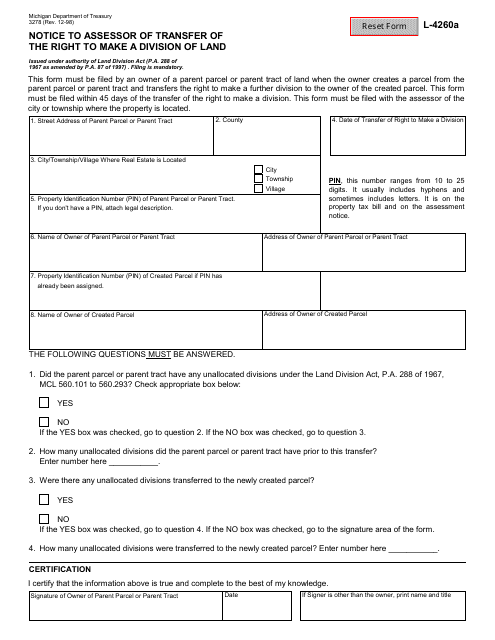

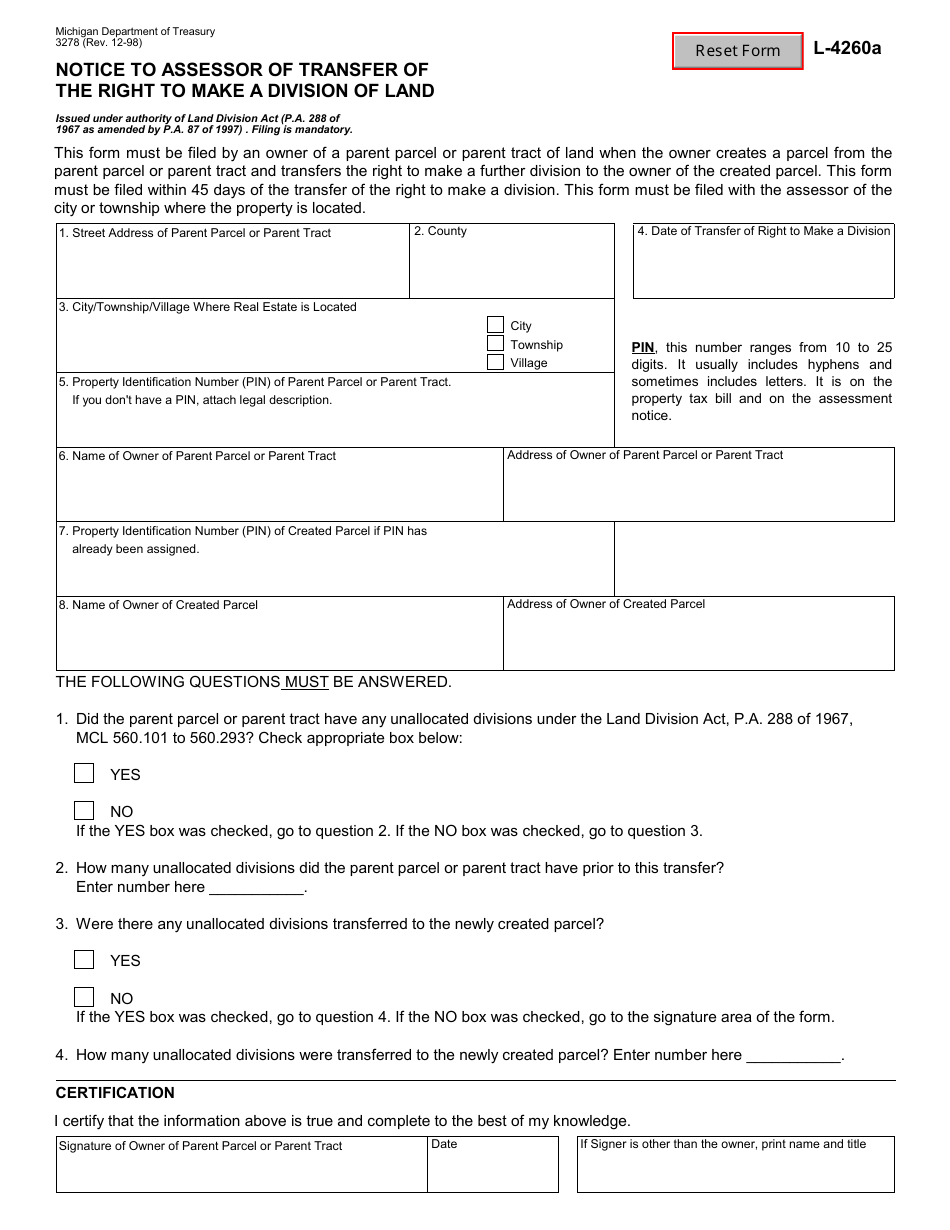

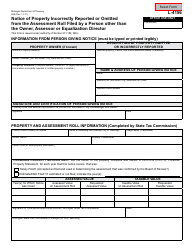

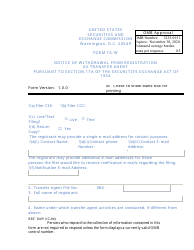

Form 3278 (L-4260A) Notice to Assessor of Transfer of the Right to Make a Division of Land - Michigan

What Is Form 3278 (L-4260A)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3278 (L-4260A)?

