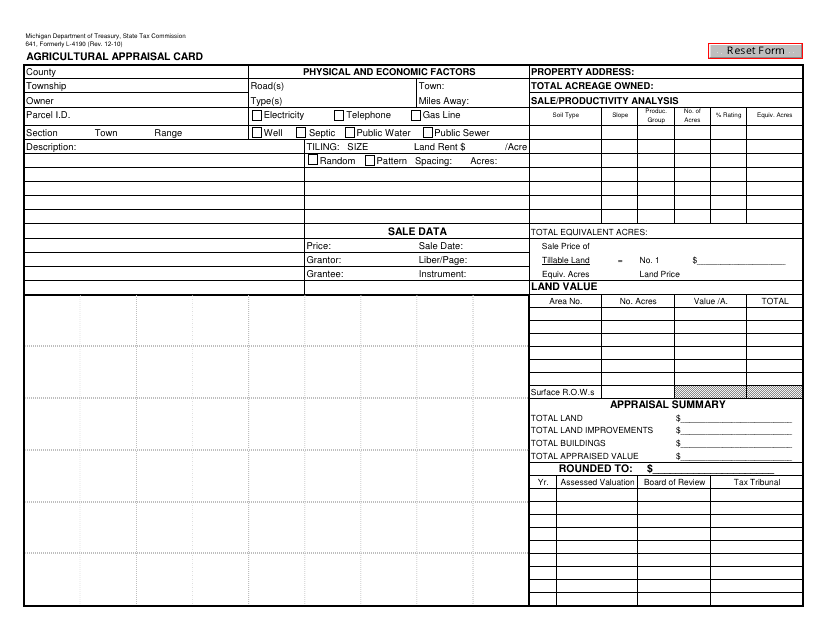

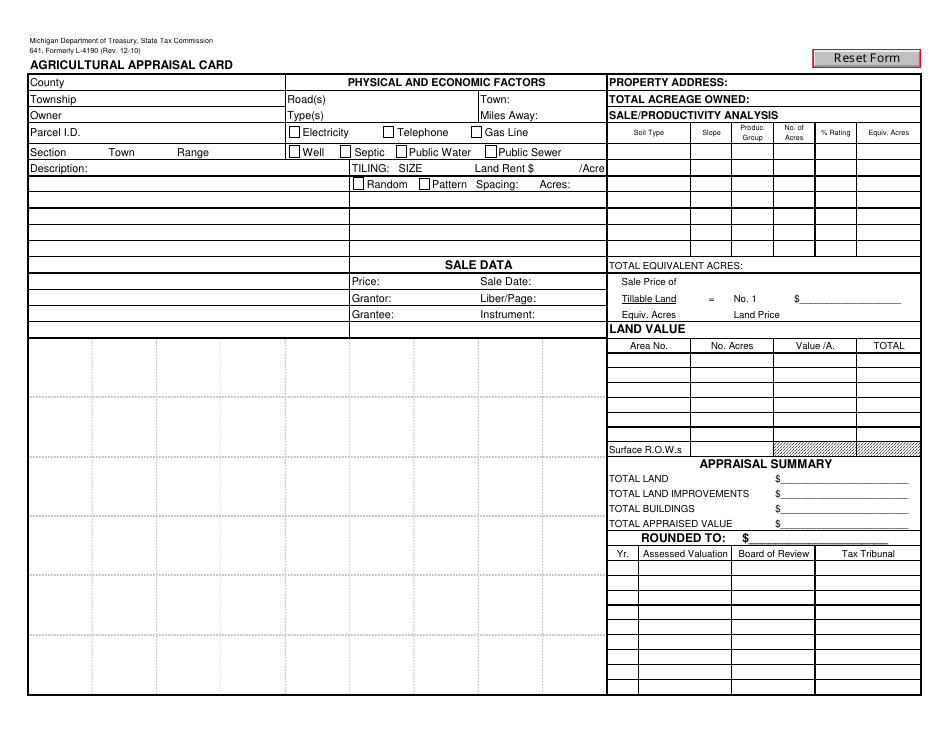

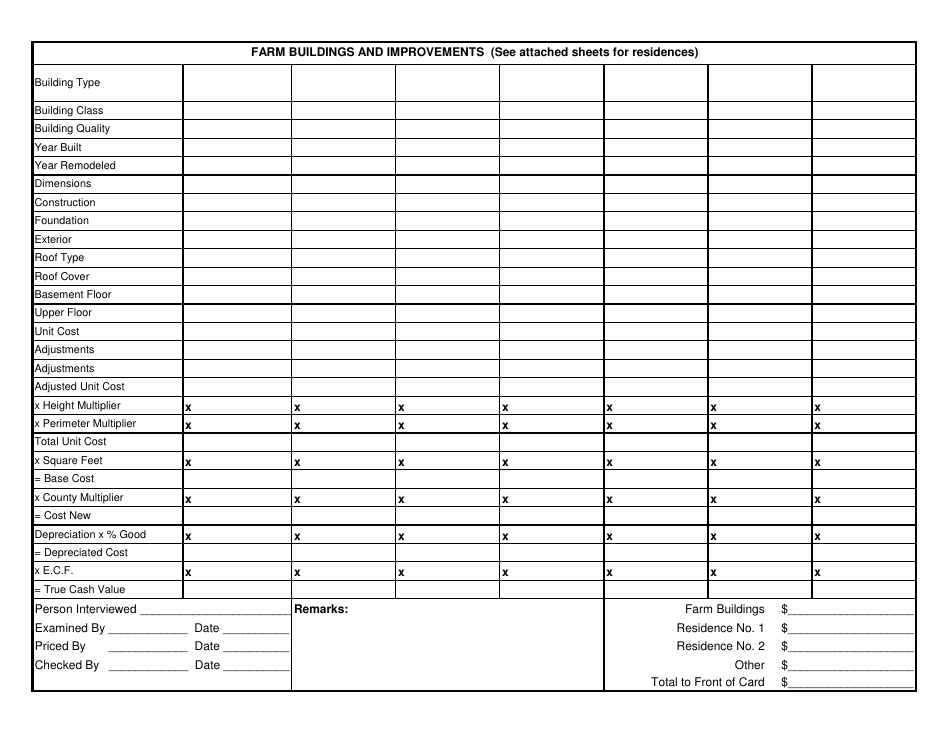

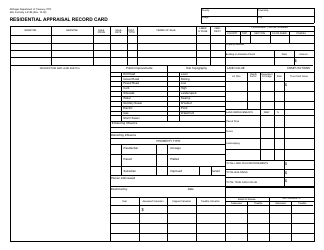

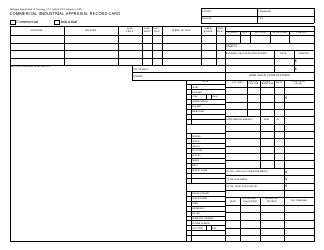

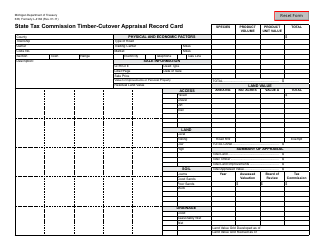

Form 641 Agricultural Appraisal Card - Michigan

What Is Form 641?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 641 Agricultural Appraisal Card?

A: Form 641 is a document used for agricultural property appraisal in Michigan.

Q: What is the purpose of Form 641?

A: The purpose of Form 641 is to provide information about agricultural properties for property tax assessment purposes.

Q: Who needs to fill out Form 641?

A: Form 641 should be filled out by owners of agricultural properties in Michigan.

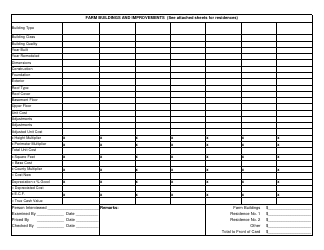

Q: What information is required on Form 641?

A: Form 641 requires information about the agricultural property, its use, crops or livestock, and other relevant details.

Q: When is Form 641 due?

A: Form 641 is due on or before May 1st of each year.

Q: Are there any penalties for not filing Form 641?

A: Failure to file Form 641 may result in the property being assessed at a higher value for property tax purposes.

Form Details:

- Released on December 1, 2010;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 641 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.