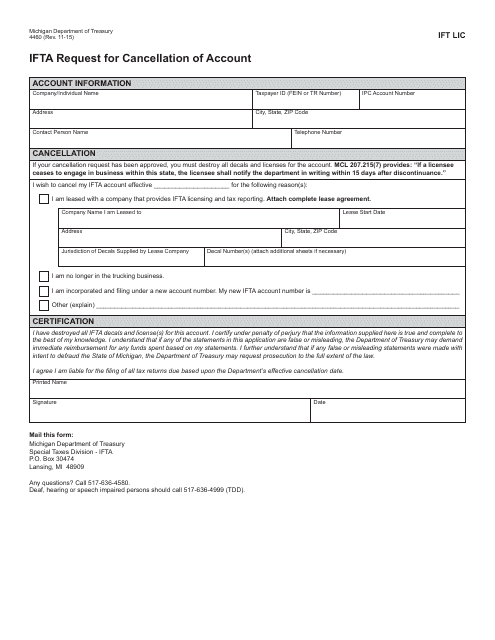

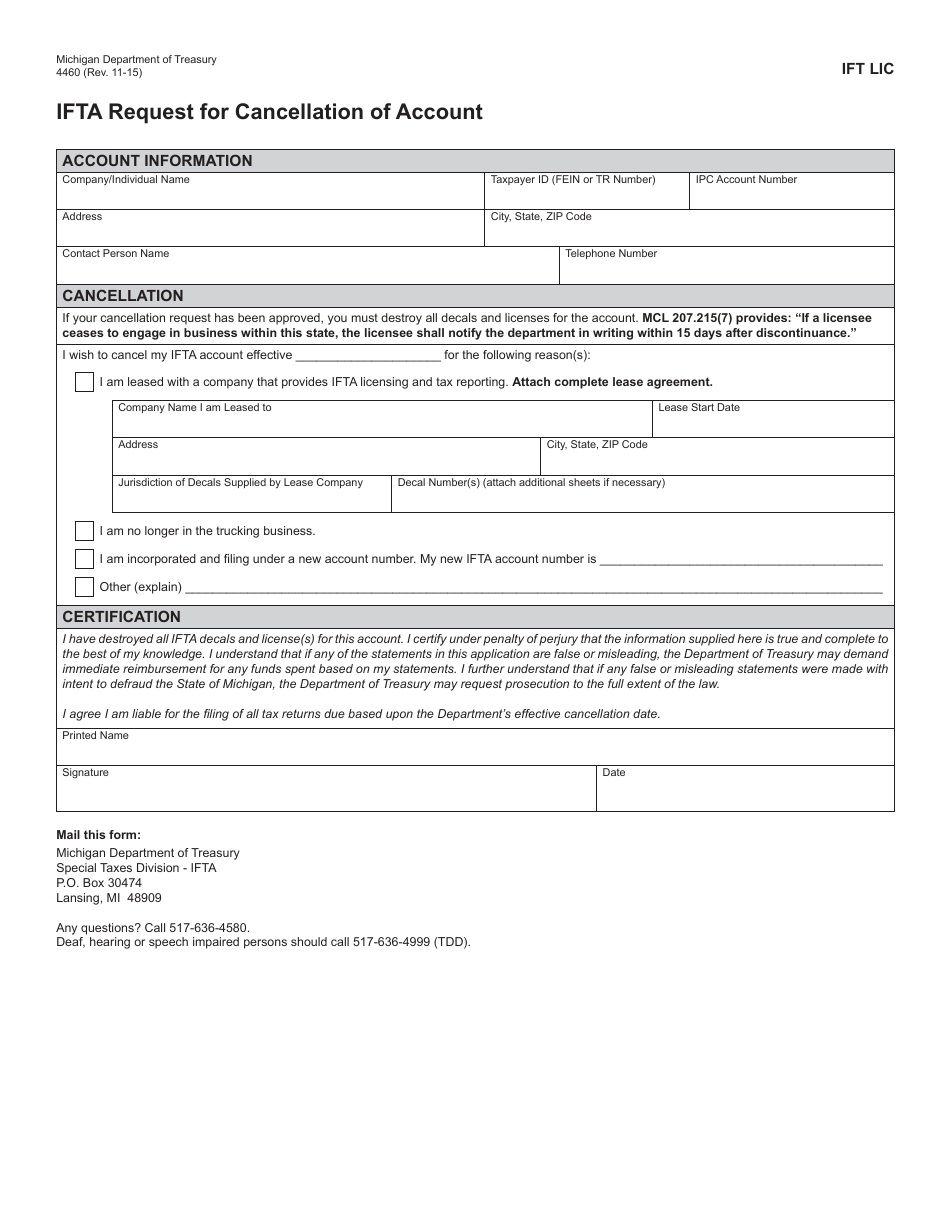

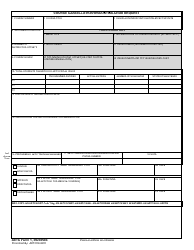

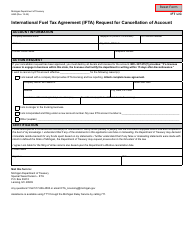

Form 4460 (IFT LIC) Ifta Request for Cancellation of Account - Michigan

What Is Form 4460 (IFT LIC)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4460 (IFT LIC)?

A: Form 4460 (IFT LIC) is the IFTA Request for Cancellation of Account form.

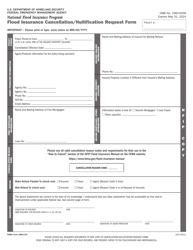

Q: What is IFTA?

A: IFTA stands for International Fuel Tax Agreement. It is an agreement between the United States and Canadian provinces that simplifies fuel reporting and tax payments for motor carriers.

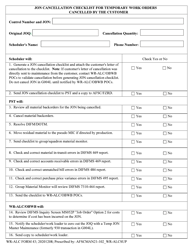

Q: What is the purpose of Form 4460 (IFT LIC)?

A: The purpose of Form 4460 (IFT LIC) is to request the cancellation of an IFTA account in Michigan.

Q: Who needs to use Form 4460 (IFT LIC)?

A: Motor carriers who have an IFTA account in Michigan and want to cancel it need to use Form 4460 (IFT LIC).

Q: Is there a fee for submitting Form 4460 (IFT LIC)?

A: There is no fee for submitting Form 4460 (IFT LIC).

Q: What information is required on Form 4460 (IFT LIC)?

A: Form 4460 (IFT LIC) requires information such as the account holder's name, account number, reason for cancellation, and effective date of cancellation.

Q: How do I submit Form 4460 (IFT LIC) after completing it?

A: After completing Form 4460 (IFT LIC), you can submit it by mail or by fax to the Michigan Department of Treasury.

Q: What happens after I submit Form 4460 (IFT LIC)?

A: After submitting Form 4460 (IFT LIC), the Michigan Department of Treasury will process your request and cancel your IFTA account.

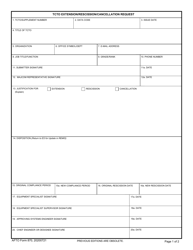

Q: Can I reinstate my IFTA account after cancellation?

A: Yes, you can reinstate your IFTA account after cancellation by completing the necessary forms and following the reinstatement process.

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 4460 (IFT LIC) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.