A: Form 3278 (L-4260A) is a Notice to Assessor of Transfer of the Right to Make a Division of Land in Michigan.

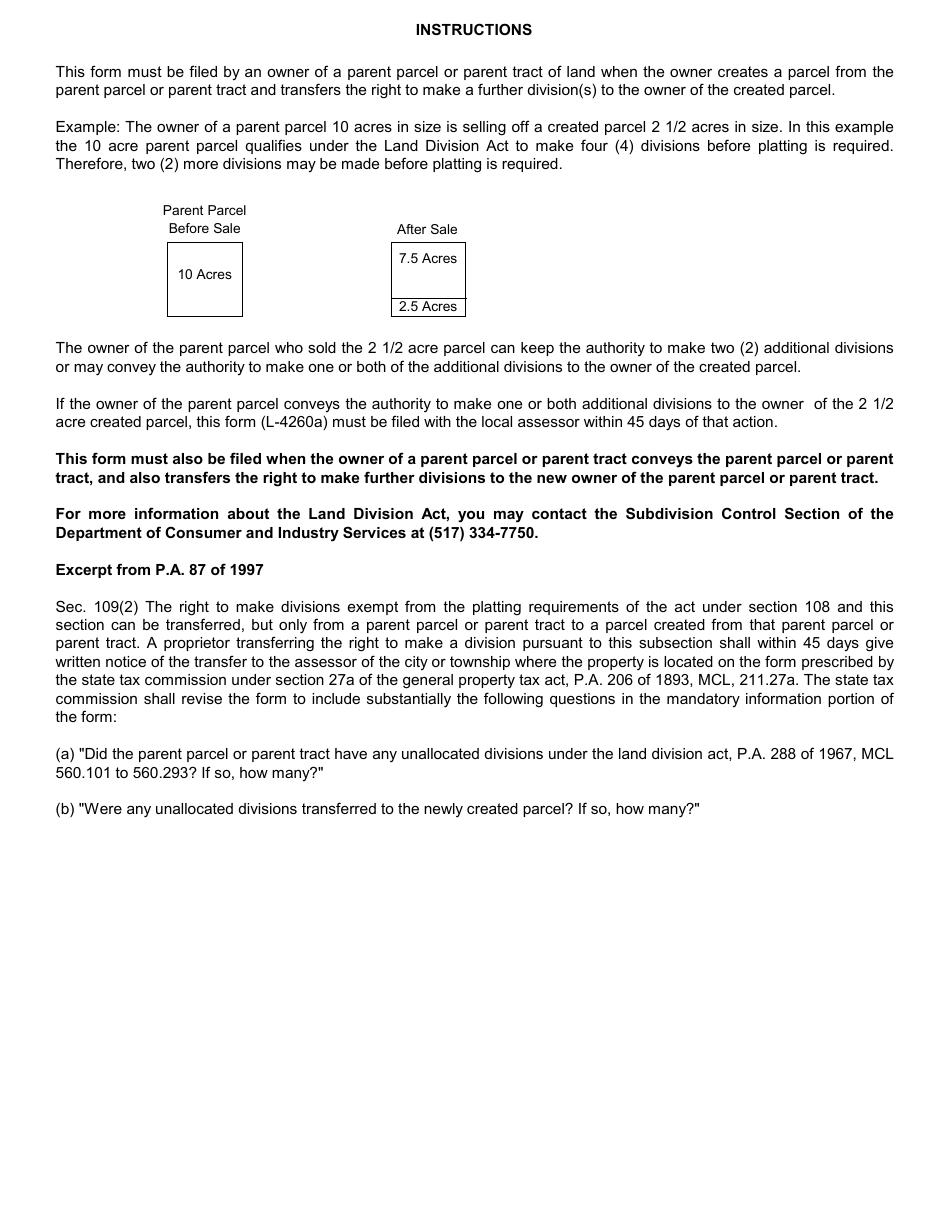

Q: What is the purpose of Form 3278 (L-4260A)?

A: The purpose of Form 3278 (L-4260A) is to notify the assessor of a transfer of the right to make a division of land in Michigan.

Q: Who needs to use Form 3278 (L-4260A)?

A: Anyone who is transferring the right to make a division of land in Michigan needs to use Form 3278 (L-4260A).

Q: Is there a fee for filing Form 3278 (L-4260A)?

A: Yes, there is a fee for filing Form 3278 (L-4260A) in Michigan.

Q: When should I file Form 3278 (L-4260A)?

A: Form 3278 (L-4260A) should be filed within 45 days of the transfer of the right to make a division of land in Michigan.

Q: What information is required on Form 3278 (L-4260A)?

A: Form 3278 (L-4260A) requires information such as the name and address of the transferor and transferee, the legal description of the land, and the date of the transfer.

Q: What happens after I file Form 3278 (L-4260A)?

A: After filing Form 3278 (L-4260A), the assessor will update the property records to reflect the transfer of the right to make a division of land in Michigan.

Q: What if I don't file Form 3278 (L-4260A)?

A: Failure to file Form 3278 (L-4260A) may result in penalties or fines in Michigan.

Form Details:

- Released on December 1, 1998;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3278 (L-4260A) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.