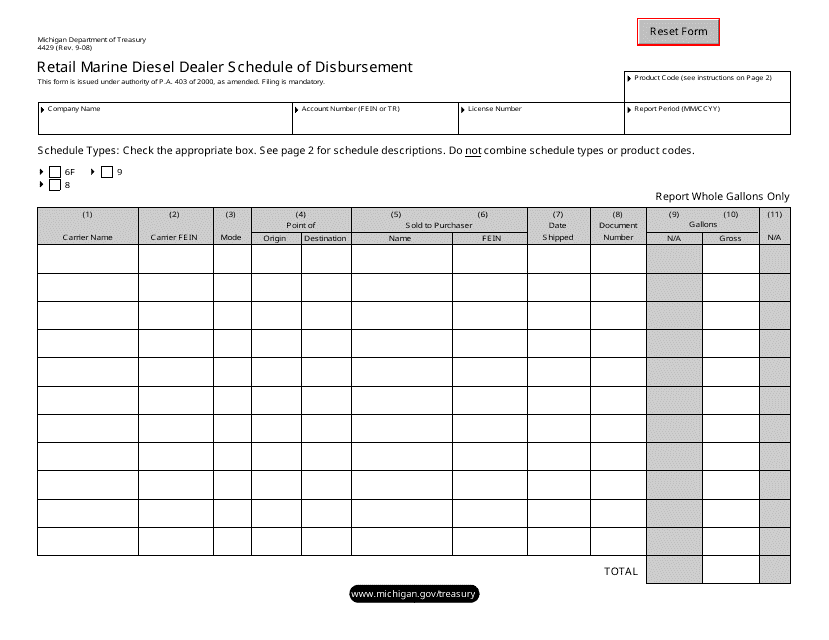

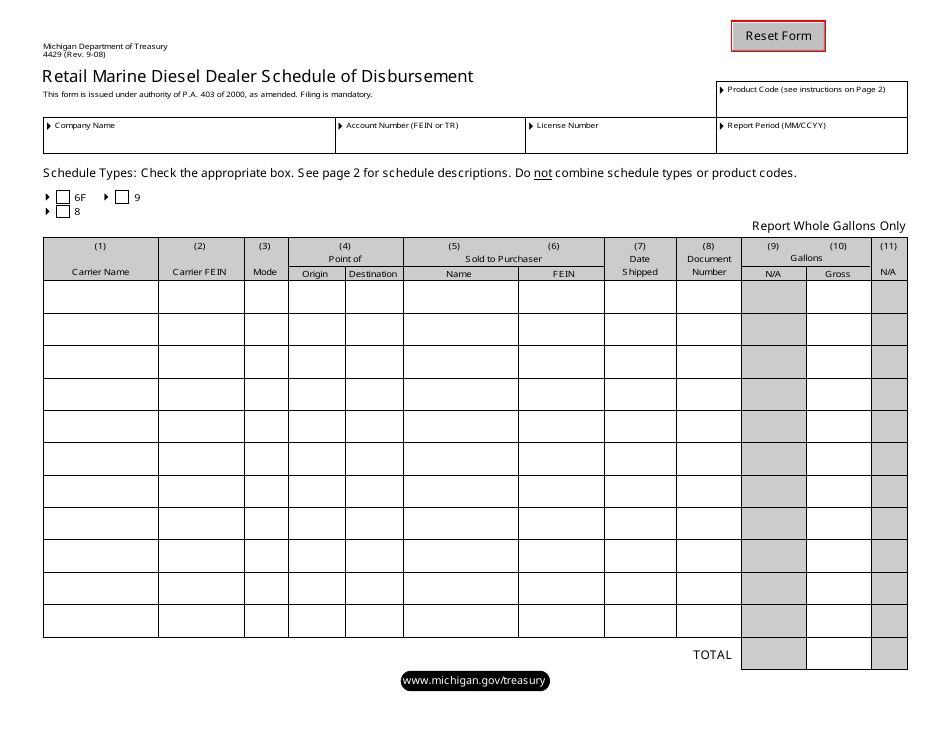

Form 4429 Retail Marine Diesel Dealer Schedule of Disbursement - Michigan

What Is Form 4429?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4429?

