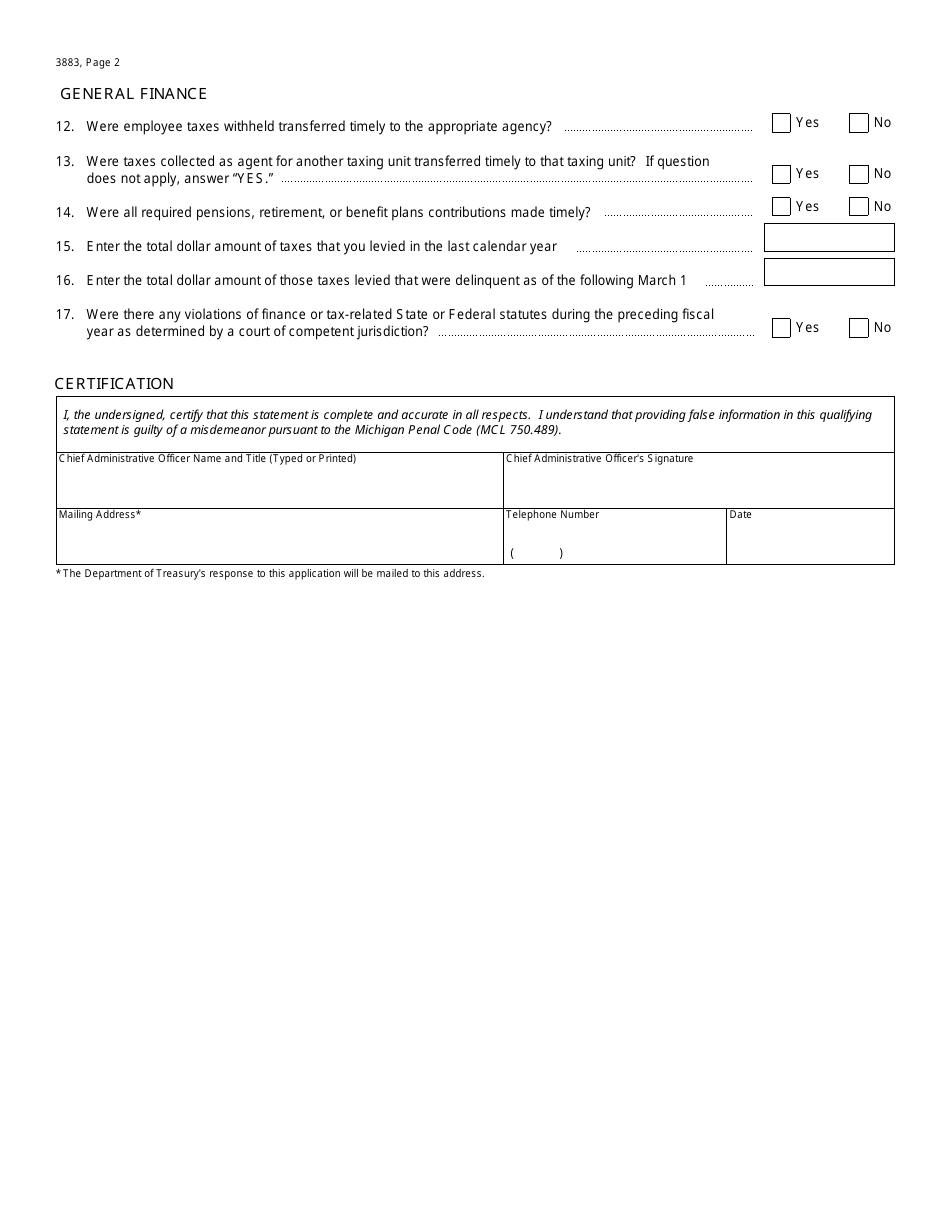

Q: What information is required on Form 3883?

A: Form 3883 requires information about the municipality's budget, estimated revenue, assessed property values, and outstanding debt.

Q: How is the maximum debt calculated using Form 3883?

A: The maximum debt is calculated by subtracting the municipality's estimated revenue and other financial obligations from its budgeted expenditures.

Form Details:

- Released on May 1, 2006;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3883 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.