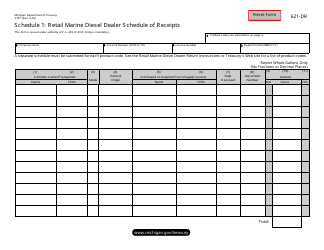

A: Form 4429 is a schedule of disbursement specifically designed for retail marine diesel dealers in the state of Michigan.

Q: Who needs to fill out Form 4429?

A: Retail marine diesel dealers in Michigan are required to fill out Form 4429.

Q: What is the purpose of Form 4429?

A: The purpose of Form 4429 is to provide a record of disbursements made by retail marine diesel dealers in Michigan.

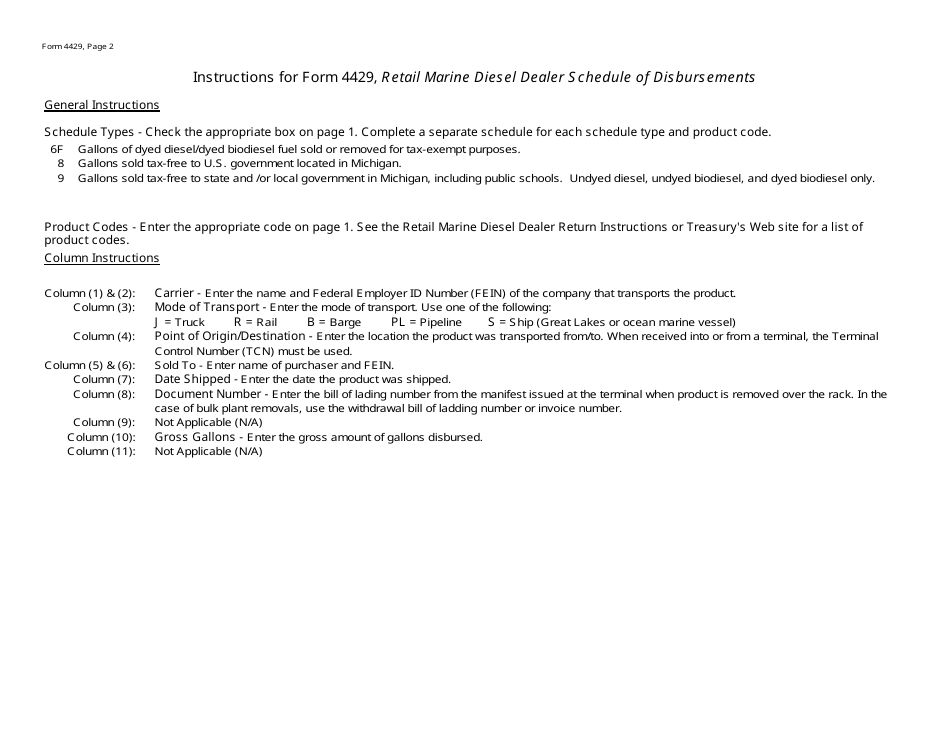

Q: Are there any specific requirements for filling out Form 4429?

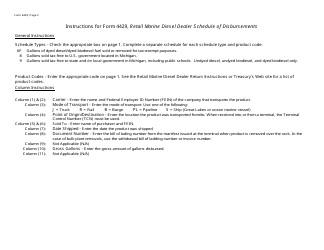

A: Yes, there are specific requirements for filling out Form 4429. It is important to carefully follow the instructions provided with the form.

Q: What if I have questions or need assistance with Form 4429?

A: If you have questions or need assistance with Form 4429, you can contact the Michigan Department of Treasury's office for further guidance.

Q: Are there any penalties for not filing or filing Form 4429 late?

A: Yes, there may be penalties for not filing or filing Form 4429 late. It is important to submit the form by the specified due date to avoid any penalties.

Form Details:

- Released on September 1, 2008;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4429 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.